8.2 Non-Strategic Investments

8.2.1 Fair Value Through Net Income (FVNI)

| Types of Investments | Accounting Treatment |

|---|---|

| Debt (bonds) | Interest and dividends through net income as earned/declared. |

| Equities (shares) | Remeasure investment to fair value at each reporting date or upon sale, with gains/losses through net income. Can be recorded directly to investment or through an asset valuation account. |

The fair value through net income (FVNI) model is required for many financial assets and liabilities. This model can be used for both debt and equity investments. The name pf the model – fair value through net income – is very descriptive of the appropriate accounting treatment.

With the FVNI model, investments in debt and equity, including derivatives, are reported at their fair value at each balance sheet date with fair value changes reported in net income. With investments using the fair value net income method, transactions costs are expensed as incurred. Any gain (loss) upon sale of the investment is reported in net income. In other words, the carrying amount (on the balance sheet) of each FVNI Investment is adjusted to its current fair value at each reporting date. All holding gains and losses are reported in net income along with any dividends or interest income earned.

FVNI investments are reported as a current asset if they meet the conditions of a current asset, such as; a cash equivalent, are held for trading purposes, or are expected to mature or be sold within 12 months of the balance sheet/SFP reporting date or the normal operating cycle. Otherwise, they are a long-term asset.

As indicated, market (fair) values can go up or down while FVNI investments are being held. As mentioned, these changes in fair value are reported in the calculation of net income.

However, it’s very important to note that IFRS and ASPE have slightly different reporting requirements and standards which can cause some confusion. There is a difference in terminology and how interest and dividends received are reported versus the change in the fair value of the investments.

With IFRS, the increases and decreases in fair value are referred to as unrealized gains and losses and are reported in net income. Any dividends or interest received can also be included in the unrealized gain or loss account. Under IFRS, both types of income (gain and dividends or interest) may be accounted for and reported together because this tends to mirror how such investments are managed. IMPORTANT: For our purposes, we will separate out dividend and interest income to show the differences – either interest income (debt) or dividend income (equity), depending on the type of investment.

ASPE on the other hand requires separate reporting of interest income and net gains and losses recognized on the financial statements. Increases and decreases in fair value, similar to IFRS, are reported in unrealized gains and losses. However, all of these items are included in the net income calculation. Again, for our purposes, we will separate out dividend and interest income to show the differences – either interest income (debt) or dividend income (equity), depending.

It is important to realize where the accounts are recorded on the income statement. For FVNI investments, unrealized gains and losses are reported in order to determine net income. Same with interest and dividends earned. One more note – some textbooks may use “Investment Income or Loss” to record the gain or loss in market value for FVNI investments. For the purposes of this text, we will use “Unrealized Gain or Loss” to be consistent.

Once a sale occurs, the investment can either be remeasured to its fair value as an unrealized gain/loss followed by the receipt of cash, or the gain or loss will be recorded as realized and reported through net income as a gain (loss) from the sale of the investment. Either treatment is acceptable for FVNI classification, because the unrealized and realized gains/losses are reported the same way in the income statement. For the purpose of this text, we will use Gain or Loss on Sale of FVNI Investments when the investment is sold.

In order to preserve the original cost of the investment, companies may choose to use an asset valuation allowance account instead of directly changing the asset carrying value. This is an option for any of the FVNI, FVOCI, and AC classification discussed in this chapter and will be illustrated in more detail below.

Impairment

Investments are reported at fair value at each reporting date, so no separate impairment evaluations and entries are required.

FVNI Investments in Shares

The accounting for FVNI equity investments such as shares is usually more straight- forward compared to debt investments such as bonds.

Assume that the following equity transactions occurred for Lornelund Ltd. in 2020:

| Lornelund Ltd. – Non-Strategic Equity Investments | ||||

|---|---|---|---|---|

| Dates in 2020 | Transaction Detail | # of Shares | Price per Share | Total Amount |

| June 1 | Purchased Symec Org. shares for $150 per share (transaction costs were an additional $1.25 per share) | 1,000 | $150.00 | $150,000 |

| Aug 15 | Purchased Hemiota Ltd. shares | 2,500 | 84.00 | 210,000 |

| Nov 30 | Dividends for Symec declared and received | 1,000 | 6.10 | 6,100 |

| Dec 31 | Market price for Symec shares at year-end | 165.00 | ||

| Dec 31 | Market price for Hemiota shares at year-end | 82.00 | ||

| Dates in 2021 | ||||

| Jan 10 | Sold Symec shares | 500 | 165.70 | 82,850 |

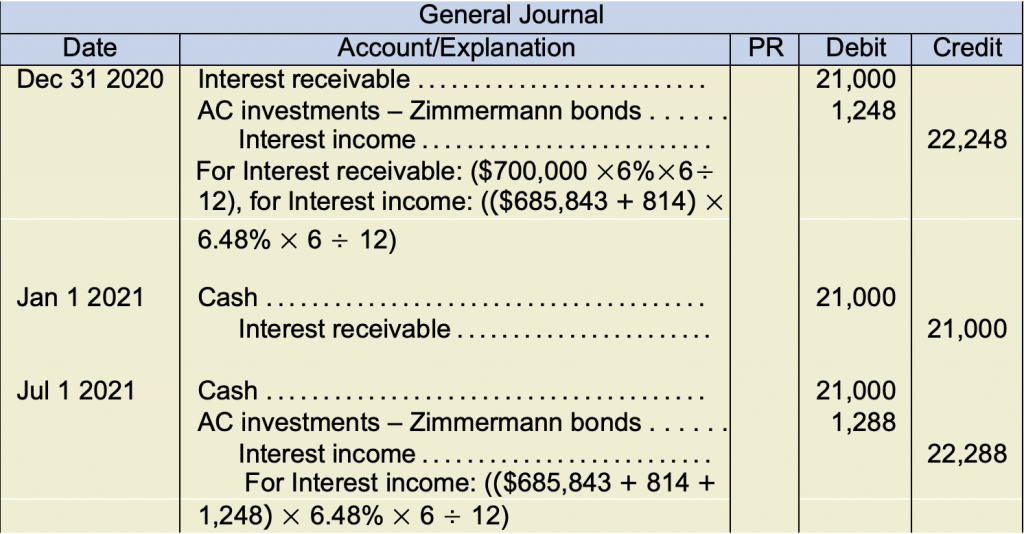

The journal entries for the FVNI investments are recorded below:

Once again, note that the change in valuation is recorded to the account “Unrealized gain (loss) on FVNI investments”. Some textbooks use “Investment income or loss”. Either way, the account MUST be included on the income statement when determining net income.

Note that the transaction fees are expensed for FVNI investments. This makes intuitive sense since the shares are being purchased at their fair market value and this represents the maximum amount that can be reported on the investor company’s balance sheet. At December 31 year-end, Lornelund makes two adjusting entries to record the latest fair values changes for each FVNI investment. The fair value for Symec shares increased from $150 to $165 per share, resulting in an overall increase in the investment value by $15,000 (from $150,000 to $165,000). Conversely, the fair value for Hemiota shares decreased from $84 to $82 per share, resulting in a decrease in the investment value of $5,000 (from $210,000 to $205,000). In both cases, the gains and losses will be reported in the income statement as unrealized gains (losses) on FVNI investments. The FVNI investment account would appear in the balance sheet as shown below.

Note that the transaction fees are expensed for FVNI investments. This makes intuitive sense since the shares are being purchased at their fair market value and this represents the maximum amount that can be reported on the investor company’s balance sheet. At December 31 year-end, Lornelund makes two adjusting entries to record the latest fair values changes for each FVNI investment. The fair value for Symec shares increased from $150 to $165 per share, resulting in an overall increase in the investment value by $15,000 (from $150,000 to $165,000). Conversely, the fair value for Hemiota shares decreased from $84 to $82 per share, resulting in a decrease in the investment value of $5,000 (from $210,000 to $205,000). In both cases, the gains and losses will be reported in the income statement as unrealized gains (losses) on FVNI investments. The FVNI investment account would appear in the balance sheet as shown below.

