8.3 Strategic Investments

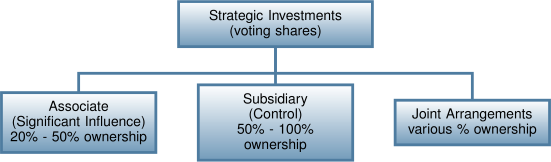

In the previous categories, investments in other companies’ debt or shares were acquired in order to make a return on idle cash. Investing in other companies can also be for strategic purposes, such as to acquire the power to influence the board of directors and company policies, or to take over control of the company outright. This is done by acquiring various amounts of another company’s voting common shares. The degree of ownership (number of votes) defines the level of influence.

Guidelines have been developed to help determine the classification of the investment based on the degree of influence. For example, the previous three categories of investments (FVNI, FVOCI, and AC) each assumed that the investor’s ownership in shares were less than 20%, therefore having no influence on the investee company.

For ownership in shares greater than 20% but less than 50%, it is assumed that significant influence exists. IFRS calls this category investment in associates. However, if an investing company owns between 20% and 50% of another company’s shares, significant influence is by no means assured and can be refuted, if there is evidence to the contrary. For example, if an investor acquires 40% of the outstanding common shares of a company but the remaining 60% of the shares are held by one other investor, then significant influence will not exist. A general assumption is that the greater the number of investors, the more likely that investment holdings of greater than 20% will result in significant influence.

If an investor holds greater than 50% of the common shares, then it has the majority of the votes at the board of directors’ meetings, thereby having control of the investee company’s operations, decisions and policies.

Joint arrangements is another type of strategic investment that involves the contractually- agreed sharing of control by two or more investors. There are two types of joint arrangements, namely; joint operations and joint ventures. A joint operation exists if the investor has rights to the assets and unlimited liability obligations of the joint entity and a joint venture exists if the investor has rights to net assets (assets and limited liability obligations of the joint entity.

Regarding strategic investments—why would an investor want to influence or control another company? If the investee company has resources that would enhance the operations of the investor, then acquiring sufficient voting shares to significantly influence or control the investee’s board of directors would be a prime motivator to do so. Acquiring an interest in another company could secure a guaranteed source of materials and products, open up new markets, or broaden existing ones for the investor company. It could also expand an investor company’s range of products and services available for sale as was the case with Hewlett Packard’s acquisition of 87% of Autonomy Corporation’s shares resulting in control of the company.

The accounting treatments for these classifications are complex and will be covered in more detail in the advanced accounting courses. The rest of this chapter will focus on an introduction to the three strategic investment classifications.

8.3.1. Investments in Associates (Significant Influence)

For IFRS, investments between 20% and 50% of the voting shares in another company are reported using the equity method. For ASPE companies, management can choose the equity method, the fair value through net income method (if this investment is traded in an active market), or the cost method if no market exists. Transactions costs are expensed for the equity and fair value methods and added to the investment (asset) account for the cost method. Investments in associates are reported as long-term investments and income from associates is to be separately disclosed.

This chapter has already discussed the fair value and cost models, so the focus will now be on the equity method.

The equity method initially records the shares at the cost of acquiring them which is also fair value. Subsequent measurement of the investment account includes recording the proportionate share of the investee’s:

- net income (loss) adjusted for any inter-company transactions

- dividends

- amortization of any fair value difference in the investee’s capital assets

- impairments, if any

- proceeds of sale

The equity method is often referred to as the one-line consolidation because all the related transactions are recorded as increases or decreases in a single investment asset account. For example, if the investee company reported net income, this would result in a proportionate increase in the investor’s investment (asset) due to the added profit. Conversely, a net loss reported or dividend received would be recorded as a proportionate decrease in the investment. Any amortization of fair value adjustments from the date of purchase or impairment would also be recorded as a decrease in the investment account. Below is an example of how the investment is accounted for using the equity method.

