Chapter 8

Solutions

Exercise 8.1

a. This investment will be classified as equity investments at cost less any reduction for impairment, because these are equity investments that are not publicly traded. They would be reported as either current or long-term, depending upon the intention of management to hold or sell within one year.

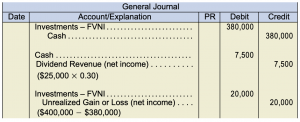

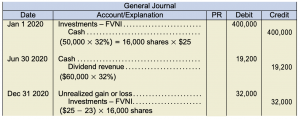

c. To purchase the investment:

To receive the cash dividends:

To receive the cash dividends:

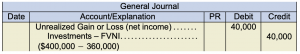

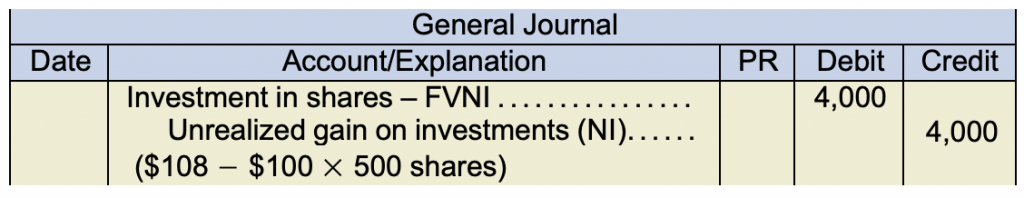

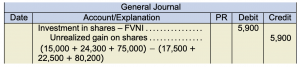

Year-end adjusting entry to fair value for FVNI investments:

Year-end adjusting entry to fair value for FVNI investments: For sale of investment:

For sale of investment:

No year-end adjustments are needed under the cost method.

No year-end adjustments are needed under the cost method.

d. Under ASPE, if the shares traded on an active market, they would be classified as a short-term trading investment at FVNI. The entries would be identical to the ones in part (c) above, including the adjustment to fair values at year end.

Exercise 8.2

- Using a business calculator present value functions, solve for interest I/Y when the present value, payment, number of periods and future values are given:

PV = (PMT, I/Y, N, FV)± 25,523PV = 1000 PMT, unknown I/Y, 10 N, 25000 FV = 3.745% (rounded)

-

Face value of the bond

Present value of the bond

Bond premium

$25,000

25,523

$523

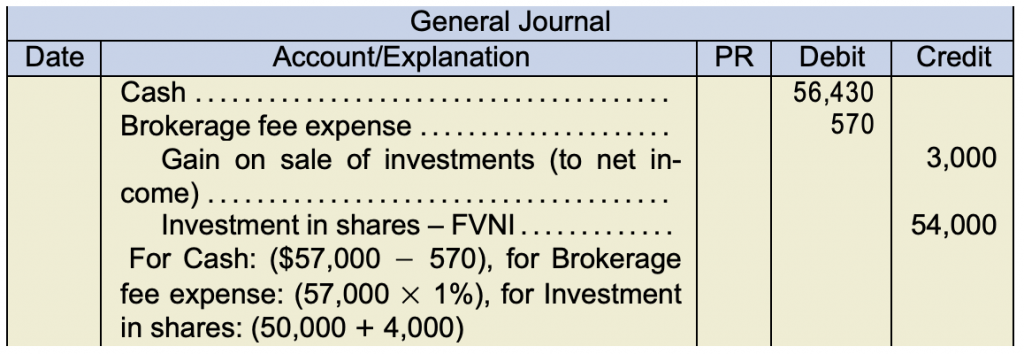

- Journal entries for a AC investment using amortized cost:

Alternative calculation to the effective interest rate schedule below using a business calculator and present value functions:

PV = 1000 PMT, 2 N, 3.745 I/Y, 25000 FV = 25,120.68 where N is 2 years left to maturity.

Effective Interest Rate Schedule

Date Cash Received 4% Interest Income (3.745%) Bond Premium Amortization Carrying Value Jan 1/20 25,523 Jan 1/21 1,000 956[1] 44 25,479 Jan 1/22 1,000 954 46 25,433 Jan 1/23 1,000 953 47 25,386 Jan 1/24 1,000 951 49 25,337 Jan 1/25 1,000 949 51 25,286 Jan 1/26 1,000 947 53 25,233 Jan 1/27 1,000 945 55 25,178 Jan 1/28 1,000 943 57 25,121 (date of sale) Jan 1/29 1,000 941 59 25,062 Jan 1/30 1,000 938 62[2] 25,000 Total $10,000 $9,477 $523 25,000 -

Total interest income is $9,477 − 941 − 938 = $7,598 after holding the investment for eight out of ten years.

Total net cash flows for Smythe is (25,523) cash paid + ($1,000 × 8 years) + 25,250 cash received upon sale = $7,727 over the life of the investment.

The difference of $129.48 (7,597.52−7,727) is the gain on the sale of the investment of $130 at the end of eight years. (The small difference is due to rounding.)

- If Smythe followed ASPE, then the investment would be accounted for using amortized cost. However, in this case, there would be a choice regarding the method used to amortize the bond premium of $523 calculated in part (b). The choices are straight-line amortization over the bond’s life or the effective interest rate method shown in part (c). If the straight-line method was used, then the yearly amortization amount would have been $523 ÷ 10 years or $52.30 per year for 8 years until the bonds were sold in 2028. The interest income would be the same over the 8 years.

