9.0 Property, Plant and Equipment Overview

Learning Objectives

After completing this chapter, you should be able to:

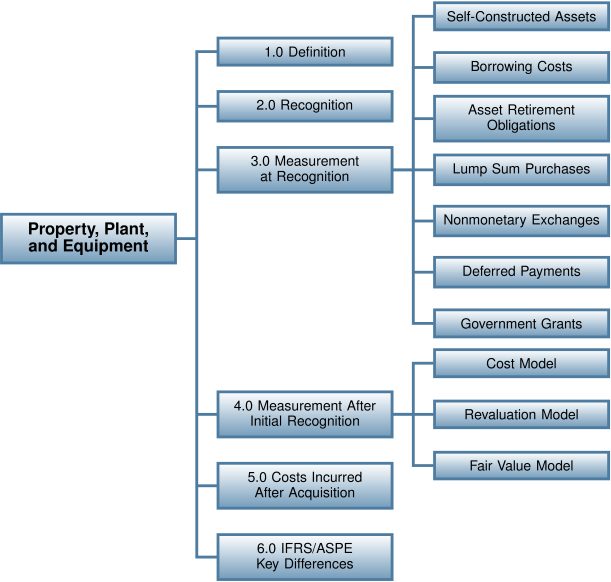

- Describe the characteristics of property, plant, and equipment assets that distinguish them from other assets.

- Identify the criteria for recognizing property, plant, and equipment assets.

- Determine the costs to include in the measurement of property, plant, and equipment at acquisition.

- Determine the cost of a property, plant, and equipment asset when the asset is acquired through a lump-sum purchase, a deferred payment, or a non-monetary exchange.

- Identify the effect of government grants in determining the cost of a property, plant, and equipment asset.

- Determine the cost of a self-constructed asset, including treatment of related interest charges.

- Identify the accounting treatment for asset retirement obligation.

- Apply the cost model.

- Apply the revaluation model.

- Apply the fair value model.

- Explain and apply the accounting treatment for post-acquisition costs related to property, plant, and equipment assets.

- Identify key differences between IFRS and ASPE.

Introduction

The rapid development of information technology in recent decades has highlighted the importance of intellectual capital. The future of commerce, we are told, lies in the development of ideas, processes, and brands. Yet, even with this change in focus from a traditional manufacturing economy, the importance of the physical assets of a business cannot be ignored. Even companies like Facebook and Google still need computers to run their applications, desks and chairs for staff to sit in, or buildings to house their operations. And even as the knowledge economy grows, there continues to be an increasing variety of consumer products being manufactured and sold. All of this activity requires capacity, and this capacity is provided by the property, plant, and equipment of a business.