Chapter 10

Solutions

Exercise 10.1

-

Straight line:

(125,000 − 10,000) ÷ 5 years = 23,000 per year (same for all years)

-

Activity based on input:

(125,000 − 10,000) ÷ 10,000 hours = $11.50 per hour of use

2021 depreciation = $11.50 × 2,150 hours = $24,725

- Activity based on output:

(125,000 − 10,000) ÷ 1,000,000 units = $0.115 per unit produced

2021 depreciation = $0.115 × 207,000 units = $23,805

-

Double declining balance:

Rate = (100 ÷ 5 years) × 2 = 40%

2020 Depreciation: $125,000 × 40% = $55,000

2021 Depreciation: ($125,000 – $50,000) × 40% = $30,000

Exercise 10.2

Depreciation rate (assume straight-line unless otherwise indicated):

(10,000 − 1,000) ÷ 3 years = $3,000 per year

Depreciation per year calculated as follows:

2020:

2021:

2022:

2023:

Total depreciation:

$3,000 × 6 ÷ 12

Full year

Full year

$3,000 × 6 ÷ 12

$1,500

$3,000

$3,000

$1,500

$9,000

(Note: in 2023, only 6 months depreciation can be recorded, as the asset has reached the end of its useful life.)

Exercise 10.3

- No journal entry is required as this is considered a change in estimate. Depreciation will be adjusted prospectively only, with no adjustment made to prior years.

-

Original depreciation:

($39,000 − $4,000) 5 years = $7,000 per year

Depreciation taken 2018-2020 = $7,000 × 3 years = $21,000

Revised depreciation for 2021 and future years:

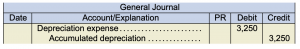

($39,000 − $21,000 − $5,000) ÷ (7 years − 3 years = 4) = $3,250 per year

Exercise 10.4

-

Depreciation from 2006 – 2011:

($450,000 − $90,000) ÷ 30 years = $12,000 per year

Total depreciation taken = $12,000 × 6 years = $72,000

-

Depreciation from 2012 – 2019:

($450,000 − $72,000 + $30,000 − $50,000) ÷ (30 − 6 + 10 = 34 years) = $10,529 per year

Total depreciation taken = $10,529 × 8 years = $84,232

-

Depreciation from 2020 and future years:

($450,000 + $30,000 − $72,000 − $84,232) ÷ (34 − 8 = 26 years) = $12,453 per year

Exercise 10.5

- Determine the recoverable amount:

Value in use

Fair value in use

= $110,000

= $116,000

The recoverable amount is the greater amount: $116,000

Carrying value = $325,000 − $175,000 = $150,00

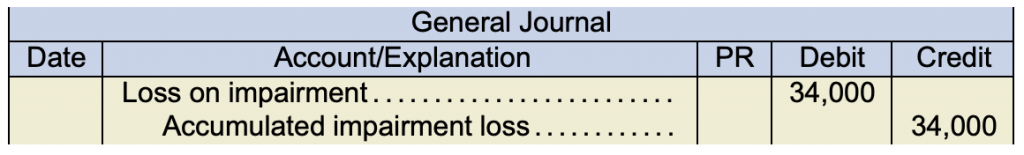

As the carrying value exceeds the recoverable amount, the asset is impaired by $150,000 − $116,000 = $34,000

-

New carrying value = $150,000 − $34,000 = $116,000

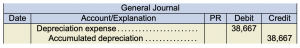

Depreciation = ($116,000 − 0) ÷ 3 years = $38,667

- Determine the recoverable amount:

Value in use

Fair value less costs to sell

$90,000

$111,000

The recoverable amount is the greater amount: $111,000

The carrying value is now $116,000 − $38,667 = $77,333

The asset is no longer impaired. However, the reversal of the impairment loss is limited. If the impairment had never occurred, the carrying value of the asset would have been:

Unimpaired carrying value on Jan 1, 2021

Depreciation for 2021 (150,000 ÷ 3)

