Chapter 1

Solutions

Exercise 1.1

Exercise 1.2

Exercise 1.3

| Debit | Credit | ||

|---|---|---|---|

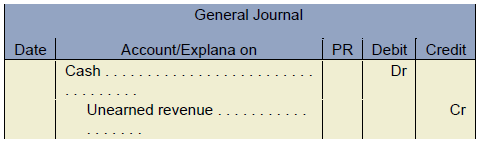

| 1 | Service Revenue | 13,450 | |

| Unearned Revenue | 13,450 | ||

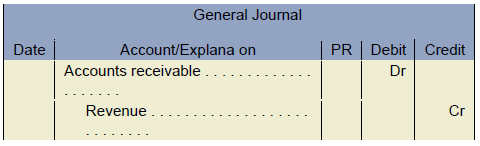

| 2 | Accounts Receivable | 15,200 | |

| Service Revenue | 15,200 | ||

| 3 | Bad Debt Expense | 1,700 | |

| Allowance for Doubtful Accounts | 1,700 | ||

| 4 | Prepaid Insurance | 5,200 | |

| Insurance Expense | 5,200 | ||

| 5 | Depreciation Expense | 8,650 | |

| Accumulated Depreciation - Equipment | 8,650 | ||

| 6 | Interest Expense | 83 | |

| Interest Payable | 83 | ||

| 7 | Prepaid Rent | 2,100 | |

| Rent Expense | 2,100 | ||

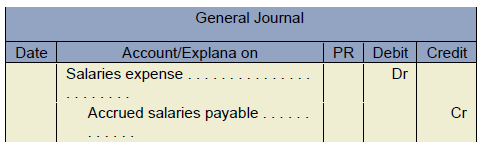

| 8 | Salaries and Wages Expense | 3,500 | |

| Salaries and Wages Payable | 3,500 | ||

| 9 | Dividends | 1,000 | |

| Dividends Payable | 1,000 | ||

Exercise 1.4

|

Adjusting Journal Entries |

|||

|---|---|---|---|

| 1 | Depreciation Expense | 2,000 | |

| Accumulated Depreciation | 2,000 | ||

| $12,000 / 6 years = $2,000 | |||

| 2 | Insurance Expense | 725 | |

| Prepaid Insurance | 725 | ||

| $4,350 / 12 month policy x 2 month expired = $725 | |||

| 3 | Supplies Expense | 555 | |

| Supplies | 555 | ||

| $1,520 on trial balance - $965 on hand = $555 used (expensed) | |||

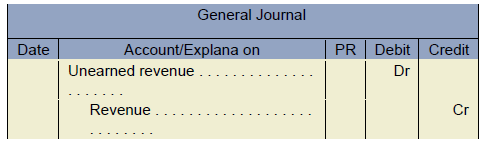

| 4 | Unearned Revenue | 1,780 | |

| Service Revenue | 1,780 | ||

| $3,560 x 1/2 = $1,780 earned | |||

| 5 | Accounts Receivable | 2,345 | |

| Service Revenue | 2,345 | ||

| record the amount earned but not invoiced or recorded | |||

| 6 | Telephone Expense | 580 | |

| Accounts Payable | 580 | ||

| record the amount of telephone expense incurred but not recorded | |||

|

Worksheet |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Trial Balance |

Adjustments |

Adjusted Trial Balance |

Income Statement |

Balance Sheet |

||||||

| Account Title | Debit | Credit | Debit | Credit | Debit | Credit | Debit | Credit | Debit | Credit |

