4.3 Statement of Cash Flows (SCF)

The last core final financial statement to discuss is the statement of cash flows. The purpose of this statement is to provide a means to assess the enterprise’s capacity to generate cash and to enable stakeholders to compare cash flows of different entities (CPA Canada, 2016). This statement is an integral part of the financial statements for two reasons. First, this statement helps readers to understand where these cash flows in (out) originated during the current year, to assess a company’s liquidity, solvency, and financial flexibility. Second, these historic cash flows in (out) can be used to predict future company performance.

The statement of cash flows can be prepared using two methods: the direct method and the indirect method. Both methods organize cash flows into three activities: operating, investing, and financing activities. The direct method reports cash flows from operating activities into categories such as cash from customers, cash to suppliers, and cash to employees. The indirect method reports cash flows from operating activities starting with net income/loss adjusted for any non-cash items, followed by the changes in each of the working capital accounts (i.e., current assets and current liabilities accounts). The total cash flows from the operating activities are the same for both methods. The investing and financing activities are prepared the same way under both methods.

This course will explain how to prepare the statement of cash flows using the indirect method. The direct method will be discussed in a subsequent intermediate accounting course.

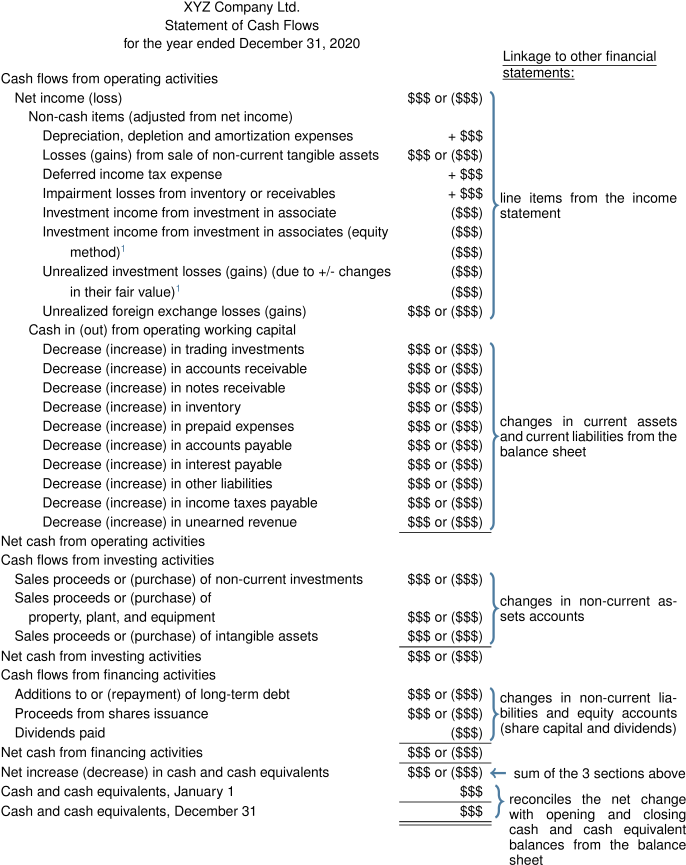

The summarized statement of cash flows:

Statement of cash flows

Cash flows provided by (used in) operating activities $$$

Cash flows provided by (used in) investing activities $$$

Cash flows provided by (used in) financing activities $$$

Net increase (decrease) in cash $$$

Cash at beginning of period $$$

Cash at end of period $$$

When you are required to prepare the statement of cash flow, you know what the answer will be before you begin to prepare the statement since the statement of cash reconciles the change in cash from period to period.

Cash receipts and cash payments during a period are classified in the statement of cash flows into three different activities:

- Operating activities are the day-to-day activities of the enterprise. These items would include changes in current assets and current liabilities as well as referencing the income statement.

- Investing activities are changes in long-term assets. These items would include the purchase or disposal long-term assets (property, plant and equipment) and some long-term investments. Note that you should only include the cash used for the purchase, not any amount financed or purchased through issuance of shares (should be disclosed though). Also when an asset is sold, the cash proceeds received should be included.