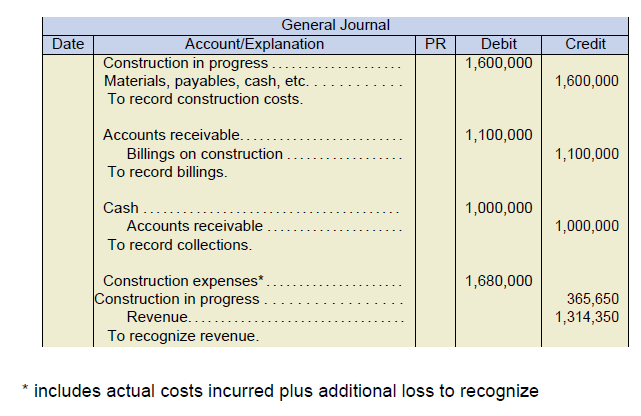

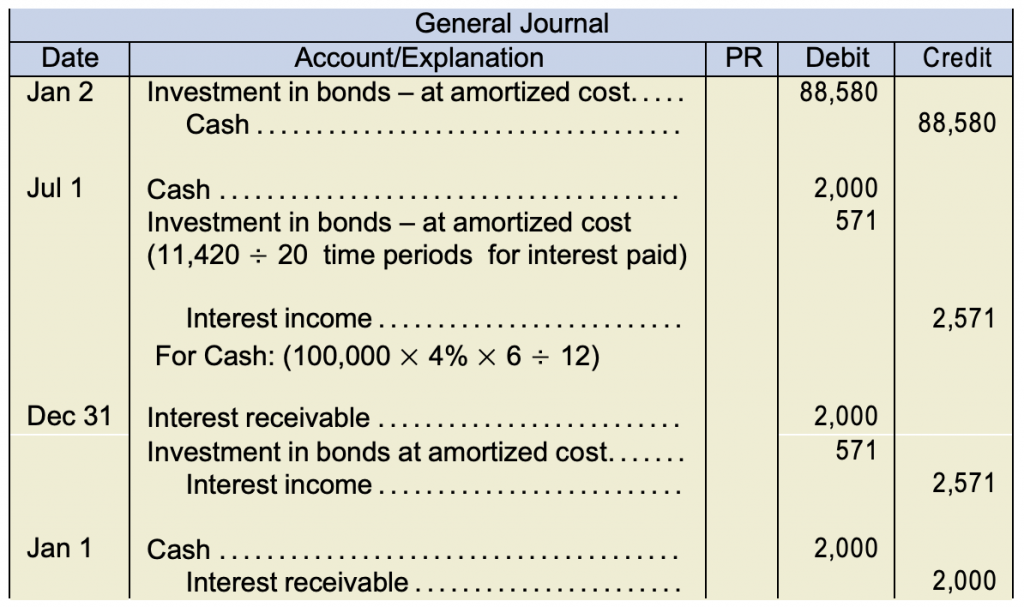

Exercise 8.3

-

Face value of the bond

Amount paid

Discount amount

$100,000

88,580

$11,420

The market value of an existing bond will fluctuate with changes in the market interest rates and with changes in the financial condition of the corporation that issued the bond. For example, a 9% bond will become more valuable if market interest rates decrease to 8% because the interest payment is at a higher rate than what investors would receive if they invested in a market that yielded only 8%.

In this case, the issued bond promises to pay 4% interest for the next 10 years in a marketplace where interest has now risen to 5.5% for bonds with similar characteristics and risks. This bond will now become less valuable because the market interest rate has risen, and investors would receive a higher return in the market than with the 4% bond. When the financial condition of the issuing corporation deteriorates, the market value of the bond is likely to decline as well.

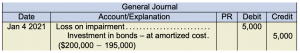

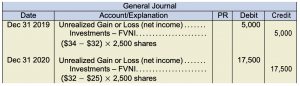

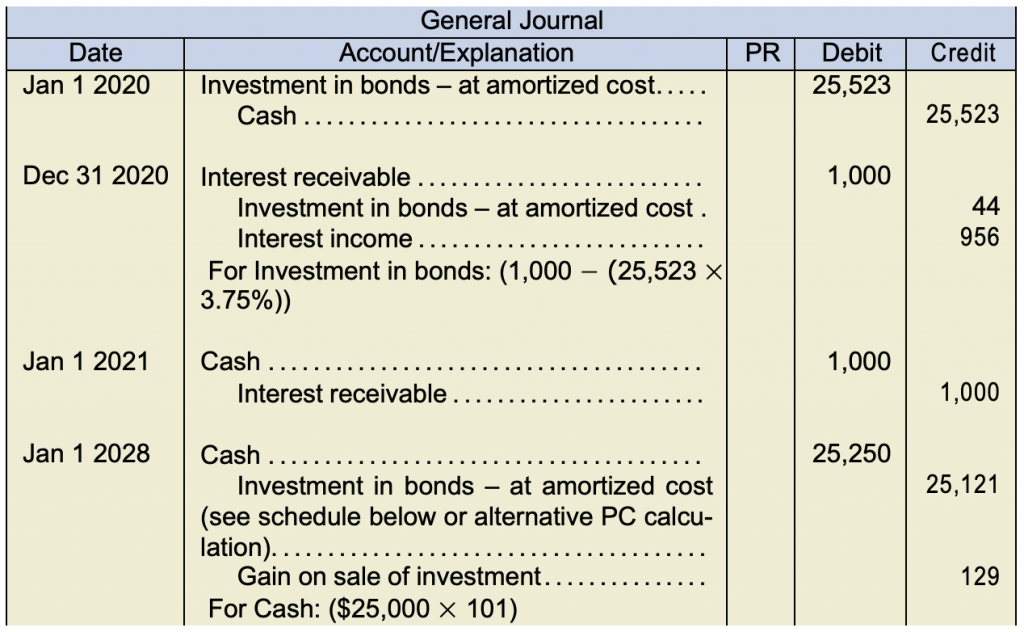

Exercise 8.4

Exercise 8.5

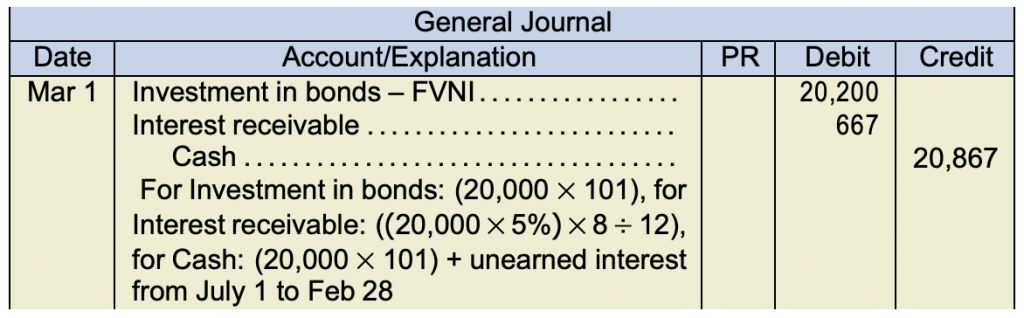

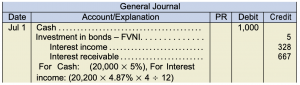

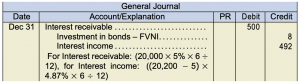

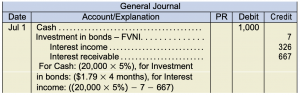

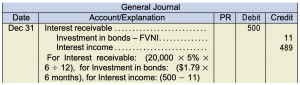

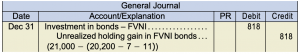

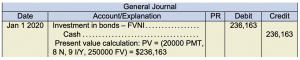

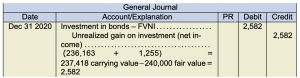

a. Imperial Mark will classify this investment as an investment in bonds – FVNI and will report the investment as a current asset.