| Cash | 7,465 | 7,465 | 7,465 | |||||||

| Accounts Receivables | 3,560 | 2,345 | 5,905 | 5,905 | ||||||

| Prepaid insurance | 4,350 | 725 | 3,625 | 3,625 | ||||||

| Supplies | 1,520 | 555 | 965 | 965 | ||||||

| Equipment | 12,000 | 12,000 | 12,000 | |||||||

| Accumulated Depreciation - Equipment | 1,200 | 2,000 | 3,200 | 3,200 | ||||||

| Accounts Payable | 3,060 | 580 | 3,640 | 3,640 | ||||||

| Unearned revenue | 3,560 | 1,780 | 1,780 | 1,780 | ||||||

| Common Shares | 10,000 | 10,000 | 10,000 | |||||||

| Retained earnings | 8,633 | 8,633 | 8,633 | |||||||

| Service revenue | 6,320 | 4,125 | 10,445 | 10,445 | ||||||

| Advertising expense | 328 | 328 | 328 | |||||||

| Depreciation Expense | 2,000 | 2,000 | 2,000 | |||||||

| Insurance Expense | 725 | 725 | 725 | |||||||

| Office expense | 450 | 450 | 450 | |||||||

| Salaries and wage expense | 3,100 | 3,100 | 3,100 | |||||||

| Supplies Expense | 555 | 555 | 555 | |||||||

| Telephone Expense | 580 | 580 | 580 | |||||||

| Totals | $32,773 | $32,773 | $7,985 | $7,985 | $37,698 | $37,698 | $7,738 | $10,445 | $29,960 | $27,253 |

| $2,707 | $2,707 | |||||||||

| $10,445 | $10,445 | $29,960 | $29,960 | |||||||

Exercise 1.5

|

Unadjusted Trial Balance |

Adjustments |

Adjusted Trial Balance |

Income Statement |

Balance Sheet |

||||||

| Account Name |

Dr |

Cr |

Dr |

Cr |

Dr |

Cr |

Dr |

Cr |

Dr |

Cr |

| Cash | 46,984 | 46,984 | ||||||||

| Inventory | 125,499 | 125,499 | ||||||||

| Accounts Receivable | 365,941 | 365,941 | ||||||||

| Prepaid Rent | 45,000 | 45,000 | ||||||||

| Land | 632,500 | 632,500 | ||||||||

| Equipment | 839,641 | 839,641 | ||||||||

| Equipment – Accumulated Depreciation | 369,852 | – | 369,852 | |||||||

| Accounts Payable | 98,654 | 98,654 | ||||||||

| Sales Tax Payable | 4,655 | 4,655 | ||||||||

| Bank Loan | 350,000 | 350,000 | ||||||||

| Common Shares | 250,000 | 250,000 | ||||||||

| Retained Earnings | 483,449 | 483,449 | ||||||||

| Service Revenue | 1,864,411 | 1,864,411 | ||||||||

| Depreciation Expense – Equipment | 89,641 | 89,641 | ||||||||

| Interest Expense | 35,000 | 35,000 | ||||||||

| Rent Expense | 540,000 | 540,000 | ||||||||

| Salaries and Wages Expense | 654,944 | 654,944 | ||||||||

| Utility Expense | 45,871 | 45,871 | ||||||||

| – | – | – | – | 3,421,021 | 3,421,021 | 1,365,456 | 1,864,411 | 2,055,565 | 1,556,610 | |

| 498,955 | 498,955 | |||||||||

| $1,864,411 | $1,864,411 | $2,055,565 | $2,055,565 | |||||||

Exercise 1.6

| 1 | Interest Expense | 3,200.00 | |

| Interest Payable | 3,200.00 | ||

| $320,000 × 4% × 3/12 | |||

| 2 | Insurance Expense | 13,541.67 | |

| Prepaid Insurance | 13,541.67 | ||

| $32,500 × 5/12 expired (used up) | |||

| 3 | Unearned Revenue | 17,433.33 | |

| Revenue | 17,433.33 | ||

| $52,300 × 1/3 earned | |||

| 4 | Wages Expense | 25,000.00 | |

| Wages Payable | 25,000.00 | ||

| $62,500 × 2/5 (Tuesday = 2 days expense incurred from 1 weeks wage) | |||

| 5 | Depreciation Expense | 6,000.00 | |

| Accumulated Depreciation | 6,000.00 | ||

| ($32,000 ÷ 4 years) × 9/ 12 (April - December) | |||

| 6 | Accounts Receivable | 31,800.00 | |

| Revenue | 31,800.00 | ||

| record the amount earned - but not yet recorded | |||

| 7 | Supplies Expense | 2,121.00 | |

| Supplies (Inventory) | 2,121.00 | ||

| $4,265 unadjusted - $2,144 on hand = the amount used | |||

| 8 | Advertising Expense | 3,200.00 | |

| Accounts Payable | 3,200.00 | ||

| record expense incurred but not recorded. | |||

| 9 | Revenue | 21,000.00 | |

| Unearned Revenue | 21,000.00 | ||

| the revenue has not been earned and should not be included in revenue | |||

| 10 | Bad Debt Expense | 12,560.00 | |

| Allowance for Doubtful Accounts | 12,560.00 | ||

| record the estimated expense | |||