- Financing activities are changes in long-term debt and equity. These items would include the payment or receipt of long-term debt as well as selling shares (preferred or common) and the payment of dividends.

Below is a detailed statement of cash flows that illustrates the overall format and its connections with the income statement and SFP/BS.

Note that interest and dividends paid can also be reported in the operating activities section.

Note that interest and dividends paid can also be reported in the operating activities section.

For the indirect method, the sum of the non-cash adjustments and changes to current assets and liabilities represents the total cash flow in (out) from operating activities. Any non-cash transactions relating to the investing or financing activities are excluded from the SCF but are disclosed in the notes. An example would be an exchange of property, plant, or equipment for common shares or a long-term note payable. The final section of the statement reconciles the net change from the three sections with the opening and closing cash and cash equivalents balances.

4.3.1. Preparing a Statement of Cash Flows

Companies can prepare the statement of cash flow using the direct and the indirect method. In this course, the focus is the INDIRECT METHOD. However, it is worth noting that only the operating activities differ between the two methods. In order to prepare the statement of cash flow, you should have access to the balance sheet, income statement and other important detailed financial information relating to the sale or purchase of assets, issuing of shares and declaration of dividends, among other selected financial information.

The following is a detailed example of the preparation of the statement of cash flows.

Presented below is the SFP/BS and income statement for Watson Ltd.

| Watson Ltd. Balance Sheet As at December 31, 2020 |

||

|---|---|---|

| 2020 | 2019 | |

| Assets | ||

| Current assets | ||

| Cash | $307,500 | $250,000 |

| Investments (trading, at fair value through net income) | 12,000 | 10,000 |

| Accounts receivable (net) | 249,510 | 165,000 |

| Notes receivable | 18,450 | 22,000 |

| Inventory (at lower of FIFO cost and NRV) | 708,970 | 650,000 |

| Prepaid insurance expenses | 18,450 | 15,000 |

| Total current assets | 1,314,880 | 1,112,000 |

| Long term investments (at amortized cost) | 30,750 | 0 |

| Property, plant, and equipment | ||

| Land | 92,250 | 92,250 |

| Building (net) | 232,000 | 325,000 |

| 324,250 | 417,250 | |

| Intangible assets (net) | 110,700 | 125,000 |

| Total assets | $1,780,580 | $1,654,250 |

| Liabilities and Shareholders’ Equity | ||

| Current liabilities | ||

| Accounts payable | $221,000 | $78,000 |

| Accrued interest payable | 24,600 | 33,000 |

| Income taxes payable | 54,120 | 60,000 |

| Unearned revenue | 25,000 | 225,000 |

| Current portion of long-term notes payable | 60,000 | 45,000 |

| Total current liabilities | 384,720 | 441,000 |

| Long-term notes payable (due June 30, 2025) | 246,000 | 280,000 |

| Total liabilities | 630,720 | 721,000 |

| Shareholders’ equity | ||

| Paid in capital | ||

| Preferred, ($2, cumulative, participating – authorized issued and outstanding, 15,000 shares) | 184,500 | 184,500 |

| Common (authorized, 400,000 shares; issued and outstanding (2020: 250,000 shares); (2019: 200,000 shares) | 862,500 | 680,300 |