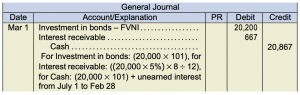

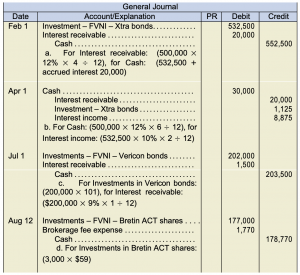

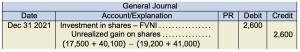

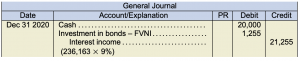

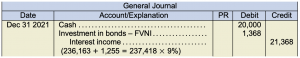

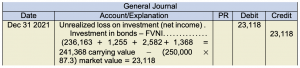

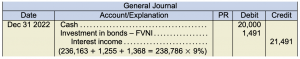

b. Investment purchase: Payment of interest using the effective interest rate (IFRS):

Payment of interest using the effective interest rate (IFRS): Interest accrual using the effective interest rate (IFRS):

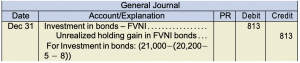

Interest accrual using the effective interest rate (IFRS): Fair value adjustment at year-end:

Fair value adjustment at year-end:

c. If Imperial Mark follows ASPE, it would classify the investment in bonds as Short- Term Trading Investments, FVNI, and report it as a current investment since management intends to sell it. The alternate method to amortize the premium is using straight-line method. The premium to amortize is the face value minus the investment cost over the life of the bond or (20,000 − 20,200) = 200 ÷ 112 months = 1.79 per month. The interest income at year-end would be the investment amount at the face rate of interest minus the premium amortized using SL for that reporting period.Investment purchase:

Interest payment using straight-line amortization of premium:

Interest payment using straight-line amortization of premium: Interest accrual using straight-line method (ASPE):

Interest accrual using straight-line method (ASPE): Fair value adjustment at year-end:

Fair value adjustment at year-end:

Exercise 8.6

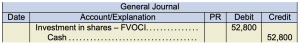

a. Halberton would classify this as an investment in shares – FVOCI equities, without recycling, which is a special irrevocable election. Even though it may be for sale, there is no specific intention as to exactly when it will be sold, so it does not fit the business model for shares that are being actively traded. The investment will be reported as a long-term asset because it is unknown when it will be sold.

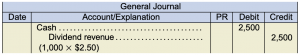

b. Purchase of investment: Dividend payment:

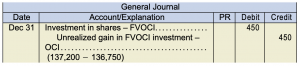

Dividend payment: Fair-value adjustment through OCI:

Fair-value adjustment through OCI: The drop in price is not due to investment impairments, it is due to market fluctuations. For this reason, it is a fair value adjustment through OCI. Had the credit risk for this investment increased due to increased expected defaults, management would have revised the ECL and adjusted the investment and loss accounts (to net income due to impairment) accordingly.

The drop in price is not due to investment impairments, it is due to market fluctuations. For this reason, it is a fair value adjustment through OCI. Had the credit risk for this investment increased due to increased expected defaults, management would have revised the ECL and adjusted the investment and loss accounts (to net income due to impairment) accordingly.

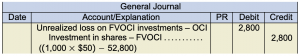

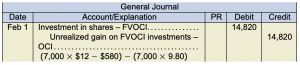

c. Sale entries – step 1 – first, record the fair value change to the investment and OCI: Step 2 – record the cash proceeds and remove the investment:

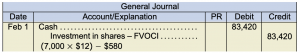

Step 2 – record the cash proceeds and remove the investment: NOTE – steps 1 and 2 can be combined as shown in the chapter illustrations. They have been separated here for illustration purposes. Either method is acceptable.

NOTE – steps 1 and 2 can be combined as shown in the chapter illustrations. They have been separated here for illustration purposes. Either method is acceptable.

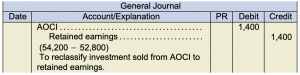

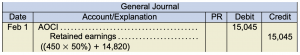

Step 3 – remove the OCI amount that related to the investment sold:

d. If Halberton followed ASPE, this investment would likely be classified as a short- term trading investment with fair value adjustments at each reporting date, since the investment for shares appears to have active market prices and the investment is for sale (though no specific intention to sell exists at the moment). If the shares were not publicly traded, then the investment would likely be classified as an Other Investment – at cost, with no fair value adjustments.

