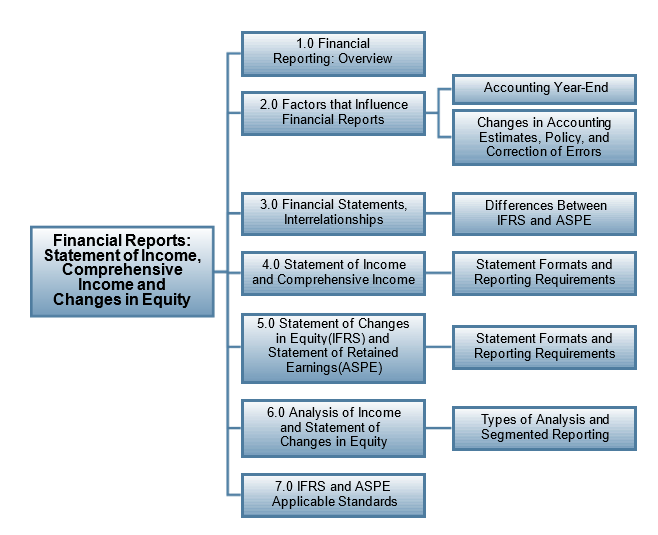

3.0 Financial Reports: Statement of Income, Comprehensive Income and Changes in Equity

Learning Objectives

After completing this chapter, you should be able to:

- Describe the statement of income, the statement of comprehensive income, and the statement of changes in equity and their roles in accounting and business.

- Identify the factors that influence what is reported in the statement of income, statement of comprehensive income, and the statement of changes in equity.

- Explain the factors that influence the choice of accounting year-end.

- Explain how changes in accounting estimates, changes due to correction of accounting errors, and changes in accounting policy affect the income and equity statements.

- Identify the core financial statements and explain how they interconnect together.

- Explain the differences between IFRS and ASPE regarding the income and equity statements.

- Describe the various formats used for the statement of income and the statement of comprehensive income, and identify the various reporting requirements for companies following IFRS and ASPE.

- Describe the various formats used to report the changes in equity for IFRS and ASPE companies, and identify the reporting requirements.

- Identify and describe the techniques used to analyze income and equity statements.

Introduction

Financial reports are the final product of a company’s accounting processes. These reports, combined with thoughtful analysis, are intended to "tell the story" about the company’s operations, its financial performance for the reporting period, and its current financial state (resources and obligations) including its cash position for that period. Is it good news or bad news for management, investors, and creditors who are the company’s stakeholders? Did the company meet its financial goals and objectives for the fiscal year? The answers depend not only on the outcome of the actual operations reported in the financial statements, but also on their accuracy and reliability, as the opening story about Penn West explained. As discussed in Chapter 2, financial statements consist of a set of core reports that identify the company’s resources (assets), claims to those resources (liabilities and investor’s equity), and information about the changes in these resources and claims (performance). A key activity after the financial statements are prepared is to accurately analyze and evaluate the company’s performance and determine if it met its objectives for the reporting period. This chapter will discuss financial statements that report net income, comprehensive income, and changes in equity and their ability to tell the story about the company’s performance for the reporting period.