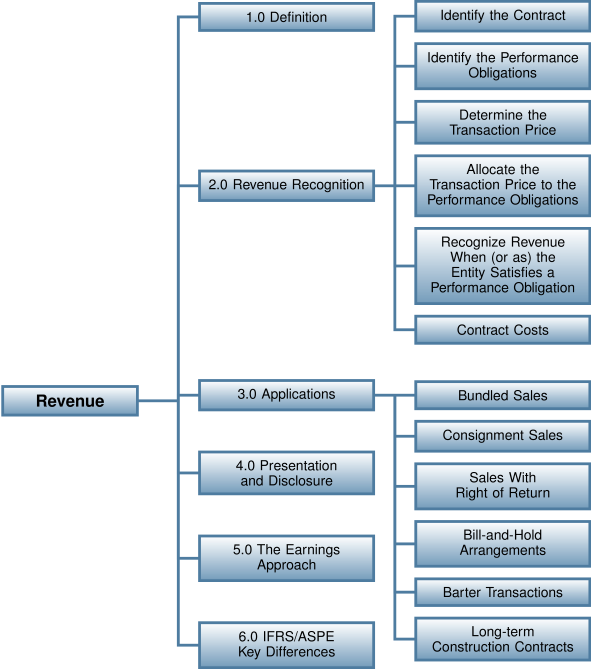

5.0 Revenue

Chapter 5 Learning Objectives

After completing this chapter, you should be able to:

- Describe the criteria for recognizing revenue and determine if a company has earned revenue in a business transaction.

- Discuss the problem of measurement uncertainty and alternative accounting treatments for these situations.

- Prepare journal entries for a number of different types of sales transactions.

- Apply revenue recognition concepts to the determination of profit from long-term construction contracts.

- Prepare journal entries for long-term construction contracts.

- Apply revenue recognition concepts to unprofitable long-term construction contracts.

- Describe presentation and disclosure requirements for revenue-related accounts.

- Discuss the earnings approach to revenue recognition and compare it to current IFRS requirements.

Introduction

Revenue is the essence of any business. Without revenue, a business cannot exist. The basic concept of revenue is well understood by business people, but complex and important accounting issues complicate the recognition and reporting of revenue. Sometimes, the complexity of these issues can lead to erroneous or inappropriate recognition of revenue. In 2007, Nortel Networks Corporation paid a $35 million settlement in response to a Securities and Exchange Commission (SEC) investigation into its reporting practices. Although several problems were identified, one of the specific issues that the SEC investigated was Nortel’s earlier accounting for bill-and-hold transactions. In a separate matter, Nortel was also required to restate its financial statements due to errors in the timing of revenue recognition for bundled sales contracts. In this chapter, we will examine these issues and determine the appropriate accounting treatment for revenues.