6.6 Appendix A: Review of Internal Controls, Petty Cash, and Bank Reconciliations

Internal Control

Assets are the lifeblood of a company and must be protected. This duty falls to managers of a company. The policies and procedures implemented by management to protect as- sets are collectively referred to as internal controls. An effective internal control program not only protects assets, but also aids in accurate record-keeping, produces financial statement information in a timely manner, ensures compliance with laws and regulations, and promotes efficient operations. Effective internal control procedures ensure that adequate records are maintained, transactions are authorized, duties among employees are divided between record-keeping functions and control of assets, and employees’ work is checked by others. The use of electronic record-keeping systems does not decrease the need for good internal controls.

The effectiveness of internal controls is limited by human error and fraud. Human error can occur because of negligence or mistakes. Fraud is the intentional decision to circumvent internal control systems for personal gain. Sometimes, employees cooperate with each other to avoid internal controls. This collusion is often difficult to detect, but fortunately, it is not a common occurrence when adequate controls are in place.

Internal controls take many forms. Some are broadly based, like mandatory employee drug testing, video surveillance, and scrutiny of company email systems. Others are specific to an asset type or process. For instance, internal controls need to be applied to a company’s accounting system to ensure that transactions are processed efficiently and correctly to produce reliable records in a timely manner. Procedures should be documented to promote good recordkeeping, and employees need to be trained in the application of internal control procedures.

Financial statements prepared according to generally accepted accounting principles are useful not only to external users in evaluating the financial performance and financial position of the company, but also for internal decision making. There are various internal control mechanisms that aid in the production of timely and useful financial information. For instance, using a chart of accounts is necessary to ensure transactions are recorded in the appropriate account. As an example, expenses are classified and recorded in applicable expense accounts, then summarized and evaluated against those of a prior year.

The design of accounting records and documents is another important means to provide financial information. Financial data is entered and summarized in records and transmitted by documents. A good system of internal control requires that these records and documents be prepared at the time a transaction takes place or as soon as possible afterwards, since they become less credible and the possibility of error increases with the passage of time. The documents should also be consecutively pre-numbered, to indicate whether there may be missing documents.

Internal control also promotes the protection of assets. Cash is particularly vulnerable to misuse. A good system of internal control for cash should provide adequate procedures for protecting cash receipts and cash payments (commonly referred to as cash disbursements). Procedures to achieve control over cash vary from company to company and depend upon such variables as company size, number of employees, and cash sources. However, effective cash control generally requires the following:

- Separation of duties: People responsible for handling cash should not be responsible for maintaining cash records. By separating the custodial and record-keeping duties, theft of cash is less likely.

- Same-day deposits: All cash receipts should be deposited daily in the company’s bank account. This prevents theft and personal use of the money before deposit.

- Payments made using non-cash means: Cheques or electronic funds transfer (EFT) provide a separate external record to verify cash disbursements. For example, many businesses pay their employees using electronic funds transfer because it is more secure and efficient than using cash or even cheques.

Two forms of internal control over cash will be discussed in this chapter: the use of a petty cash account and the preparation of bank reconciliations.

Petty Cash

The payment of small amounts by cheque may be inconvenient and costly. For example, using cash to pay for postage on an incoming package might be less than the total processing cost of a cheque. A small amount of cash kept on hand to pay for small, infrequent expenses is referred to as a petty cash fund.

Establishing and Reimbursing the Petty Cash Fund

To set up the petty cash fund, a cheque is issued for the amount needed. The custodian of the fund cashes the cheque and places the coins and currency in a locked box. Responsibility for the petty cash fund should be delegated to only one person, who should be held accountable for its contents. Cash payments are made by this petty cash custodian out of the fund as required when supported by receipts. When the amount of cash has been reduced to a pre-determined level, the receipts are compiled and submitted for entry into the accounting system. A cheque is issued to reimburse the petty cash fund. At any given time, the petty cash amount should consist of cash and supporting receipts, that total to the petty cash fund amount. To demonstrate the management of a petty cash fund, assume that a $200 cheque is issued to establish a petty cash fund.