Unimpaired carrying value at Dec 31, 2021

$ 150,000

(50,000)

100,000

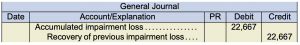

Therefore, the reversal of the impairment loss is limited to: $100,000 − $77,333 = $22,667

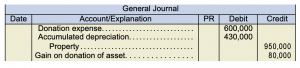

The journal entry will be:

Exercise 10.6

-

ASPE 3063 uses a two-step process for determining impairment losses. The first step is to determine if the asset is impaired by comparing the undiscounted future cash flows to the carrying value:

Undiscounted future cash flows:

Carrying value

$140,000

$150,000

Therefore, the asset is impaired.

The second step is to determine the amount of the impairment. This amount is the difference between the carrying value and the fair value of the asset:

Carrying value

Fair value

Impairment loss

$150,000

$125,000

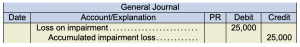

$ 25,000

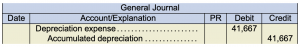

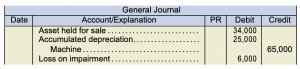

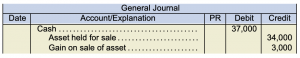

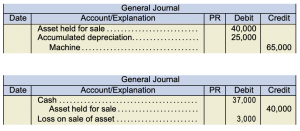

Thus, the journal entry will be:

-

Depreciation will now be based on the new carrying value:

$150,000 − $25,000 = $125,000

$125,000 ÷ 3 years = $41,667 per year

-

The carrying value is now $125,000 − $41,667 = $83,333. As this is less than the undiscounted future cash flows, the asset is no longer impaired. However, under ASPE 3063, reversals of impairment losses are not allowed, so no adjustment can be made in this case.

Exercise 10.7

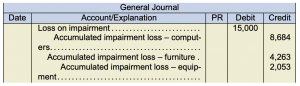

- The total carrying value of the division is $95,000. The fair values of the individual assets cannot be determined, so the value in use is the appropriate measure. In this case, the value in use is $80,000, which means the division is impaired by $15,000. This impairment will be allocated on a pro-rata basis to the individual assets:

Asset Carrying Amount Proportion Impairment Computers $55,000 55/95 $8,684 Furniture 27,000 27/95 4,263 Equipment 13,000 13/95 2,053 95,000 15,000 - The journal entry would be:

- The value in use ($80,000) is greater than the fair value less costs to sell ($60,000) so the calculation of impairment loss is the same as in part (a) (i.e., $15,000). However, none of the impairment loss should be allocated to the computers, as their carrying value ($55,000) is less than their recoverable amount ($60,000). The impairment loss would therefore be allocated as follows:

Asset Carrying Amount Proportion Impairment Loss Furniture $27,000 27/40 $10,125 Equipment 13,000 13/40 4,875 40,000 15,000 - The impairment loss is still calculated as $15,000. However, this time the computers are also impaired, as their carrying value ($55,000) is greater than their recoverable amount ($50,000). In this case, the computers are reduced to their recoverable amount and the remaining impairment loss ($15,000 − $5,000 = $10,000) is allocated to the furniture and equipment on a pro-rata basis:

Asset Carrying Amount Proportion Impairment Loss Computers $55,000 $5,000 Furniture 27,000 27/40 6,750 Equipment 13,000 13/40 3,250 95,000 15,000

Exercise 10.8

Exercise 10.9

Exercise 10.10

| Undiscounted cash flow (UDCF) | $355,000 | |||

| Carrying value | $408,700 | ($654,600 - $245,900) | ||

| Since UDCF < Carrying value, the is impairment. | ||||

| To determine impairment, compare the carrying value to the fair value | ||||

| Fair value | $395,600 | |||

| Carrying value | $408,700 | |||

| Loss due to impairement is $13,100 ($408,700 - $395,600) | ||||

| Loss on impairment | 13,100 | |||

| Accumulated impairment loss - equipment | 13,100 | |||

Exercise 10.11

1. Hanover follows ASPE – Cost recovery impairment model

a. Compare the undiscounted cash flow to the carrying value:

