4.2 Statement of Financial Position/Balance Sheet

The purpose of the Statement of Financial Position/Balance Sheet (SFP/BS) is to report the assets of a company and the composition of the claims against those assets by creditors and investors at a specific point in time. Assets and liabilities come from several sources and are usually separated into current and non-current (IFRS) or long-term (ASPE) categories.

The statement of financial position (balance sheet under ASPE), reports a businesses assets, liabilities and shareholders’ equity at a specific date (at a point in time). This financial statement thus becomes a way for calculating rates of returns on invested assets and for evaluating a business’ capital structure.

The statement of financial position is useful for analyzing a company’s liquidity, solvency and financial flexibility.

Liquidity depends on the amount of time that is expected to pass until an asset is converted to cash or until a liability has to be paid. Solvency reflects an enterprises ability to pay its debt and associated interest. Liquidity and solvency therefore impact the financial flexibility of a company. Financial flexibility considers the ability of a company to take effective actions to alter the amounts and timing of cash flows so it can respond to unexpected needs and opportunities.

4.2.1. Disclosure Requirements

IFRS (IAS 1) and ASPE (section 1521) identify the disclosure requirements for SFP/BS, which are quite similar. Listed below are summary points for some of the more commonly required disclosures for both standards:

- The application of the standards is required, with additional disclosures when necessary, so that the SFP/BS will be relevant and faithfully representative. Relevance means that the information in the SFP/BS can make a difference in decision-making. Faithfully representative means that the statement is complete, neutral, and free from errors.

- Any material uncertainties about a company’s ability to continue as a going concern are to be disclosed.

- Company name, name of the financial statement, and date must be provided.

- The SFP/BS is to report assets and liabilities separately in many cases. The schedule below lists many of the more common assets and liabilities that are to be separately reported. In addition, any material classes of similar items are to be separately disclosed in either the statement or in the notes to the financial statements (e.g., items of property, plant, and equipment, types of inventories, or classes of equity share capital).

- When preparing the SFP/BS, assets are not to be netted with liabilities. This does not apply to contra accounts.

- Assets and liabilities are to be separated into current and non-current (long-term). Some companies further report assets in order of their liquidity.

- The measurement basis used for each line item in the statement is to be disclosed. Examples would be whether the company applied fair value, fair value less costs to sell, cost, amortized cost, net realizable value, or lower of cost and net realizable value (LCNRV) when preparing the statement.

- Due dates and interest rates for any financial instruments payable such as loans, notes, mortgages, and bonds payable, as well as details about any security required for the loan are to be disclosed.

- Cross-reference note disclosures to the related line items in the statement.

Below are the basic classifications for some of the more common reporting line items and accounts. The focus is mainly IFRS for simplicity, though ASPE is substantially similar. The required supplemental disclosures below focus on the measurement basis of the various assets, the due dates, interest rates, and security conditions for non-current liabilities; and the structure for each class of share capital in shareholders’ equity when preparing a SFP/BS. These will be discussed in more detail in the chapters that follow in the next intermediate accounting course.

Let’s review some important concepts before looking at specific accounts:

Asset is a resource with economic value that a company owns or controls with the expectation that it will provide a future benefit.

Current assets are those assets that are converted into cash within the operating cycle or one year, whichever is longer.

Monetary assets represent cash or claims to future cash flows that are fixed and determinable in amounts and timing. These assets are either money itself or claims to future cash flows that are fixed or determinable in amount and timing. Examples include accounts or notes receivable.

Nonmonetary assets include assets where measurement is uncertain. Their value, in terms of a monetary units such as dollars, is not fixed. Examples include inventory, property plant and equipment and intangibles.

Property, plant and equipment are tangible, capital assets. These assets last for a longer period, are durable in nature and are used in ongoing business operations to generate income.

Intangible assets are capital (long-term) assets that have no physical substance.

Liability is an enforceable economic burden or obligation.

Current liabilities are those obligations due within one year from the reporting date or the operating cycle, whichever is longer.