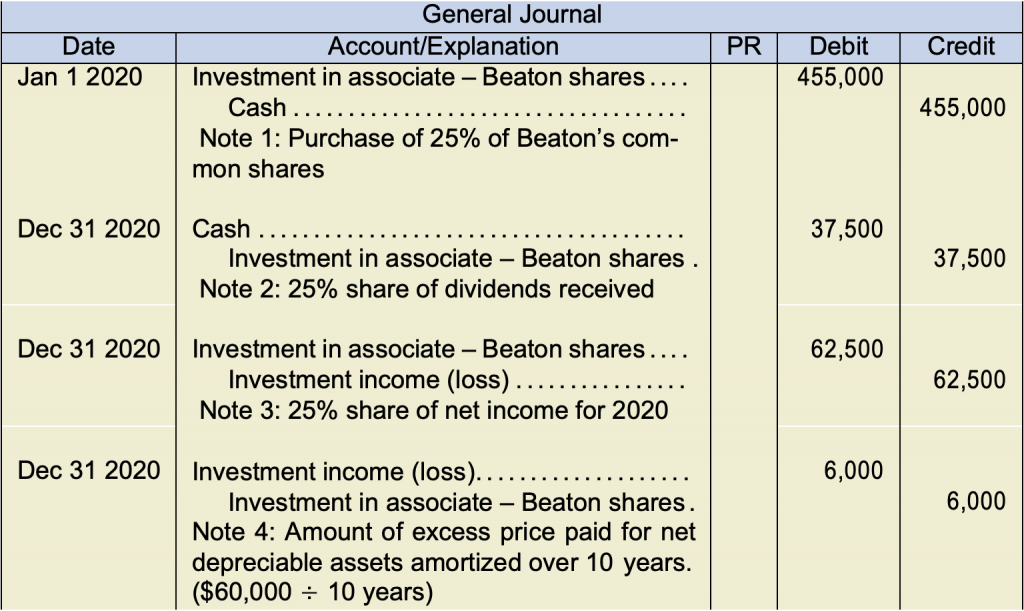

On January 1, 2020, Tilton Co. purchased 25% of the 100,000 outstanding common shares of Beaton Ltd. for $455,000. Beaton currently is one of Tilton’s suppliers of manufactured goods. The outstanding shares are widely held, so with this purchase, Tilton can exercise significant influence over Beaton. This investment solidified the relationship between Tilton and will guarantee a steady supply of goods needed by Tilton for its customers. The following financial information relates to Beaton:

Below are the entries recorded to Tilton’s books that relate to its investment in Beaton:

On December 31, Tilton recorded its 25% share of dividends received, net income (loss), and amortization of Beaton’s net depreciable assets. But what about the $80,000 excess paid for the investment? The excess of $60,000 relates to Beaton’s net depreciation assets, so this portion of the excess is amortized over ten years. The remaining $20,000 is inexplicable, so it will be treated as unrecorded goodwill. Goodwill is discussed in detail in Chapter 11: Intangible Assets and Goodwill. Since there is unrecorded goodwill, an intangible asset, Tilton must evaluate its investment each reporting date to determine if there has been any impairment in the investment’s value.

Below is a partial balance sheet and income statement reporting the investment at December 31, 2020.

Tilton Co.

Balance Sheet

December 31, 2020

Long-term investment:

Investment in associates (equity method)* $474,000

*($455,000 – 37,500 + 62,500 – 6,000)

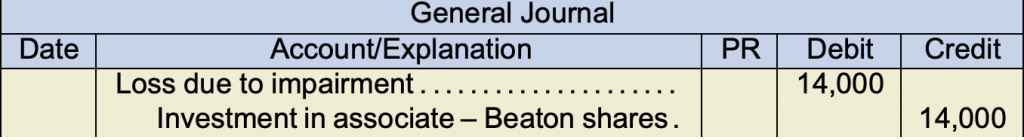

For IFRS, investments in this classification are assessed each balance sheet date for possible impairment. If it was determined that the investment’s recoverable amount— being the higher of its value in use (the present value of expected cash flows from holding the investment, discounted at the current market rate) and fair value less costs to sell, both of which are discounted cash flow concepts—was $460,000, then the carrying value is more than the recoverable amount and an impairment loss of $14,000 ($460,000 − 474,000) is recorded as a reduction to the investment (or valuation account) and to net income (loss).