Lornelund Ltd.

Balance Sheet

December 31, 2020

Current assets:

FVNI investments (at fair value)* $370,000

*($150,000 + 210,000 + 15,000 − 5,000)

As previously mentioned, instead of recording the changes in fair value directly to the FVNI investment account as shown above, companies may record the changes to a valuation allowance as a contra account to the FVNI investment account (asset). This separates and preserves the original cost information from the fair value changes in much the same way as the accumulated depreciation account for buildings or equipment. If a valuation allowance contra account was used, the balance sheet would appear as follows:

Lornelund Ltd.

Balance Sheet

December 31, 2020

Current assets:

FVNI investments (at cost)*

Valuation allowance for fair value adjustments**

$360,000

$10,000

$370,000

*($150,000 + 210,000)

**($15,000 − 5,000)

On January 10, 2021, the Symec shares were sold at $165.70 per share. As previously explained, the shares can be remeasured to fair value prior to recording the sales proceeds, or the entry can skip that step and record the sales proceeds with the gain/loss as realized from sale of the investment. The entry above chose the latter, simpler alternative.

FVNI Investments in Debt

FVNI model of accounting for investments can also be bonds (debt investments), if market fair values are determinable. On January 1, 2020, Osterline Ltd. purchases 7%, 5-year bonds of Waterland Inc. with a face value of $500,000. Interest is payable on July 1 and January 1. The market rate for a bond with similar characteristics and risks is 6%. The bond sells for $521,326.[1]

On December 31, the fair value of the bonds at year-end is $510,000. Osterline follows IFRS. The interest is calculated using the effective interest method as shown below.

| Effective Interest Method for 7% Bonds (market/yield rate 6%) | ||||

|---|---|---|---|---|

| Date | Cash Received @ 3.5% stated rate for 6 months | Interest Income @ 3% market rate for 6 months | Amortized Premium (decreases carrying value) | Carrying Value |

| Jan 1, 2020 | $521,326 | |||

| Ju1 1 | 17,500 | 15,640 | 1,860 | 519,466 |

| Jan 1, 2021 | 17,500 | 15,584 | 1,916 | 517,550 |

| Jul 1 | 17,500 | 15,527 | 1,973 | 515,577 |

| Jan 1, 2022 | 17,500 | 15,467 | 2,033 | 513,544 |

| Jul 1 | 17,500 | 1406 | 2,094 | 511,450 |

| Jan 1, 2023 | 17,500 | 15,344 | 2,156 | 509,294 |

| Jul 1 | 17,500 | 15,279 | 2,221 | 507,073 |

| Jan 1, 2024 | 17,500 | 15,212 | 2,288 | 504,073 |

| Jul 1 | 17,500 | 15,144 | 2,356 | 502,429 |

| Jan 1, 2025 | 17,500 | 15,073 | 2,429 (rounded) | 500,000 |

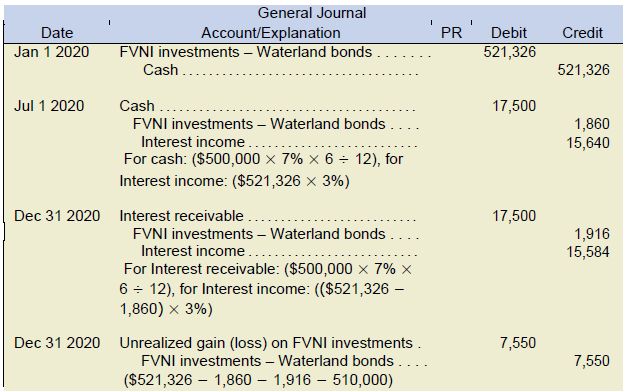

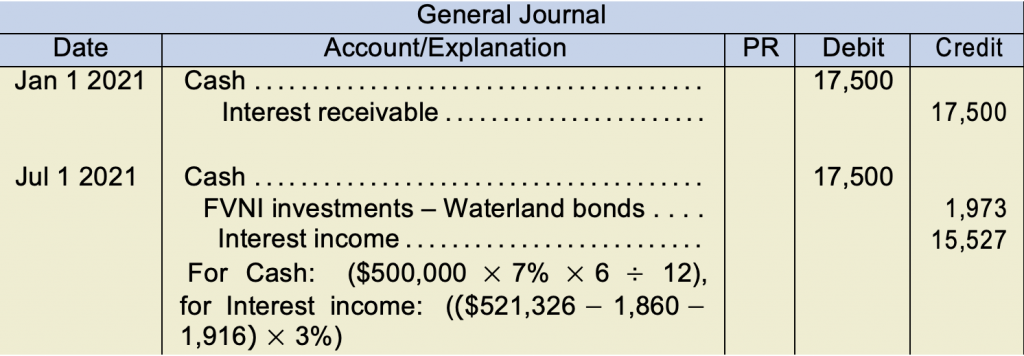

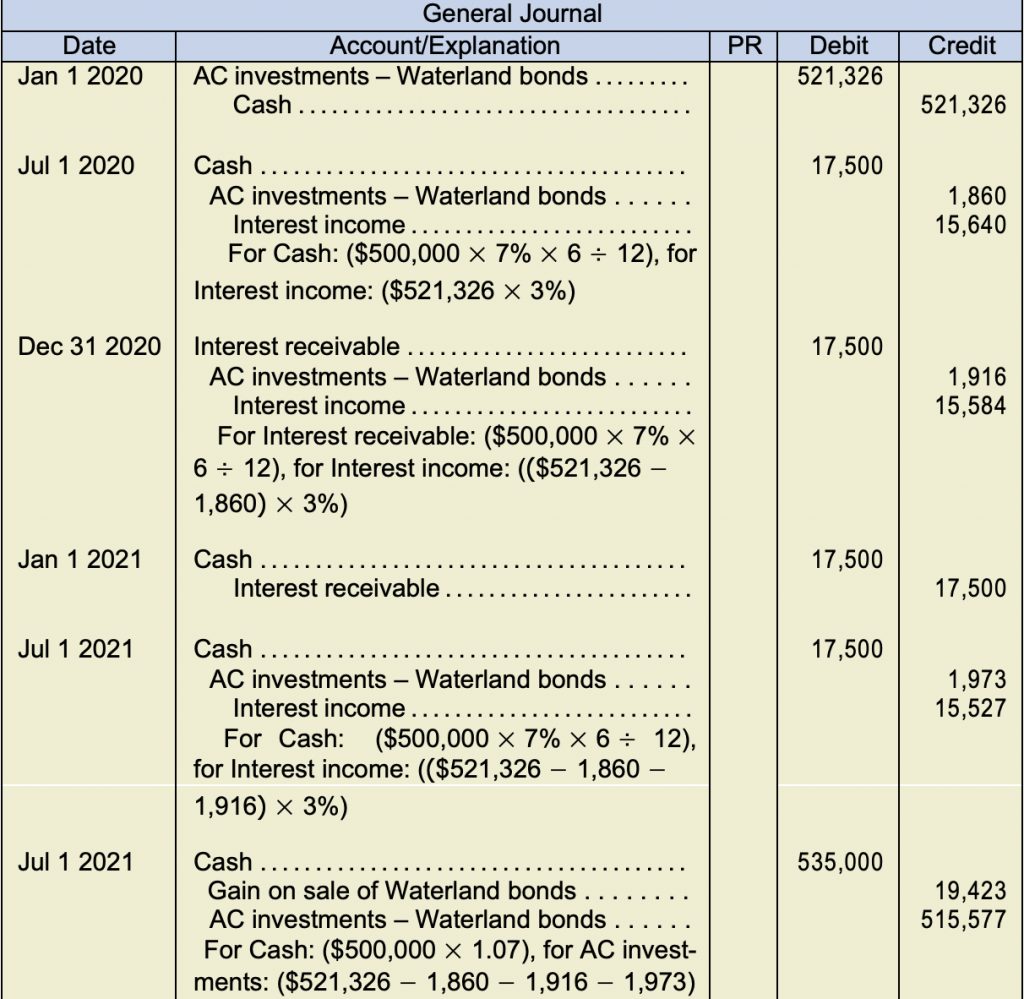

Osterline’s journal entries from January 1, 2020 to July 1, 2021 are shown below.