Monetary liabilities require future cash flows that are fixed or determinable in amount and timing. Examples include accounts and notes payable as well as long-term debt. (we know the amount of cash to pay).

Long-term liabilities are obligations that are not reasonable expected to be liquidated (paid) within the normal operating cycle but instead are payable as some later date.

In summary:

| Balance Sheet Template | |

| Current Assets: | Current Liabilities: |

| Cash | Accounts Payable |

| S/T Investments | Accrued Tax, and other Expenses |

| Accounts Receivable | Unearned Revenues |

| Inventory | S/T Loans Payable |

| Prepaid Items | Current Portions of L/T Debt |

| Long Term Assets: | Long Term Liabilities: |

| Noncurrent Investments | Bonds Payable |

| Investments in Shares of other Co. | Notes Payable |

| Investments in Debt of other Co. | Other L/T Debt |

| Bond Sinking Fund | Pension Liabilities |

| Investment in Subsidiary | |

| L/T assets not currently used in | |

| operations | |

| Property Plant and Equipment | Shareholder’s Equity: |

| Land | Contributed Capital: |

| Building | Common Shares |

| Less: Accumulated Depreciation | Preferred Shares |

| Equipment | |

| Less: Accumulated Depreciation | Contributed Surplus |

| Vehicles | |

| Less: Accumulated Depreciation | Retained Earnings |

| Mineral Deposits | |

| Accumulated Other Comprehensive Income | |

| Intangible Assets: | Unrealized AFS gains/losses |

| Goodwill (always kept separate) | Unrealized Hedge gains/losses |

| Copyrights | Foreign Currency Translation |

| Trademarks | gains/losses from Subs |

| Patents | Unrealized gains/losses from |

| Franchises | asset revaluations |

| Licences | |

| Other/Deferred Assets: | |

| L/T Loans to Officers | |

| L/T held for sale assets | |

| Deferred Tax Assets | |

| Offsetting Assets and Liabilities: | |

| Offsetting is allowed only if assets and liabilities are at the same institution | |

| Ex: overdraft at a bank |

SFP/BS – Classifications and Reporting Requirements

| Classification | Report Line Items | Includes | Measurement Bias and Other Required Disclosures at Each Reporting Date |

|---|---|---|---|

| Current assets – assets realized within one year from the reporting date or the operating cycle, whichever is longer. | Cash and cash equivalents (unrestricted) | Currency, coin, bank accounts, petty cash, treasury bills maturing within three months at acquisition. | Fair value, stated in local currency. Restricted cash and compensating balances are reported separately as a current or long-term asset, as appropriate. |

| Investments – trading | Equity investments such as shares purchased to sell within a short time | Usually fair value | |

| Accounts receivable | Trade receivables net of allowance for doubtful account (AFDA) | Net realizable value as a fair value measure | |

| Related party receivables | Amounts owing by related parties | Carrying amount or exchange amount | |

| Notes receivable | Notes receivable within one year | Net realizable value | |

| Inventories | Raw materials, work-in-process, finished goods held for sale, or goods held for resale | Lower of cost and net realizable value (LCNRV) using FIFO, weighted average cost or specific identification | |

| Supplies on hand | Supplies that are expected to be consumed within one year | Usually invoice cost | |

| Prepaid expenses | Cash paid items where the expense is to be incurred within one year of the reporting date |

Usually invoice cost | |

| Assets held for sale | Land, buildings, and equipment no longer used to generate income. | If criteria met (ASPE), lower of carrying less costs to sell. | |

| Income taxes receivable | Income taxes receivable based on current taxable loss | Based on tax rate | |

| Deferred income tax assets | Current portion of deferred income taxes avoided/saved arising from differences between accounting income/loss and taxable income/loss | ASPE only

Under IFRS, all deferred tax is non-current |

|

| Non-current / long-term assets | Investments – non-strategic | Debt and equity investments such as held to maturity to collect principal and interest (AC), fair value through OCI to collect principal and interest and to sell (FVOCI), and FVNI for all else | AC – cost, amortized cost

