11.3 Goodwill

11.3.1 Initial Recognition and Measurement

Goodwill arises when one company purchases another business and pays more than the fair value of its net identifiable assets (total identifiable assets – identifiable liabilities). Goodwill can not be arbitrarily assigned internally, it should be purchased.

This excess amount of consideration paid by the purchaser is classified as goodwill. As discussed at the beginning of this chapter, since goodwill is not a separately identifiable asset and has no contractual or other legally enforceable rights, it does not meet the definition of an intangible asset. It is therefore classified separately as goodwill on the SFP/BS. Also, a third-party purchase is the only circumstance where goodwill can be recognized. This is due to the complexities of recognizing and measuring internally generated goodwill, which lacks any arm’s-length third-party associations.

All the identifiable assets and identifiable liabilities received are initially recorded by the purchaser at their fair values at the date of purchase. The difference between the sum of the fair values and the purchase price (or the fair value of any consideration given up) is classified and recorded as goodwill. Consideration can be cash or other assets, notes payable, shares, or other equity instruments.

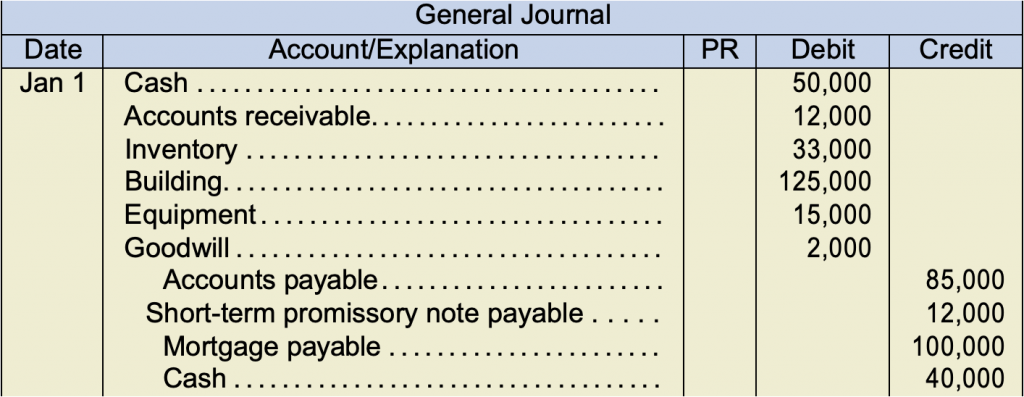

For example, on January 1, Otis Equipment Ltd. purchases the net identifiable assets of Waverly Corp. for $40M cash and a short-term promissory note for $12M. Waverly’s unclassified year-end balance sheet as at December 31 is shown below.

| Waverly Corp Balance Sheet December 31, 2019 (in $000s) |

|||

|---|---|---|---|

| Assets | Liabilities and shareholders’ equity | ||

| Cash | $50,000 | Accounts payable | $85,000 |

| Accounts receivable (net) | 15,000 | Mortgage payable due Dec 31, 2029 | 100,000 |

| Inventory | 35,000 | Share capital | 40,000 |

| Building (net) | 100,000 | Retained earnings | 5,000 |

| Equipment (net) | 25,000 | ||

| Patent (net) | 5,000 | ||

| Total assets | $230,000 | Total liabilities and equity | $230,000 |

To determine the amount of consideration (cash and short-term promissory note) to offer Waverly, Otis completed a detailed fair value analysis of the net identifiable assets, as shown below.

| Fair Values December 31, 2019 (in $000s) | |

|---|---|

| Cash | $50,000 |

| Accounts receivable | 12,000 |

| Inventory | 33,000 |

| Building | 125,000 |

| Equipment | 15,000 |

| Patent | 0 |

| Accounts payable | (85,000) |

| Mortgage payable, due Dec 31, 2029 | (100,000) |

| Total fair value of net identifiable assets | $50,000 |

Differences between fair values and the carrying values of the net identifiable assets are common. For example, the accounts receivable may be adjusted because the bad debt estimate was not sufficient. Inventory may be adjusted due to obsolescence or due to a recent decline in prices from the supplier. Long-term assets values for property, plant, and equipment are usually determined either by independent appraisals or from published pricing guides such as those used for vehicles. Vehicles will lose value as they age, but land and buildings can appreciate over time. The patent may have been assessed a zero value because it was almost fully amortized and was due to expire the next year. Fair values for current liabilities such as accounts payable are usually the same as their book values. Long-term liabilities may require adjustments if interest rates have significantly changed.

The total consideration given up by Otis is $52M combined cash and short-term promissory note compared to the fair value of the net identifiable assets of $50M. The $2M difference will be classified as goodwill. As previously stated, goodwill is not an identifiable asset on its own but simply that portion of the purchase price not specifically accounted for by the net identifiable assets. In other words, goodwill represents the future economic benefits arising from other assets acquired in the business acquisition that cannot be identified separately.

To summarize. Goodwill is the excess paid over the net assets of another company. Remember that the net assets are equal to assets minus liabilities. Any amount paid over the net assets is considered to be goodwill. Goodwill can only be purchased, it cannot be created within a company.

Note that a bargain purchase will result in negative goodwill. This arises when a purchaser pays LESS than the fair value of the net assets. Negative goodwill, for the purchaser should be shown as a gain in net income.

Otis would make a journal entry as shown below.

Any transaction costs incurred by Otis associated with the purchase would be expensed as incurred.

