7.5 Inventory Errors

Given the volume of inventory transactions that occur in a merchandising or manufacturing business and the portable nature of many inventory items, it is inevitable that errors in accounting for those items will occur. It is important to understand how inventory errors affect the reported net income and financial position of the company, as these errors could be material and could affect users’ interpretations of financial results. To understand the effects of inventory errors, it is useful to review the formula for determining the cost of goods sold:

Opening inventory

+ Purchases

= Goods available for sale

− Ending inventory

= Cost of goods

As the ending inventory for one accounting period becomes the opening inventory for the next period, it is easy to see how an inventory error can affect two accounting periods. Let’s look at a few examples to determine the effects of different types of inventory errors.

Example 1

Using our previous company, assume PartsPeople missed counting a box of rotors during the year-end inventory count on December 31, 2019, because the box was hidden in a storage room. Further assume that the cost of these rotors was $7,000 and that the invoice for the purchase was correctly recorded. How would this error have affected the financial statements? If we consider the cost of goods sold formula above, we can see that understating ending inventory would have overstated the cost of goods sold, as the ending inventory is subtracted in the formula.

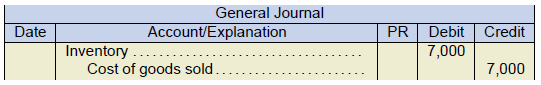

As well, consider the following year. The opening inventory on January 1, 2020, would have also been understated, which would have resulted in an understatement of cost of goods sold for 2020. Thus, over a two-year period, net income would have been understated by $7,000 in 2019 and overstated by $7,000 in 2020. At the end of two years, the error would have corrected itself, and the total income reported for those two years would be correct. However, the allocation of income between the two years was incorrect, and the company’s balance sheet at December 31, 2019, would have been incorrect. This could be significant if, for example, PartsPeople had a bank loan with a covenant condition that required maintenance of certain ratios, such as debt to equity or current ratios. If the error were discovered prior to the closing of the 2019 books, it would have been corrected as follows:

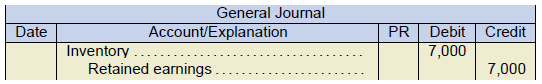

If the error was not discovered until after the 2019 books were closed, it would have been corrected as follows:

After 2020, as noted above, the error would have corrected itself, so no adjustment would be required. However, the 2019 financial statements used for comparative purposes in future years would have to be restated to reflect the correct amounts of inventory and cost of goods sold.

Example 2

Suppose instead that PartsPeople correctly counted its inventory on December 31, 2019, but missed recording an invoice to purchase a $4,000 shipment of brake pads, because the invoice fell behind a desk in the accounting office. Again, using our cost of goods sold formula, we can see that an understatement of purchases will result in an understatement of the cost of goods sold. As the ending inventory balance was counted correctly, one may think that this problem was isolated to this year only.

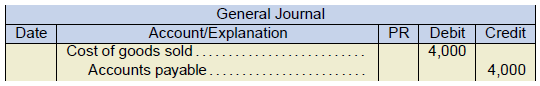

However, in 2020, the vendor may have issued a replacement invoice when they realized PartsPeople hadn’t paid for the shipment. When PartsPeople recorded the invoice in 2020, the purchases for that year would have been overstated, which means the cost of goods sold was also overstated. Again, the error corrected itself over two years, but the allocation of income between the two years was incorrect. If the error was discovered before the books were closed for 2019 (and before a replacement invoice is issued by the vendor), it would have been corrected as follows:

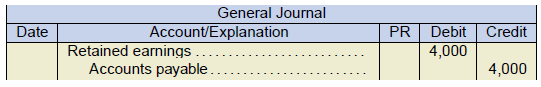

If the error was not discovered until after the 2019 books were closed, it would have been corrected as follows:

Example 3

This time, let’s consider the effect of two errors. Assume PartsPeople sold goods to a customer with terms FOB shipping on December 29, 2019. The company correctly recorded this as a sale on December 29, but due to a data-processing error, the goods, with a cost of $900, were not removed from inventory. Further, assume that a supplier sent a shipment to PartsPeople on December 29, also with the terms FOB shipping, and the cost of these goods was $500. These goods were not received until January 4 of the following year, but due to poor cut-off procedures at PartsPeople, these goods were not included in the year-end inventory balance.

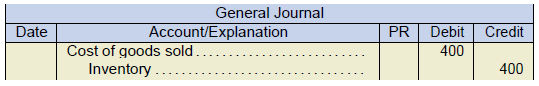

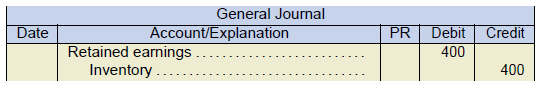

In this situation, we have two different errors that create opposing effects on the income statement and balance sheet. The goods sold to the customer should not have been included in inventory, resulting in an overstatement of year-end inventory. The goods shipped by the supplier should have been included in inventory, resulting in an under- statement of year-end inventory. The net effect of the two errors is a $900 − $500 = $400 overstatement of ending inventory. This will result in an understatement of the cost of goods sold and thus an overstatement of net income. If these errors were discovered before the books were closed in 2019, the entry to correct them would be as follows:

If the errors were not discovered until after the 2019 books were closed, they would have been corrected as follows:

These three illustrations are just a small sample of the many kinds of inventory errors that can occur. In evaluating the effect of inventory errors, it is important to have a clear understanding of the nature of the error and its impact on the cost of goods sold formula. It is also important to consider the effect of the error on subsequent years. Although immediate correction of errors is preferable, most inventory errors will correct themselves over a two-year period. However, even if an error corrects itself, there may still be a need to restate comparative financial-statement information.

To summarize, inventory errors happen because of the nature of the asset. The following charts and examples should help you with understanding how inventory errors impact the financial statements.

Suppose beginning inventory and purchases were recorded correctly, but ending inventory was incorrect. Suppose items were excluded from the ending inventory amount. In other words, how would an understatement of ending inventory impact the current year financial statements?

| Statement of Financial Position | Income Statement | |||

|---|---|---|---|---|

| Inventory | Understated | Cost of goods sold | Overstated | |

| Retained Earnings | Understated | Net income | Understated | |

| Working Capial | Understated | |||

| Current Ratio | Understated |

From the chart, working capital and the current ratio are understated because part of the ending inventory is missing (not included in the count). Net income is understated because cost of goods sold is overstated.

Recall the items that impact cost of goods sold. Suppose items that a company owns was not recorded as a purchase and therefore are not counted in ending inventory. In other words, how would an understatement of ending inventory and purchases impact the current year financial statements?

| Statement of Financial Position | Income Statement | |||

|---|---|---|---|---|

| Inventory | Understated | Cost of goods sold | no effect | |

| Retained Earnings | no effect | Net income | no effect | |

| Accounts Payable | Understated | Purchases | Understated | |

| Working Capial | no effect | Ending Inventory | Understated | |

| Current Ratio | Overstated |

If both purchases and ending inventory are understated, net income for the period is not impacted because purchases and ending inventory are both understated by the same amount. The errors offset in the cost of goods sold.