FVOCI – fair value through OCI (IFRS only) FVNI – fair value through net income – debt or equity investments not classified as FVOCI (IFRS), or equity investments in active markets (ASPE) |

| Investments – strategic | Associate/Significant Influence equity investments in shares | IFRS – equity method

ASPE – equity method, cost method, or FVNI |

|

| Joint-ventures and subsidiaries | Equity investments of greater than 50% of the investee company’s outstanding shares | Partial or full consolidation | |

| Investment property | Land or building held as an investment | Usually fair value | |

| Biological assets | Dairy cattle, pigs, sheep, farmed fish, trees for timber, trees or vines for fruit | IFRS – fair value less costs to sell

ASPE – N/A |

|

| Property, plant, and equipment | Tangible assets used to generate income such as land, buildings, machinery, equipment, furniture | Land – cost

All else – amortized cost IFRS also allows fair value (revaluation); accumulated depreciation disclosed separately |

|

| Intangible assets | Copyrights, customer lists, franchises, patents, trademarks, trade names | Finite life and indefinite life – initially cost, and subsequently cost less accumulated amortization (finite life only) net of accumulated impairment losses (both).

Accumulated amortization disclosed separately |

|

| Goodwill | Purchased goodwill | Goodwill – excess of purchase price over fair values of net identifiable assets and tested annually for impairment | |

| Deferred income tax assets | Non-current portion of deferred income taxes avoided/saved arising from differences between accounting income/loss and taxable income/loss | IFRS and ASPE | |

| Current liabilities – obligations due within one year from the reporting date or the operating cycle, whichever is longer | Bank indebtedness or bank overdraft | Amounts owing to the bank that cannot be offset by a same-bank positive balance, amount, and is payable on demand | Fair value or contract amount stated in local currency |

| Accounts payable | Trade payables, such as suppliers’ invoices owing for goods and services received |

Invoice cost, net of realized discounts | |

| Notes and loans payable | Notes and loans due within one year | Also includes principal portion of long-term debt obligation due within one year of the reporting date | |

| Accrued liabilities | Adjusting entries for various types of expenses incurred but not paid such as salaries, benefits, interest, property taxes, non-trade payables | Invoice or contract cost | |

| Unearned revenue | Cash received in advance for goods and services not yet provided to customer | Consideration amount received | |

| Income taxes payable | Income taxes payable based on current taxable income | Based on taxable income at the current tax rate | |

| Deferred income tax liabilities | Current portion of deferred income taxes expected to be owed and arising from differences between accounting income/loss and taxable income/loss | ASPE only | |

| Non-current/long-term liabilities | Long-term debt payable | Long-term mortgages, bonds, notes, loans, capital leases net of current portions, long-term construction obligations | Each item is reported separately

Measurement basis varies – amortized cost, fair value, discounted present value, estimated construction obligation, and so on Reporting requirements include the amortization period, due date, interest rate and security conditions |

| Employee pension benefits payable | Employer pension obligations for the shortfall between the defined benefit obligation (DBO) and the plan assets both of which are held and reported through a separate trust | The net defined benefit liability/asset is determined by deducting the fair value of the plan assets from the present value of the defined benefit obligation | |

| Deferred income tax liabilities | Non-current portion of deferred income taxes expected to be owed arising from differences between accounting income/loss and taxable income/loss | IFRS and ASPE | |

| Equity – a company’s net assets, which is equal to total assets minus total liabilities

Represents the ownership interest |

Share capital | Preferred shares and common shares of various classes are each separately reported | The exchanged value (transaction price less any transaction costs) of issued shares

The dividend amount, characteristics of each share class, as well as the number of shares authorized, issued, and outstanding for each class of share |

| Contributed surplus | Gains from certain shares transactions, donated assets by a shareholder, redemption or conversion of shares |

||

| Retained earnings/(deficit) | Undistributed accumulated net income

If a negative number, label as a “deficit” |

||

| Accumulated other comprehensive income (AOCI) | Accumulated gains or losses reported in other comprehensive income (OCI) each reporting period that are closed to AOCI at the end of that reporting period | IFRS only | |

| Non-controlling interest/minority interest | Minority interest | An equity claim for the portion of a subsidiary corporation’s net assets that are not owned by the parent corporation (third-party investors) |

