9.4 Measurement After Initial Recognition

Once a PPE asset has been recognized and recorded, there are three choices in IFRS of how to deal with the asset in subsequent accounting periods. The asset may be accounted for using the cost model, the revaluation model, or the fair value model. Each of these models treats subsequent changes in the value of the asset differently. When a model is chosen, it must be applied consistently to all the assets in a particular class.

9.4.1. Cost Model

The cost model is considered the more established or traditional method of accounting for PPE assets. This model measures the asset after its acquisition at its cost, less any accumulated depreciation or accumulated impairment losses. The model, thus, does not attempt to adjust the asset to its current value, except in the case of impairment. This means that changes in the value of the asset are not recognized in income until that value is actually realized through the sale of the asset. This model is widely used and is very easy to understand and apply. Depreciation and impairment will be discussed in a later chapter.

Recall the formula for determining net book value (carrying value):

Cost − Accumulated Depreciation = Net Book Value (or Carrying Value)

9.4.2. Revaluation Model

IFRS allows an alternative method for subsequent reporting of PPE assets. The revaluation model attempts to capture changes in an asset’s value over its life. An essential condition of using this model is that the fair value of an asset be available and reliable at the reporting date. Fair values can often be determined through the use of qualified appraisers or other professionals who understand how to interpret market conditions. If appraisals are not available, other valuation techniques may be used to estimate the value. However, in some cases reliable fair values will not be available, so the model cannot be used.

The standard does not require that revaluations be performed at each reporting date, but it does require that the reported value not be materially different from the current fair value at the reporting date. If the property, plant, and equipment asset is expected to have volatile and significant changes in value, then annual revaluations are required. If the asset is only subject to insignificant changes in fair value each year, then revaluations every three to five years are recommended. The costs of obtaining valuation data or appraisals are likely one reason this method is not used by many companies. There is an additional cost in obtaining the reliable fair values, which many companies would compare to the marginal benefit of adjusting the PPE amounts on the balance sheet. In many cases, the fair values and depreciated costs of PPE assets would not be significantly different, so the model would not be applied. For some types of assets such as real estate, however, the revaluation model may provide significantly different results than the cost model. In these instances, the use of the revaluation model has a stronger justification.

In applying the revaluation model, adjustments are made to the PPE asset value by either adjusting the cost and accumulated depreciation proportionally (not used in this textbook), or by eliminating the accumulated depreciation and adjusting the asset cost to the new value. The second approach is simpler to apply, and will be used in the illustrations below.

When adjusting the value of the PPE asset, the obvious question is how to treat the offsetting side of the journal entry. The answer is to use an account called Revaluation Surplus, which is reported as part of other comprehensive income. However, there are some complicating factors in using this account.

If the adjustment increases the reported value of the asset, then report as part of revaluation surplus. If the adjustment decreases the reported value, then first reduce any existing revaluation surplus for that asset to zero, and record the remaining reduction as an expense in profit or loss. This expense may be reversed in future periods, if the value once again rises.

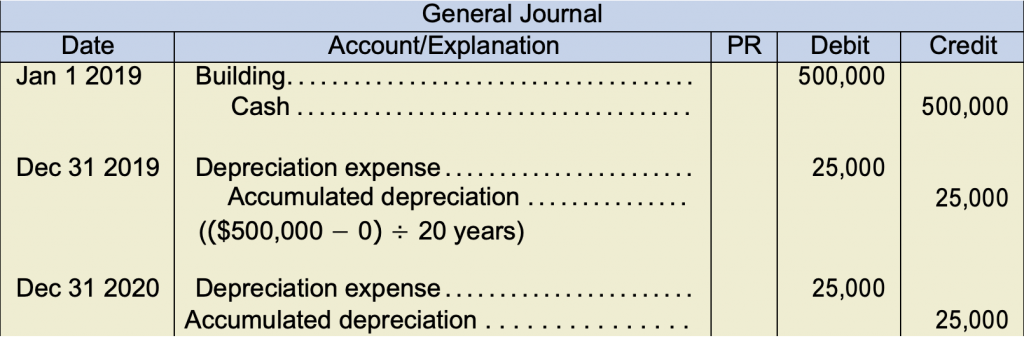

Consider the following example to illustrate this model. ComLink Ltd. purchases a factory building on January 1, 2019, for $500,000. The building is expected to have a useful life of twenty years with no residual value. The company uses the revaluation model for this class of asset and will obtain current valuations every two years. The journal entries for the first two years would be:

