3.1 The Competitive Market Model

Learning Objectives

By the end of this section, you will be able to:

- Explain the limitations of the Competitive Market Model

- Understand Product Homogeneity, Buyer Power, & Supplier Power

An Economic Model of Demand and Supply

Recall that an economic model is a simplified framework that is designed to illustrate complex processes. The first model we looked at in Topic 2 was the Production Possibility Frontier, which outlined efficient production under autarky and under trade. We mentioned that although these models can seem oversimplified, holding certain variables constant to analyze the most important ones is an effective way to build a basis of understanding. For demand and supply, we must remain conscious of the model’s simplifications to understand its limitations and strengths. The next model we will explore is the competitive market model.

Assumptions of the Competitive Market Model

1. Product Homogeneity

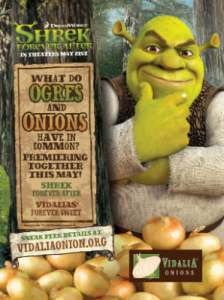

Under product homogeneity, all goods offered for sale are identical in the eyes of the economic agent. Say, for example, you go to the farmer’s market and consider buying onions. Suppose there are two different farms selling identical onions. In this case, the product is “homogeneous,” as you, the consumer, have no preference over which onion to buy and will simply go with whichever is cheaper. Instances of perfect homogeneity are actually quite rare, as firms strive to differentiate themselves from their competitors. Farms may position themselves as more organic, or more local. One onion firm even used Shrek to differentiate its onions, playing off the line “ogres are like onions, we have many layers.”

2. No Buyer Power

Under the assumption of buyer power, no single consumer has the power to influence the price at which they purchase a good. For example, your choice whether or not to buy a Coke is not going to cause Coca Cola to change its prices, since Coca Cola has many other consumers who would will purchase. If you are buying a car, you likely have some degree of buyer power, since your purchase results in substantial revenue for the car lot. In a perfectly competitive market, consumers have no buyer power.

3. No Supplier Power

Under this assumption, no single producer has the power to influence the price at which they sell a good. Consider a small manufacturer attempting to negotiate prices with multinational retail corporation Walmart. The manufacturer will likely have to take the price or go somewhere else. Compare that to Apple supplying an Apple Specialist store, in this case Apple has a lot of power and can likely dictate prices to the retailer. In a perfectly competitive market, producers have no supplier power.

Are These Realistic Assumptions?

Some of these assumptions are not too far from reality. In fact, the economic climate in which firms operate ranges from instances like these of perfect competition to monopolies, in which one firm sets its own prices. By first understanding the model on one end of the extreme, we can begin to understand the spectrum.

In 3.2, we will look at potential buyers on the demand side.

In 3.3, we will look at potential sellers on the supply side.

Then, looking at how they interact, we will determine where the market equilibrium lies in 3.4.

Let’s first focus on what economists mean by demand.

Summary

The model to examine supply and demand is called the competitive market model. In the competitive market, we assume products are homogeneous, and there is no supplier or buyer power.