Note that in addition to the measurement basis identified for each asset category in the chart above, many assets’ valuations can be subsequently adjusted, depending on the circumstances. Below are examples of some of the common valuation adjustments made to various asset accounts that will be discussed in later chapters.

| Accounts | Adjustments |

|---|---|

| Cash and cash equivalents | Foreign exchange adjustments for foreign currencies |

| Investments – trading | Adjust to fair values, therefore no subsequent adjustment for impairment |

| Accounts receivable and AFDA | AFDA adjustments at each reporting date are the basis for reporting accounts receivable at NRV |

| Related party receivables | Adjust for impairment |

| Notes receivable | Adjust for impairment |

| Inventory | Adjust for cost of goods sold, shrinkage, obsolescence, damage; reported at lower of cost and net realizable value (LCNRV) |

| Supplies/office supplies | Adjust for usage, shrinkage, obsolescence, damage |

| Assets held for sale | Adjust to fair values, therefore no subsequent adjustment for impairment |

| Investments | Adjust to either fair value or for impairment, depending on classification of investment (refer to classification schedule above for details) |

| Biological assets | Adjust to fair values, therefore no subsequent adjustment for impairment |

| Property, plant, and equipment | Adjust for impairment |

| Intangible assets | Adjust for impairment |

Disclosures such as those listed in the classification schedule above may be presented in parentheses beside the line item within the body of the SFP/BS, if the disclosure is not lengthy. Otherwise, the disclosure is to be included in the notes to the financial statements and cross-referenced to the corresponding line item in the SFP/BS.

Using parentheses tends to be more common for ASPE companies with simpler disclosure requirements. IFRS companies and larger ASPE companies extensively use the cross-referencing method because of the more complex and lengthy notes disclosures required.

Below is an example of a Statement of Financial Position. Recall that a classified SFP/BS reports groupings of similar line items together as either current or non-current (long-term) assets and liabilities.

| ABC Company Statement of Financial Position December 31, 2020 |

|||

|---|---|---|---|

| Assets | |||

| Current assets | |||

| Cash | $250,000 | ||

| Investments (fair value) | |||

| Accounts receivable | $180,000 | ||

| Allowance for doubtful accounts | (2,000) | 178,000 | |

| Note receivable (NRV) | 15,000 | ||

| Inventory (at lower of FIFO cost and NRV) | 500,000 | ||

| Prepaid expenses | 15,000 | ||

| Total current assets | 958,000 | ||

| Long term investments (fair value) | 25,000 | ||

| Property, plant and equipment | |||

| Land | 75,000 | ||

| Building | $325,000 | ||

| Accumulated depreciation | (120,000) | 205,000 | |

| Equipment | 100,000 | ||

| Accumulated depreciation | (66,000) | 34,000 | 314,000 |

| Intangible assets (net of accumulated amortization for $25,000) | 55,000 | ||

| Goodwill | 35,000 | ||

| Total assets | $1,387,000 | ||

| Liabilities and Shareholders’ Equity | |||

| Current liabilities | |||

| Accounts payable | $75,000 | ||

| Accrued interest payable | 15,000 | ||

| Accrued other liabilities | 5,000 | ||

| Income taxes payable | 44,000 | ||

| Unearned revenue | 125,000 | ||

| Total current liabilities | $264,000 | ||

| Long-term bonds payable (20-year 5% bonds, due June 20, 2029) | 200,000 | ||

| Total liabilities | 464,000 | ||

| Shareholders’ equity | |||

| Paid in capital | |||

| Preferred, ($2, cumulative, participating – authorized, 30,000 shares, issued and outstanding, 15,000 shares) | $150,000 | ||

| Common (authorized, 400,000 shares; issued and outstanding 250,000 shares) | 750,000 | ||

| Contributed surplus | 15,000 | 915,000 | |

| Retained earnings | 8,000 | 923,000 | |

| Total liabilities and shareholders’ equity | $1,387,000 | ||

Note that the measurement basis disclosures are in parenthesis for any assets where a measurement other than cost is possible. Also note the interest rate and due date parenthetical disclosure for the long-term liability. In the equity section, the class, authorized, and outstanding shares are disclosed.