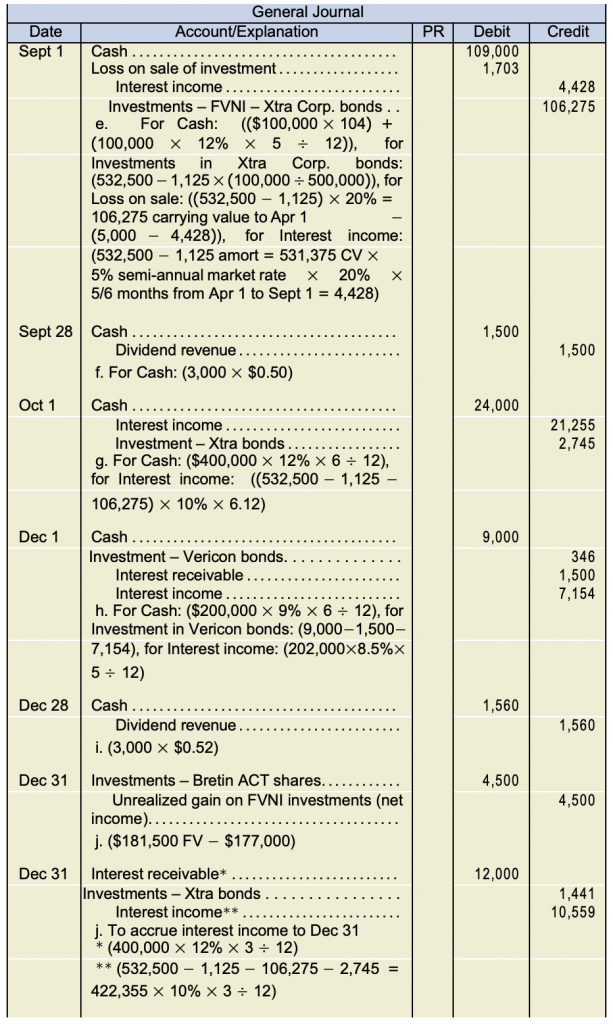

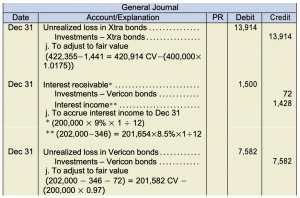

Exercise 8.7

NOTE – An alternative treatment is to debit interest income at the date of purchase of the bonds instead of interest receivable. This procedure is correct, assuming that when the cash is received for the interest, an appropriate credit to interest income is recorded. Consistency is key.

Exercise 8.8

a. Verex follows IFRS because only IFRS companies can account for investments using the FVOCI classification. In this case, the FVOCI is without recycling because these are equities.

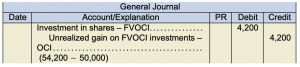

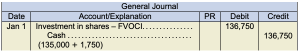

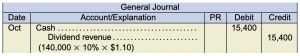

b. Purchase of investment: Cash dividend declared:

Cash dividend declared: Year-end fair value adjusting entry:

Year-end fair value adjusting entry: Sale entries – step 1 – first, record the fair value change to the investment and OCI:

Sale entries – step 1 – first, record the fair value change to the investment and OCI: Step 2 – record the cash proceeds and remove the investment:

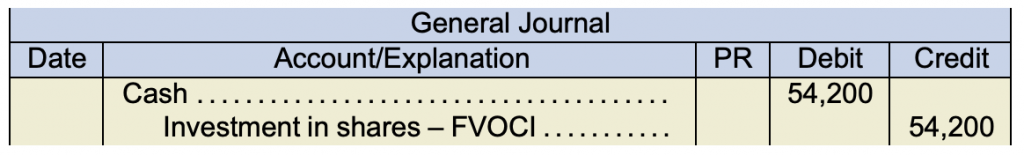

Step 2 – record the cash proceeds and remove the investment: Step 3 – reclassify the OCI amount related to the investment sold from AOCI to OCI:

Step 3 – reclassify the OCI amount related to the investment sold from AOCI to OCI: NOTE – steps 1 and 2 are combined in the chapter illustrations. They have been separated here for illustration purposes.

NOTE – steps 1 and 2 are combined in the chapter illustrations. They have been separated here for illustration purposes.

Exercise 8.9

Other Comprehensive Income (OCI) = unrealized holding gain in FVOCI investments = $350,000 − 320,000 = $30,000

Comprehensive Income (CI) = net income + OCI = $250,000 + 30,000 = $280,000

Accumulated Other Comprehensive Income (AOCI) = AOCI opening balance + OCI = $15,000 + 30,000 = $45,000

Exercise 8.10

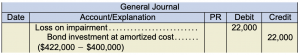

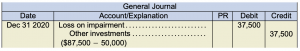

Entry for impairment:

Note: For ASPE, the impaired value is the higher of the discounted cash flow using the current market interest rate and the net realizable value (NRV) either through sale or by exercising the company’s rights to collateral. Since the NRV information is not available, the discounted cash flow using the current market interest rate is the measure used to determine impairment.

Entry for impairment recovery:

Exercise 8.11

- If Camille followed ASPE, these equity investments would be classified as FVNI since there appears to be an active market for these shares. The entries would be the same as those shown for parts (a), (b), and (c). No impairment measurements are required since the investments are already accounted for using fair values.

Exercise 8.12

-

Partial Balance Sheet

As at December 31, 2019Current assets Interest receivable $ 1,500 Investments in bonds – FVNI (225,000 + 5,850) 230,850 Partial income statement

For the Year Ended December 31, 2019Other income Interest income (750 + 1,500) $2,250 Unrealized gain on FVNI investments 5,850 - ASPE requires separate reporting of interest income from net gains or losses recognized on financial instruments (CPA Canada Handbook, Part II, Accounting Standards for Private Enterprises, Section 3856.52) whereas IFRS can choose to dis- close whether the net gains or losses on financial assets measured at fair value and reported on the income statement include interest and gains or losses, but it is not mandatory. (For purposes of this text, the preferred treatment for either standard is to separate unrealized gains/loss, interest income and dividend income separately since some of the information is required when completing the corporate tax returns for either ASPE or IFRS companies.)

- The overall returns generated from the bond investment was $10,050, calculated as follows:

Interest Oct 31, 2019

Interest accrued Dec 31, 2019

Unrealized gain to Dec 31, 2019

Interest accrued Mar 1, 2020

Gain on sale of bonds Mar 1, 2020

Total investment returns (income and gains)

$ 750

1,500

5,850

1,500

450

10,050

This return represents a 10.72% annual return on the investment [($10,050 ÷ 5 months × 12) ÷ $225,000]. This return is more than anything the company might be able to earn in a typical savings account.

Exercise 8.13

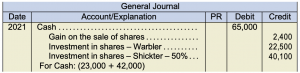

- December 31, 2020 entry:

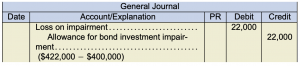

Under ASPE, the carrying amount is reduced to the higher of the discounted cash flow using a current market rate or the bond’s net realizable value NRV. Impairment reversals are permitted under ASPE for both debt and equity instruments.

Under ASPE, the carrying amount is reduced to the higher of the discounted cash flow using a current market rate or the bond’s net realizable value NRV. Impairment reversals are permitted under ASPE for both debt and equity instruments. - December 31, 2020 entry:

The investment account remains at its current carrying amount and it is offset by the credit balance in the asset valuation allowance account.