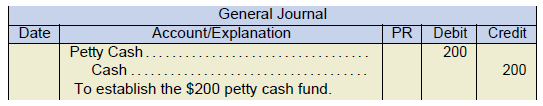

The journal entry is:

Petty Cash is a current asset account and is reported with Cash as one amount.

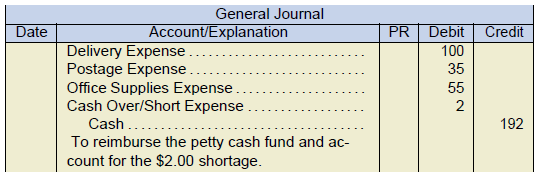

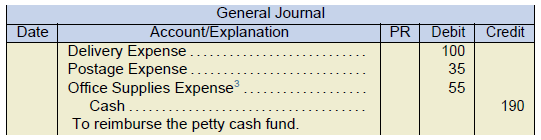

Assume the petty cash custodian has receipts totalling $190 and $10 in coin and currency remaining in the petty cash box. The receipts consist of the following: delivery charges $100, $35 for postage, and office supplies of $55. The petty cash custodian submits the receipts to the accountant who records the following entry and issues a cheque for $190.

The petty cash receipts should be cancelled at the time of reimbursement to prevent their reuse for duplicate reimbursements. The petty cash custodian cashes the $190 cheque. The $190 plus the $10 of coin and currency in the locked box immediately prior to reimbursement equals the $200 total required in the petty cash fund.

Sometimes, the receipts plus the coin and currency in the petty cash locked box do not equal the required petty cash balance. To demonstrate, assume the same information above except that the coin and currency remaining in the petty cash locked box was $8. This amount plus the receipts for $190 equals $198 and not $200, indicating a shortage in the petty cash box. The entry at the time of reimbursement reflects the shortage and is recorded as:

The $192 credit to Cash plus the $8 of coin and currency remaining in the petty cash box immediately prior to reimbursement equals the $200 required total in the petty cash fund.

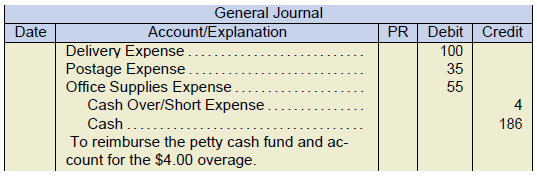

Assume, instead, that the coin and currency in the petty cash locked box was $14. This amount plus the receipts for $190 equals $204 and not $200, indicating an overage in the petty cash box. The entry at the time of reimbursement reflects the overage and is recorded as:

The $186 credit to Cash plus the $14 of coin and currency remaining in the petty cash box immediately prior to reimbursement equals the $200 required total in the petty cash fund.

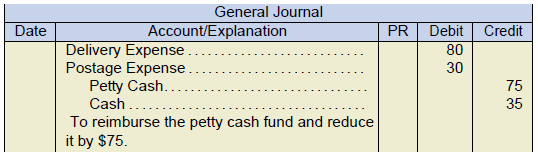

What happens if the petty cash custodian finds that the fund is rarely used? In such a case, the size of the fund should be decreased to reduce the risk of theft. To demonstrate, assume the petty cash custodian has receipts totalling $110 and $90 in coin and currency remaining in the petty cash box. The receipts consist of the following: delivery charges $80 and postage $30. The petty cash custodian submits the receipts to the accountant and requests that the petty cash fund be reduced by $75. The following entry is recorded and a cheque for $35 is issued.

The $35 credit to Cash plus the $90 of coin and currency remaining in the petty cash box immediately prior to reimbursement equals the $125 new balance in the petty cash fund ($200 original balance less the $75 reduction).

