8.3 Why Monopolies Persist

Learning Objectives

- Distinguish between a natural monopoly and a legal monopoly.

- Explain how economies of scale and the control of natural resources led to the necessary formation of legal monopolies

- Analyze the importance of trademarks and patents in promoting innovation

Because of the lack of competition, monopolies tend to earn significant economic profits. These profits should attract vigorous competition as described in Perfect Competition, and yet, because of one particular characteristic of monopolies, they do not. Barriers to entry are the legal, technological, or market forces that discourage or prevent potential competitors from entering a market. Barriers to entry can range from the simple and easily surmountable, such as the cost of renting retail space, to the extremely restrictive. For example, there are a finite number of radio frequencies available for broadcasting. Once the rights to all of them have been purchased, no new competitors can enter the market.

In some cases, barriers to entry may lead to monopoly. In other cases, they may limit competition to a few firms. Barriers may block entry even if the firm or firms currently in the market are earning profits. Thus, in markets with significant barriers to entry, it is not true that abnormally high profits will attract new firms, and that this entry of new firms will eventually cause the price to decline so that surviving firms earn only a normal level of profit in the long run.

There are two types of monopoly, based on the types of barriers to entry they exploit. One is a natural monopoly, where the barriers to entry are something other than legal prohibition. The other is a legal monopoly, where laws prohibit (or severely limit) competition.

Natural Monopoly

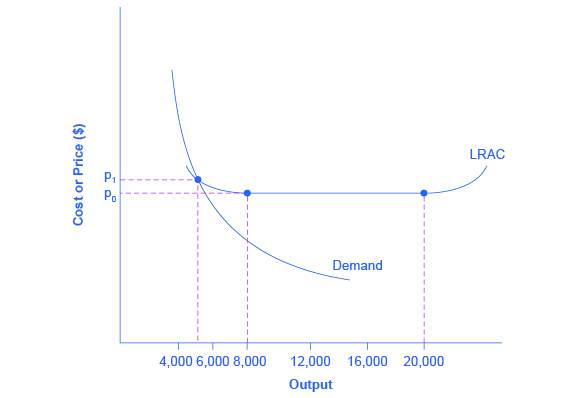

Economies of scale can combine with the size of the market to limit competition. Figure 8.3a presents a long-run average cost curve for the airplane manufacturing industry. It shows economies of scale up to an output of 8,000 planes per year and a price of P0, then constant returns to scale from 8,000 to 20,000 planes per year, and diseconomies of scale at a quantity of production greater than 20,000 planes per year.

Now consider the market demand curve in the diagram, which intersects the long-run average cost (LRAC) curve at an output level of 6,000 planes per year and at a price P1, which is higher than P0. In this situation, the market has room for only one producer. If a second firm attempts to enter the market at a smaller size, say by producing a quantity of 4,000 planes, then its average costs will be higher than the existing firm, and it will be unable to compete. If the second firm attempts to enter the market at a larger size, like 8,000 planes per year, then it could produce at a lower average cost—but it could not sell all 8,000 planes that it produced because of insufficient demand in the market.

This situation, when economies of scale are large relative to the quantity demanded in the market, is called a natural monopoly. Natural monopolies often arise in industries where the marginal cost of adding an additional customer is very low, once the fixed costs of the overall system are in place. Once the main water pipes are laid through a neighborhood, the marginal cost of providing water service to another home is fairly low. Once electricity lines are installed through a neighborhood, the marginal cost of providing additional electrical service to one more home is very low. It would be costly and duplicative for a second water company to enter the market and invest in a whole second set of main water pipes, or for a second electricity company to enter the market and invest in a whole new set of electrical wires. These industries offer an example where, because of economies of scale, one producer can serve the entire market more efficiently than a number of smaller producers that would need to make duplicate physical capital investments.

A natural monopoly can also arise in smaller local markets for products that are difficult to transport. For example, cement production exhibits economies of scale, and the quantity of cement demanded in a local area may not be much larger than what a single plant can produce. Moreover, the costs of transporting cement over land are high, and so a cement plant in an area without access to water transportation may be a natural monopoly.

Control of a Physical Resource

Another type of natural monopoly occurs when a company has control of a scarce physical resource. In the U.S., one historical example of this pattern occurred when the Aluminum Company of America (ALCOA) controlled most of the supply of bauxite, a key mineral used in making aluminum. Back in the 1930s, when ALCOA controlled most of the bauxite, other firms were simply unable to produce enough aluminum to compete.

As another example, the majority of global diamond production is controlled by DeBeers, a multinational company that has mining and production operations in South Africa, Botswana, Namibia, and Canada. It also has exploration activities on four continents, while directing a worldwide distribution network of rough cut diamonds. Though in recent years they have experienced growing competition, their impact on the rough diamond market is still considerable.

Legal Monopoly

For some products, the government erects barriers to entry by prohibiting or limiting competition. Under U.S. law, no organization but the U.S. Postal Service is legally allowed to deliver first-class mail. Many states or cities have laws or regulations that allow households a choice of only one electric company, one water company, and one company to pick up their garbage. Most legal monopolies are considered utilities – products necessary for everyday life – that are socially beneficial to have. As a consequence, the government allows producers to become regulated monopolies to ensure that an appropriate amount of these products is provided to consumers. Additionally, legal monopolies are often subject to economies of scale, so it makes sense to allow only one provider.