The bond was initially valued and recorded at its purchase price (fair value) of $521,326. Note that this is higher than the face value of $500,000. This is referred to as purchasing at a premium, which is amortized to the FVNI investment account over the life of the bond using the effective interest method. This method was also discussed in Chapter 6: Cash and Receivables; review that material again, if necessary. There were no transaction costs, but these would have been expensed as incurred just as was done in the previous FVNI shares example.

The July 1, 2020, entry was for interest income based on the market rate (or yield) for 3% (6% annually for six months), while the cash paid by Waterland on that date of $17,500 was based on the stated or face rate for 3.5% (7% annually for six months). The $1,860 difference was the amount of premium to be amortized to the FVNI investment account on that date. On Dec 31, there were two adjusting entries:

- The first entry was for the interest income that has accrued since the last interest payment on July 1. This interest entry must be done before the fair value adjustment to ensure that the carrying value is up to date.

- The second adjusting entry is for the fair value adjustment which is the difference between the investment’s carrying value of $517,550 ($521,326 − 1,860 − 1,916) and the fair value on that date of $510,000. Since the fair value is less than the carrying value, this FVNI investment (or a valuation allowance) is reduced to its fair value by $7,550 ($517,550 − 510,000). The investment carrying amount after the adjustment is now equal to the fair value of $510,000.

It is important to note that the July 1, 2021, interest income of $15,527 calculated after the fair value adjustment had been recorded continues to be based on the amounts calculated in the original effective interest schedule. The interest rate calculations will continue to use the original effective interest rate schedule amounts throughout the bond’s life, without any consideration for the changes in fair value.

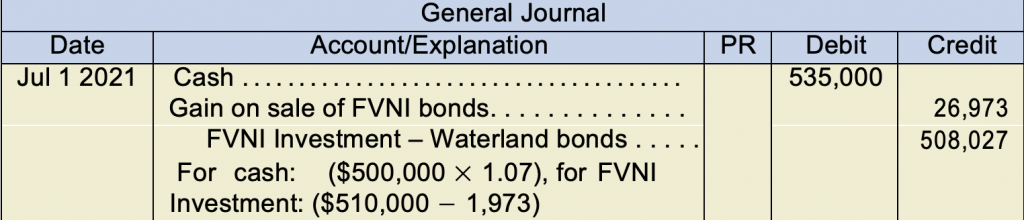

On July 1, 2021, just after receiving the interest, Osterline sells the bonds at the market rate of 107. The entry for the sale of the bonds on July 1, 2021 is shown below.

Recall from the journal entries above that on December 31, 2020, the investment had been reduced to its fair value of $510,000. On July 1, 2021, the interest entry included amortization of the premium for $1,973, resulting in a carrying value as at July 1, 2021 of $508,027. The market price for selling the investment was 107 resulting in a gain of $26,973. Note that this entry skipped the remeasure to fair value as an unrealized holding gain and recorded the sale entry as simply a gain on sale. Either method is acceptable.

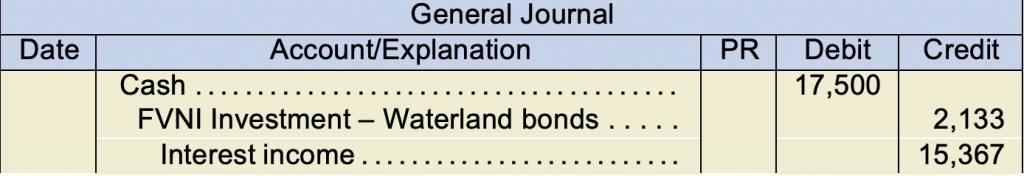

ASPE companies can choose to use straight-line amortization of the bond premium in- stead of the effective interest method. If straight-line was used, the amount recorded to the investment account would be $2,133 ($21,326 ÷ 5 years × 6 ÷ 12) at each interest date until the investment is sold.

Again, note that no separate impairment evaluations or entries are recorded since the debt investment is already adjusted to its current fair value at each reporting date.

Investments in Foreign Currencies

Investments may be priced in foreign currencies, which must be converted into Canadian currency for recording and reporting purposes. Illustrated below are the accounting entries for a FVNI investment priced in a foreign currency.

FVNI investments purchased in foreign currencies are converted into Canadian currency using the exchange rates at the time of the purchase. Also, depending on the accounting standard and the circumstances of the investment, the fair value adjusting entry may have to separately record the foreign exchange gain (loss) from the fair value adjustment amount.

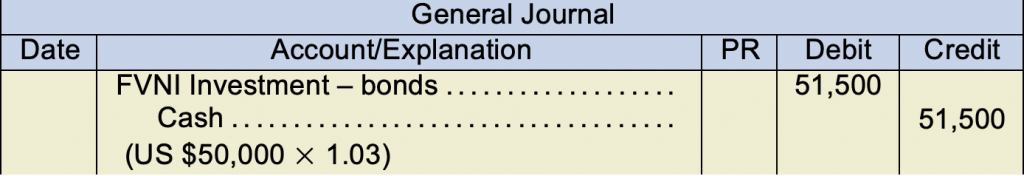

For example, assume that the US dollar is worth $1.03 Canadian at the time of an investment purchase for US $50,000 bonds at par. In Canadian dollars, the amount would be $51,500. The entry to record the purchase would be:

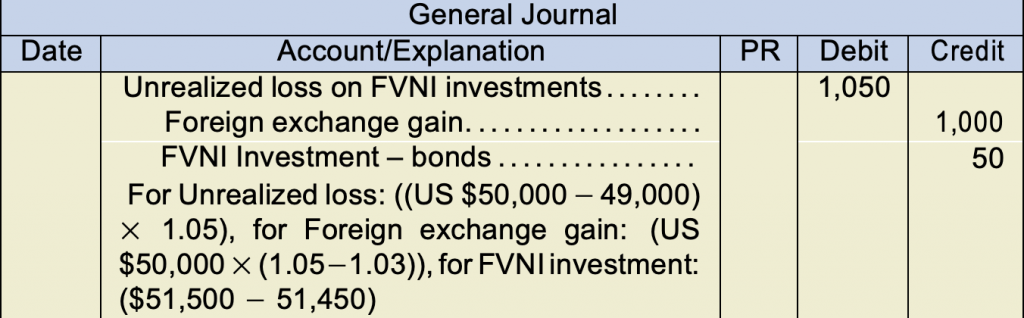

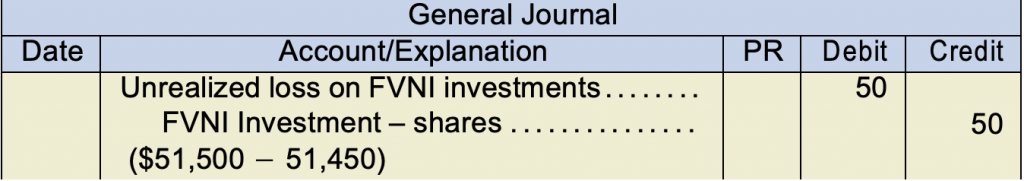

At year-end, the fair value of the bonds is US $49,000 and the exchange rate at that time is 1.05. In Canadian dollars the amount would be $51,450 (US $49,000 × 1.05) compared to the original purchase price in Canadian dollars of $51,500, an overall net loss of $50.

The entry to record the fair value adjustment separately from the exchange gain/loss would be:

Note that the exchange rate increased from 1.03 to 1.05 for the US $50,000 investment amount. This increase in the exchange rate resulted in a gain of Cdn $1,000 which was recorded separately from the fair value adjustment loss of Cdn $1,050.