For ASPE, impairment evaluation and measurement is the same as IFRS except “fair value” does not include netting the costs to sell.

Since there is $20,000 of unrecorded goodwill, the $14,000 impairment charge represents a loss in an intangible asset and is therefore not reversible. If there had been no unrecorded goodwill, any subsequent impairment charge would be reversible, but limited and the recovery amount could not result in a carrying value balance greater than if there had been no impairment.

If the investment in the associate is sold, a gain or loss can be recorded as appropriate.

8.3.2. Investments in Subsidiaries (Control)

For IFRS, investments greater than 50% of the voting shares in another company are reported using the consolidation method. For ASPE companies, there is a choice of consolidation, equity, or cost methods. Transactions costs are expensed for the consolidation and equity methods and added to the investment (asset) account for the cost method.

For IFRS companies, the investor is referred to as the parent, and the investee as the subsidiary, and it is reasonable to treat the two companies as one economic unit and prepare a consolidated set of financial reports for the combined entity. This means that the investment account is eliminated and 100% of each asset and liability of the subsidiary is reported within the parent company’s balance sheet on a line-by-line basis. For example, the accounts receivable ending balance for the subsidiary would be added to the accounts receivable balance of the parent and reported as a single amount on the consolidated balance sheet. This would be done for all of the subsidiary’s assets and liabilities sheet accounts. As well, 100% of each of the subsidiary’s revenues, expenses, gains, and losses accounts would be included with those of the parent company and reported in the consolidated income statement.

Since 100% of all the net assets and net income (loss) is being reported by the parent, any percentage of ownership held by outside investors, referred to as the minority interest, must also be reported in the financial statements. This is reported as a single line in the balance sheet and the income statement as non-controlling interest . For example, in the cover story, Hewlett Packard purchased a majority of the voting shares of Autonomy Corp. The remaining percentage would be the minority interest shareholders who did not sell their shares to Hewlett Packard and continue to be investors of Autonomy Corp. This non-controlling interest would be reported as a single line in the balance sheet and the income statement. Earlier chapters regarding the income statement and statement of financial position both illustrate how the non-controlling interest is presented in these financial statements.

8.3.3. Investments in Joint Arrangements

As previously stated in the overview of strategic investments, joint arrangements is an- other type of strategic investment for both IFRS and ASPE that involves a contractual arrangement between two or more investors regarding control of a joint entity. Control in this case means that the investors must together agree on the decision-making. For IFRS, there are two types of joint arrangements:

- Joint operations—investor has direct rights to assets and (unlimited) liability obligations of the joint entity, such as a partnership where liability can be unlimited. Each investor would include in their financial statements the assets, liabilities, revenue, and expenses that they have a direct interest in. In other words, it is a form of proportionate consolidation where the investor’s proportionate share of the assets, liabilities, revenue and expense accounts from the joint entity are added to the investor’s existing accounts.

- Joint ventures—investor has rights to net assets (assets and (limited) liability obligations) of the joint entity, such as the case involving corporations with limited liability. The equity method is used for this type of investment which is the method illustrated for investments in associates above. In this case, the joint entity is shown on a net basis in an investment account on the statement of financial position.

The ASPE standards are very similar, though the terms are a bit different, namely, jointly controlled operations, jointly controlled assets, and jointly controlled enterprises. ASPE companies can make a policy choice to use proportionate consolidation, equity, or cost to account for their joint entity investments. Once chosen, the method must be applied to all investments of this nature.