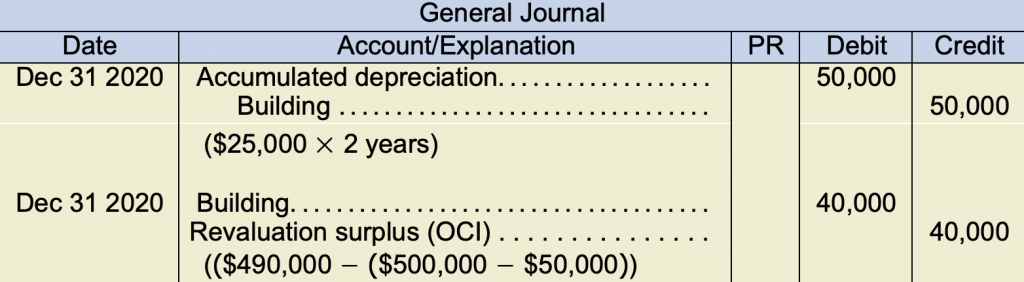

On December 31, 2020, an appraisal on the building is conducted and its fair value is determined to be $490,000. The following adjustment, which eliminates accumulated depreciation and adjusts the asset’s cost to its new value, will be required:

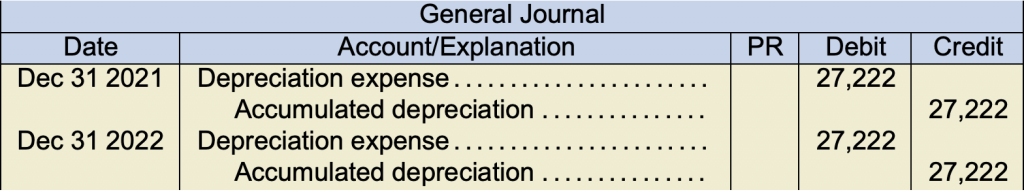

The cost of the building is now $490,000 and the accumulated depreciation is $nil. Because the building has now been revalued, we need to revise the depreciation calculation. Assuming no change in the remaining useful life of the asset, the new depreciation rate will be $490,000 ![]() 18 years = $27,222. The journal entries for the next two years will be:

18 years = $27,222. The journal entries for the next two years will be:

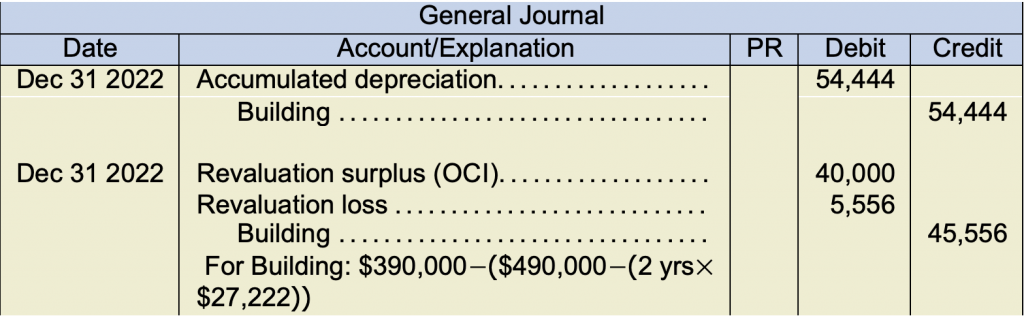

On December 31, 2022, the building is again appraised, and this time the fair value is determined to be $390,000. The following journal entries will be required:

The revaluation loss of $5,556 will be reported on the income statement in the current year. In future years, if the value of the building increases again, a revaluation gain can be reported on the income statement up to this amount. Any further increases will once again increase the Revaluation Surplus account.

