5.5 The Earnings Approach

ASPE uses a different approach to revenue recognition. This approach, often referred to as the earnings approach, focuses on how an entity adds value during the completion of a business transaction. While IFRS focuses on the balance sheet (contract assets and liabilities), ASPE focuses more on the processes the entity undertakes to earn revenue. In this sense, it can be thought of as income statement approach to revenue.

With the earnings approach, revenue is recognized when four conditions are met:

- The seller has transferred the significant risks and rewards of ownership to the buyer

- The seller maintains no continuing managerial involvement or control over the goods

- Reasonable assurance exists regarding the measurement of consideration to be received and the extent to which goods can be returned

- Collection of the consideration is reasonably assured

(CPA Canada Handbook – Accounting, ASPE 3400.04 and .05)

Although conceptually this approach appears quite different from the IFRS five-step approach, the results will often be the same when applying the two methods to the same circumstances. The transfer of risks and rewards of ownership under ASPE will often coincide with the satisfaction of a performance obligation under IFRS. There are, however, some situations where the results will be different under the two approaches.

One area where IFRS and ASPE differ is in the treatment of long-term contracts. ASPE allows for either the percentage-of-completion method or the completed contract method to be used. The choice between methods is based on the accountant’s professional judgment as to which method better relates the revenue to the work accomplished. The completed contract method would usually be used when a company is unable to make reasonable estimates of progress or performance of the contract consists of a single act. Under the completed contract method, no revenues or expenses are recognized until the contract is completed. This means the income statement will not reveal any information about the company’s progress on the contract, as all costs and billings will simply be accumulated in balance sheet accounts. In the year the contract is completed, all revenue and expenses are recognized. Although this method avoids the problem of estimation error, it does not provide useful information in the interim periods before project completion.

Let’s use the same information from the percentage of completion example above:

Salty Dog Marine Services Ltd. commenced a $25 million contract on January 1, Y1, to construct an ocean-going freighter. The company expects the project will take three years to complete. The total estimated costs for the project are $20 million. Assume the following data for the completion of this project:

| Y1 | Y2 | Y3 | |

|---|---|---|---|

| Costs to date | 5,000,000 | 12,000,000 | 20,100,000 |

| Estimated costs to complete project | 15,000,000 | 8,050,000 | |

| Progress billings during the year | 4,500,000 | 7,000,000 | 13,500,000 |

| Cash collected during the year | 4,200,000 | 6,800,000 | 14,000,000 |

There is no need to perform a calculation to determine an amount of revenue to be recognized each year. Unlike the percentage of completion method, with the completed contract method, a company does not recognize any revenue until the contract is complete. Some of the journal entries are similar between the percentage of completion method and the completed contract method. The exception is when the revenue should be recognized.

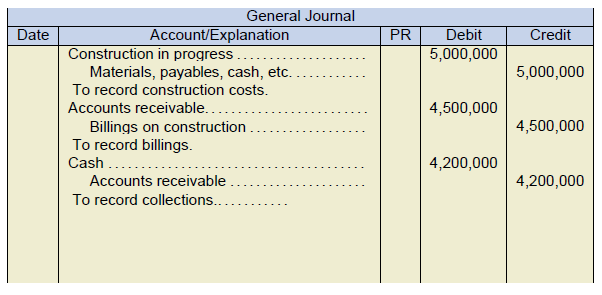

The journal entries to record these transactions in Year 1 (Y1) would look like this:

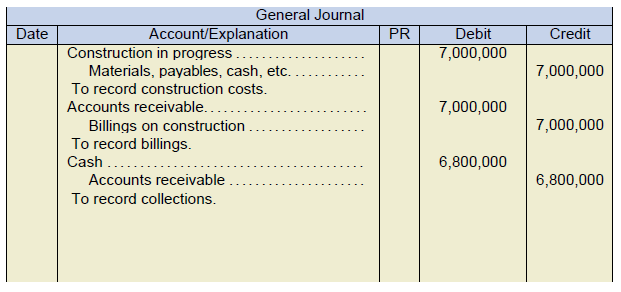

The journal entries to record these transactions in Year 2 (Y2) would look like this:

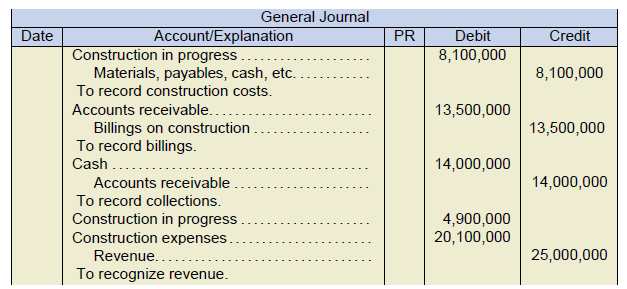

The journal entries to record these transactions in Year 3 (Y3) would look like this:

Note that in Year 3 (Y3), all of the revenue is now recognized. With the completed contract method, we only recognize revenue and profit when the contract is complete.

Accounts receivable you notice has a zero ($0) balance at the end of the contract. That makes sense at the customer should be paying as they work through the project. Note that progress billings are a way to help and manage cash flow. Progress billings do not necessarily correspond to revenue.

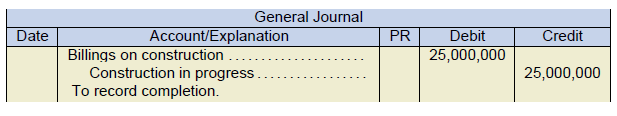

In Year 3 (Y3), once the contract is completed, an additional journal entry is required to close the billings on construction and construction in progress accounts: