11.2 Intangible Assets: Initial Recognition and Measurement

Recognition as an intangible asset is based on both criteria being met:

- the probability that benefits will flow to the business and

- the asset cost can be reliably measured.

If these are not met, then the item is expensed when it is incurred.

If the three conditions of an intangible asset and the two recognition criteria above are met, then the intangible asset is:

- initially measured at cost

- subsequently measured at cost (or measured using the revaluation model for IFRS)

- amortized on a systematic basis over its useful life (unless the asset has an indefinite useful life, in which case it is not amortized). For IFRS, the intangible asset is tested annually for impairment. Normally intangible assets that can be amortized (finite life) are amortized using the straight-line method.

Intangible assets can be acquired:

- as a separate purchase

- as part of a business combination (either through the purchase of the business’s assets or acquiring the controlling shares of the business)

- by an exchange of assets

- by a government grant

- by self-creation (internally developed)

Rather than depreciating intangible assets, the cost is amortized. Amortization expense is calculated using the straight-line method over the useful life of the intangible asset.

11.2.1 Purchased Intangible Assets

Intangible assets purchased from another party are measured at cost. Costs are capitalized to intangible assets the same way as is done for property, plant, and equipment. As a basic review, capital costs include the acquisition cost, legal fees, and any direct costs required to get the intangible asset ready for use. If intangible assets are purchased with other assets, the cost is then allocated to each asset based on relative fair values (basket purchase). Other costs, such as training to use the asset, marketing, administration or general overhead, interest charges due to late payment for the asset purchase, and any costs incurred after the asset is put into its intended use, are expensed as incurred.

Like property, plant, and equipment, intangible assets that are purchased in exchange for other monetary and/or non-monetary assets are measured at either the fair value of the assets given up or the fair value of the intangible asset received, whichever is the most reliable measure, if there is commercial substance. When an exchange lacks commercial substance, the assets received are measured at the lessor of the carrying amount or the fair value of the assets given up.

If a company receives an intangible asset at no cost or for a nominal cost in the form of a government grant such as a grant of timber rights, then the fair value of the intangible asset acquired is typically the amount recorded.

11.2.2 Internally Developed Intangible Assets

All company activities to create new products or substantially improve existing products are to be separated into a research phase and a development phase for the various costs incurred. In broad terms, research is the planned investigation undertaken with the hope of gaining new scientific or technical knowledge and have a better understanding. Development on the other hand is the translation of research findings or other knowledge into a plan or design for new or substantially improved materials, devices, products, processes, systems or services before starting commercial production or use.

The accounting standards are very clear that costs incurred on research, or during the research phase, of an internal project do NOT meet the criteria for recognition of an intangible asset. Therefore, all such costs are recognized as expenses when they are incurred. Property, plant and equipment needed for research should not be expensed. Those assets should be capitalized and depreciated as usual with depreciation deducted as part of research and development costs. To reiterate, research costs are normally expensed.

An intangible asset can be recognized during the development stage of an internal project but only when an entity can demonstrate its technical and financial feasibility and the company’s intention to generate future economic benefits. In order for costs incurred during the development stage to be capitalized, all of the six specific conditions listed below must be demonstrated.

Meeting the six criteria means that an entity should only capitalize costs incurred during the development phase only when the future benefits are reasonably certain. There is a fine line that has to be monitored when capitalizing development costs. Often internally generated intangible assets are recognized in limited situations and projects may be in process for some time before ALL six criteria are met. Only when all the criteria are met do the costs begin to be capitalized. No costs incurred prior to this point and previously expenses can be added to the internally generated intangible asset.

Below is a summary of the two phases and their accounting treatment (IFRS, 2014; IAS 38 Intangible Assets):

| Research Phase | Development Phase | |

|---|---|---|

| All original and planned investigation activities including evaluation and selecting products or processes from several possible alternatives. If there is any uncertainty about which phrase is appropriate for an activity, then the research phase is used. | This is where the application of research findings before commercial production begins. It includes designing, testing and constructing prototypes, models, pilot plants chosen from the alternatives identified in the research phase, as well as costs for any new tools, templates, or castings. | |

| All costs are expenses as incurred because the activities do not relate to an identifiable product or process. | IAS 38: the six criteria must ALL be met to be capitalized, otherwise costs are expensed as incurred.

