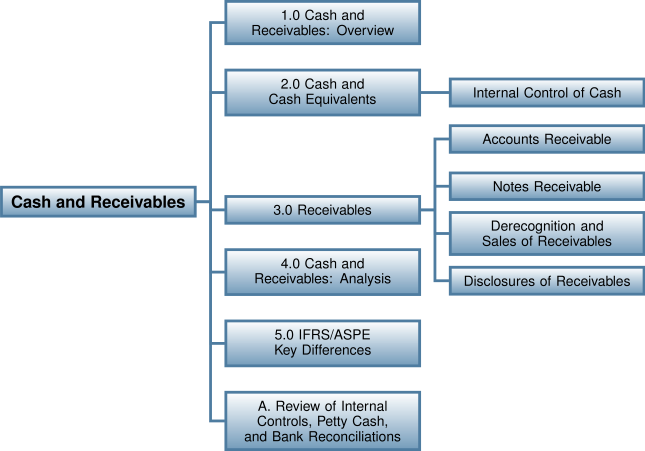

6.0 Cash and Receivables

Learning Objectives

After completing this chapter, you should be able to:

- Describe cash and receivables, and explain their role in accounting and business.

- Describe cash and cash equivalents, and explain how they are measured and reported.

- Explain the purpose and key activities of internal control for cash.

- Describe receivables, identify the different types of receivables, explain their ac- counting treatment, and prepare the relevant journal entries.

- Describe accounts receivable, and explain how they are initially and subsequently measured and reported.

- Describe notes receivables, and explain how they are initially and subsequently measured and reported.

- Describe derecognition of receivables and the various strategies businesses use to shorten the credit-to-cash cycle through sales of receivables or borrowings secured by receivables.

- Describe how receivables are disclosed on the balance sheet and in the notes.

- Identify the different methods used to analyze cash and receivables.

- Explain the differences between IFRS and ASPE for recognition, measurement, and reporting for cash and receivables.

Introduction

As the opening story about Apple illustrates, actively managing cash and receivables has important implications for businesses. The time frame required to convert receivables to cash is a cycle that calls for regular monitoring. This chapter addresses how management uses financial reporting to regularly assess both the credit-to-cash cycle and its overall cash position in terms of liquidity (the availability of liquid assets to pay short-term obligations as they come due) or solvency (the ability to meet all maturing obligations as they come due). This chapter will focus on cash, cash equivalents, accounts receivable, and notes (loans) receivable. Each of these will be discussed in terms of their use in business: their recognition, measurement, reporting, and analysis.