| Undiscounted cash flow (UDCF) | 7,695,000 | ||||

| Carrying value ($11,500,000 - $3,500,000) | 8,000,000 | ||||

| Since UDCF < Carrying value, there is impairment | |||||

| To calculate the amount of impairment, compare fair value to carrying value | |||||

| Fair value | 6,200,000 | ||||

| Carrying value | 8,000,000 | ||||

| Impairment = $1,800,000 ($8,000,000 - $6,200,000) | |||||

| Dec 31, Y4 | Loss on impairment | 1,800,000 | |||

| Accumulated impairment loss - equipment | 1,800,000 | ||||

b. Depreciation expense (straight-line)

| New value of equipment | 6,200,000 | ||||

| remaining useful life | 4 | years | |||

| Annual depreciation | 1,550,000 | ||||

| Dec 31, Y5 | Depreciation expense | 1,550,000 | |||

| Accumulated depreciation - equipment | 1,550,000 | ||||

c. No entry allowed! Under the cost recovery impairment model (ASPE), recovery of any impairment loss is NOT permitted.

2. Hanover follows IFRS – Rational entity impairment model

a. Determine the recoverable amount and compare that value to the carrying value:

| Carrying value | 8,000,000 | |||||

| Recoverable amount (higher of): | ||||||

| Value in use | 6,350,000 | |||||

| Fair value less costs to sell | 6,110,500 | |||||

| Therefore, recoverable amount is | 6,350,000 | |||||

| Impairment | 1,650,000 | |||||

| Dec 31, Y4 | Loss on impairment | 1,650,000 | ||||

| Accumulated impairment loss - equipment | 1,650,000 | |||||

b. Depreciation expense (straight-line)

| New value of equipment | 6,350,000 | ||||

| remaining useful life | 4 | years | |||

| Annual depreciation | 1,587,500 | ||||

| Dec 31, Y5 | Depreciation expense | 1,587,500 | |||

| Accumulated depreciation - equipment | 1,587,500 | ||||

c. Recovery of impairment is allowed under IFRS but there is a maximum amount.

| Carrying value of equipment (at Dec 31, Y5) | 4,762,500 | |||

| Fair value of equipment (at Dec 31, Y5) | 6,500,000 | |||

| Potential recovery is $1,737,500 ($6,500,000 - $4,762,500) | ||||

| However, we have to check what the carrying value would have been WITHOUT impairment: | ||||

| Original carrying value ($11,500,000 - $3,500,000) | 8,000,000 | |||

| Y5 depreciation ($8,000,000 / 4 years) | 2,000,000 | |||

| Carrying value at end of Y5 | $6,000,000 | MAXIMUM AMOUNT | ||

| The maximum amount we can recover is up to $6,000,000, not the $6,500,000 fair value | ||||

| Maximum recovery: | ||||

| Carrying value of equipment (at Dec 31, Y5) | 4,762,500 | |||

| Carrying value of equipment (if no impairment) | 6,000,000 | |||

| Recovery is $1,237,500 ($6,000,000 - $4,762,500) | ||||

| Accumulated impairment loss - equipment | 1,237,500 | |||

| Recovery of loss from impairment | 1,237,500 | |||

Exercise 10.12

1. Goderich follows APSE – Cost recovery impairment model

a. Compare the undiscounted cash flow to the carrying value:

| Undiscounted cash flow (UDCF) | 295,300 | ||||

| Carrying value ($529,600 - 224,200) | 305,400 | ||||

| Since UDCF < Carrying value, there is impairment | |||||

| To calculate the amount of impairment, compare fair value to carrying value | |||||

| Fair value | 245,600 | ||||

| Carrying value | 305,400 | ||||

| Impairment = $9,800 ($305,400 - 295,600) | |||||

| Dec 31, Y4 | Loss on impairment | 59,800 | |||

| Accumulated impairment loss - equipment | 59,800 | ||||

b. Depreciation expense (straight-line)

| New value of equipment | 245,600 | |||

| remaining useful life | 5 | years | ||

| Annual depreciation | 49,120 | |||

| Dec 31, Y5 | Depreciation expense | 49,120 | ||

| Accumulated depreciation - equipment | 49,120 |

c. No entry allowed! Under the cost recovery impairment model (ASPE), recovery of any impairment loss is NOT permitted.