Promoting Innovation

Innovation takes time and resources to achieve. Suppose a company invests in research and development and finds the cure for the common cold. In this world of near- ubiquitous information, other companies could take the formula, produce the drug, and because they did not incur the costs of research and development (R&D), undercut the price of the company that discovered the drug. Given this possibility, many firms would choose not to invest in R&D, and as a result, the world would have less innovation.

To prevent this from happening, the patent act was created in Canada as a part of the British North America Act in 1869. A patent gives the inventor the exclusive legal right to make, use, or sell the invention for a limited time in Canada. The idea is to provide limited monopoly power so that innovative firms can recoup their investment in R&D, but then to allow other firms to produce the product more cheaply once the patent expires.

A trademark is an identifying symbol or name for a particular good, like Chevrolet cars, or the Nike “swoosh” that appears on shoes and athletic gear. A firm can renew a trademark over and over again, as long as it remains in active use.

A copyright, according to the Canadian Intellectual Property Office, “is the exclusive legal right to produce, reproduce, publish or perform an original literary, artistic, dramatic or musical work. ” No one can reproduce, display, or perform a copyrighted work without permission from the author. Copyright protection generally lasts for the life of the author plus 70 years.

Roughly speaking, the patent law covers inventions and copyright protects books, songs, and art. But in certain areas, like the invention of new software, it has been unclear whether patent or copyright protection should apply. There is also a body of law known as trade secrets. Even if a company does not have a patent on an invention, competing firms are not allowed to steal its secrets. One famous trade secret is the formula for Coca-Cola, which is not protected under copyright or patent law, but is simply kept secret by the company.

Taken together, this combination of patents, trademarks, copyrights, and trade secret law is called intellectual property, because it implies ownership over an idea, concept, or image, not a physical piece of property like a house or a car. Countries around the world have enacted laws to protect intellectual property, although the time periods and exact provisions of such laws vary across countries.

Visit this website for examples of some pretty bizarre patents.

Intimidating Potential Competition

Businesses have developed a number of schemes for creating barriers to entry by deterring potential competitors from entering the market. One method is known as predatory pricing, in which a firm uses the threat of price cuts to discourage competition. Predatory pricing is a violation of antitrust law, but it is difficult to prove.

Consider a large airline that provides most of the flights between two particular cities. A new, small start-up airline decides to offer service between these two cities. The large airline immediately slashes prices on this route so that the new entrant cannot make any money. After the new entrant has gone out of business, the incumbent firm can raise prices again.

After this pattern is repeated once or twice, potential new entrants may decide that it is not wise to try to compete. Small airlines often accuse larger airlines of predatory pricing: in the early 2000s, for example, ValuJet accused Delta of predatory pricing, Frontier accused United, and Reno Air accused Northwest. In 2015, the Justice Department ruled against American Express and Mastercard for imposing restrictions on retailers who encouraged customers to use lower swipe fees on credit transactions.

In some cases, large advertising budgets can also act as a way of discouraging the competition. If the only way to launch a successful new national cola drink is to spend more than the promotional budgets of Coca-Cola and PepsiCo., not too many companies will try. A firmly established brand name can be difficult to dislodge.

Summing Up Barriers to Entry

Table 8.3a lists the barriers to entry that have been discussed here. This list is not exhaustive since firms have proved to be highly creative in inventing business practices that discourage competition. When barriers to entry exist, perfect competition is no longer a reasonable description of how an industry works. When barriers to entry are high enough, a monopoly can result.

| Barrier to Entry | Government Role? | Example |

|---|---|---|

| Natural monopoly | Government often responds with regulation (or ownership) | Water and electric companies |

| Control of a physical resource | No | DeBeers for diamonds |

| Legal monopoly | Yes | Post office, past regulation of airlines and trucking |

| Patent, trademark, and copyright | Yes, through protection of intellectual property | New drugs or software |

| Intimidating potential competitors | Somewhat | Predatory pricing; well-known brand names |

| Table 8.3a Barriers to Entry | ||

Key Concepts and Summary

Barriers to entry prevent or discourage competitors from entering the market. These barriers include: economies of scale that lead to natural monopoly, control of a physical resource, legal restrictions on competition, patent, trademark and copyright protection, and practices to intimidate the competition like predatory pricing. Intellectual property refers to the legally guaranteed ownership of an idea, rather than a physical item. The laws that protect intellectual property include patents, copyrights, trademarks, and trade secrets. A natural monopoly arises when economies of scale persist over a large enough range of output that if one firm supplies the entire market, no other firm can enter without facing a cost disadvantage.

Glossary

- Barriers to Entry

- the legal, technological, or market forces that may discourage or prevent potential competitors from entering a market

- Copyright

- a form of legal protection to prevent copying, for commercial purposes, original works of authorship, including books and music

- Deregulation

- removing government controls over setting prices and quantities in certain industries

- Intellectual Property

- the body of law including patents, trademarks, copyrights, and trade secret law that protect the right of inventors to produce and sell their inventions

- Legal Monopoly

- legal prohibitions against competition, such as regulated monopolies and intellectual property protection

- Natural Monopoly

- economic conditions in the industry, for example, economies of scale or control of a critical resource, that limit effective competition

- Patent

- a government rule that gives the inventor the exclusive legal right to make, use, or sell the invention for a limited time

- Predatory Pricing

- when an existing firm uses sharp but temporary price cuts to discourage new competition

- Trade Secrets

- methods of production kept secret by the producing firm

- Trademark

- an identifying symbol or name for a particular good and can only be used by the firm that registered that trademark