11.0 Intangible Assets and Goodwill

Learning Objectives

After completing this chapter, you should be able to:

- Describe intangible assets and goodwill and their role in accounting and business.

- Describe intangible assets and explain how they are recognized and measured.

- Describe purchased intangibles and explain how they are initially measured.

- Describe internally developed intangibles and explain how they are initially measured.

- Describe how intangible assets are subsequently measured.

- Describe how intangible assets are evaluated for impairment and derecognized.

- Describe goodwill and explain how it is recognized and measured.

- Identify the disclosure requirements for intangible assets and goodwill.

- Describe how intangible assets and goodwill affect the analysis of company performance.

- Explain the similarities and differences between ASPE and IFRS for recognition, measurement, and reporting for intangible assets and goodwill.

Introduction

Why did Tesla purposely share its valuable and closely guarded patent secrets with its competitor electric car manufacturers? As the covering story explains, their largest competition does not come from within their own electric vehicle industry sector—it comes from the massive hydrocarbon-operated (i.e., gasoline, diesel) car market. If Tesla shares its critical intellectual property, such as its patents, with other electric car manufacturers at no cost, the electric car industry sector could strengthen enough to cause a shift in consumers from hydrocarbon vehicles to electric. In short, it is all about increasing the market share for electric cars. By sharing these valuable intangible assets within their industry sector, it increases these odds significantly.

Tesla thinks they can use their patents, which are some of Tesla’s intangible assets, to make a difference and create a shift in demand from hydrocarbon to electric-powered vehicles. This must mean that there is a tremendous value regarding Tesla’s patents. As intangibles assets, how might Tesla account for these patents? This chapter look at intangible assets and goodwill and how they impact business.

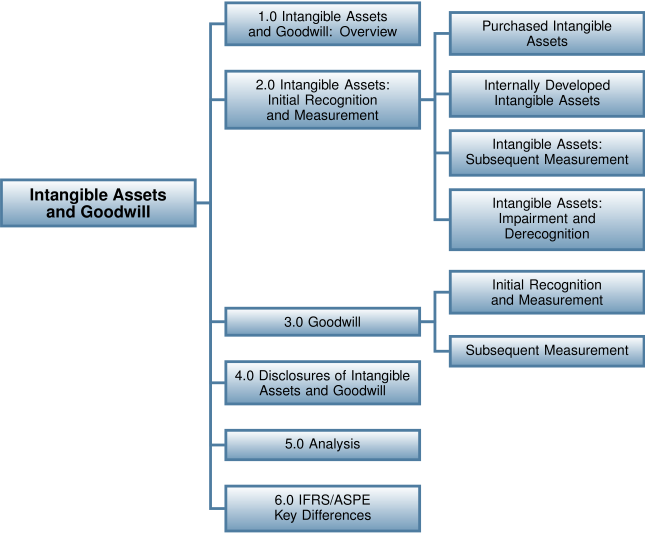

Chapter Organization

Like property, plant, and equipment (PPE) assets, intangible assets are long-lived, non- monetary assets whose costs are capitalized and reported as long-term assets on the statement of financial position/balance sheet (SFP/BS). But unlike PPE, intangible assets have no physical presence. Patents and copyrights have often become the subject of news headlines when competitor companies attempt to infringe upon them. Many costly and prolonged court battles have occurred as a result. Significant value is associated with these intangible assets, so it is critical that they be accounted for as realistically as possible.

This chapter will focus on the various kinds of intangible assets and goodwill in terms of their use in business, as well as their recognition, measurement, reporting, and analysis.