| Contributed surplus | 18,450 | 18,450 |

| 1,065,450 | 883,250 | |

| Retained earnings | 84,410 | 50,000 |

| 1,149,860 | 933,250 | |

| Total liabilities and shareholders’ equity | $1,780,580 | $1,654,250 |

| Watson Ltd. Income Statement For the Year Ended December 31, 2020 |

|

|---|---|

| Sales | $3,500,000 |

| Cost of goods sold | 2,100,000 |

| Gross profit | 1,400,000 |

| Operating expenses | |

| Salaries and benefits expense | 800,000 |

| Depreciation expense | 43,000 |

| Travel and entertainment expense | 134,000 |

| Advertising expense | 35,000 |

| Freight-out expenses | 50,000 |

| 12,000 | |

| Telephone and internet expense | 125,000 |

| Legal and professional expenses | 48,000 |

| Insurance expense | 50,000 |

| 1,297,000 | |

| Income from operations | 103,000 |

| Other revenue and expenses | |

| Dividend income | 3,000 |

| Interest income from investments | 2,000 |

| Gain from sale of building | 5,000 |

| Interest expense | (3,000) |

| 7,000 | |

| Income from continuing operations before income tax | 110,000 |

| Income tax expense | 33,000 |

| Net income | $77,000 |

Additional information:

- The trading investment does not meet the criteria to be classified as a cash equivalent and no purchases or sales took place in the current year.

- An examination of the intangible assets sub-ledger revealed that a patent had been sold in the current year. The intangible assets have an indefinite life.

- No long-term investments were sold during the year.

- No buildings or patents were purchased during the year.

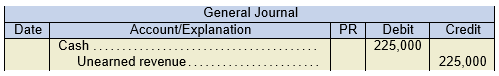

- Most of the unearned revenues occurred on December 31, 2019.

- There were no other additions to the long-term note payable during the year.

- Common shares were sold for cash. No other transactions occurred during the year.

- Cash dividends were declared and paid.

The statement of cash flows can be challenging to prepare. This is because preparing the entries requires analyses of the accounts as well as an understanding of the types of transactions that affect each account. Preparing a statement of cash flows is made much easier if specific steps in a sequence are followed. Below is a summary of those steps.

- Complete the statement headings.

- Record the net income/loss in the operating activities section.

- Adjust for any non-cash line items reported in the income statement to restate net income/loss from an accrual to a cash basis (i.e., depreciation expense, amortization expense and any non-cash gains or losses).

- Record the description and change amount as cash inflows or outflows for each current asset and current liability (working capital accounts) except for the “current portion of long-term debt” line item, since it is not a working capital account. Subtotal the operating activities section.

- In the investment activities section, using T-accounts or other techniques, determine the change for each non-current (long-term) asset account. Analyze and determine the reasons for the change. Record a description and the change amount(s) as cash inflows or outflows.

- In the financing activities section, add back to long-term debt any current portion identified in the SFP/BS for both years, if any. Using T-accounts or other techniques, determine the change for each non-current liability and equity account. Analyze and determine the reason for the change(s). Record a description and the change amount(s) as cash inflows or outflows.

- Subtotal the three sections and record as the net change in cash. Record the opening and closing cash and cash equivalents balances. Sum the opening balance, the new change in cash subtotal, and the closing balance. This should to reconcile with the ending cash and cash equivalent balances from the SFP/BS.

- Complete any required disclosures.

![]() We can summarize the steps above into a few key words and phrases to remember as follows:

We can summarize the steps above into a few key words and phrases to remember as follows:

- Headings

- Record net income/(loss)

- Adjust out non-cash income statement items

- Current assets and current liabilities changes

- Non-current asset accounts changes

- Non-current (long-term) liabilities and equity accounts changes

- Subtotal and reconcile

- Disclosures

Applying the Steps:

