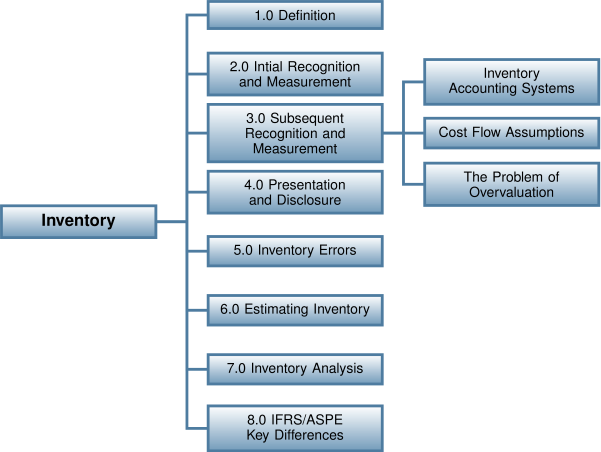

7.0 Inventory

Learning Objectives

After completing this chapter, you should be able to:

- Define inventory and identify those characteristics that distinguish it from other assets.

- Identify the types of costs that should be included in inventory.

- Identify accounting issues and treatments applied to inventory subsequent to its purchase.

- Describe the differences between periodic and perpetual inventory systems.

- Identify the appropriate criteria for selection of a cost flow formula and apply different cost flow formulas to inventory transactions.

- Determine when inventories are overvalued and apply the lower of cost and net realizable value rule to write-down those inventories.

- Describe the presentation and disclosure requirements for inventories under both IFRS and ASPE.

- Identify the effects of inventory errors on both the balance sheet and income statement and prepare appropriate adjustments to correct the errors.

- Calculate estimated inventory amounts using the gross profit method.

- Calculate gross profit margin and inventory turnover period and evaluate the significance of these results with respect to the profitability and efficiency of the business’s operations.

- Identify differences in accounting for inventories between ASPE and IFRS.

Introduction

The nature of economic activity has been evolving rapidly over the last two decades. The knowledge economy is becoming an increasingly significant component of the world’s gross domestic product. But even in the wired world of services and data, there is always a need for physical products. The concept of retail business may be changing through the development of online shopping, but consumers still expect to receive their goods eventually. This chapter will deal with some accounting issues surrounding the acquisition, production, and sale of inventory items, and it will discuss some of the problems that can arise when errors are made in the recording of inventory items.