The investment account remains at its current carrying amount and it is offset by the credit balance in the asset valuation allowance account.

Exercise 8.14

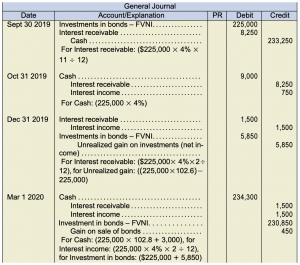

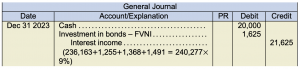

a. Purchase of bonds: Interest payment:

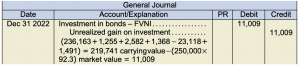

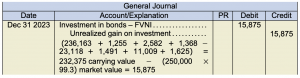

Interest payment: Fair value adjustment:

Fair value adjustment: Interest payment:

Interest payment: Fair value adjustment:

Fair value adjustment: Interest payment:

Interest payment: Fair value adjustment:

Fair value adjustment: Interest payment:

Interest payment: Fair value adjustment:

Fair value adjustment:

- b. Part (a) uses a fair values to measures for FVNI investments and are re-measured to their FV at each year-end. No, separate impairment measurement if required because they are already at their fair values. If Helsinky had accounted for this investment at amortized cost, the impairment model would change to an incurred loss model. When there is objective evidence that the expected future cash flows have been significantly reduced, an impairment loss is measured and recognized as follows:

The loss is measured as the difference between the carrying amount and higher of the present value of the revised expected cash flows, dis- counted at the current market discount rate and the estimated net realizable value of the investment.

The impairment losses can be reversed if the investment values increase.

Exercise 8.15

a. Dec 31, 2019: No entry as there was no trigger or loss event in 2019. b.

b.

c. For an investment in equities classified as FVOCI, there are no impairment evaluations required because the investment is remeasured to its fair value each reporting date and the gains/losses upon sale are reclassified from AOCI to retained earnings. Had the investment been a debt investment and classified as FVOCI, such as bonds, an impairment evaluation would be required initially upon acquisition and based on either a 12-month or lifetime ECL valuation. This is because the gains/losses are recycled through net income upon sale. Any impairment loss would be immediately recorded to net income in this case and not to OCI.

Exercise 8.16

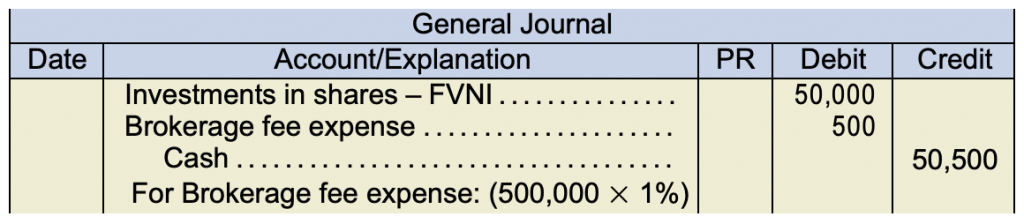

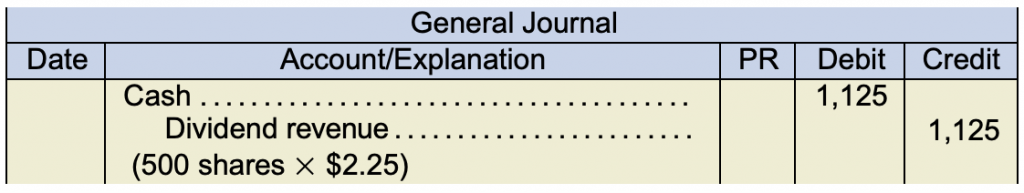

a. Since Yarder’s shares were quoted in an active market, Sandar is required to apply the FVNI classification to account for its investment. If the shares were not quoted in an active market, the cost method would have been required.FVNI – where the shares are traded in an active market:

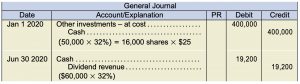

b. Cost method – where there is no active market for the shares: Dec 31, 2020: No entry required.

Dec 31, 2020: No entry required.

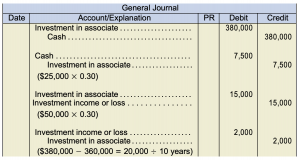

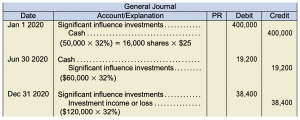

c. Equity method: NOTE: Even though Sandar has significant influence over the operations of Outlander, companies that follow ASPE have a choice between the equity method and the held-for-trading (active market), or the equity method and the cost method (no active markets).

NOTE: Even though Sandar has significant influence over the operations of Outlander, companies that follow ASPE have a choice between the equity method and the held-for-trading (active market), or the equity method and the cost method (no active markets).

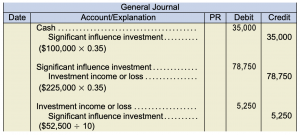

Exercise 8.17

- Investee’s total net income = $60,000 ÷ 30% = $200,000

- Investee’s total dividend payout = $200,000 × 15% = $30,000

- Investor’s share of net income = $200,000 × 30% = $60,000

- Investor’s annual depreciation of the excess payment for net capital assets is the only other credit amount recorded in the T-account for $1,500

- Goodwill = $900,000 × 30% = 270,000 − 290,000 = 20,000 − (1,500 × 10 years) = 5,000 to goodwill

- Investor’s share of dividends = $30,000 × 30% = $9,000

Exercise 8.18

b. Recall that comprehensive income is:

Net income + Other Comprehensive Income (i.e., unrealized fair value gains/losses from FVOCI investments) = Comprehensive Income

With this in mind, comprehensive income will be the same amount as net income because there is no Other Comprehensive Income (OCI) amount to report as the investment is classified as FVNI with unrealized gains and losses due to fair value adjustments being recorded to net income. Had the investment been classified as FVOCI, then the $20,000 fair value change would have been reported as OCI and not in net income, thus increasing comprehensive income by $20,000 more than net income in 2019, and by $40,000 in 2020.

NOTE: there is no entry to adjust the investment to its fair value under the equity method.

2020:

NOTE: there is no entry to adjust the investment to its fair value under the equity method.