Step One: Headings

| Watson Ltd. Statement of Cash Flows For the Year Ended December 31, 2020 |

| Cash flows from operating activities

Net income (loss) Non-cash items (adjusted from net income): |

| Net cash from operating activities

Cash flows from investing activities |

| Net cash from investing activities

Cash flows from financing activities |

| Net cash from financing activities

Net increase (decrease) in cash Cash, January 1 Cash, December 31 |

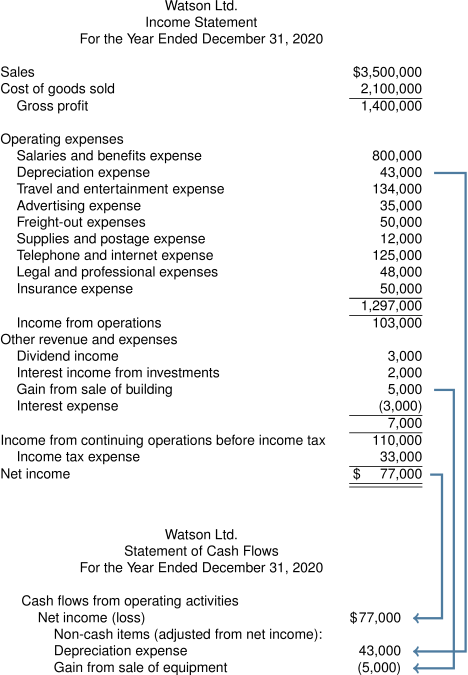

Step Two: Record net income/(loss)

Illustrated in Step 3 below

Step Three: Adjustments

Enter the amount of the net income/(loss) as the first amount in the operating activities section. Next, review the income statement and select the non-cash items. Look for items such as depreciation, depletion, amortization, and gain/loss on sale/disposal of assets. In this case, there are two non-cash items to adjust. Record them as adjustments to net income in the statement of cash flows.

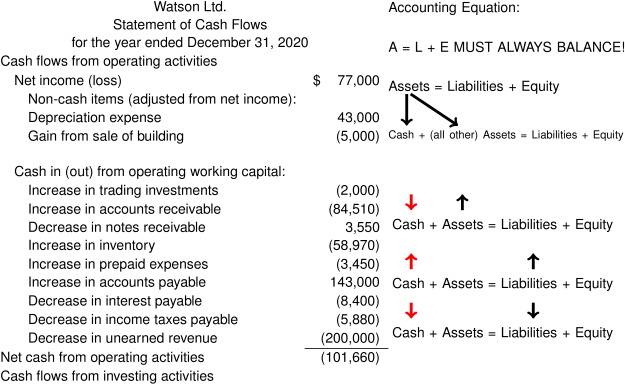

Step 4: Current assets and liabilities

Calculate and record the change for each current asset and current liability (except the current portion of long-term notes payable, which is to be included with its corresponding long-term notes payable account) as shown in the financing activities section below:

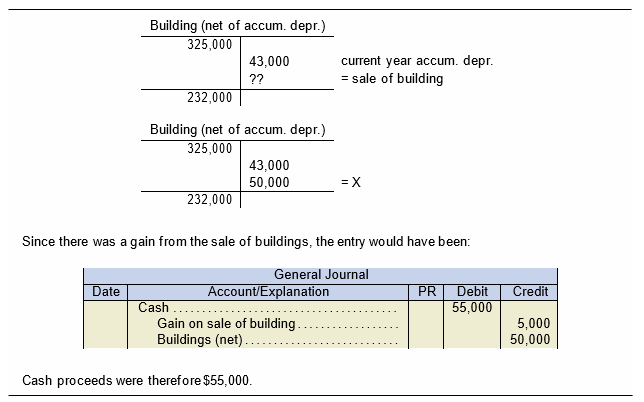

Cash inflows are reported as positive numbers, while cash outflows are reported as negative numbers. To determine if the amount is a positive or negative number, a simple method is to use the accounting equation to determine whether cash is increasing as a positive number or decreasing as a negative number.

Cash inflows are reported as positive numbers, while cash outflows are reported as negative numbers. To determine if the amount is a positive or negative number, a simple method is to use the accounting equation to determine whether cash is increasing as a positive number or decreasing as a negative number.

Recall that the accounting equation, Assets = Liabilities + Equity, must always remain in balance. This concept can be applied when analyzing the various accounts and recording the changes. For example, accounts receivable has increased from $165,000 to $249,510 for a total change of $84,510. Using the accounting equation, this can be expressed as:

Expanding the A = L + E equation a bit:

Cash + accounts receivable + all other assets = Liabilities + Equity.