If there was no requirement to separate the exchange gain from the fair value adjusting entry, the adjusting entry would be:

8.2.2. Fair Value Through OCI Investments (FVOCI); (IFRS only)

| Types of Investments | Accounting Treatment |

|---|---|

| Debt | Interest and dividends through net income as earned/declared. |

| Debt (bonds)

Equities (shares) by special irrevocable election only at aquisition |

Remeasure investment to fair value at each reporting date through OCI. Can be recorded directly to investment or through an asset valuation account.

Upon sale, remeasure investment sold to its fair value with gains/losses through OCI. Reclassify the OCI for the debt investment sold to net income (FVOCI with recycling), and to retained earnings for equities investments (FVOCI without recycling). |

Looking at the table above, one cannot help but notice how the FVOCI debt investments are “recycled” through net income when sold in contrast to the FVOCI equities investments which are not recycled, and are reclassified to retained earnings instead, bypassing net income altogether. Originally, the FVOCI classification was without recycling for both debt and equity. This was done to lessen the instances of “earnings management” which is the manipulation of earnings due to bias. By timing the most opportune time to sell, a company could suddenly boost net income resulting from the reclassification of OCI from AOCI to net income of the unrealized gains dating back to when the investment was purchased. However, it appears that an exception has now been made to allow FVOCI debt investments to recycle through net income. FVOCI investments in equities continue to be classified as FVOCI without recycling.

To be clear – recycling means that when an investment is sold any amount associated with that investment in the accumulated other comprehensive income account is “recycled” into net income.

FV-OCI with recycling = debt instruments

FV-OCI without recycling = equity investments

FVOCI debt and equity investments are reported at their fair value at each balance sheet date with fair value changes recorded in Other Comprehensive Income (OCI). We will use the same account to record the increase or decrease in value – Unrealized Gain or Loss – OCI. Recall from Chapter 4, other comprehensive income is NOT included in the net income calculation. Understanding that subtle difference is important.

Unlike FVNI investments, transaction costs are usually added to the carrying amount of the FVOCI investment (capitalized), and FVOCI investments are usually reported as long-term assets unless it is expected they will be sold within twelve months or the normal operating cycle.

Dividends or interest earned should be reported in the appropriate revenue account under FVOCI investment reporting.

The fair value measurement at each reporting date is recorded to the investment asset account (or an asset valuation account). The unrealized holding gain (loss) is recorded to unrealized gain (loss) OCI and reported in OCI (net-of-tax). When the investments are sold, a remeasure to fair value can precede the entry for the sales proceeds, or alternatively, any gains (losses) resulting from the sale are reported in net income as a realized gain (loss) on sale of investment.

This is the point where FVOCI investments in debt differ from FVOCI investments in equity.

For FVOCI, debt investment sold:

- any unrealized gain (loss) in AOCI at the time of the sale is reclassified from AOCI to net income (with recycling).

For FVOCI, equity investment sold:

- any unrealized gain (loss) in AOCI at the time of the sale is reclassified from AOCI to retained earnings (without recycling).

Recall from the chapter on Statement of Income and Statement of Changes in Equity, that OCI is not included in net income, and is reported in a separate statement called the Statement of Comprehensive Income. This means that any unrealized gains (losses) from holding FVOCI investments will not be reported as net income until the debt investment is sold or impaired as will now be discussed. Students are encouraged to review the material regarding the topic of OCI.

Impairment of Investments with no recycling (Equity)

For FVOCI in equity investments, there is no need for impairment tests because equities are continually re-measured to their fair value based on the readily available market prices and these changes in value are not reported in net income, so impairment testing is not done. For FVOCI investments in debt, impairments will be discussed in detail in the FVOCI with recycling (debt) section later in this chapter.

FVOCI (without recycling) – Investments in Shares

The similarities and differences between FVNI and FVOCI investments journal entries will be examined next, since both apply fair value remeasurements, but differ in how these are recorded and reported. Using the same example for Lornelund Ltd. used in the FVNI investments above, a comparison between the entries required for FVNI and FVOCI is shown below. The transactions are repeated below but now include another fair value change at the end of 2021.

| Lornelund Ltd. – Non-Strategic Equity Investments | ||||

|---|---|---|---|---|

| Dates in 2020 | Transaction Detail | # of Shares | Price per Share | Total Amount |

| June 1 | Purchased Symec Ord. shares for $150 per share (transaction costs were an additional $1.25 per share) | 1,000 | $150.00 | $150,000 |

| Aug 15 | Purchased Hemiota Ltd. shares | 2,500 | 84.00 | 210,000 |

| Nov 30 | Dividends for Symec declared and received | 1,000 | 6.10 | 6,100 |

| Dec 31 | Market price for Symec shares at year-end | 165.00 | ||

| Dec 31 | Market price for Hemiota shares at year-end | 82.00 | ||

| Dates in 2021 | ||||

| Jan 10 | Sold Symec shares | 500 | 165.70 | 82,850 |

| Dec 31 | Market price for Symec shares at year-end | $167.00 | ||

| Dec 31 | Market price for Hemiota shares at year-end | $75.00 | ||

| Comparison of FVNI to FVOCI (without recycling) | |||||

|---|---|---|---|---|---|

| Date | (FVNI) | (FVOCI) | |||

| 2020 | |||||

| June 1 | Investments – Symec shares | 150,000 | 151,250 | ||

| Transactions fees expense | 1,250 | ||||

| Cash | 151,250 | 151,250 | |||

| Aug 15 | Investments Hemiota shares | 210,000 | 210,000 | ||

| Cash | 210,000 | 210,000 | |||

| Nov 30 | Cash (or dividend receivable if declared but not paid) | 6,100 | 6,100 | ||

| Dividend income | 6,100 | 6,100 | |||

| Dec 31 | Investments – Symec shares | 15,000 | 13,750 | ||

| Unrealized gain (loss) on FVNI investments (NI) ($165 × 1,000 shares) | 15,000 | ||||

| Unrealized gain (loss) on FVOCI investments (OCI) ($165,000 − 151,250) | 13,750 | ||||

| NOTE – Both FVNI and FVOCI shares carrying values for Symec are $165 per share × 1,000 = $165,000 | |||||

| 2021 | |||||

| Jan 10 | Cash | 82,850 | 82,850 | ||

| Investments – Symec shares | 82,500 | 82,500 | |||

| Gain (loss) on sale of investments (NI) | 350 | ||||

| Gain (loss) on sale of investments (OCI) | 350 | ||||

| For Cash: ($165.70 × 500 shares), For Investments: ($165 × 500 shares) | |||||

| Jan 10 | AOCI | 7,225 | |||

| Retained earnings ($13,750 × (500 ÷ 1,000 shares)) +$350 To reclassify unrealized gains from AOCI to retained earnings for 500 Symec shares sold | 7,225 | ||||

| Dec 31 | Investments – Symec shares | 1,000 | 1,000 | ||

| Unrealized gains (loss) on FVNI investments (NI) | 1,000 | ||||

| Unrealized gain (loss) on FVOCI investments (OCI) | 1,000 | ||||

| (500×($165.00-167.00)) | |||||

| Dec 31 | Unrealized gain (loss) on FVNI investmensts (NI) | 17,500 | |||

| Investments – Hemiota shares ($205,000 − (2,500 × $75)) | 17,500 | ||||

| Unrealized gain (loss) on FVOCI investments (OCI) | 17,500 | ||||

| FVOCI Investments – Hemiota shares | 17,500 | ||||

NOTE – See the Jan 10 entry to reclassify unrealized gains from AOCI to retained earnings. Remember that AOCI is the accumulation of the revaluation entries in this example and there is no entry per se that moves the amounts from unrealized gain or loss (OCI) to the AOCI account, it is assumed.

Note that the transaction fees are expensed for FVNI investments but are added to the carrying value for FVOCI investments. At December 31 year-end, Lornelund makes two end- of-period adjusting entries to record the latest fair values changes for each investment. The fair value for Symec shares increased FVOCI $150 to $165 per share resulting in an increase in the investment value by $15,000 and $13,750 for FVNI and FVOCI categories respectively. These amounts are different due to the transaction costs originally recorded to the investment asset of the FVOCI investment. The fair value for Hemiota shares decreased from $84 to $82 per share resulting in a decrease in the investment value of $5,000 for both FVNI and FVOCI investments.