In cases when the size of the petty cash fund is too small, the petty cash custodian could request an increase in the size of the petty cash fund at the time of reimbursement. Care should be taken to ensure that the size of the petty cash fund is not so large as to become a potential theft issue. Additionally, if a petty cash fund is too large, it may be an indicator that transactions that should be paid by cheque are not being processed in accordance with company policy. Remember that the purpose of the petty cash fund is to pay for infrequent expenses; day-to-day items should not go through petty cash.

Cash Collections and Payments

The widespread use of banks facilitates cash transactions between entities and provides a safeguard for the cash assets being exchanged. This involvement of banks as intermediaries between entities has accounting implications. At any point in time, the cash balance in the accounting records of a company usually differs from the bank cash balance. The difference is usually because some cash transactions recorded in the accounting records have not yet been recorded by the bank and, conversely, some cash transactions recorded by the bank have not yet been recorded in the company’s accounting records.

The use of a bank reconciliation is one method of internal control over cash. The reconciliation process brings into agreement the company’s accounting records for cash and the bank statement issued by the company’s bank. A bank reconciliation explains the difference between the balances reported by the company and by the bank on a given date.

A bank reconciliation proves the accuracy of both the company’s and the bank’s records, and reveals any errors made by either party. The bank reconciliation is a tool that can help detect attempts at theft and manipulation of records. The preparation of a bank reconciliation is discussed in the following section.

The Bank Reconciliation Process

The bank reconciliation is a report prepared by a company at a point in time. It identifies discrepancies between the cash balance reported on the bank statement and the cash balance reported in a business’s Cash account in the general ledger, more commonly referred to as the books. These discrepancies are known as reconciling items and are added or subtracted to either the book balance or bank balance of cash. Each of the reconciling items is added or subtracted to the business’s cash balance. The business’s cash balance will change as a result of the reconciling items. The cash balance prior to reconciliation is called the unreconciled cash balance. The balance after adding and subtracting the reconciling items is called the reconciled cash balance. The following is a list of potential reconciling items and their impact on the bank reconciliation.

|

Book reconciling items

|

Bank reconciling items

|

Book Reconciling Items

The collection of notes receivable may be made by a bank on behalf of the company. These collections are often unknown to the company until they appear as an addition on the bank statement, and so cause the general ledger cash account to be understated. As a result, the collection of a notes receivable is added to the unreconciled book balance of cash on the bank reconciliation.

Cheques returned to the bank because there were not sufficient funds (NSF) to cover them appear on the bank statement as a reduction of cash. The company must then request that the customer pay the amount again. As a result, the general ledger cash account is overstated by the amount of the NSF cheque. NSF cheques must therefore be subtracted from the unreconciled book balance of cash on the bank reconciliation to reconcile cash.

Cheques received by a company and deposited into its bank account may be returned by the customer’s bank for many reasons (e.g., the cheque was issued too long ago, known as a stale-dated cheque, an unsigned or illegible cheque, or the cheque shows the wrong account number). Returned cheques cause the general ledger cash account to be overstated. These cheques are therefore subtracted on the bank statement, and must be deducted from the unreconciled book balance of cash on the bank reconciliation.

Bank service charges are deducted from the customer’s bank account. Since the service charges have not yet been recorded by the company, the general ledger cash account is overstated. Therefore, service charges are subtracted from the unreconciled book balance of cash on the bank reconciliation.

A business may incorrectly record journal entries involving cash. For instance, a deposit or cheque may be recorded for the wrong amount in the company records. These errors are often detected when amounts recorded by the company are compared to the bank statement. Depending on the nature of the error, it will be either added to or subtracted from the unreconciled book balance of cash on the bank reconciliation. For example, if the company recorded a cheque as $520 when the correct amount of the cheque was $250, the $270 difference would be added to the unreconciled book balance of cash on the bank reconciliation. Why? Because the cash balance reported on the books is understated by $270 because of the error. As another example, if the company recorded a deposit as $520 when the correct amount of the deposit was $250, the $270 difference would be subtracted from the unreconciled book balance of cash on the bank reconciliation. Why? Because the cash balance reported on the books is overstated by $270 because of the error. Each error requires careful analysis to determine whether it will be added or subtracted in the unreconciled book balance of cash on the bank reconciliation.