Costs that are initially expensed because they do not meet the six criteria cannot be capitalized later. |

1) Technical feasibility of completing the intangible asset must be proven. |

| 2) Management intention exists to complete it for use or for sale. | ||

| 3) The entity must be able to use or sell it. | ||

| 4) Adequate resources to complete the development and to use or sell the intangible asset are available. | ||

| 5) Probability of future economic benefits is clearly established and are reasonably certain, such as the existence of a market or the usefulness of the intangible asset to the entity. | ||

| 6) Costs can be reliably measured. | ||

| Typical ineligible costs for capitalization | Business start-up costs, training, advertising and promotion, relocation, re-organization costs or any costs after the asset is ready for use/sale. Internally generated branding or customer lists are also excluded from capitalization because they are indistinguishable from other business costs. | |

| Once the six criteria are met, direct costs that are eligible | Any external or internal costs directly attributable to the specific asset such as direct materials and direct labour (i.e. salaries and benefits), as well as other direct costs such as engineering costs, and any directly attributable over-head costs. | |

| Once the intangible asset is ready for its intended use, then any subsequent cots are expensed and no longer capitalized. | ||

To further expand on research and development, these activities can be further expanded into stages or phases. Below is a list of various activities that can be broken out by each stage:

Activities in the research stage:

- Obtaining new knowledge.

- Searching for, evaluating, and selecting ways to use research findings or knowledge.

- Investigating possible alternatives for existing products or processes.

- Formulating, designing, evaluating and choosing possible alternatives for improved or new products or processes.

Activities in the development stage:

- Designing, constructing, and testing prototypes and models prior to production or use.

- Designing tools or moulds involving new technology.

- Designing, constructing, and operating pilot plants that are not economically feasible for commercial production.

- Designing, constructing, and testing selected alternatives for new or improved products or processes.

During the research phase, all costs are recognized as expenses as they are incurred. In contrast, for development costs, all six of the criteria listed above must be met in order to capitalize costs, otherwise the development costs are also expensed.

For ASPE, CPA Handbook, Sec. 3064, Goodwill and Intangible Assets (CPA Canada, 2016), allows a choice between expensing the costs for internally developed intangibles or recognizing the intangible asset when certain criteria (similar to the criteria above) are met.

11.2.3 Intangible Assets: Subsequent Measurement

After the initial recognition and measurement, subsequent measurement is as follows:

- ASPE–Cost model only

- IFRS–If the intangible asset has its fair values determined in an active market, then the Revaluation model can be used. Important note – the Revaluation model is not widely used in actual practice since an active market for intangible assets usually does not exist.

The accounting treatment under both models is applied the same way as is applied to property, plant, and equipment (tangible assets). Since intangible assets rarely have an active market to provide readily available fair values, discussions in this chapter will focus on the cost model.

Cost Model

- Asset is initially recorded upon acquisition at its cost.

- Subsequently, its carrying value will be at cost less accumulated amortization and accumulated impairment losses since acquisition, if any.

- On disposal, its carrying value is removed from the accounts and any gain or loss (sales proceeds minus the carrying value) is reported in net income.

An intangible asset with a limited useful life will be amortized over its estimated useful life, like plant and equipment, as follows:

- Amortization can be calculated using the units of production or straight-line methods, but usually assuming a residual value of zero (unless it can be sold to a third party). The method to use is determined using similar criteria as plant and equipment. Nearly all intangible assets are amortized using the straight-line method with no residual value unless there is compelling evidence to prove otherwise.

- Estimating useful life considers criteria such as expected use of the assets, any limits imposed by law, statute, or contract, and the impact on value from obsolescence and technology advances. If a patent has a legal life of twenty years but expects a competing product to emerge in fifteen years, then the useful life would be the lesser of the two, or fifteen years.

- Amortization begins and ends according to when the asset is ready for use and when it is to be disposed of or sold.

- Amortization policy is reviewed in terms of the asset’s useful life, amortization method, and residual value, if any.

- Changes in useful life, residual value (if any), and amortization method are changes in accounting estimates and accounted for prospectively.

- Intangible assets are reviewed for impairment at the end of each reporting period (IFRS), or whenever circumstances indicate that the carrying value of the asset may not be recoverable (ASPE).

If the intangible asset has an indefinite life, no amortization is recorded, but it will be subject to review at the end of each reporting period. Should this status change to a definite life, it is treated as a change in estimate and accounted for prospectively. Indefinite life assets are also subject to impairment reviews and adjustments.