Ignoring taxes for simplicity, below are the financial statements for 2020 under FVNI and FVOCI:

| Lornelund Ltd Balance Sheet December 31,2020 |

||

|---|---|---|

| FVNI | FVOCI | |

| Current assets: FVNI investments (at fair value)[2] |

$370,000 | |

| Long-term assets: Long-term investment (at fair value) |

$370,000 | |

| Equity: Accumulated other comprehensive income[3] |

$8,750 | |

There is no difference in the ending balances of the investment asset accounts under the FVNI and FVOCI methods on December 31, 2020, because both are reported at fair value at each reporting date. Even though the transaction costs were initially capitalized under the FVOCI method, the year-end fair value adjustment entry for both FVNI and FVOCI investments resulted in equalizing the investments balances.

| Lornelund Lt. Income Statement and Comprehensive Income Statement (partial) For the Year Ended December 31, 2020 |

||

|---|---|---|

| FVNI | FVOCI | |

| Dividend income | $6,100 | $6,100 |

| Unrealized gain ($15,000 − 5,000) | 10,000 | |

| Transaction fees expense | (1,250) | |

| Net income | $14,850 | $6,100 |

| Other Comprehensive Income: Items that may be reclassified subsequently to net income or loss: Unrealized gain from FVOCI investments ($13,750 − 5,000) |

$8,750 | |

| Total comprehensive income | $14,850 | $14,850 |

At December 31, 2021 year-end, 50% of the Symec shares have been sold in January and the fair values are once again adjusted for both Symec and Hemiota investments at year-end.

Below is a partial balance sheet and income statement reporting the investment at December 31, 2021.

| Lornelund Ltd Balance Sheet December 31,2021 |

||

|---|---|---|

| FVNI | FVOCI | |

| Current assets: FVNI investments (at fair value)[4] |

$271,000 | |

| Long-term assets: Long-term investment (at fair value) |

$271,000 | |

| Equity: Retained earnings income Accumulated other comprehensive income/loss[5] |

$7,050 (14,500) |

|

| Lornelund Lt. Income Statement and Comprehensive Income Statement (partial) For the Year Ended December 31, 2021 |

||

|---|---|---|

| FVNI | FVOCI | |

| Gain on sale of shares | $350 | |

| Unrealized loss | (16,500) | |

| Net income/(loss) | $(16,150) | |

| Other Comprehensive Income: Items that may be reclassified subsequently to net income or loss: Unrealized gain from FVOCI investments |

$(16,150)[6] | |

| Total comprehensive income/(loss) | $(16,150) | $(16,150) |

As can be seen from the illustrations above, there are significant differences in net income, due to the accounting treatments between FVNI and FVOCI investments. This could lead to earnings management, if care is not taken to ensure that these differences are considered solely for the purpose of managing net income to get higher bonuses, or fall under the radar regarding any restrictive covenants (for example, net income minimum thresholds set by creditors as performance targets). These differences also have to be taken into account when analyzing investment portfolio performance.

FVOCI (with recycling) – Investments in Debt

FVOCI investments for IFRS companies can also be debt, such as bonds. FVOCI shares (no recycling) reports dividends in net income and unrealized gains in OCI until sold, at which time the OCI corresponding to the shares sold are reclassified from OCI/AOCI to retained earnings. FVOCI debt (with recycling) reports interest in net income and unrealized gains in OCI until sold. As the “with recycling” name suggests, when the debt securities are sold, the corresponding OCI is recycled through net income.

Using the same example as for FVNI investments in bonds discussed earlier, where Osterline Ltd. purchased 7%, 5-year Waterland bonds with a face value of $500,000. On July 1, 2021, just after receiving the interest, Osterline sells the bonds at the market rate of 107. Osterline’s journal entries from Jan 1, 2020 to July 1, 2021 classified as FVNI are repeated below and compared with debt investments classified as FVOCI.

| Osterline Ltd. Comparison of FVNI to FVOCI (without recycling) |

|||||

|---|---|---|---|---|---|

| Date | (FVNI) | (FVOCI) | |||

| 2020 | |||||

| Jan 1 | Investments – Waterland bonds | 521,326 | 521,326 | ||

| Cash | 521,326 | 521,326 | |||

| Jul 1 | Cash | 17,500 | 17,500 | ||

| Investments – Waterland bonds | 1,860 | 1,860 | |||

| Interest Income | 15,640 | 15,640 | |||

| For Cash: ($500,000 × 7% × 6 ÷ 12), For Interest income: ($521,326 × 3%) | |||||

| Dec 31 | Interest receivable | 17,500 | 17,500 | ||

| Investments – Waterland bonds | 1,916 | 1,916 | |||

| Interest Income | 15,584 | 15,584 | |||

| For Interest receivable: ($500,000 × 7% × 6 ÷ 12), For Interest income: (($521,326 − 1,860) × 3%) | |||||

| Dec 31 | Unrealized loss on FVNI investment (NI) | 7,550 | |||

| Unrealized gain (loss) on investments (OCI) | 7,550 | ||||

| Investments – Waterland bonds | 7,550 | 7,550 | |||

| For NI: ($521,326 − 1,860 − 1,916 − 510,000) | |||||

| 2021 | |||||

| Jan 1 | Cash | 17,500 | 17,500 | ||

| Interest receivable | 17,500 | 17,500 | |||

| Jul 1 | Cash | 17,500 | 17,500 | ||

| Investments – Waterland bonds | 1,973 | 1,973 | |||

| Interest income | 15,527 | 15,527 | |||

| For Cash: ($500,000 × 7% × 6 ÷ 12), For Interest income: (($521,326 − 1,860) × 3%) | |||||

| Jul 1 | Cash | 535,000 | 535,000 | ||

| Gain on sale of Waterland bonds | 26,973 | ||||

| Gain on sale of Waterland bonds (OCI) | 26,973 | ||||

| Investments – Waterland bonds | 508,027 | 508,027 | |||

| For Cash: ($500,000 × 1.07), For Investments: ($510,000 − 1,973) | |||||

| Jul 1 | OCI – removal of gain due to sale | 19,473 | |||

| Gain from sale of investment (NI) ($26,973 − 7,550 loss) | 19,473 | ||||

Note the similarities in accounting treatment between the FVNI and FVOCI classifications for bonds. As was the case for the FVNI investment in shares, the investment is adjusted to fair value at the reporting date. The difference between the two methods is the account used for the fair value adjustment. For FVNI, the unrealized gain/loss is reported in net income, whereas for FVOCI, the unrealized gain/loss is reported as Other Comprehensive Income which is closed at each year-end to the AOCI account (an equity account), until the investment is sold. Once sold, any unrealized gains/losses that relate to the sale of this investment are now realized and are transferred from OCI to net income. This is referred to as “with recycling” (through net income). Recall that FVOCI in equities do not recycle through net income. It is for this reason that FVOCI investments in debt with recycling must be evaluated for impairment which is discussed next.

Also note the order of the entries upon sale. The July 1 sales is comprised of two entries above. The first entry is a combined entry that records the cash proceeds, removal of the investment sold and any realized gain/loss through OCI. This is the same as the method used for FVOCI equities. The second entry is a transfer of the OCI related to the sale from OCI to net income. For FVOCI equities this entry is a reclassification from OCI to retained earnings. This is an important distinction regarding the accounting treatment for the FVOCI investments.

Because the entire investment was sold, the net income differed in the first and second year between FVNI and FVOCI with recycling, but over two years, the net income was the same for both. If only part of the investment been sold, the differences would be similar to the example regarding FVOCI equities, with regard to balances in the OCI/AOCI account compared to FVNI where all the gains/losses are reported through net income.