NOTE: there is no entry to adjust the investment to its fair value under the equity method.

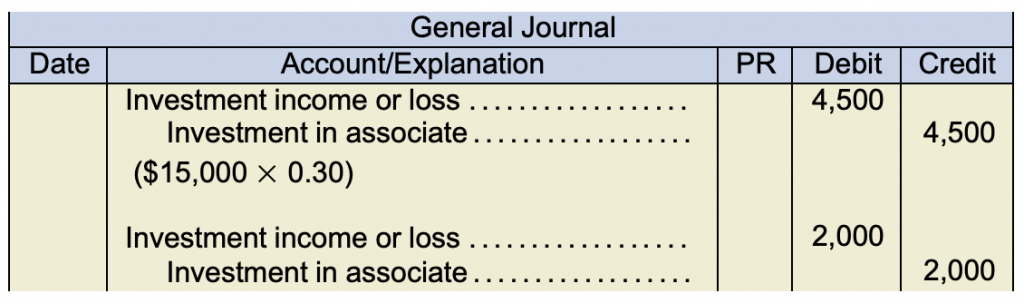

d. Carrying amount of the investment:

Cost

Dividend received in 2019

Income earned in 2019 (15,000 – 2,000)

Loss incurred in 2020 (4,500 + 2,000)

Carrying amount at December 31, 2020

Fair value of investment at December 31, 2020

$380,000

(7,500)

13,000

(6,500)

$379,000

$360,000

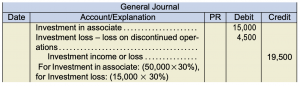

e. For part (c), if the investee had reported a loss from discontinued operations, all entries would stay the same except for the entry recording the 2019 share of income. This entry would change to reflect the investor’s share of the loss from discontinued operations separately from its share of the loss from continuing operations because separate reporting of discontinued operations is a reporting requirement for IFRS and ASPE.2019: Income Statement details:

Income Statement details:

Income from continuing operations

Loss from discontinued operations

Net income

$ 65,000

(15,000)

$ 50,000

Exercise 8.19

Cost of 35% investment

Carrying values:

Assets ($900,000 + 780,000)

Liabilities

Excess paid over share of carrying value

$1,680,000

225,000

1,455,000 × 35%

$90,750

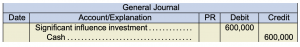

$600,000

509,250

$90,750

Excess of $90,750 allocated to:

Assets subject to amortization

[($1,050,000 − $900,000) × 35%]

Residual to goodwill

52,500

38,250

$90,750

Exercise 8.20

| a) ASPE | b) IFRS | |

|---|---|---|

| i. | FVNI since an active market exists. No separate impairment evaluation needed since investment is adjusted to fair value. | FVOCI without recycling, with unreal- ized gain/loss through OCI since there is no specific intention to sell for trading purposes. No separate impairment evaluation needed since investment is adjusted to fair value and not recycled through net income. |

| ii. | Other investment in equities at cost, since no active market exists. No fair value adjustments are done. Impairment adjustment is possible if a trigger event occurs. Impairment reversal is possible. When 30% is obtained, management will need to re-measure. | FVOCI without recycling, with unrealized gain/loss through OCI since there is a long-term strategy regarding this investment. No separate impairment evaluation needed since investment is adjusted to fair value and not recycled through net income. When 30% is obtained, management will need to reclassify to investment in associates, if significant influence exists. |

| iii. | Other investment at amortized cost since the intention was to originally hold to maturity. No fair value adjustments are done. Impairment adjustment is possible if a trigger event occurs. Impairment reversal is possible. | Amortized cost since this investment has been accounted for since the initial purchase at amortized cost. Impairment evaluation is done based on an assessment of probability-based estimated default scenarios and +/- adjustments going forward until bond has matured. |

| iv. | Other investment in equities at cost. The FV of the shares is not a factor as they are being held to improve business relations. No fair value adjustments are done. Impairment adjustment is possible if a trigger event occurs. Impairment reversal is possible. | Likely FVOCI without recycling with unrealized gain/loss through OCI since there is no intention to actively trade them. No separate impairment evaluation needed since investment is adjusted to fair value and not recycled through net income. |

| v. | FVNI since the bonds trade on the market. Management intent is to sell as soon as the market price increases. No separate impairment evaluation needed since investment is adjusted to fair value. |

FVNI. No separate impairment evaluation needed since investment is adjusted to fair value. |

| vi. | Other investments at amortized since the intention is to hold to maturity. No fair value adjustments are done. Impairment adjustment is possible if a trigger event occurs. Impairment reversal is possible. | At amortized cost since this investment will be held until maturity. Impairment evaluation is done based on an assessment of probability-based estimated default scenarios and +/- adjustments going forward until bond has matured. |

| vii. | FVNI since management intends to sell them within one year. No separate impairment evaluation needed since investment is adjusted to fair value. | FVNI since management intent is to sell within one year. No separate impairment evaluation needed since investment is adjusted to fair value. |

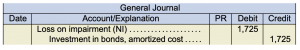

Exercise 8.21

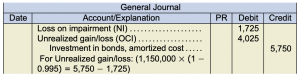

The intent is to hold the investment and to collect interest and principal until maturity, so the classification should be amortized cost.

(1,150,000 × 0.01 × 0.15) = 1,725 ECL over the next 12 months

Carrying value of the investment in bonds is (1,150,000 − 1,725) = $1,148,275

Exercise 8.22

(1,150,000 × 0.06 × 0.50) = 34,500 ECL over the investment’s lifetime

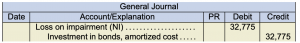

1,150,000 − 34,500 = 1,115,500 probability-based fair value − 1,148,275 carrying value = 32,775 impairment

Carrying value of the investment in bonds is therefore 1,115,500.

The ECL increase is deemed to be significant by management and as a result, the ECL has changed from a 12-month ECL to the investment’s lifetime (Lifetime ECL).