Taking a closer look at this statement, ASPE Company reports $1,387,000 in total assets and $464,000 in corresponding obligations against those assets owing to suppliers and other creditors.

On the topic of debt reporting, the current portion of long-term debt is a reported as a current liability. The current portion of the long-term debt is the amount of principal that will be paid within one year of the SFP/BS date.

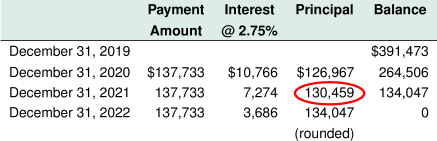

For example, on December 31, 2019, ASPE Company signed a three-year, 2%, note. Payments of $137,733 are payable each December 31. If the market rate was 2.75%, the present value of the note would be $391,473 at the time of signing on December 31, 2019. Below is the payments schedule of the note using the effective interest method.

If the SFP/BS date is December 31, 2020, the current portion of the long-term debt to report as a current liability would be $130,459 from the note payable payments schedule above. Note that this amount comes from the year following the 2020 reporting year to correspond with the principal amount owing within one year of the current reporting date (December 31, 2020). The total amount owing as at December 31, 2020 is $264,506; therefore, the long-term portion of $134,047 would be the amount owing net of the current portion of $130,459. Below is how it would be reported in the SFP/BS at December 31, 2020:

Current Liabilities

Current portion of long-term note payable

Long-term Liabilities

Note payable, 2%, three-year, due date Dec 31, 2022 (balance owing Dec 31, 2020, of $264,506-$130,459)

$130,459

$134,047

If the current portion of the long-term debt is not reported as a current liability, there will be a material reporting misstatement that would affect the assessment of the company’s liquidity and solvency.

Total equity of $923,000 represents the remaining assets financed by the company shareholders. Ranking first are the preferred shareholders capital investors of $150,000. They are usually reported before the common shares because they are senior to common shares in terms of both dividend payouts and claims to resources if a company liquidates. However, this is not a reporting requirement. The contributed surplus of $15,000 is additional paid-in capital from shareholders. Examples of transactions that recognize contributed surplus include:

- stock options such as an employee stock option plan, or other share-based compensation plan and issuance of convertible debentures

- for certain share repurchase transactions where the purchase proceeds are lower than the assigned value of the shares

- donated assets by shareholders

- defaulted shares subscriptions

- certain related party transactions (ASPE)

If there are more line items than simply common shares, a paid-in capital subtotal is also required for IFRS companies. Paid-in capital is the total amount “paid in” by shareholders and therefore not resulting from ongoing operations. It is comprised of all classes of share capital plus contributed surplus, if any. Finally, the retained earnings line item is the total net income accumulated by the company since its inception that has not been distributed in dividends to the shareholders.

Below are other reporting requirements:

- The statement can be prepared on a consolidated basis. This means that there are subsidiaries included where the reporting company is the parent company. Subsidiaries are investments in the shares of another company where the shares purchased are greater than 50%. In this case, there will be a line item called “non-controlling interest” that must be included for the portion of the subsidiary owned by other third-party investors.

- The presentation currency is stated as Canadian dollars and the level of rounding can be to the nearest thousand dollars or million dollars, depending on the size of the company.

- The financial data is to include the previous year (an IFRS disclosure requirement).

- An accumulated other comprehensive income/loss (AOCI) is an equity account used only by IFRS companies to accumulate items reported in OCI in the statement of comprehensive income. AOCI. Recall from the previous chapter that an example of an OCI transaction would be the unrealized gains or losses from fair value adjustments while holding certain FVOCI investments. FVOCI investments and AOCI will be covered in detail later in this course. For now, note the position of the AOCI account in the equity section.