Bank Reconciling Items

Cash receipts are recorded as an increase of cash in the company’s accounting records when they are received. These cash receipts are deposited by the company into its bank. The bank records an increase in cash only when these amounts are actually deposited with the bank. Since not all cash receipts recorded by the company will have been recorded by the bank when the bank statement is prepared, there will be outstanding deposits, also known as deposits in transit. Outstanding deposits cause the bank statement cash balance to be understated. Therefore, outstanding deposits are a reconciling item that must be added to the unreconciled bank balance of cash on the bank reconciliation.

On the date that a cheque is prepared by a company, it is recorded as a reduction of cash in a company’s books. A bank statement will not record a cash reduction until a cheque is presented and accepted for payment (or clears the bank). Cheques that are recorded in the company’s books but are not paid out of its bank account when the bank statement is prepared are referred to as outstanding cheques. Outstanding cheques mean that the bank statement cash balance is overstated. Therefore, outstanding cheques are a reconciling item that must be subtracted from the unreconciled bank balance of cash on the bank reconciliation.

Bank errors sometimes occur and are not revealed until the transactions on the bank statement are compared to the company’s accounting records. When an error is identified, the company notifies the bank to have it corrected. Depending on the nature of the error, it is either added to or subtracted from the unreconciled bank balance of cash on the bank reconciliation. For example, if the bank cleared a cheque as $520 that was correctly written for $250, the $270 difference would be added to the unreconciled bank balance of cash on the bank reconciliation. Why? Because the cash balance reported on the bank statement is understated by $270 as a result of this error. As another example, if the bank recorded a deposit as $520 when the correct amount was $250, the $270 difference would be subtracted from the unreconciled bank balance of cash on the bank reconciliation. Why? Because the cash balance reported on the bank statement is overstated by $270 because of this specific error. Each error must be carefully analyzed to determine how it will be treated on the bank reconciliation.

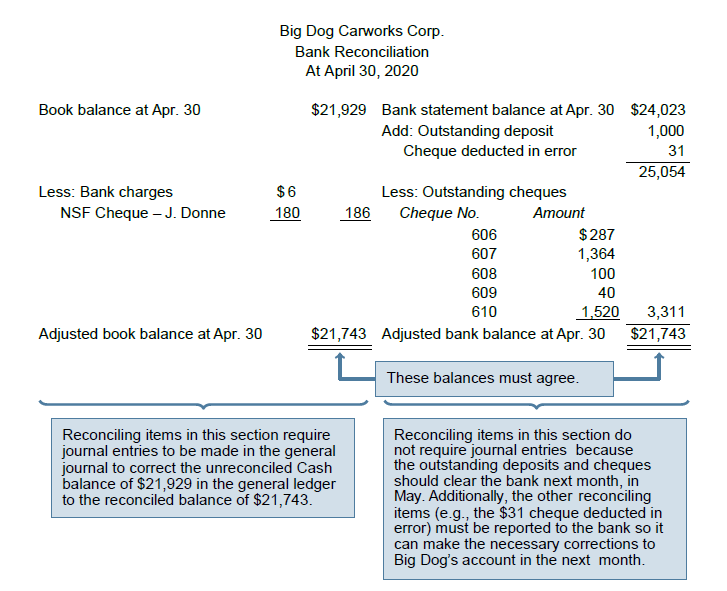

Illustrative Problem—Bank Reconciliation

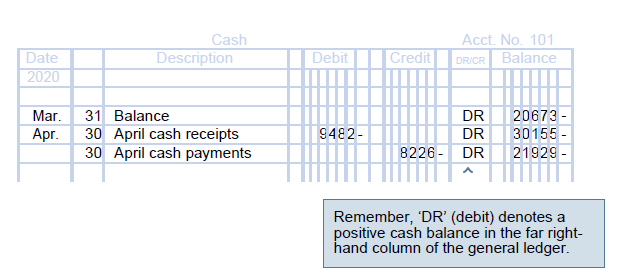

Assume that a bank reconciliation is prepared by Big Dog Carworks Corp. (BDCC) at April 30. At this date, the Cash account in the general ledger shows a balance of $21,929 and includes the cash receipts and payments shown in Figure 6.1.