If accounts receivable increases by $84,510, this can be expressed as a black up-arrow above the account in the equation:![]() If accounts receivable increases, its effect on the cash account must be a corresponding decrease to keep the equation balanced:

If accounts receivable increases, its effect on the cash account must be a corresponding decrease to keep the equation balanced:![]() If cash decreases, it is a cash outflow, and the number must be negative (bracketed) as shown in the statement above.The same technique can be used when analyzing liability or equity accounts. For example, an increase in account payable (liability) of $143,000 will affect the equation as follows:

If cash decreases, it is a cash outflow, and the number must be negative (bracketed) as shown in the statement above.The same technique can be used when analyzing liability or equity accounts. For example, an increase in account payable (liability) of $143,000 will affect the equation as follows:![]()

If accounts payable increases, cash must also increase by a corresponding amount in order to keep the equation in balance.![]() If cash increases, it is a cash inflow and the number must be positive (no brackets) as shown in the statement above.

If cash increases, it is a cash inflow and the number must be positive (no brackets) as shown in the statement above.

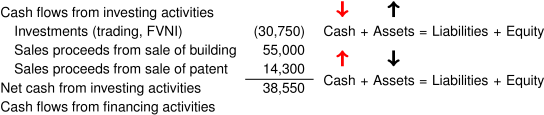

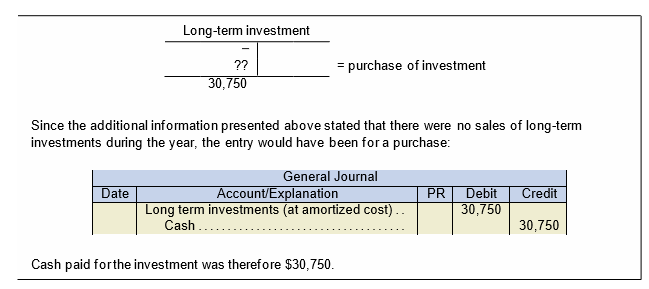

Step Five: Non-current asset changes

The next section is the investing activities section. The analysis of all the non-current asset accounts must also take into account whether there have been any current year purchases or disposals/sales (or both) as part of the analysis. The use of T-accounts for this type of analysis provides a useful visual tool to help understand the changes that occurred in the account.

Analysis of the buildings account is a bit more complex because of the effects of the contra account for accumulated depreciation. In this case, the building account and its contra account must be merged since the SFP/BS reports only the net carrying amount. Analyzing the buildings account results in the following cash flows:

The sale of the patent is straightforward since there were no other sales or purchases in the current year.

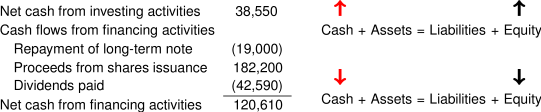

Step Six: Non-current liabilities and equity changes

There are five long-term liability and equity accounts: long-term notes payable, preferred shares, common shares, contributed surplus, and retained earnings. The preferred shares and contributed surplus accounts had no changes to report. Analyzing the long-term note payable account results in the following cash flows:

| Long-term note payable | ||

|---|---|---|

| 280,000 | ||

| 45,000 | ||

| ?? | = repayment | |

| 246,000 | ||

| 60,000 | ||

Since there were no other transactions stated in the additional information above, the entry would have been:

Cash paid was therefore $19,000.

Note how the current portion of long-term debt has been included in the analysis of the long-term note payable. The current portion line item is a reporting requirement regarding the principal amount owing one year after the reporting date, but it is not actually a working capital account, so it is omitted from the operating section and included with its corresponding long-term liability account in the financing activities section as shown above.

The common shares and retained earnings accounts are straightforward and the analysis of each are shown below.

| Common shares | ||

|---|---|---|

| 680,300 |

= share issuance |

|

| ?? | ||

| 862,500 | ||

Since there were no other transactions stated in the additional information above, the entry would have been:

Cash received was therefore $182,200.

| Retained earnings | ||

|---|---|---|

| 50,000 | ||

| 77,000 | net income = dividends paid | |

| ?? | ||

| 84,410 | ||

The additional information stated that cash dividends were declared and paid, so the entry would have been:

Cash paid was therefore $42,590.