4.2.2. Factors Affecting the Statement of Financial Position/Balance Sheet (SFP/BS)

Accounting Estimates, Changes in Accounting Policy, and Correction of Errors

These were discussed in the previous chapter, but a summary of the pertinent information in this chapter is warranted because of their impact on the SFP/BS.

Financial statements can be affected by changes in accounting estimates, changes due to accounting errors or omissions, and changes in accounting policies. These were first introduced in the introductory accounting course and will also be discussed in detail in the next intermediate accounting course. However, it is worth including a review at this time because of the potentially significant effect on the financial statements.

Changes in Accounting Estimates

Accounting is full of estimates that are based on the best information available at the time. As new information becomes available, estimates may need to be changed. Examples of changing estimates would be the useful life, residual value, or the depreciation pattern used to match the use of assets with revenues earned. Other changes in estimates involve uncollectible receivables, asset impairment losses, and pension assumptions that could affect the accrued pension asset/liability account in the SFP/BS. Changes in accounting estimates are applied prospectively, meaning they are applied to the current fiscal year if the accounting records have not yet been closed and for all future years going forward.

Changes Due to Accounting Errors or Omissions

The accounting treatment for an error or omission is a retrospective adjustment with restatement. Retrospective adjustment means that the company reports treat the error or omission as though it had always been corrected. If an accounting error in inventory originating in the current fiscal year is detected before the current year’s books are closed, the inventory error correction is easily recorded to the current fiscal year accounts. If the accounting records are already closed when the inventory error is discovered, the error is adjusted to the inventory account and to retained earnings, net of taxes. This results in a restatement of inventory and retained earnings in the current year. If the financial statements are comparative and include previous year’s data, this data is also restated to include the error correction from the previous year.

Changes in Accounting Policy

The accounting treatment for a change in accounting policy is retrospective adjustment with restatement.

Examples of changes in accounting policies are:

- Changes in valuation methods for inventory such as changing from FIFO to weighted average cost.

- Changes in financial assets and liabilities such as FVNI, FVOCI and AC investments or certain lease obligations. Details of these are discussed in the chapter on intercorporate investments, later in this text.

- Changes in the basis of measurement of non-current assets such as historical cost and revaluation.

- Changes in the basis used for accruals in the preparation of financial statements.

Accounting policies must be applied consistently to promote comparability between financial statements for different accounting periods. A change in accounting policy is only allowed under the following two conditions:

- due to changes in a primary source of GAAP

- may be applied voluntarily by management to enhance the relevance and reliability of information contained in the financial statements for IFRS. [ASPE has some exceptions to this “relevance and reliability” rule to provide flexibility for changes from one existing accounting standard to another.]

Changes in accounting policies are applied retrospectively in the financial statements. As with accounting errors, retrospective application means that the company implements the change in accounting policy as though it had always been applied. Consequently, the company will adjust all comparative amounts presented in the financial statements affected by the change in accounting policy for each prior period presented. Retrospective application reduces the risk of changing policies to manage earnings aggressively because the restatement is made to all prior years as well as the current year. If this were not the case, the change made to a single year could materially affect the statement of income for the current fiscal year. A cumulative amount for the restatement is estimated and adjusted to the affected asset or liability in the SFP/BS and to the opening retained earnings balance of the current year, net of taxes, in the statement of changes in equity (IFRS) or the statement of retained earnings (ASPE).

Contingencies, Provisions and Guarantees

In accounting, a contingency (ASPE) or provision (IFRS) exists when a material future event, or circumstance, could occur but cannot be predicted with certainty. IFRS (IAS 37.10) has the following definitions regarding the various types of contingencies in accounting (IFRS, 2015).

Key Definitions [IAS 37.10]

Provision:

- a liability of uncertain timing or amount.