Exercise 8.23

Exercise 8.24

1. Cost Model

| Feb 20, Y5 | Investments - Huron Inc | 13,332 | |

| Cash | 13,332 | ||

| purchase of investment + commission ($13,200 × 1.01) | |||

| Jun 30, Y5 | Cash | 840 | |

| Dividend Revenue | 840 | ||

| 400 shares × $2.10 per share | |||

| Jan 20, Y6 | Cash | 14,700 | |

| Gain on disposal of investments | 1,368 | ||

| Investments - Huron Inc | 13,332 | ||

| cash received = 400 shares × $36.75 per share |

2. FVNI Model

| Feb 20, Y5 | FV-NI Investments - Huron Inc | 13,200 | |

| Transaction fee expense | 132 | ||

| Cash | 13,332 | ||

| commission (an expense for FV-NI investments) = $13,200 × 1% | |||

| Jun 30, Y5 | Cash | 840 | |

| Dividend Revenue | 840 | ||

| 400 shares × $2.10 per share | |||

| Dec 31, Y5 | FV-NI Investments - Huron Inc | 480 | |

| Unrealized gain on FVNI Investments | 480 | ||

| fair value (at Dec 31) | 13,680 | ||

| carrying value | 13,200 | ||

| GAIN | 480 | ||

| Jan 20, Y6 | Cash | 14,700 | |

| FV-NI Investments - Huron Inc | 13,680 | ||

| Gain on sale of FV-NI Investments | 1,020 | ||

| cash received = 400 shares × $36.75 per share |

3. FVOCI Model

| Feb 20, Y5 | FV-OCI Investments - Huron Inc | 13,332 | ||

| Cash | 13,332 | |||

| purchase of investment + commission ($13,200 × 1.01) | ||||

| Jun 30, Y5 | Cash | #colspan# | 840 | |

| Dividend Revenue | 840 | |||

| 400 shares × $2.10 per share | ||||

| Dec 31, Y5 | FV-OCI Investments - Huron Inc | 348 | ||

| Unrealized gain on FVOCI Investments | 348 | |||

| fair value (at Dec 31) | 13,680 | |||

| carrying value | 13,332 | |||

| GAIN | 348 | |||

| Jan 20, Y6 | Cash | 14,700 | ||

| FV-NI Investments - Huron Inc | 13,680 | |||

| Gain on sale of FV-OCI Investments | 1,020 | |||

| record sale | ||||

| Jan 20, Y6 | Accumulated other comprehensive income | 1,368 | ||

| Retained earnings | 1,368 | |||

| since investments are equity investments and have been sold, must close the AOCI to retained earnings (no recycling). | ||||

Exercise 8.25

1. Journal Entries

|

Date |

Debit |

Credit |

||

| 1/1/Y3 | Investment in Associate | 596,430 | ||

| Cash | 596,430 | |||

|

Date |

Debit |

Credit |

||

| 7/1/Y3 | Cash | 28,000 | ||

| Investment in Associate | 28,000 | |||

|

Date |

Debit |

Credit |

||

| 12/31/Y3 | Investment Income or Loss | 840 | ||

| Investment in Associate | 840 | |||

| undevalued assets | $42,000 | |||

| % owned by Waterlook | 20% | |||

| 8,400 | ||||

| useful life | 10 | years | ||

| additional depreciation | 840 | |||

|

Date |

Debit |

Credit |

||

| 12/31/Y3 | Investment in Associate | 91,250 | ||

| Investment Income or Loss | 91,250 | |||

| share of net income $456,250 × 20% ownership | ||||

2. Balance in “Investment in Associate” at December 31, Y3

| Initial investment | $596,430 |

| Dividends received | -28,000 |

| Additional depreciation | -840 |

| Share of net income | 91,250 |

| Investment in Associate (Dec 31,Y3) | $658,840 |

Exercise 8.26

1. IFRS – Effective Interest

| PV | -$64,595 | |

| Rate | 5% | (interest is semi-annual) |

| Nper | 10 | (interest is semi-annual) |

| Pmt | 2,8000 | $70,000 × 8% × 1/2 |

| FV | 70,000 | |

| Type | 0 | for bonds - always type 0 (interest at end of period) |

|

Date |

Cash |

Interest Revenue |

Amortization |

Carrying Value |

|---|---|---|---|---|

| Jan 1, Y3 | 64,595 | |||

| Jun 30, Y3 | 2,800 | 3,230 | 430 | 65,025 |

| Dec 31, Y3 | 2,800 | 3,251 | 451 | 65,476 |

| Jun 30, Y4 | 2,800 | 3,274 | 474 | 65,950 |

| Dec 31, Y4 | 2,800 | 3,297 | 497 | 66,447 |

| Jun 30, Y5 | 2,800 | 3,322 | 522 | 66,969 |

| Dec 31, Y5 | 2,800 | 3,348 | 548 | 67,519 |

| Jun 30, Y6 | 2,800 | 3,376 | 576 | 68,094 |

| Dec 31, Y6 | 2,800 | 3,405 | 605 | 68,698 |

| Jun 30, Y7 | 2,800 | 3,435 | 635 | 69,333 |

| Dec 31, Y7 | 2,800 | 3,467 | 667 | 70,000 |

| Jan 1, Y3 | Bond Investment - at Amortized Cost | $64,595 | |

| Cash | $64,595 | ||

| June 30, Y3 | Cash | 2,800 | |

| Bond Investment - at Amortized Cost | 430 | ||

| Interest Revenue | 3,230 | ||

| Dec 31, Y3 | Cash | 2,800 | |

| Bond Investment - at Amortized Cost | 451 | ||

| Interest Revenue | 3,251 | ||

| June 30, Y4 | Cash | 2,800 | |

| Bond Investment - at Amortized Cost | 474 | ||

| Interest Revenue | 3,274 | ||

| Dec 31, Y4 | Cash | 2,800 | |

| Bond Investment - at Amortized Cost | 497 | ||

| Interest Revenue | 3,297 |

2. ASPE – Straight Line

| Face value of bonds | 70,000 |

| Present value of bonds | 64,595 |

| Difference | 5,405 |

| Number of periods | 10 |

| Semi-annual amortization | $541 |

| Jan 1, Y3 | Bond Investment - at Amortized Cost | $64,595 | |

| Cash | $64,595 | ||

| June 30, Y3 | Cash | 2,800 | |

| Bond Investment - at Amortized Cost | 541 | ||

| Interest Revenue | 3,341 | ||

| Dec 31, Y3 | Cash | 2,800 | |

| Bond Investment - at Amortized Cost | 541 | ||

| Interest Revenue | 3,341 | ||

| June 30, Y4 | Cash | 2,800 | |

| Bond Investment - at Amortized Cost | 541 | ||

| Interest Revenue | 3,341 | ||

| Dec 31, Y4 | Cash | 2,800 | |

| Bond Investment - at Amortized Cost | 541 | ||

| Interest Revenue | 3,341 |

Exercise 8.27

| June 15, Y6 | Cash | 73,000 | |

| Unrealized gain - OCI investment | 500 | ||

| FV-OCI Investment | 72,500 | ||

| FV-OCI investment $70,000 original cost + $2,500 unrealized gain | |||

| June 15, Y6 | Accumulated Other Comprehensive Income | 3,000 | |

| Retained Earnings | 3,000 | ||

| since this is an equity investment, no recycling - AOCI closes to retained earnings | |||