2. Goderich follows IFRS – Rational entity impairment model

a. Determine the recoverable amount and compare that value to the carrying value:

| Carrying value | 305,400 | |||||

| Recoverable amount (higher of): | ||||||

| Value in use | 296,500 | |||||

| Fair value less costs to sell | 245,600 | |||||

| Therefore, recoverable amount is | 296,500 | |||||

| Impairment | 8,900 | |||||

| Dec 31, Y4 | Loss on impairment | 8,900 | ||||

| Accumulated impairment loss - equipment | 8,900 | |||||

b. Depreciation expense (straight-line)

| New value of equipment | 296,500 | ||||

| remaining useful life | 5 | years | |||

| Annual depreciation | 59,300 | ||||

| Dec 31, Y5 | Depreciation expense | 59,300 | |||

| Accumulated depreciation - equipment | 59,300 | ||||

c. Recovery of impairment is allowed under IFRS but there is a maximum amount.

| Carrying value of equipment (at Dec 31, Y5) | 237,200 | |||

| Fair value of equipment (at Dec 31, Y5) | 305,100 | |||

| Potential recovery is $82,725 ($305,100 - $222,375) | ||||

| However, we have to check what the carrying value would have been WITHOUT impairment: | ||||

| Original carrying value ($529,600 - $224,200) | 305,400 | |||

| Y5 depreciation ($305,400 / 5 years) | 61,080 | |||

| Carrying value at end of Y5 | $244,320 | MAXIMUM AMOUNT | ||

| The maximum amount we can recover is up to $244,320, not the $305,100 fair value | ||||

| Maximum recovery: | ||||

| Carrying value of equipment (at Dec 31, Y5) | 237,200 | |||

| Carrying value of equipment (if no impairment) | 244,320 | |||

| Recovery is $7,120 ($244,320 - $237,200) | ||||

| Accumulated impairment loss - equipment | 7,120 | |||

| Recovery of loss from impairment | 7,120 | |||

Exercise 10.13

1. Straight-line method

| Y8 |

$256,000 - $16,000

10 years

|

= | 20,000 | × 9/12 = | $15,000 |

| Y9 |

$256,000 - $16,000

10 years

|

= | $20,000 |

2. Units-of-production method

|

$256,000 - $16,000

125,000 units

|

= | $1.60 | rate per unit | ||

| Y8 | 9,860 units × $1.60 | = | $15,776 | ||

| Y9 | 11,400 units × $1.60 | = | $18,240 |

3. Double-declining balance method

| 1/10 × 2 = .10 × 2 = 20% annual rate | ||

| Y8 | $256,000 × 20% × 9/12 = | $38,400 |

| Y9 | ($256,000 - $38,400) × 20% = | $43,520 |

Exercise 10.14

1. Straight-line method

|

Depreciation |

Accumulated |

|||

|---|---|---|---|---|

| Y3 |

$345,000 - $34,700

8 years

|

= | $38,875 | $38,875 |

| Y4 |

$345,000 - $34,700

8 years

|

= | $38,875 | $77,750 |

2. Unit-of-Production

|

Depreciation |

Accumulated |

|||||

|---|---|---|---|---|---|---|

|

$345,000 - $34,700

31,100 units

|

= | $10.00 | rate | |||

| Y3 | 3,890 units x $10.00 rate per unit = | $38,900 | $38,900 | |||

| Y4 | 3,560 units x $10.00 rate per unit = | $35,600 | $74,500 | |||