155 IP and Commercialization | Market Analysis

When looking at commercializing a product or service offering, conducting a thorough market analysis can provide valuable insight into product-market fit, opportunities, market influencers and trends, audiences, and competitors. These insights can help inform how to best proceed with commercialization efforts, evaluate progress, and scale the business opportunity. The next sections will look more closely at various aspects of a market analysis report and why the information gathered is important in deciding commercialization activities.

Market Research

“Market research is the process of determining the viability of a new service or product through research conducted directly with potential customers. Market research allows a company to discover the target market and get opinions and other feedback from consumers about their interest in the product or service” (Twin, A, 2020).

Primary market research involves talking directly to customers and end-users to gather unfiltered and unedited feedback, opinions, and data on a specific market opportunity. This is a time-consuming process often conducted by one-on-one interviews or individual surveys, but it is tremendously valuable as it provides insights into the customer that you would never have predicted. These insights are useful to maximize the value your invention or new product may provide to a customer.

Secondary research is a process that collects information and data about the customer or market from other market researchers (or companies) that have conducted the primary research. Secondary research can be misleading because it has already been filtered, processed and compiled into a summary or protocol. However, secondary research is much faster, cheaper, and easier to obtain, therefore it is useful, but with some degree of caution on its validity related to your specific invention or product. Academics often have excellent access to abundant secondary research through their libraries and databases. It can be tempting to only do secondary research, but this is a mistake. Entrepreneurs, especially academic ones, must get out and take an active role in talking with potential customers if they are truly committed to the commercialization process.

Again, market research highlights the importance of knowing the target audience to inform decision making activities related to commercialization. While a value proposition may be informed by a theoretical audience based on facts, market research is seeking and assessing the audience’s interests and feedback from real consumers. Interviews, surveys, focus groups, product testing and other activities provide insights that can help guide commercialization efforts by defining specific market categories and appropriate sales messaging, defining pricing parameters (i.e., what customers are willing to pay for the product/service), and outlining satisfaction measures and key marketable features.

For example, by observing customers using a product, it may be found that the item is used in ways that are not expected, therefore opening a potential new market; or they may encounter difficulties using the product, helping refine the product design. Additionally, if a consumer is only willing to pay $13 for a product and the final cost of the product is $17 (for production and profit margin), the parties considering commercialization of that product may want to re-evaluate production costs or source new part manufacturers. They may also choose not to commercialize the product as the consumer pricing may indicate a non-viable business plan.

Competitive Analysis

Competitive analysis, often called competitive intelligence, is an investigation into the direct and indirect businesses that produce products or services that currently, or will likely in the future, compete with your proposed product that you would like to commercialize. Direct competitors are those companies, individuals, and their products sold that are very similar to your planned product, while indirect competitors are those that offer a different type of product or service that provides the same functional solution to the market problem that exists in your target market. Indirect competitors may provide different value propositions through different features, but they solve or eliminate the same problem that you are trying to solve but in a different way.

Competitive assessments must be done in detail if you aim to identify strategies to out-compete, circumvent, outsell, or out-market a strong competitor. Competitive analysis must take into consideration existing threats in the market and future threats. Which products (companies) must I out-compete today, and which companies are likely to enter the market in the future? Depending on your time horizon, these secondary entrants can be a greater threat than those currently in the market.

Many larger companies do not desire to be first to market, allowing small, early entrants to experiment and play in the market, which provides valuable information on the market potential and customer behaviour. Once they have adequately analyzed the market with a few small competitors fighting it out and growing, these larger companies, seeing that there is a profit to be made in this new market space, buy the smaller companies and integrate them into their larger corporation, or they massively out-spend them on sales, marketing, and product development. Google uses this strategy. Consequently, some entrepreneurs start new companies with a very short time horizon of only a few years, because they fully expect a large established corporation to take them over once they are recognized as a threat. This is one type of an “exit” that a founding entrepreneur may take, and it often pays very well, but now they need to create another business to get back in the game.

Understanding the strengths and weaknesses of a competitor is a continual process that never stops – “an innovation arms race” to see who can develop and improve products and delight customers the fastest. This competitive analysis can be leveraged to develop a commercialization strategy. Knowing where competitors exist in the market can help you identify a gap in the market in which your new product could be positioned to thrive. However, if you fill this gap, the competition is likely to follow. Never expect the competition to allow you to steal market share without them trying to take it back. Small companies are nimble and may respond quickly while larger companies are slower, but eventually the competition will challenge you.

First, any competitive analysis must start with identifying all the companies in the target market and those that you predict are likely to enter it. Common tools used by entrepreneurs to conduct analyses of your competition include:

- A simple product-to-product feature comparison

- A list of competitive market characteristics (target market, customer type, price, distribution and sales channels used, marketing strategy used, environmental impact, value-propositions, positioning statements, web traffic, and any other business metric you can obtain about your competitor’s product)

- PESTEL Analysis which looks at the political, economic, socio-cultural, technological, environmental and legal factors affecting a specific target market

- A SWOT table (Strengths, Weaknesses, Opportunities, Threats)

- A Four Corner Analysis developed by Michael Porter that documents your competitor’s drivers and assumptions (i.e. motivation) and their capabilities and strategy (actions)

- A financial analysis using traditional accounting statements and ratios

- Interviews with customer using similar or competing products

- and many more

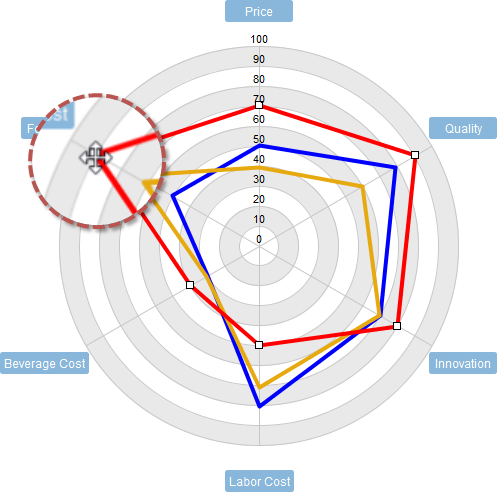

Most importantly, the entrepreneur must try to be objective and remove their personal bias from the analysis. This is very difficult due to the high level of passion most entrepreneurs have for their invention, product and start-up company. If possible get an arms-length third party to do the analysis so they can be sufficiently critical and unbiased. Results can be tabulated or placed within a more visual framework – like a perceptual map. A few simple examples of how to visualize your competitor’s strengths and weaknesses are mapped below.

Perceptual Mapping: The Benefit of Visualizing Your Competitive Landscape