Impairment of Investments – FVOCI with recycling (Debt)

For FVOCI in debt investments, an evaluation is done starting at its acquisition date. Under IFRS 9, impairment evaluation and measurement is based on expected losses, and must now reflect the basic principles below:

- An unbiased evaluation over a range of probability-based possible outcomes

- Estimated revised cash flows are discounted to reflect time value of money

- The evaluation and measurements are based on data from past, current and estimated future economic conditions, using reasonable and supportable information without undue cost or effort at the reporting date

The last point suggests that a company does not need to identify every possible scenario when risks are low, and companies are encouraged to use modelling techniques to simplify evaluations and impairment measurements of large low-risk portfolios.

Essentially how it works is that for each investment at acquisition, various potential default scenarios (where the debt owing is not paid when due) are identified. Expected future cash flows are estimated for each scenario, which is multiplied by its probability of occurring. These probability-based cash flows are summed, and the total is deemed as the expected credit loss (ECL) for that investment. This is a separate evaluation and measurement of impairment losses than fluctuations in the market.

These estimated cash flows can either be based on scenarios and probabilities of default over the investment’s next 12 months (12-month ECL) from acquisition, if risk of default is low, or over the investment’s lifetime (Lifetime ECL), if risk of default is higher. IFRS 9 identifies three approaches for receivables and investments:

- Credit adjusted approach – for investments that are impaired at acquisition, such as deeply discounted investments from high risk investee companies. This approach will apply only rarely. Evidence of high risk could be due to significant financial difficulties or potential bankruptcy, a history of defaults, a history of concessions granted by creditors on previous debt, or economic downturns in the investee company’s industry sector. This approach uses the cumulative change in Lifetime ECL.

- Simplified approach – this approach is intended specifically for trade receivables, IFRS 15 contract assets and lease receivables where the financial instrument does not contain a significant interest component. It is based on Lifetime ECL

- General approach – this approach applies to all other financial instruments not covered in the first two approaches. It is based on a 12-month ECL unless the credit risk increases significantly.

If the credit risk is high at the investment’s acquisition, the credit adjusted approach with Lifetime ECL will apply, otherwise the general approach would be used with the shorter 12-month ECL. The end-result is that every investment will have an ECL amount associated with it. These risk-based cash flows are discounted using the historic interest rate at acquisition, and compared to the carrying value of the debt investment at the evaluation date. The carrying value of the investment (or an asset valuation account) is reduced by the loss amount and recorded to net income. Below is a schedule that illustrates a simple ECL calculation:

| Investment in Bonds – Emil Ltd. Investee Expected Credit Loss Calculation |

||||

|---|---|---|---|---|

| Scenario 1 | Scenario 2 | Scenario 3 | Total | |

| Estimated future cash flows at acquisition assuming no risk of default, discounted @ effective interest rate | $500,000 | $500,000 | $500,000 | |

| Future cash flows if default occurs, discounted @ historic effective rate at acquisition | 450,000 | 400,000 | 350,000 | |

| Cash flow shortage | 50,000 | 100,000 | 150,000 | |

| Probability of default | 2.0% | 1.5% | 0.5% | |

| Expected Credit Loss (ECL) | $1,000 | $1,500 | $1,750 | $4,250 |

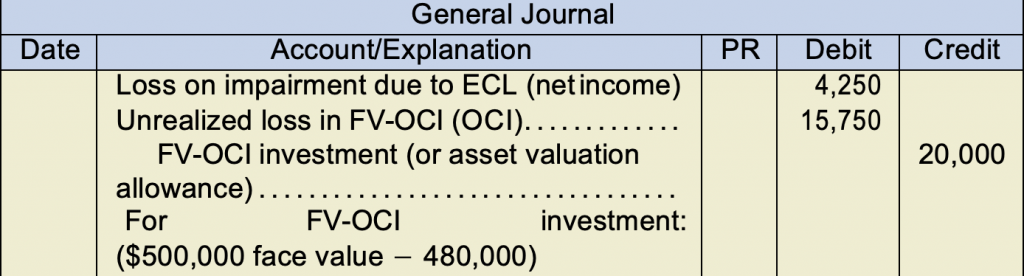

Management can include as many default scenarios as is appropriate. In this case, there are three scenarios where management has identified potential defaults for this investment. If at the first reporting date after acquisition the fair value of the investment is $480,000, the entry to record the fair value change would be:

The unrealized loss of $15,750 is to adjust for changes in the market fluctuations that is not due to an impairment, so it is recorded to OCI . The loss on impairment resulting from the ECL calculation must be reported through net income. Compared to the previous accounting standard (IAS 39), this results in an earlier recognition of an impairment loss because it is recorded at the first reporting period after the investment acquisition. This clearly could create more volatility in the income statement.

After the initial recognition, the ECL is adjusted up or down, through net income at each reporting date as the probabilities of default change. Once the investment is collected, the ECL will be reduced to zero and impairment recoveries will be reported through net income. If default risk increases due to adverse changes in business conditions, not only will the estimated cash flow shortages and probabilities increase, the increased credit risk could result in a change from the simpler 12-month ECL to the Lifetime ECL if risk becomes too high. If a default does occur, the ECL amount will equal the actual cash flow shortage. In IFRS 9, there is a presumption that credit/default risk significantly increases if contractual payments from the investee are more than 30 days past due.

To summarize, assessing credit risk is only required for amortized cost and FVOCI debt (with recycling). FVNI and FVOCI equities do not need to be evaluated for impairment because they are always remeasured to fair value each reporting date. Evaluating and measuring impairments requires considerable judgement and companies are encouraged to establish an accounting policy regarding factors to consider when determining if in- creases in credit risk (ECL) is to be deemed as significant or not.

8.2.3. Amortized Cost Investments (AC) – Cost

For ASPE companies, either debt or equities that are not traded in an active market are reported at amortized cost (debt) or cost (equity) respectively. Unlike investments acquired for short-term profit such as FVNI investments, shares or bonds may be purchased as AC investments for other reasons, such as to strengthen relationships with a supplier or an important customer.

For IFRS companies, if the investment business model is to acquire investments to collect the contractual cash flows of principal and interest, and there is no intention to sell, investments in debt securities such as bonds are reported at their amortized cost at each balance sheet date. Management intent is to hold these investments until maturity, so debt instruments are included in this category. Equity investments have no set maturity dates; therefore they are not classified as an AC investment. Even if equities such as shares are not part of a quoted market system, IFRS states that fair values are still normally determinable, making FVOCI equities (without recycling) the more appropriate classification for unquoted equities.

Transactions costs are added to the investment (asset) account. AC investments are reported as long-term assets unless they are expected to mature within twelve months of the balance sheet date or the normal operating cycle.

To summarize the initial and subsequent measurements used for AC investments:

- Initial purchase is at cost (purchase price) which is also fair value on the purchase date. Unlike FVNI investments, transaction fees are added to the investment (asset) account. This is because AC investments are cost-based investments, so any fees paid to acquire the asset are to be capitalized like property, plant, and equipment, which are also cost-based purchases.

- Bond interest and share dividends declared are reported in net income as realized. Any premium or discount is amortized to the investment asset using the effective interest rate method (IFRS). For ASPE companies, they can choose between the effective interest rate method and the straight-line method.

- If the investment is impaired, determine the impairment amount. For ASPE the impairment amount is the higher of: a) the present value of impaired future cash flows at the current market interest rate, and b) net realizable value through sale (or sale of collateral). ASPE allows for reversals of impairment. For IFRS, refer to the Impairment section above in the FVOCI debt (with recycling).

- Report the investment at its carrying value at each reporting date, net of any impairment. As asset valuation account can be used instead of recording the impairment loss directly to the investment account.

- When the investment is sold, remove the related accounts from the books. For debt instruments, ensure that any interest, amortization or possible impairment recovery is updated before calculating the gain/loss on sale prior to its removal from the books. The difference between the carrying value and the net sales proceeds is reported as a gain/loss on sale (including full or partial recovery of a previous impairment, if applicable) and reported in net income.