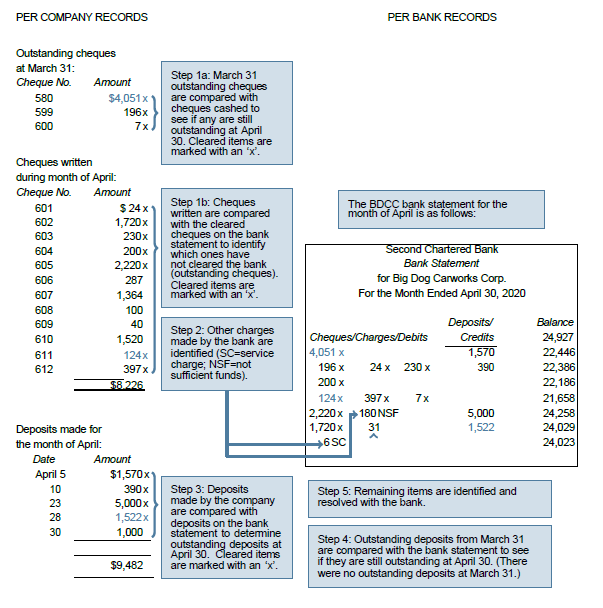

Extracts from BDCC’s accounting records are reproduced with the bank statement for April in Figure 6.2.

For each entry in BDCC’s general ledger Cash account, there should be a matching entry on its bank statement. Items in the general ledger Cash account but not on the bank statement must be reported as a reconciling item on the bank reconciliation. For each entry on the bank statement, there should be a matching entry in BDCC’s general ledger Cash account. Items on the bank statement but not in the general ledger Cash account must be reported as a reconciling item on the bank reconciliation.

There are nine steps to follow in preparing a bank reconciliation for BDCC at April 30, 2020:

Step 1

Identify the ending general ledger cash balance ($21,929 from Figure 6.1) and list it on the bank reconciliation as the book balance on April 30 as shown in Figure 6.3. This represents the unreconciled book balance.

Step 2

Identify the ending cash balance on the bank statement ($24,023 from Figure 6.2) and list it on the bank reconciliation as the bank statement balance on April 30 as shown in Figure 6.3. This represents the unreconciled bank balance.

Step 3

Cheques written that have cleared the bank are returned with the bank statement. These cheques are said to be cancelled because, once cleared, the bank marks them to prevent them from being used again. Cancelled cheques are compared to the company’s list of cash payments. Outstanding cheques are identified using two steps:

- Any outstanding cheques listed on the BDCC’s March 31 bank reconciliation are compared to the cheques listed on the April 30 bank statement.For BDCC, all of the March outstanding cheques (nos. 580, 599, and 600) were paid by the bank in April. Therefore, there are no reconciling items to include in the April 30 bank reconciliation. If one of the March outstanding cheques had not been paid by the bank in April, it would be subtracted as an outstanding cheque from the unreconciled bank balance on the bank reconciliation.

- The cash payments listed in BDCC’s accounting records are compared to the cheques on the bank statement. This comparison indicates that the following cheques are outstanding.

Cheque No. Amount 606 $287 607 1,364 608 100 609 40 610 1,520 Outstanding cheques must be deducted from the bank statement’s unreconciled ending cash balance of $24,023 as shown in Figure 6.3.

Step 4

Other payments made by the bank are identified on the bank statement and subtracted from the unreconciled book balance on the bank reconciliation.

- An examination of the April bank statement shows that the bank had deducted the NSF cheque of John Donne for $180. This is deducted from the unreconciled book balance on the bank reconciliation as shown in Figure 6.3.

