10.4 Derecognition

At some point in a PPE asset’s life, it will be sold, disposed, abandoned, or otherwise removed from use. The accounting treatment for these events will depend on the timing and nature of the transactions.

10.4.1. Held for Sale

When management first makes the decision to sell a noncurrent asset rather than continue to use it in operations, it should be reclassified as an asset that is held for sale. This is a class of current assets that is disclosed separately from other assets. For an asset to be classified as held for sale, the following conditions must be met:

- The asset must be available for immediate sale in its present condition, subject only to terms that are usual and customary for sales of such assets.

- The sale must be highly probable.

- Management must be committed to a plan to sell the asset.

- There must be the initiation of an active program to locate a buyer and complete the plan.

- The asking price must be reasonable in relation to the asset’s current fair value.

- The sale should be expected within one year of the decision, unless circumstances beyond the entity’s control delay the sale.

- It is unlikely that the plan will be withdrawn.

Remember, if an asset is listed as held for sale, it is not in use and depreciation expense must stop.

There are a number of accounting issues with held-for-sale assets. First, the asset needs to be revalued to the lower of its carrying value, or its fair value, less costs to sell. Because the company expects to sell these assets in a short period of time, it is reasonable to report them at an amount that is no greater than the amount of cash that can be realized from their sale. Second, assets that are held for sale are no longer depreciated. This is reasonable, as these assets by definition are available for immediate sale. This means that they are no longer being used for productive purposes, so depreciating them would not be appropriate.

The result of the revaluation described above means that an impairment loss will occur if the expected proceeds (fair value less costs to sell) are less than the carrying value. This loss will be reported in the year that management makes the decision to sell the asset, even if the asset is not actually sold by the year-end. The impairment loss will be reported in a manner consistent with other impairment losses, as described in IAS 36. When the asset is actually sold, the difference between the actual proceeds and the amount expected will be treated as a gain or loss in that year, not as an increase or reversal of the previous impairment loss.

If, at the time of classification as held for sale, the expected proceeds are greater than the carrying amount, this gain will not be reported until the asset is actually sold. This gain will simply be reported as a gain consistent with the treatment of other gains.

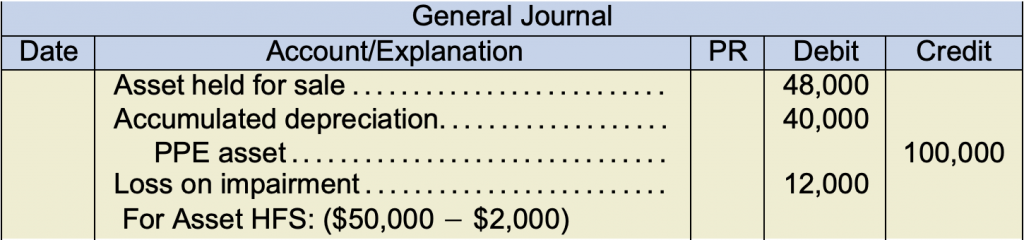

Consider this example. A company purchases an asset for $100,000 in 2015 and decides in late 2020 to sell the asset immediately. The accumulated depreciation at the time the decision is made is $40,000. Management estimates that the asset can be sold for $50,000, less disposal costs of $2,000. In 2020, when the decision to sell the asset is made, the following journal entry will be required.

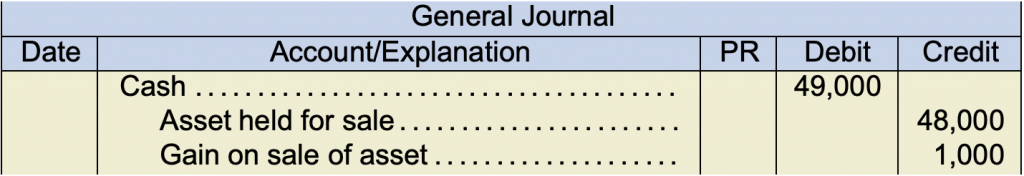

In 2021, the asset is actually sold for net proceeds of $49,000. The journal entry to record this transaction is as follows:

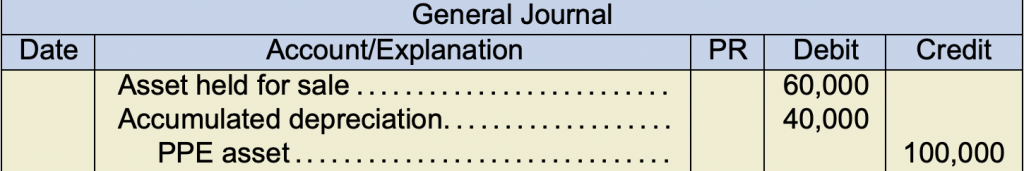

Now, if in 2020, the amount management estimates the sales proceeds to be $65,000 instead of $50,000, less costs to sell of $2,000, the journal entry would be as follows:

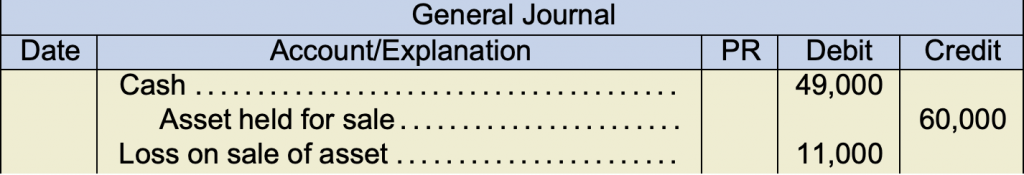

Note that we do not report the asset held for sale at its estimated realizable value ($65,000 − $2,000 = $63,000), as this is greater than the carrying value. When the sale occurs in 2021, the following journal entry would be required:

As a practical matter, many companies may not immediately reclassify the asset as held for sale, as they expect to sell it within the same accounting period, or they do not meet the strict criteria for classification. If this occurs, then the disposal journal entry will simply remove the carrying value of the asset, report the net proceeds received, and report a gain or loss on disposal. This gain or loss will be reported on the income statement, but gains cannot be classified as revenues.

As a practical matter, many companies may not immediately reclassify the asset as held for sale, as they expect to sell it within the same accounting period, or they do not meet the strict criteria for classification. If this occurs, then the disposal journal entry will simply remove the carrying value of the asset, report the net proceeds received, and report a gain or loss on disposal. This gain or loss will be reported on the income statement, but gains cannot be classified as revenues.

10.4.2 Other Derecognition Issues

There are times when assets may be disposed of in ways other than by direct sale. For example, an asset can be expropriated by a government agency that has the authority to do so, with compensation being paid. Insurance proceeds may be received for an asset destroyed in a fire. These types of transactions would be recorded much as a simple sale would be, with a resulting gain or loss (the difference between the compensation received and the carrying value of the assets) being reported on the income statement.

In other instances, a company may choose to simply abandon or scrap an asset for no proceeds. If this occurs, the asset should be derecognized, and a loss equal to the carrying value of the asset at the time of abandonment should be recognized.

A less common situation may occur when a business agrees to donate an asset to some other entity. For example, a land-development company may donate a piece of land to a municipality for use as a recreational space. The company may believe that this will help develop a positive business relationship with the municipality and its citizens. With this type of transaction, the fair value of the property needs to be determined. The disposal will then be recorded at this value, which will result in expense being recorded equal to this fair value. The carrying value of the asset will also be derecognized, which will result in a gain or loss if the carrying value differs from the fair value.