Cost Investments in Equity

ASPE applies the cost model when considering recording an investment in shares (equity). The method of recording journal entries using the cost model is very straightforward since there is no adjustment to the fair value as considered with earlier methods. The steps are outlined below as well as an example of the required journal entries.

To record an investment in equity, using the cost model:

- Recognize the cost of the investment at that fair value of the shares acquired (the cost). Add any transaction costs incurred to acquire the shares.

- Unless impaired, report the investment at its cost at each balance sheet date (no adjustment to the cost is necessary).

- Recognize dividend income when the investment company has established it right to receive the dividend.

- When the shares are sold, derecognize the investment and report a gain or loss on disposal in net income. The gain or loss on disposal is the difference between the investments carrying value (cost) and the proceeds on disposal.

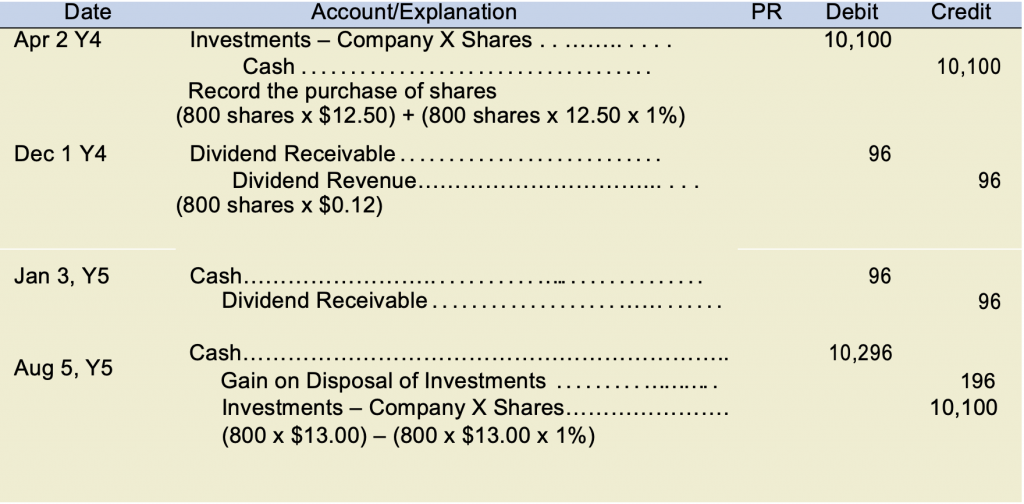

As an example:

Assume that Company A purchases 800 shares of Company X at $12.50 per share on April 2, Y4. A 1.0% commission is charged on the transaction. On December 1, Y4, the board of directors declares a dividend of $0.12 per share to the shareholders of record on December 31, Y4, payable on January 3, Y5. On August 4, Y5, Company A sells all the shares of Company X for $13.00 and pays a 1.0% commission on the sale. Company A has a December 31 year end.

Note – if only a portion of the shares purchased have been sold, it is logical to use an average carrying value for the disposal.

And remember – using the cost method for equity investments, there is NO need to revalue the investment to the current market value.

AC (Amortized Cost) Investments in Debt

Remember, when you prepare the amortization schedule for bonds (amortizing the premium or discount), that is the logic with the amortized cost method. There is no need to revalue the investment.

In the previous sections discussing FVNI and FVOCI investments, Osterline purchased Waterland bonds on the January 1, 2020, the interest payment date. Assume now that Osterline classified this as an AC investment. The entries would be the same as illustrated earlier for the FVNI category, except to exclude any fair value adjustments.

If you recall the steps listed above for equity, the steps are similar.

Note that the entry to the investment account for the sale of Waterland bonds for the FVNI or FVOCI methods shown earlier is $508,027 compared to AC method above for $515,577. The reason for this difference is due to the fair value adjustment for $7,550 for the FVNI and FVOCI methods (both fair-value based) but not done for AC method which is based on amortized cost.

AC Investments in Bonds – Between Interest Dates

What if the debt investment is purchased in between interest payment dates? Below is an example of the accounting treatment for an AC investment in bonds that is purchased between interest payment dates.