11.2.4 Intangible Assets: Impairment and Derecognition

The process of impairment and derecognition of intangible assets is like that of property, plant, and equipment. Similar to property, plant and equipment the carrying value of intangible assets and goodwill should be reviewed to ensure they do not exceed economic benefits the assets are expected to provide. If an item is determined to be impaired, its carrying amount will have to be written down and a loss on impairment is recognized.

Below is a summary of two models used for definite-life and indefinite-life intangible assets.

| ASPE Cost Recovery Impairment Model | IFRS: Rational Entity Impairment Model | ||

|---|---|---|---|

| Assumes that the asset will continue to be used. The asset is impaired only if the carrying value of the asset is more than the sum of the net future undiscounted cash flows from both the use and eventual disposal of the asset. | Assumes that the asset will either continue to be used or disposed of, depending upon which results in a higher return. The asset is impaired only if the carrying value of the asset is more than the asset’s recoverable amount (a discounted cash flow concept), being the higher of its value in use and its fair value less costs to sell. | ||

| Definite-Life Intangible Assets | |||

| Impairment recognition | Only when events and circumstances indicate that the carrying value may not be recoverable, as determined by a recoverability test. | Impairment recognition | An assessment is made at the end of each reporting period as to whether there is any indication that the asset is impaired. |

| Recoverability test | If the carrying value is greater than the undiscounted future cash flows, then the asset is impaired, and the impairment loss is calculated. | Recoverability test | None |

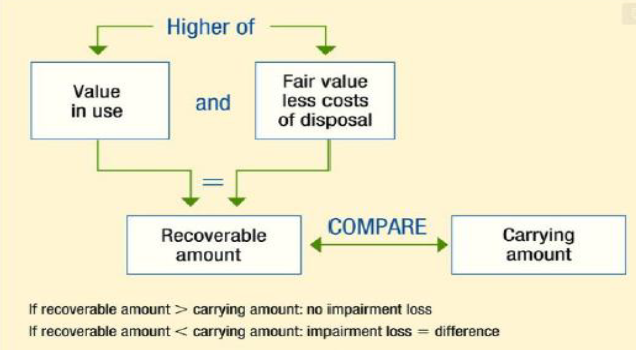

| Impairment loss | The asset carrying value less fair value. | Impairment loss | 1) Calculate the recoverable amount as the higher of the value in use and the fair value less costs to sell.

2) If the asset carrying value is more than the recoverable amount, then the asset is impaired by the difference between these two amounts. |

| Indefinite-Life Intangible Assets | |||

| Impairment recognition | Only when events and circumstances indicate impairment is possible as determined by a fair value test. | Impairment recognition | Tested for impairment annually |

| Fair value test | If the carrying value is greater than the fair value, then the asset is impaired, and the loss is calculated. | Fair value test | None |

| Impairment loss | Equal to the difference resulting from the fair value test. | Impairment loss | Same as for definite-life intangible assets above. |

| Impairment reversal | Not permitted. | Impairment reversal | Same as for definite-life intangible assets above. |

To summarize the Cost Recovery Impairment Model (ASPE):

- Determine if impairment exists by comparing the future undiscounted cash flow (UDCF) to the carrying value (if UDCF < CV) there is impairment. NOTE – this is NOT the impairment calculation, this step is needed to determine if impairment exists.

- To determine the impairment, compare the fair value of the asset to the carrying value (if FV < CV) that is the amount of impairment.

Rational Entity Impairment Model (IFRS):

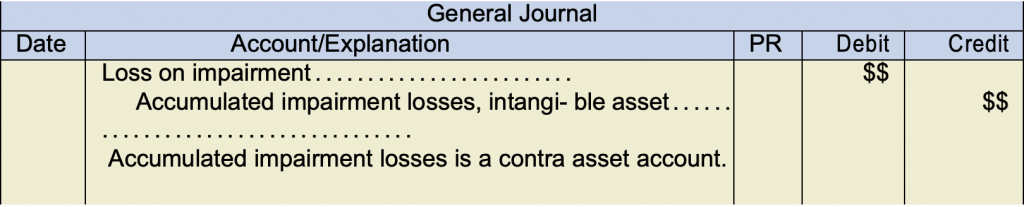

The entry for impairment for both ASPE and IFRS is:

Amortization calculation after impairment for both ASPE and IFRS is based on the ad- justed carrying value after impairment, the revised residual value (if any), and the asset’s estimated remaining useful life.