Liability:

- present obligation resulting from past events

- settlement is expected to result in an outflow of resources (payment)

Contingent liability:

- a possible obligation depending on whether some uncertain future event occurs, or

- a present obligation but payment is not probable, or the amount cannot be measured reliably

Contingent asset:

- a possible asset that arises from past events, and

- whose existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the entity.

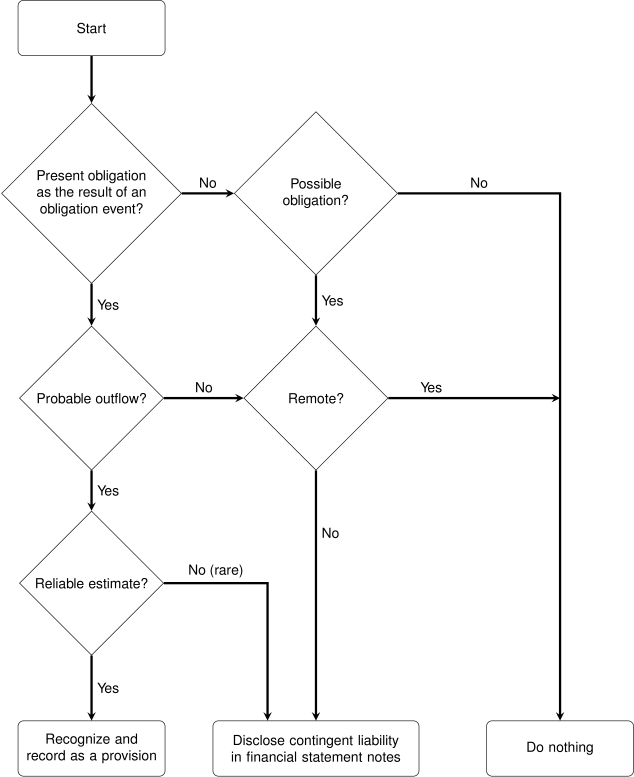

IAS 37 explains that a contingent liability is to be disclosed in the financial statement notes. Figure 4.1 is a decision tree that identifies the various decision points when determining if a potential obligation should be recognized and recorded, because it meets the definition of a liability; added only to the notes, because it meets the definition of a contingent liability; or omitted altogether because it fails to meet any of the relevant criteria (Friedrich, Friedrich, & Spector, 2009).

IAS 37 also states that a contingent asset is not to be recorded until it is actually realized but can be included in the notes if it is probable that an inflow of economic benefits will occur (IFRS, 2012). If a note disclosure is made, management must take care not to mislead the reader regarding its potential realization; if the potential asset is not probable, it must not be disclosed.

ASPE is similar, but the provision is usually interpreted as “more likely than not” whereas a contingent liability is one that is “likely.”

Contingencies will be discussed further in the chapter on liabilities in the next intermediate accounting course.

A guarantee is a type of contingent liability because it is a promise to take responsibility for another company’s financial obligation if that company is unable to do so. An example might be a parent company that guarantees part or all of a bond issuance to investors by its subsidiary company. Guarantees are not recognized and recorded because they are not probable, so they are to be disclosed in the notes. This will enable investors and creditors to assess the potential impact of the guarantee and the risk associated with it.

Subsequent Events

There is a period of time after the year-end date when economic events apparent in the new year may need to be either reported in the financial statements for the year just ended or disclosed in the notes prior to their release.

If this subsequent event is significant and relates to business operations prior to the reporting date, it is to be included in the financial statements prior to release. These would include adjusting entries such as inventory write-downs due to shrinkage, recording additional accounts payable for late arriving invoices from suppliers or correction of errors or omissions found when reconciling the general ledger accounts as part of the year-end process.

If a subsequent event is significant but relates to operations occurring after the reporting period, it is to be included in the notes. An example might be where early in the new fiscal year, there is a flood causing serious damage to buildings and equipment, if the repair or replacement costs are significant and perhaps uninsured, these costs, though correctly paid and recorded in the new year, are to be disclosed in the notes to the financial statements for the year-end just ended. This will ensure that the company stakeholders will be aware of all the information about risks that could detrimentally affect company operations.