- An examination of the April 30 bank statement shows that the bank had also deducted a service charge of $6 during April. This amount is deducted from the unreconciled book balance on the bank reconciliation as shown in Figure 6.3.

Step 5

Last month’s bank reconciliation is reviewed for outstanding deposits at March 31. There were no outstanding deposits at March 31. If there had been, the amount would have been added to the unreconciled bank balance on the bank reconciliation.

Step 6

The deposits shown on the bank statement are compared with the amounts recorded in the company records. This comparison indicates that the April 30 cash receipt amounting to $1,000 was deposited but it is not included in the bank statement. The outstanding deposit is added to the unreconciled bank balance on the bank reconciliation as shown in Figure 6.3.

Step 7

Any errors in the company’s records or in the bank statement must be identified and reported on the bank reconciliation.

An examination of the April bank statement shows that the bank deducted a cheque issued by another company for $31 from the BDCC bank account in error. Assume that when notified, the bank indicated it would make a correction in May’s bank statement.

The cheque deducted in error must be added to the bank statement balance on the bank reconciliation as shown in Figure 6.3.

Step 8

Total both sides of the bank reconciliation. The result must be that the book balance and the bank statement balance are equal or reconciled. These balances represent the adjusted balance.

The bank reconciliation in Figure 6.3 is the result of completing the preceding eight steps.

Step 9

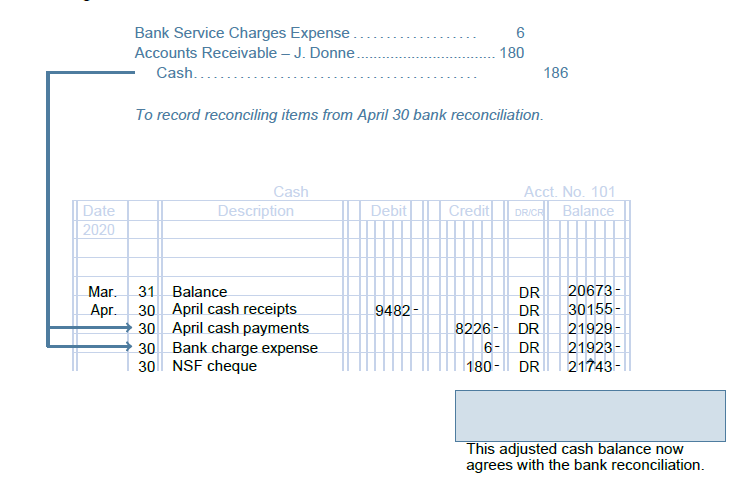

For the adjusted balance calculated in the bank reconciliation to appear in the accounting records, an adjusting entry (or entries) must be prepared.

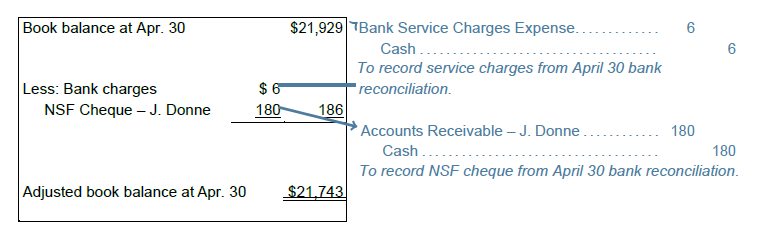

The adjusting entry (or entries) is based on the reconciling item(s) used to calculate the adjusted book balance. The book balance side of BDCC’s April 30 bank reconciliation is copied to the left below to clarify the source of the following April 30 adjustments.

It is common practice to use one compound entry to record the adjustments resulting from a bank reconciliation as shown below for BDCC.

Once the adjustment is posted, the Cash general ledger account is up to date, as illustrated in Figure 6.4.

Note that the balance of $21,743 in the general ledger Cash account is the same as the adjusted book balance of $21,743 on the bank reconciliation. Big Dog does not make any adjusting entries for the reconciling items on the bank side of the bank reconciliation since these will eventually clear the bank and appear on a later bank statement. Bank errors will be corrected by the bank.