8.1 Intercorporate Investments: Overview

There are many reasons why companies invest in bonds (debt), shares (equity), and securities of other companies. It is well-known that banks, insurance companies, and other financial institutions hold large portfolios of investments (financed by deposits and fees their customers paid to the banks) to increase their interest income. But it may also be the best way for companies in non-financial industry sectors to utilize excess cash and to strengthen relationships with other companies. If the investments can earn a higher return compared to idle cash sitting in a bank account, then it may be in a company’s best interests to invest. The returns from these investments will be in the form of interest income, dividend income, or an appreciation in the value of the investment itself, such as the market price of a share.

In some cases, investments are a part of a portfolio of actively managed short-term investments undertaken in the normal course of business, to offset other financial risks such as foreign exchange fluctuations. Other portfolios may be for longer-term investments such as bonds that will increase the company’s interest income. These are examples of non-strategic investments where the prime reason for investing is to increase company income using cash not required for normal business operations.

Alternatively, companies may undertake strategic investments where the prime reason is to enhance a company’s operations. If the percentage of voting shares held as an investment is large enough, the investing company can exercise its right to influence or control the investee company’s investing, financing and operating decisions. Strategies to purchase shares of a manufacturer, wholesaler, or customer company can strengthen those relationships, perhaps to guarantee a source of raw materials or increase market share for sales. In some cases, it can be part of a strategy to take over a competitor because it would enhance business operations and profits to do so. Intercorporate investments do have risks as the opening story explains. Hewlett Packard’s acquisition of a controlling interest in the voting shares of Autonomy Corp. is an example of where a strategic investment, which was to improve HP’s operations and profit, does not always work out as originally intended.

The many different reasons why companies invest in other companies creates significant accounting and disclosure challenges for standard setters. For example, how are investments to be classified and reported in order to provide relevant information about the investments to the stakeholders? What is the best measurement—cost or fair value? How should investments be reported if the investment’s value were to suddenly decline in the market place? Are there differences in the accounting treatments and reporting requirements between IFRS and ASPE? These are all relevant accounting issues that will be examined in this chapter.

Companies may hold investments for many reasons, including:

- to have the capital appreciate

- to earn dividends, interest or other income

What are Investments?

Investments are financial assets. Chapter 6: Cash and Receivables, defines financial assets as those that have contractual rights to receive cash or other financial assets from another party. Examples of intercorporate investments include the purchase of another company’s debt instruments (such as bonds or convertible debt) or equity instruments (such as common shares, preferred shares, options, rights, and warrants). The company purchasing the investment (investor) will report these purchases as investment assets, while the company whose bonds or shares were purchased (investee) will report these as liabilities or equity respectively. For this reason, intercorporate investments are financial instruments because the financial asset reported by one company gives rise to a financial liability or equity instrument in another company.

Initial Measurement

The initial measurement for investments is relatively straightforward. All investments are initially measured at fair value which is the acquisition price that would normally be agreed to between unrelated parties. Any transaction costs such as fees and commissions are either expensed or included in the investment asset except valuation which will be explained later in the chapter.

Subsequent Measurement

There is no single subsequent measurement for all investments for IFRS and ASPE. Below is a summary of the various classification alternatives for the two current standards for IFRS 9 and ASPE.

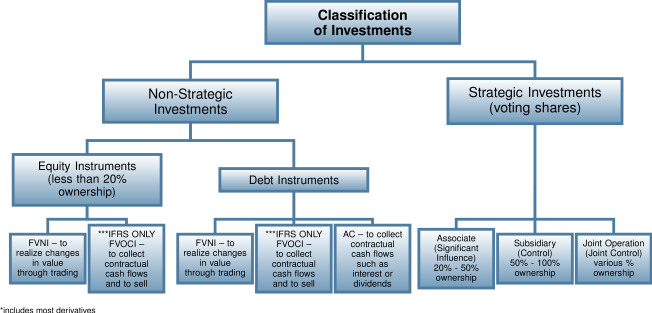

As stated above, investments can either be a strategic acquisition of voting shares of an- other company in order to influence the investee company’s operating, investing, financing decisions, or a non-strategic financing decision in order to earn a return on otherwise idle or under-utilized cash. Within these two broad categories are six classifications: fair value through net income (FVNI), fair value through OCI (FVOCI), amortized cost (AC), significant influence, subsidiary, and joint arrangement.

