4.1 Financial Reporting: Overview

As discussed previously, investors and creditors assess a company’s overall financial health by using published financial statements. Recall that the previous chapter about financial reporting illustrated how the core financial statements link into a cohesive network of financial information. The illustration in that chapter showed how the ending cash balance from the statement of cash flows (SCF) is also the ending cash balance in the SFP/BS. This is the final link that completes the connection of the core financial statements.

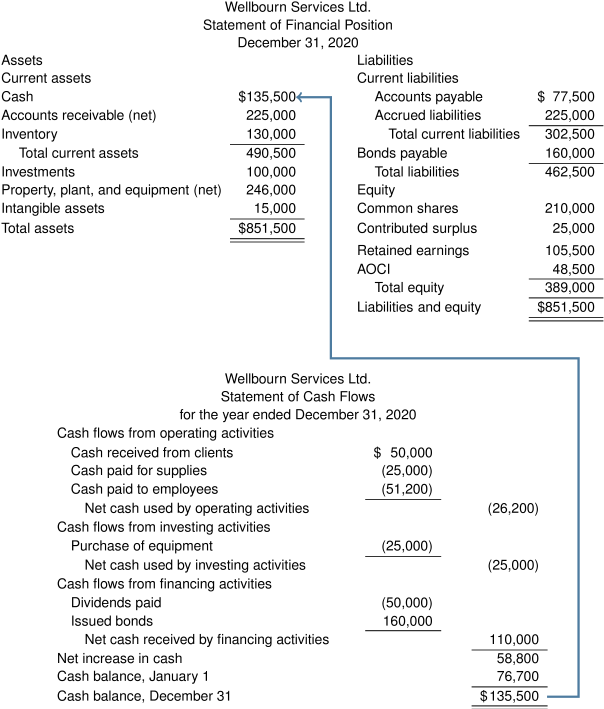

For example, in the SFP/BS for Wellbourn Services Ltd. at December 31 (which we saw also in the previous chapter) note how the cash ending balance links the two statements.

The SFP/BS provides information about a company’s resources (assets) at a specific point in time and whether these resources are financed mainly by debt (current and long-term liabilities) or equity (shareholders’ equity). In other words, the SFP/BS provides the information needed to assess a company’s liquidity and solvency. Combined, these represent a company’s financial flexibility.

Recall the basic accounting equation:

Assets = Liabilities + Equity

The key issues to consider regarding the SFP/BS are the valuation and management of resources (assets) and the recognition and timing of debt obligations (liabilities). Reporting the results within the SFP/BS creates a critical reporting tool to assess a company’s overall financial health.

The statement of cash flows, discussed later in this chapter, identifies how the company utilized its cash inflows and outflows over the reporting period. Since the SCF separates cash flows into those resulting from operating activities versus investing and financing activities, investors and creditors can quickly see where the main sources of cash originate. If cash sources are originating more from investing activities than from operations, this means that the company is likely selling off some of its assets to cover its obligations. This may be appropriate if these assets are idle and no longer contributing towards generating profit, but otherwise, selling off useful assets could trigger a downward spiral, with profits plummeting as a result. If cash sources are originating mainly from financing activities, the company is likely sourcing its cash from debt or from issuing shares. Higher debt requires more cash to make the principal and interest payments, and more shares means that existing investors’ ownership is becoming diluted. Either scenario will be cause for concern for both investors and creditors. Even if most of the cash sources are mainly from operating activities, a large difference between net income and the total cash from operating activities is a warning sign that investors and creditors should be digging deeper.

The bottom line after reviewing the two statements is: if debt is high and cash balances are low, the greater the risk of failure.

The SFP/BS will discussed in detail in the next section, 4.2 Statement of Financial Position/Balance Sheet.