2.0 Why Accounting?

Learning Objectives

After completing this chapter, you should be able to:

- Identify the purpose of financial reporting.

- Describe the problem of information asymmetry, and discuss how this problem can affect the production of financial information.

- Describe how accounting standards are set in Canada and identify the key entities that are responsible for setting standards.

- Discuss the purpose of the conceptual framework, and identify the key components of the framework.

- Describe the qualitative characteristics of accounting information.

- Identify the elements of financial statements.

- Discuss the criteria required for recognizing an element in financial statements.

- Identify different measurement bases that could be used, and discuss the strengths and weaknesses of each base.

- Identify the alternative models of capital maintenance that could be applied.

- Discuss the relative strengths and weaknesses of rules-based and principles-based accounting systems.

- Discuss the possible motivations for management bias of financial information.

- Discuss the need for ethical behaviour by accountants, and identify the key elements of the codes of conduct of the accounting profession.

- Explain the effects on the accounting profession of changes in information technology.

Introduction

The profession and practice of accounting has seen tremendous changes since the turn of the new millennium. A series of accounting scandals in the early 2000s, followed by the tremendous upheaval in capital markets and the world economy that resulted from the 2008 meltdown of the financial services industry, has led many to question the purpose and value of accounting information. In this chapter, we will examine the nature and purpose of accounting information and the key challenges faced by those who create accounting standards. We will also examine the accounting profession’s response to those challenges, including the conceptual framework that currently shapes the development of accounting standards. We will also discuss the role of ethical behaviour in the accounting profession and the issues faced by practicing accountants.

Accounting is the process of identifying, measuring, recording, and communicating an organization’s economic activities to users. Users need information for decision making. Internal users of accounting information work for the organization and are responsible for planning, organizing, and operating the entity. The area of accounting known as managerial accounting serves the decision-making needs of internal users. External users do not work for the organization and include investors, creditors, labour unions, and customers. Financial accounting is the area of accounting that focuses on external reporting and meeting the needs of external users. This book addresses financial accounting. Managerial accounting is covered in other books.

The goal of accounting is to ensure information provided to decision makers is useful. To be useful, information must be relevant and faithfully represent a business’s economic activities. This requires ethics, beliefs that help us differentiate right from wrong, in the application of underlying accounting concepts or principles. These underlying accounting concepts or principles are known as Generally Accepted Accounting Principles (GAAP).

GAAP in Canada, as well as in many other countries, is based on International Financial Reporting Standards (IFRS) for publicly accountable enterprises (PAE). IFRS are issued by the International Accounting Standards Board (IASB). The IASB’s mandate is to promote the adoption of a single set of global accounting standards through a process of open and transparent discussions among corporations, financial institutions, and accounting firms around the world. Private enterprises (PE) in Canada are permitted to follow either IFRS or Accounting Standards for Private Enterprises (ASPE), a set of less onerous GAAP-based standards developed by the Canadian Accounting Standards Board (AcSB). The AcSB is the body that governs accounting standards in Canada. The focus in this book will be on IFRS for PAEs.

Accounting practices are guided by GAAP which are comprised of qualitative characteristics and principles. As already stated, relevance and faithful representation are the primary qualitative characteristics. Comparability, verifiability, timeliness, and understandability are additional qualitative characteristics.

Information that possesses the quality of:

- Relevance has the ability to make a difference in the decision-making process.

- Faithful representation is complete, neutral, and free from error.

- Comparability tells users of the information that businesses utilize similar accounting practices.

- Verifiability means that others are able to confirm that the information faithfully represents the economic activities of the business.

- Timeliness is available to decision makers in time to be useful.

- Understandability is clear and concise.

The above concepts will be reviewed again later in this chapter as the discussion focus’ on enhancing characteristics.

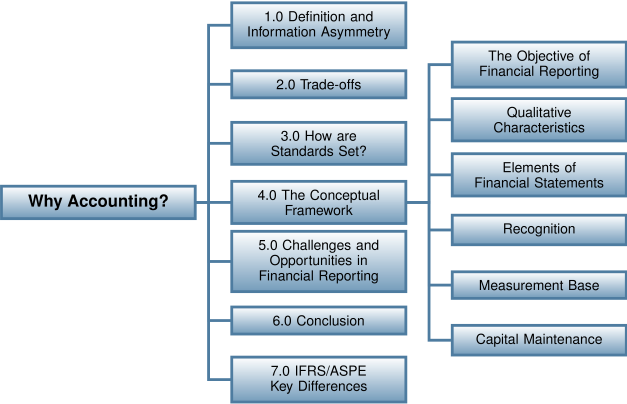

Chapter Organization