Both IFRS and ASPE identify some percentage of ownership reference points as guide- lines to help determine in which category to classify an investment. For example, any investment in shares where the ownership is less than 20% would be considered a non-strategic investment. It is highly unlikely that this level of ownership would result in having any influence on a company’s decisions or operations. These investments are acquired mainly for the investment return of interest income, dividend income, and capital appreciation resulting from a change in fair values of the investment itself, depending on the company’s investment business model. For share purchases of between 20% and 50%, the investor will more likely have a significant influence over the investee company as previously explained. These percentages are not cast in stone. Classifications of investments do not always have to adhere to these ranges where it can be shown that another classification is a better measure of the true economic substance of the investment. For example, an investment of 30% of the shares of a company may not have any significant influence if the remaining 70% is held by very few other investors who are tightly connected together. The circumstances for each investment must be considered when determining the classification of an investment purchase.

A share investment of 50% or greater will result in the investor having control over the company’s decisions and policies because the majority of the shares are held by the investing company. The investee company will be regarded as a subsidiary of the investor company. This was the case in the cover story where Hewlett Packard purchased the majority of the outstanding shares of Autonomy Corporation in order to enhance HP’s operations.

Classifications and Accounting Treatments

Below is a classification summary for IFRS 9 and ASPE (Sec. 3856). Note the differences between the accounting standards. ASPE has two classifications for its non-strategic investments and IFRS has three classifications. The table below summarizes the classification criteria for ASPE and IFRS:

| ASPE | IFRS | |||

|---|---|---|---|---|

| Classification basis | Type of investment as either debt or equity, and if there is an active market | Management intent and investment business model is to hold and collect interest and dividends only, or to also sell/trade in order to realize changes in value of the investment | ||

| Description | Classification | Description | Classification | |

| Non-strategic Investments | ||||

| Short-term trading Investments: equities trading in an active market | Fair value through net income (FVNI) | Equities, debt or non-hedged derivatives (i.e., options, warrants) where intent is to sell/trade to realize changes in value of the investment | Fair value through net income (FVNI) | |

| Equities[1] and debt where intent is to collect cash flows of interest or dividends, AND to sell, to realize changes in value of the investment. | Fair value through Other Comprehensive Income (FVOCI) with recycling (debt) or no recycling (equities) | |||

| All other equities and debt | Equities at cost and debt at amortized cost (AC) | Debt where intent is to collect contractual cash flows of principal and interest and to hold investment until maturity. | Amortized cost (AC) | |

| Strategic Investments – must be voting shares | ||||

| Significant Influence: equities | Choice of equity method, cost or fair value through net income if active market exists | Associate: equities acquired to influence company decisions | Equity method | |

| Subsidiary: equities | Choice of consolidation equity, cost, or quoted amount if active market exists | Control: equities acquired for control of company | Consolidation | |

| Joint Arrangement: equities | Proportionate consolidation, equity, or cost depending upon the nature of the joint arrangement and arrangement terms | Joint Arrangement: equities | Proportionate consolidation or equity depending upon the nature of the joint arrangement and arrangement terms | |

Under IFRS 9, investments are divided into separate portfolios according to the way they are managed. For non-strategic investments these classifications are based on “held to collect solely principal and interest cash flows (AC)”, “held to collect solely principal and interest cash flows AND to sell (FVOCI)”, and “all else (FVNI)”. That is not to say that investments classified as AC can never be sold, but sales in this classification would be incidental and made in response to some sort of change in the investment, such as an increase in investment risk. FVOCI considers that sales are an integral part of portfolio management where active buying and selling are typical activities in order to collect cash flows while investing is held, AND to realize increases in fair values through selling. Both ASPE and IFRS allows companies to classify an investment as FVNI only at acquisition. For IFRS this FVNI election is only to eliminate or significantly reduce an accounting mismatch arising from a measurement or recognition inconsistency for investments that would otherwise be classified as AC or FVOCI.

Differences in the ASPE standard, such as the choice of either straight-line or effective interest rate methods or impairment evaluation and measurement of certain investments, will be separately identified throughout the chapter. Companies that follow IFRS can choose to record interest, dividends, and fair value adjustments to a single “investment income or loss” account or they can keep these separated in their own accounts. ASPE requires that interest, dividends, and fair value adjustments each be reported separately. Since IFRS companies still need to know the interest expense from any dividends received for tax purposes, this chapter separates interest and dividends for both IFRS and ASPE companies, as this is appropriate for both standards and for simplicity and consistency.

In section 8.2 Non-Strategic Investments are the classification categories with details about how they are measured and reported.

- Equities is a special irrevocable election only. ↵