| AOCI = $2,500 prior unrealized gain + $500 unrealized gain at time of sale |

OR

1st entry can be broken into two steps:

| June 16, Y6 | FV-OCI Investment | 500 | ||

| Unrealized gain - OCI investment | 500 | |||

| FV-OCI investment = $72,500 value on books - fair value at time of sale = $73,000 | ||||

| June 15, Y6 | Cash | 73,000 | ||

| FV-OCI Investment | 73,000 | |||

Exercise 8.28

| June 15, Y6 | Cash | 73,000 | ||

| Unrealized gain - OCI investment | 500 | |||

| FV-OCI Investment | 72,500 | |||

| FV-OCI investment $70,000 original cost + $2,500 unrealized gain | ||||

| June 15, Y6 | Accumulated Other Comprehensive Income | 3,000 | ||

| Retained Earnings | 3,000 | |||

| since this is an equity investment, no recycling - AOCI closes to retained earnings | ||||

| AOCI = $2,500 prior unrealized gain + $500 unrealized gain at time of sale | ||||

OR

1st entry can be broken into two steps:

| June 16, Y6 | FV-OCI Investment | 500 | ||

| Unrealized gain - OCI investment | 500 | |||

| FV-OCI investment = $72,500 value on books - fair value at time of sale = $73,000 | ||||

| June 15, Y6 | Cash | 73,000 | ||

| FV-OCI Investment | 73,000 | |||

Exercise 8.29

| PV | -322,745 |

| Rate | 10% |

| Nper | 5 |

| Pmt | 36,000 |

| FV | 300,000 |

| Type | 0 |

1. Amortization Schedule

|

Date |

Cash |

Interest Revenue |

Amortization |

Carrying Value |

|---|---|---|---|---|

| Jan 1, Y2 | 322,745 | |||

| Jan 1, Y3 | 36,000 | 32,274 | 3,726 | 319,019 |

| Jan 1, Y4 | 36,000 | 31,902 | 4,098 | 314,921 |

| Jan 1, Y5 | 36,000 | 31,492 | 4,508 | 310,413 |

| Jan 1, Y6 | 36,000 | 31,041 | 4,959 | 305,455 |

| Jan 1, Y7 | 36,000 | 30,545 | 5,455 | 300,000 |

2. Journal Entries

| Jan 1, Y2 | FV-OCI Investment - bonds | 322,745 | |||

| Cash | 322,745 | ||||

| record initial investment | |||||

| Dec 31, Y2 | Interest Receivable | 36,000 | |||

| Interest Revenue | 32,274 | ||||

| FV-OCI Investment - bonds | 3,726 | ||||

| to accrue for interest earned for Y2 (cash to be received Jan 1, Y3) | |||||

| Dec 31, Y2 | FV-OCI Investment - bonds | 1,481 | |||

| Unrealized gain on OCI Investments | 1,481 | ||||

| Fair value | 320,500 | given | |||

| Carrying value | 319,019 | from amortization schedule above | |||

| Gain | 1,481 | ||||

| Jan 1, Y3 | Cash | 36,000 | |||

| Interest Receivable | 36,000 | ||||

| Dec 31, Y3 | Interest Receivable | 36,000 | |||

| Interest Revenue | 31,902 | ||||

| FV-OCI Investment - bonds | 4,098 | ||||

| to accrue for interest earned for Y3 (cash to be received Jan 1, Y4) | |||||

| Dec 31, Y3 | Unrealized loss on OCI Investment | 7,402 | |||

| FV-OCI Investment - bonds | 7,402 | ||||

| Fair value | 309,000 | given | |||

| Carrying value | 316,402 | FV @ Dec 31, Y2 - Y3 amortization ($320,500 - 4,098) | |||

| Loss | 7,402 | ||||

![General journal. Jan 2 Investment in bonds – at amortized cost under debit 88,580 Cash under credit 88,580 Jul 1 Cash under debit 2,000 Investment in bonds – at amortized cost under debit 436 Interest income under credit 2,436 For Cash: (100,000×4%×6÷12), for Interest income: (88,580 × 5.5% × 6 ÷ 12) Dec 31 Interest receivable under debit 2,000 Investment in bonds – at amortized cost under debit 448 Interest income under credit 2,448 For Interest income: ([$88,580 + $436] × 5.5% × 6 ÷ 12) Jan 1 Cash under debit 2,000 Interest receivable under credit 2,000](https://ecampusontario.pressbooks.pub/app/uploads/sites/1911/2021/10/8.3-general-journal-solution-exercise-example-b--1024x640.png)

![General journal. Jul 1: Cash under debit 2,000 Investment in bonds – at amortized cost under debit 436 Interest income under credit 2,436 For Cash: (100,000×4%×6÷12), for Interest income: (88,580 × 5.5% × 6 ÷ 12) Sept 30: Interest receivable under debit 1,000 Investment in bonds – at amortized cost. under debit 224 Interest income under credit 1,224 For Interest receivable: (100,000 × 4% × 3 ÷ 12), for Interest income: ([$88,580 + $436] × 5.5% × 3 ÷ 12) Jan 1: Cash under debit 2,000 Investment in bonds – at amortized cost. under debit 224 Interest receivable under credit 1,000 Interest income under credit 1,224 ([$88,580 + $436] × 5.5% × 3 ÷ 12)](https://ecampusontario.pressbooks.pub/app/uploads/sites/1911/2021/10/8.4-general-journal-solution-exercise-1024x685.png)