9.5 Costs Incurred After Acquisition

Costs to operate and maintain a PPE asset are rarely ever captured completely by the initial purchase price. After a PPE asset is acquired, it is quite likely that there will be additional costs incurred over time to maintain or improve the asset. The essential accounting question that needs to be answered here is whether these costs should be recognized immediately as an expense, or whether they should be capitalized and depreciated in future periods. IAS 16 indicates that costs incurred in the day-to-day servicing of a PPE asset should not be capitalized, as they do not meet the recognition criteria (i.e., they do not provide future economic benefits). The types of costs discussed in the standard include labour, consumables, and small parts. Immediately expensing these types of costs recognizes the fact that normal repair and maintenance activities do not significantly extend the useful life of an asset, nor do they improve the function of the asset. Rather, they simply maintain the existing capacity. As such, they should be recognized as period costs.

Sometimes, a major component of a PPE asset may require periodic replacement. For example, the motor of a transport truck may need replacement after operating for a certain number of hours. Or, a restaurant may choose to knock down its existing walls to reconfigure and redecorate the space to create a fresher image. If the business managers think these changes create the potential for future economic benefits, then capitalization would be appropriate.

When these types of items are capitalized, they are actually replacing an existing component of a PPE asset. In these cases, the old component needs to be removed from the carrying value of the asset before the new addition is capitalized. This procedure is required, even if the part being replaced was not actually recorded as a separate component. If this is the case, the standard allows for a reasonable estimate to be made of the asset’s carrying value.

Be aware of the difference between capital expenditures – those expenditures that are needed to improve the efficiency or useful life of an asset. An example could be an engine overhaul to a truck that extends the useful life. The amount of the engine overhaul would be capitalized (as an addition to the existing asset) rather than expensing the item.

In contrast, a revenue expenditure is something much smaller, such as a day-to-day expense. An example could be an oil change to the truck. The amount is not material enough to capitalize, the expense does not necessarily extend the useful life but is required in order for the asset to continue to produce revenue.

- A $250 oil change is an operating expense (revenue expenditure).

- A $25,000 engine overhaul that extends the useful life is a capital expenditure.

Be mindful of various accounting terms:

Additions – is the increase or extension of an existing asset. These types of expenditures are relatively straightforward. An addition to a building is capitalized and then depreciated over its useful life.

Replacement – are substitutions of one asset component for another. As an example – replacing the engine in a truck.

Consider the following example. LeCorre, a Michelin-starred restaurant, has recently decided to update its image through a complete renovation of the dining room. This process involved tearing out all the existing fixtures and relocating several walls. None of the fixtures or walls were reported as separate components, as they were merely included as part of the original building cost when it was purchased five years ago. The building has been depreciated on a straight-line basis over an estimated useful life of thirty years. The total cost of the renovation was $87,000, and the company received an additional $2,000 from the sale of the old fixtures. It was also determined that construction costs in this area have increased by approximately 30% over the last five years.

The journal entries to record this renovation will be separated into two parts: the disposal of the old assets and the purchase of the new assets.

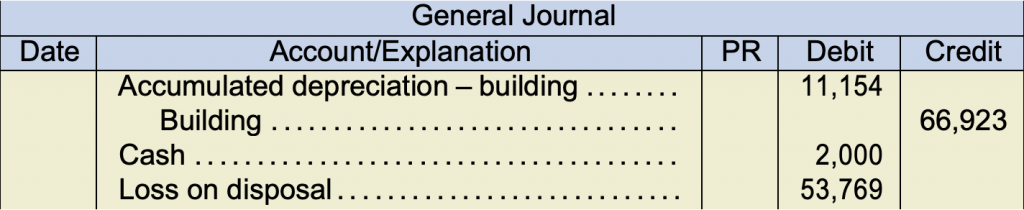

- Disposal of old assets

If we assume that the old fixtures and decorations are of a similar quality as the new ones, then the construction cost of the new renovations can be used to estimate the cost of the assets that have been removed. With an increase in construction costs of 30% over five years, the original cost can be estimated to be $87,000 × 1 ÷ (1 + 3) = $66,923. If the asset has been depreciated for five years, then the accumulated depreciation would be ($66,923 ÷ 30) × 5 = $11,154. The loss on disposal equals the difference between the calculated, net carrying value and the proceeds received.

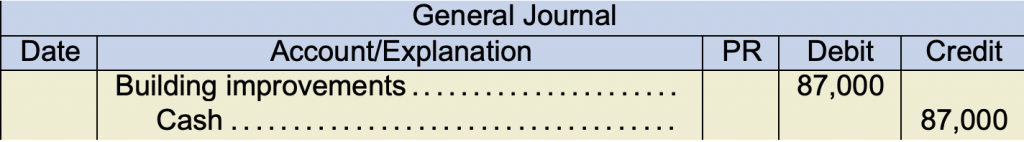

- Purchase of the new assets

If the management of LeCorre believes that these types of interior renovations will continue in the future at similar intervals, it should record the cost as a separate component, as the useful life would clearly differ from the building itself.

Note that if the original renovations had already been recorded as a separate component, the journal entries would take the same form, but there would be no need to estimate the cost and book value of the original assets, as they would be evident from the accounting records.