The Revaluation Surplus (OCI) account itself can be dealt with in two ways. It can simply continue to be reported as part of accumulated other comprehensive income for the life of the asset. Once the asset is disposed of, the balance of the account is transferred from Accumulated Other Comprehensive Income directly to retained earnings. Another option is to make an annual transfer from the revaluation surplus account to retained earnings. The amount that can be transferred is limited to the difference between the depreciation expense that is actually recorded (using the revalued carrying amount) and the amount that would have been recorded had the cost model been used instead.

Some important items to remember:

The Revaluation Surplus can only have a credit balance (or zero balance). Revaluation surplus cannot have a debit balance. If an additional debit is needed to balance an entry, the additional debit should be to the income statement (Revaluation Loss).

The main steps to remember with the Revaluation Model:

- Record the purchase of the asset and depreciate accordingly. Remember, you may have to record depreciation up to the time of revaluation.

- At time of revaluation, reverse (close) accumulated depreciation (be sure to depreciate to the time of revaluation).

- Make the revaluation entry needed

- Depreciate based on the new value of the asset (watch remaining useful life).

9.4.3. Fair Value Model

The fair value model is a specialized type of optional accounting treatment that may be applied to only one type of asset: investment properties. IAS 40 (IAS, 2003b) considers investment properties to be land or buildings that are held primarily for the purpose of earning rental income or capital appreciation, are not used for production or administrative purposes of the business, and are not held for resale in the ordinary course of business. This definition suggests that the asset will earn cash flows that are largely independent of the regular operations of the business, which is why a different accounting standard can be applied. The fair value model requires adjustment of the carrying value of the investment property to its fair value every reporting period. As well, no depreciation is recorded for investment properties under the fair value model. The key feature that differentiates this model from the revaluation model is that gains and losses in value with investment properties are reported directly on the income statement, rather than using a Revaluation Surplus (OCI) account. This can be illustrated with the following example.

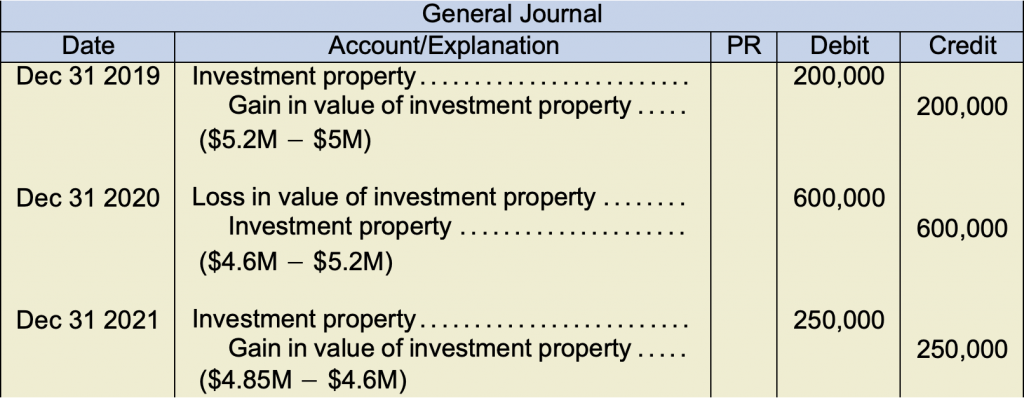

ComLink Ltd. purchases a vacant piece of land that it feels will appreciate in value over the next ten years as a result of suburban expansion. The land is initially purchased for $5 million on January 1, 2019. The company has classified this land as an investment property and has chosen to use the fair value model. The appraised values of the land over the next three years are:

| Appraisal Date | Appraised Value |

|---|---|

| December 31, 2019 | $5,200,000 |

| December 31, 2020 | $4,600,000 |

| December 31, 2021 | $4,850,000 |

The adjustments will be recorded each year as follows:

It should be noted that this model is optional for reporting purposes and can only be used with investment properties. A company may choose to use the cost model for its investment properties. However, if the fair value model is chosen, all investment properties must be reported this way. As well, there are significant disclosure requirements under this model.