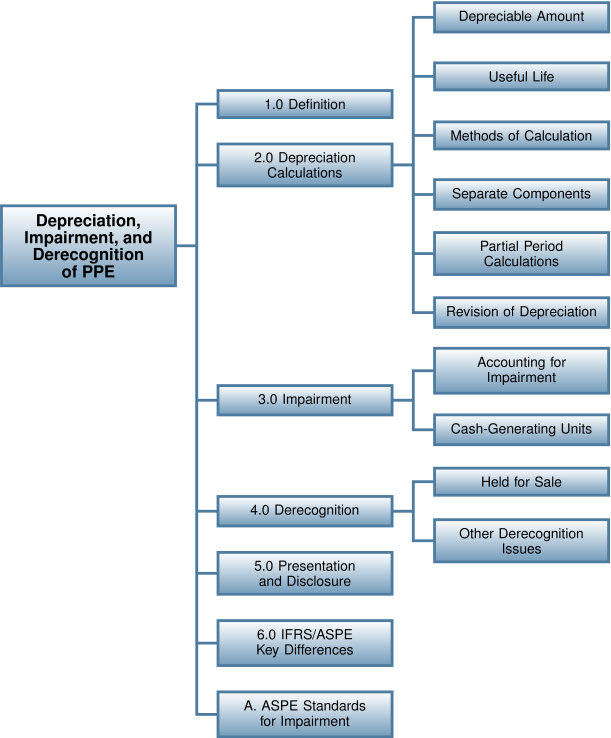

10.0 Depreciation, Impairment, and Derecognition of Property, Plant, and Equipment

Learning Objectives

After completing this chapter, you should be able to:

- Identify the purpose of depreciation, and discuss the elements that are required to calculate depreciation.

- Calculate depreciation using straight-line, diminishing-balance, and units-of-production methods.

- Discuss the reasons for separate component accounting and the accounting problems that may arise from this approach.

- Calculate depreciation when partial periods or changes in estimates are required.

- Discuss indicators of impairment and calculate the amount of impairment.

- Identify the criteria required to classify an asset as held for sale.

- Prepare journal entries for assets held for sale.

- Discuss other derecognition issues.

- Identify the presentation and disclosure requirements for property, plant, and equipment.

- Identify key differences between IFRS and ASPE.

Introduction

As we saw in the previous chapter, companies invest significant amounts of capital in property, plant, and equipment (PPE) assets. The purpose of these investments is to gain productive capacity that will further the goals of the business. The success of these investments in PPE will be evaluated based on the productive capacity attained relative to the costs incurred. We have already learned how to determine the costs to record for PPE assets. In this chapter, we will examine how to record the use of PPE assets and how to deal with the eventual disposal of these assets.