Any transaction costs incurred by Otis associated with the purchase would be expensed as incurred.

There are many reasons why Otis was willing to pay an additional $2M to purchase Waverly. Waverly may possess a top credit rating with its creditors, an excellent reputation for quality products and service, a highly competent management team, or highly skilled employees. These factors will positively affect the total future earning power and hence the value of the business entity.

If Waverly accepted an offer from Otis of $49M and the fair values of the net identifiable assets of $50M were re-examined and considered accurate, then the $1M difference would be recorded by Otis as a gain (credit) from the acquisition of assets in net income. This is referred to as a bargain purchase.

11.3.2 Subsequent Measurement of Goodwill (Impairment only)

Once purchased, goodwill is deemed to have an indefinite life and not amortized, but it is evaluated for impairment. Under IFRS, this is done annually and whenever there is an indication that impairment exists. For ASPE this is done whenever circumstances indicate that an impairment exists.

Goodwill in not an identifiable asset and cannot generate cash flows independently from other assets. Since goodwill is not a separately identifiable asset, it is allocated to reporting (ASPE) or cash generating units (CGUs; IFRS) expected to benefit from the business acquisition on the acquisition date. Goodwill is NEVER amortized (or depreciated). Goodwill is only tested for impairment.

Impairment for goodwill is very similar as impairment to tangible and intangible assets. There are some notable and slight differences.

For ASPE, after testing and adjusting the individual assets of the CGU as required, impairment is then applied to the whole reporting unit the same as for intangible assets with an indefinite life. If the carrying value of the reporting unit is greater than its fair value, this difference is the impairment amount. With ASPE, goodwill should be tested for impairment when events or circumstances indicate impairment may exist.

For IFRS, if the carrying value of the CGU is greater than the recoverable amount (which is the higher of the CGU’s value in use or fair value less costs to sell) then this difference is the impairment amount. Impairment is allocated first to goodwill (accumulated impairment losses, goodwill account), with any further excess allocated to the remaining assets’ carrying values in the CGU on a proportional basis. With IFRS, goodwill should be tested for impairment annually and when events or circumstances indicate impairment may exist.

Important – Goodwill impairment reversals are not permitted for ASPE or IFRS.

For example, assume that Calter Ltd. purchased Turnton Inc. and identified it as a reporting unit (CGU). The goodwill amount that was recorded at acquisition was $40,000 and the carrying amount of the whole unit, including goodwill was $360,000. One year later, due to an economic downturn in that industry sector, management is assessing whether the unit has incurred an impairment of its net identifiable assets. The fair value of the unit was evaluated to be $330,000. The direct costs to sell would be $9,300 and the unit’s value in use is $340,000.

Under ASPE:

After testing and adjusting the individual assets within the unit, the whole unit was evaluated at a fair value of $330,000 as stated in the scenario above.

Carrying amount of whole unit, including goodwill

Fair value of the unit

Goodwill impairment loss

$360,000

330,000

$30,000

Carrying amount of whole unit, including goodwill

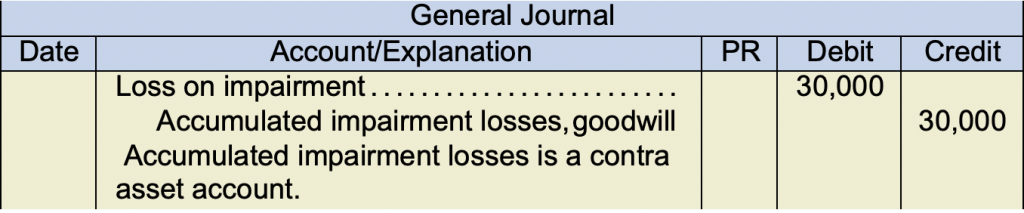

The entry to record the loss is shown below.

The net carrying value for goodwill will be $10,000 ($40,000 − 30,000). Since individual asset testing and adjustments within the unit was done prior to the evaluation of the whole unit, the impairment amount would not exceed goodwill.

Under IFRS:

Carrying amount of CGU as a unit, including goodwill

Recoverable amount of unit

(Higher of value in use of $340,000

and fair value less costs to sell

330,000 − 9,300 = $320,700)

Goodwill impairment loss

$360,000

340,000

$20,000

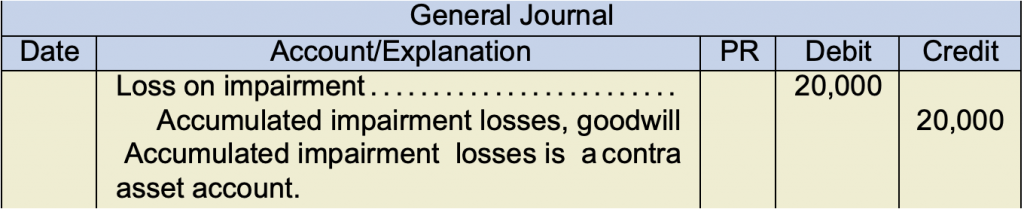

Entry to record the loss is shown below.

The net carrying value for goodwill after the impairment is $20,000 ($40,000 − 20,000). Had the impairment amount exceeded the $40,000 goodwill carrying value, the amount of the difference would be allocated to the remaining net identifiable assets on a prorated basis, since there had been no impairment testing of individual assets as was done for ASPE above.

Remember, goodwill is only tested for impairment. Goodwill is not amortized and goodwill reversals of impairment is not allowed.