Cash paid was therefore $42,590.

Step Seven: Subtotal and reconcile

The three activities total a net increase in cash of $57,500. When added to the opening cash balance of $250,000, the resulting total of $307,500 is equal to the ending cash balance, December 31, 2020 in the SFP/BS. This can be seen in the completed statement below.

4.3.2. Disclosure Requirements

Step Eight: Required disclosures

Step 8 involves the identification and preparation of disclosures. The statement of cash flows must disclose cash flows associated with interest paid and received, dividends paid and received, and income taxes paid, as well as any non-cash transactions that occurred in the current year. These can be disclosed in the notes or at the bottom of the statement, if not too lengthy. The cash received for dividend income and interest income was taken directly from the income statement since no accrual accounts exist on the SFP/BS for these items. Cash paid for interest charges and income taxes are calculated based on an analysis of their respective liability accounts from the SFP/BS and expense accounts from the income statement. Following is the completed statement of cash flows, including disclosures, for Watson Ltd., for the year ended December 31, 2020:

| Watson Ltd. Statement of Cash Flows For the Year Ended December 31, 2020 |

|

|---|---|

| Cash flows from operating activities | |

| Net income (loss) | $77,000 |

| Non-cash items (adjusted from net income): | |

| Depreciation expense | 43,000 |

| Gain from sale of equipment | (5,000) |

| Cash in (out) from operating working capital: | |

| Increase in trading investments | (2,000) |

| Increase in accounts receivable | (84,510) |

| Decrease in notes receivable | 3,550 |

| Increase in inventory | (58,970) |

| Increase in prepaid expenses | (3,450) |

| Increase in accounts payable | 143,000 |

| Decrease in interest payable | (8,400) |

| Decrease in income taxes payable | (5,880) |

| Decrease in unearned revenue | (200,000) |

| Net cash from operating activities | (101,660) |

| Cash flows from investing activities | |

| Purchase of AC investments | (30,750) |

| Sales proceeds from sale of building | 55,000 |

| Sales proceeds from sale of patent | 14,300 |

| Net cash from investing activities | 38,550 |

| Cash flows from financing activities | |

| Repayment of long-term note | (19,000) |

| Proceeds from shares issuance | 182,200 |

| Dividends paid | (42,590) |

| Net cash from financing activities | 120,610 |

| Net increase (decrease) in cash | 57,500 |

| Cash, January 1 | 250,000 |

| Cash, December 31 | 307,500 |

Disclosures:

Cash paid for income taxes

(60,000 + 33,000 − 54,120)

Cash paid for interest charges

(33,000 + 3,000 − 24,600)

Cash received for interest income

Cash received for dividend income

$38,880

11,400

2,000

3,000

[There were no non-cash transactions to disclose.]

4.3.3 Interpreting the Statement of Cash Flows

The cash balance shows an increase of $57,500 from the previous year. Without looking deeper into the reasons why, a hasty conclusion could be drawn that all is well with Watson Ltd. However, there is trouble ahead for this company. For example, the operating activities section, which represents the reason for being in business, is in a negative cash flow position. The profit that a company earns is expected to result in positive cash flows, and this positive cash flow should be reflected in the operating activities section. In this case, it does not, since there is a negative cash flow of $101,660 from operating activities. Why?

For Watson, both the accounts receivable and inventory have increased, resulting in a net decrease in cash of $143,480. An increase in accounts receivable may mean that sales have occurred, but the collections are not keeping pace with the sales on account. An increase in inventory may be because there have not been enough sales in the current year to cycle the inventory from a current asset to sales/profit and ultimately into cash. The risk of holding large amounts of inventory is the increased possibility that inventory will become obsolete or damaged and unsellable.