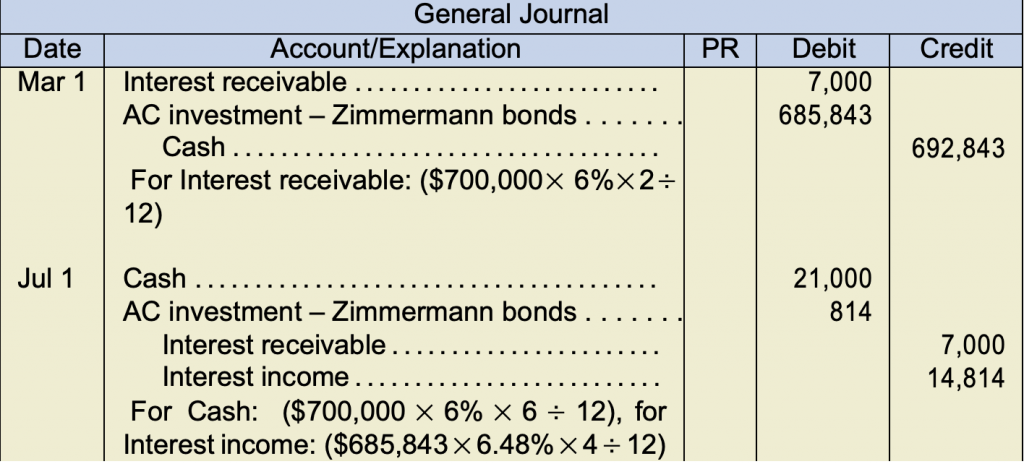

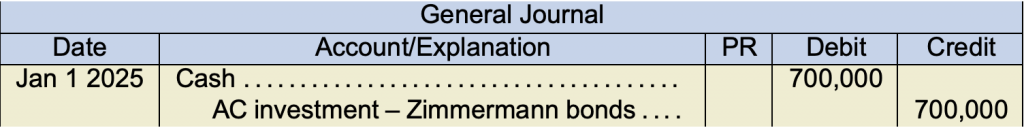

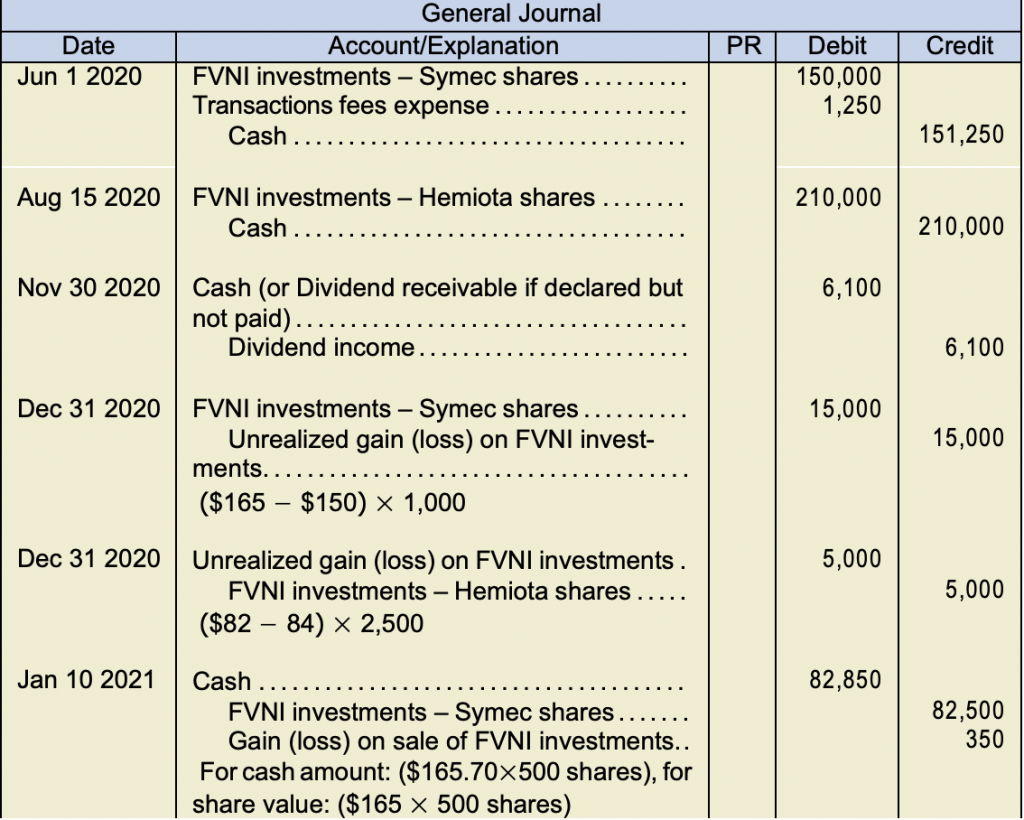

On March 1, 2020, Trimliner Co. purchases 6%, 5-year bonds of Zimmermann Inc. with a face value of $700,000. Interest is payable on January 1 and July 1. The market rate for a bond with similar characteristics and risks is 6.48%. The bond is purchased for $685,843 cash. Stated another way, the bond is purchased at 98 ($685,843 ÷ $700,000) on March 1, 2020. On December 31, 2020 year-end, the fair value of the bond at year-end is $710,000. Trimliner follows IFRS and intends to hold the investment to collect the contractual cash flows of principal and interest and to hold until maturity (AC classification).

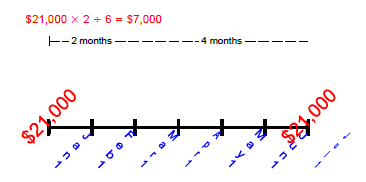

Note that the purchase date of March 1 falls in between interest payments on January 1 and July 1. The business practice regarding bond interest payments is for the bond issuer to pay the full six months interest to the bond holder throughout the life of the bond. This creates a much simpler bond interest payment process for the bond issuer, but it creates an issue for the purchaser since they are only entitled to the interest from the purchase date to the next interest date, or four months in this case, as illustrated below.

This issue is easily resolved. The purchaser includes in the cash paid any interest that has accrued between the last interest payment date on January 1 and the purchase date on March 1, or two months. In other words, the purchaser adds to the cash payment any interest that they are not entitled to receive. Later, when they receive the full six months of interest on July 1 for $21,000, the net amount received will be for the four-month period that was earned, which was from the purchase date on March 1 to the next interest payment on July 1 as shown above.

In this example, the purchase price of $685,843 is lower than the face value of $700,000, so the bonds are purchased at a discount.

The entry to record the investment for Trimliner, including the interest adjustment on March 1, 2020 and the first interest payment on July 1, 2020, is shown below. Note that the discount is also amortized from the date of the purchase of bonds to the end of the interest period.

The net interest income recorded by Trimliner is $14,814 on July 1 ($685,843 × 3.24% × 4 ÷ 6), which represents the four months interest earned from the March 1 purchase date to the first interest payment date on July 1. The interest receivable is now eliminated.

Note that for AC bonds, there are no entries to adjust the AC investment to fair value at year-end. The fair value information of $710,000 on December 31, 2020, that was provided in the question data is not relevant for AC investments.

When the bonds mature at the end of five years, the entry to record the proceeds of the sale is shown below.

As previously stated, ASPE companies can choose to use either the effective interest or the straight-line method to amortize premiums or discounts. If straight-line method is used, the discount for $14,157 ($700,000 − 685,843) will be amortized over five years.

The amortization amount for the July 1 entry would be for four months or $944 ($14,157 ÷ 5 years × 4 ÷ 12). After that, the amortization will be for every six months or $1,416 ($14,157 ÷ 5 × 6 ÷ 12).

AC Impairment

For IFRS companies, the process to evaluate and measure impairments was already discussed in FVOCI debt (with recycling). The accounting treatment for impairments (IFRS) is the same for both FVOCI debt with recycling and AC.

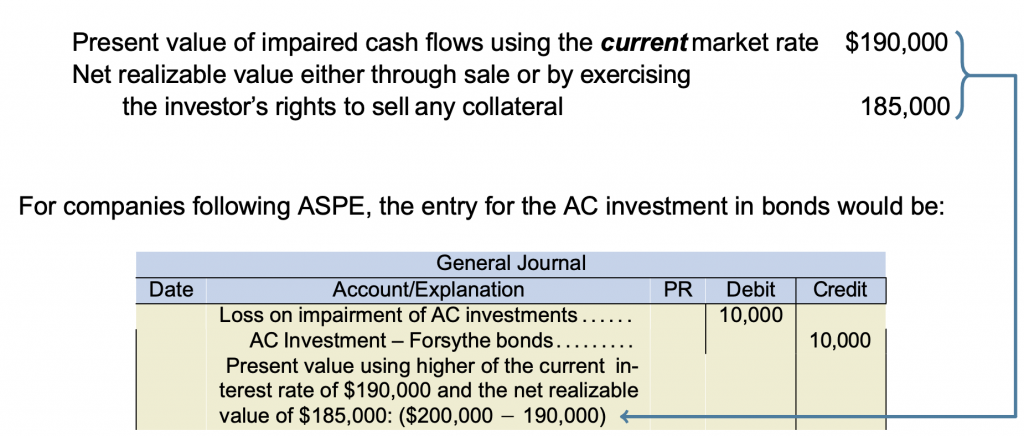

This section will now discuss impairment for ASPE companies with AC investments.

Since AC investments are measured at amortized cost for bonds and cost for shares, there is always the possibility of an impairment loss since fair values are not used. For this reason, investments should be assessed at the end of each reporting period to see if there has been a loss event. Investment assets should be evaluated on both an individual investment and portfolio (grouped) investment basis to minimize any possibilities of hidden impairments within a portfolio of investments with similar risks. Below are details regarding how impairments for AC investments are measured:

ASPE—reduce the investment carrying value to the higher of:

- the present value of impaired future cash flows using the current market interest rate and

- the net realizable value either through sale or by exercising the entity’s rights to sell any collateral.

The loss is reported in net income and the investment (or an asset valuation allowance) is reduced accordingly. These impairments may be reversed.

For example, assume that Vairon Ltd. purchased an investment in Forsythe Ltd. bonds for $200,000 at par value on January 1 and intends to hold them until maturity. The bonds pay interest on December 31 of each year. At year-end, Forsythe experiences cash flow problems that are considered by the investor as a loss event that triggers an impairment evaluation. The following cash flows are identified:

Changes in Classifications

Changes in management’s intention to sell or hold to maturity can result in a change in classification. However, earlier in this chapter some significant impacts in net income and investment asset values were illustrated between FVNI, FVOCI, and AC methods. It is easy to see how this might lead to manipulation of net income or asset values by management. To minimize this possibility, for ASPE, no reclassification is permitted unless there’s a change in the company’s business model, which happens very rarely. For IFRS, there is the fair value option discussed earlier for FVOCI equities, which is irrevocable.

- $521,326 is the present value of the bond’s future cash flows. Since the bond interest is being paid twice per year, the number of payments is 10 payments (5 years × 2 payments per year) until the bond matures. The market interest rate is 6% or 3% for each semi-annual interest payment. At maturity, $500,000 principal amount of the bond is payable to the bondholder/investor. The present value can be calculated using a financial calculator as follows: PV = 17,500 P/A, 3 I/Y, 10 N, 500,000 FV). For a review of present value techniques, refer to Chapter 6: Cash and Receivables. ↵

- FVNI ($150,000 + 210,000 + 15,000 − 5,000); FVOCI ($151,250 + 210,000 + 13,750 − 5,000) ↵

- AOCI ($13,750 - 5,000) ↵

- FVNI ($370,000 - 82,500 + 1,000 − 17,500); FVOCI ($370,000 - 82,500 + 1,000 − 17,500) ↵

- AOCI ($8,750 + 350 − 7,050 + 1,000 − 17,500) ↵

- ($1,000 + 350 − 17,500) ↵