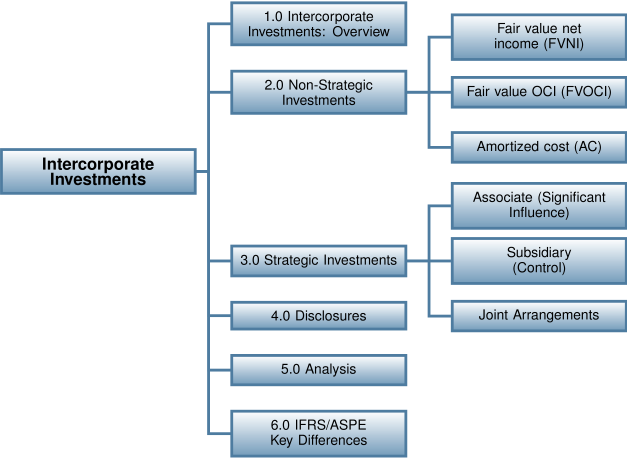

8.0 Intercorporate Investments

Learning Objectives

After completing this chapter, you should be able to:

- Describe intercorporate investments and their role in accounting and business.

- Identify and describe the three types of non-strategic investments.

- Fair value through net income (FVNI) classification and accounting treatment.

- Fair value through OCI (FVOCI) classification and accounting treatment.

- Amortized Cost (AC) classification and accounting treatment.

- Identify and describe the three types of strategic investments.

- Investments in associates classification and accounting treatment.

- Investments in subsidiaries classification and accounting treatment.

- Investments in joint arrangements general overview.

- Explain disclosures requirements for intercorporate investments.

- Identify the issues for stakeholders regarding investment analyses of performance.

- Discuss the similarities and differences between IFRS and ASPE for the three non-strategic investment classifications.

Introduction

Intercorporate investments arise when companies invest in other companies’ securities as the Hewlett Packard shares acquisition cover story illustrates. This chapter will focus on explaining how these investments are classified, measured (both initially and subsequently), reported, and analyzed. Canada currently has two IFRS standards in effect: IFRS 9, which was effective January 1, 2018 and ASPE. The purpose of this chapter is to identify the various classifications and accounting treatments permitted by either standard for investments in other companies’ debt and equity securities.