2.7. Porter’s Five Forces

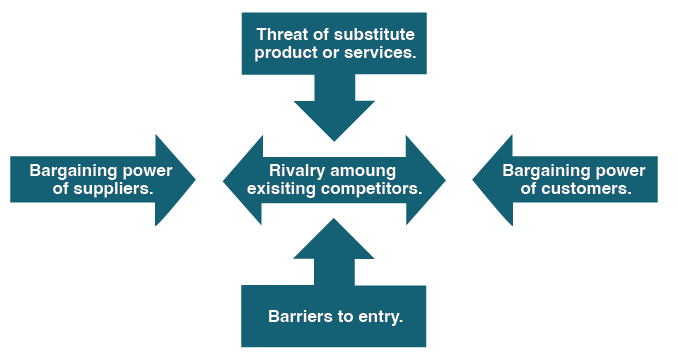

The Five Forces model was developed as a framework for industry analysis. This model can be used to help understand the degree of competition in an industry and analyze its strengths and weaknesses. The model consists of five elements, each of which plays a role in determining the average profitability of an industry. In 2001 Porter wrote an article entitled ”Strategy and the Internet,” in which he takes this model and looks at how the Internet impacts the profitability of an industry. Below is a quick summary of each of the Five Forces and the impact of the Internet.

- Threat of substitute products or services. The first force challenges the user to consider the likelihood of another product or service replacing the product or service you offer. The more types of products or services there are that can meet a particular need, the less profitability there will be in an industry. The Internet has made people more aware of substitute products, driving down industry profits in those industries where substitution occurs. Substitution refers to a product being replaced by a similar product to accomplish the same task. Digital hybrid substitutes are digital services wrapped around a physical product. An example is Uber and Lyft, where the service is administered through a digital app (Evans, 2015).

- Bargaining power of suppliers. A supplier’s bargaining power is vital when there are few suppliers from which a company can obtain a needed product or service. Conversely, bargaining power is lower when there are many suppliers since there are many sources to choose from. This provides the opportunity to negotiate a lower price. For example, if only one company makes the controller chip for a car engine, that company can control the price, at least to some extent. In cases where network effects are strong or a seller’s goods are highly differentiated, the Internet can strengthen supplier bargaining power. With e-commerce platforms like Shopify, many businesses can now create an online presence and expand their market base.

- Bargaining power of customers. A customer’s bargaining power is strong when many companies are providing the same product to this customer. In this instance, the customer has many sources to buy to negotiate a price reduction. If there are few suppliers in an industry, then the customer’s bargaining power is considered low. Social media, and the ability to access price and review information online, has increased buyer power in commodities. Switching costs weakens buyer bargaining power.

- Barriers to entry. The easier it is to enter an industry, the more challenging it will be to make a profit in that industry. Imagine you are considering starting a lawn mowing business. The entry barrier is very low since all you need is a lawn mower. No special skills or licenses are required. However, this means your neighbor next door may decide to start mowing lawns also, resulting in increased competition. In contrast, a highly technical industry, such as the manufacturing of medical devices has numerous barriers to entry. You would need to find numerous suppliers for various components, hire a variety of highly skilled engineers, and work closely with Health Canada to secure approval for the sale of your products. The nature of competition is changing with the rise of new digital business models and technology innovations. Some digital businesses require little start-up, sometimes just a website, making it easier to enter the market.

- Rivalry among existing competitors: Rivalry among existing competitors helps you evaluate your entry into the market. When rivalry is fierce, each competitor attempts to gain additional market share from the others. This can result in aggressive pricing, increasing customer support, or other factors which might lure a customer away from a competitor. Markets in which rivalry is low may be easier to enter and become profitable sooner because all of the competitors are accepting of each other’s presence. Rivalry is increasing as technological advancements are making it easier to enter markets and keep costs low. For example, platform business models that facilitate exchanges between people while producing business value are changing the industry dynamics(Evans, 2015). These models do not require physical infrastructure and they provide a focus on customer support. Examples include: Google, Facebook, Airbnb and eBay.

Porter’s five forces are used to analyze an industry to determine the average profitability of a company within that industry. Adding in Porter’s analysis of the Internet to his Five Forces results in the realization that technology has lowered overall profitability (Porter, 2001).

Technology plays a significant role in shaping and reshaping Porter’s five forces, but it’s not the only significant force that can create an industry impact. Government deregulation or intervention, political shock, and social and demographic changes can all play a role in altering the competitive landscape. Because we live in an age of constant and relentless change, managers need to continually visit strategic frameworks to consider any market-impacting shifts. Predicting the future is difficult, but ignoring change can be catastrophic. There is also a danger in relying too much on technology.

“Chapter 7: Does IT Matter? “ from Information Systems for Business and Beyond (2019) by David Bourgeois is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License, except where otherwise noted.