In this case, an additional reason for decreased net cash from operating activities is due to a decrease in unearned revenue. This is an interesting issue that needs to be explained more fully. Recall that unearned revenue is cash received from customers in advance of earning the revenue. In this case, the cash would have been reported as a positive cash flow in the operating activities section in the previous reporting period when the cash was actually received. At that time, the cash generated from operating activities would have increased by the amount of the cash received for the unearned revenue. The entry upon receipt of the cash would have been:

When the company provides the goods and services to the customer, the net income reported at the top of the operating section will reflect that portion of the unearned revenue that is now earned. However, it did not obtain actual cash for this revenue in this reporting period because the cash was already received in the prior reporting period. Keep in mind that unearned revenue is not normally an obligation that must be paid in cash to the customer. Once the goods and services are provided to the customer, the obligation ceases.

Looking at the investing activities, there was a sale of a building and a purchase of a long-term investment. The sales proceeds from the building may have been partially invested in the investment to make a return on the cash proceeds until it can be used for its intended purpose in the future. Again, more analysis is necessary to confirm whether this is the case. The sale of the patent also generated a positive cash flow. There was no gain on sale of the patent reported in the income statement, so the sales proceeds did not exceed its carrying value at the time it was sold. Hopefully, the patent sale was not the result of a panic sale to raise additional cash.

Looking at the financing activities the majority of cash inflows for this reporting period resulted from the issuance of additional common shares of $182,200. This represents an increase in the share capital of greater than 25%. Increased shares will have a negative impact on the earnings per share and possibly its market price as well, which may send warning signals to investors. The shareholders were also paid dividends of $42,590, but this amount only barely covers the preferred shareholders dividend of $30,000 (15,000 × $2) plus its share of the participating dividend. This leaves very little dividend left over for the common shareholders. At some point, the common shareholders will likely become concerned with receiving so little in dividends, along with the dilution of their shareholdings due to the large issuance of additional shares.

When looking at the opening and closing cash balances for Watson, these seem like sizeable balances, but what matters is where the cash came from and whether those sources are sustainable. The $250,000 opening balance was almost entirely due to the $225,000 unearned revenue received in advance, but this is likely not a sustainable source. The ending cash balance of $307,500 is due to the issuance of additional share capital of $182,200 (possibly a one-time transaction) and an increase in accounts payable of $143,000 that must be paid soon. Consider that during the year, the cash from the unearned revenues was being consumed and the issuance of the additional capital had not yet occurred. It would be no surprise, if cash at the mid-year point was insufficient to cover even the short-term liabilities, hence the increase in accounts payable and ultimately the issuance of additional capital shares.

Watson is currently unable to generate positive cash flows from its operating activities. The unearned revenue of $225,000 at the start of the year added some needed cash early on, but this reserve was depleted by the end of the reporting year. In the meantime, without a significant change in how the company manages its inventory and receivables, Watson may continue to experience a shortage of cash from its operating activities. To compensate, it may continue to sell off assets, issue more shares, or incur more long- term debt to obtain needed cash. In any case, these sources will dry up eventually when investors are no longer willing to invest, creditors are no longer willing to loan cash, and no assets worth selling remain. This current negative cash position from operating activities for Watson Ltd. is unsustainable and must be turned around quickly for the company to remain a going concern.

Not all companies who report profits are financially stable. This is because profits do not translate on a one-to-one basis with cash. Watson reported a $77,000 net income (profit), but it is currently experiencing significant negative cash flows from its operating activities.

If sufficient cash is generated from operating activities, the company will not have to increase its debt, issue shares, or sell off useful assets to pay their bills. For Watson Ltd., it increased its short-term debt (accounts payable), sold off a building, and issued 25% more common shares.

Perhaps Watson’s negative cash flow from operating activities will turn itself around in the next reporting period. This would be the company’s best hope. For other companies who experience positive cash flows from operations, they must also ensure that this is sustainable and can be repeated consistently in the future.