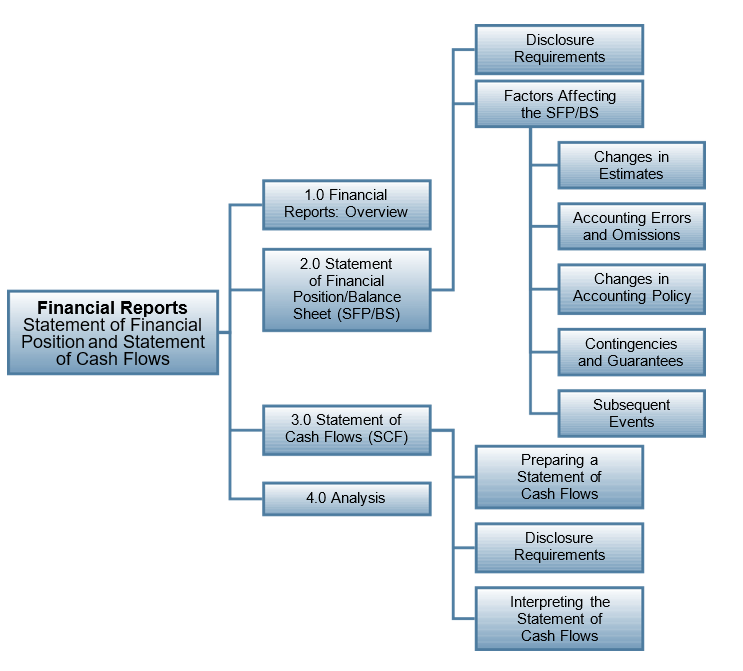

4.0 Financial Reports – Statement of Financial Position and Statement of Cash Flows

Learning Objectives

After completing this chapter, you should be able to:

- Describe the statement of financial position/balance sheet (SFP/BS) and the statement of cash flows (SCF), and explain their role in accounting and business.

- Explain the purpose of the SFP/BS.

- Identify the various disclosure requirements for the SFP/BS and prepare a SFP/BS in good form.

- Identify and describe the factors can affect the SFP/BS, such as changes in accounting estimates, changes in accounting policies, errors and omissions, contingencies and guarantees, and subsequent events.

- Explain the purpose of the statement of cash flows (SCF) and prepare a SCF in good form.

- Explain and describe an acceptable format for the SCF.

- Describe and prepare a SCF in good form with accounts analysis as required, and interpret the results.

- Identify and describe the techniques used to analyze income and equity statements.

Introduction

In Chapter 3 we discussed three of the core financial statements. This chapter will now discuss the remaining two, which are the SFP/BS, and the SCF. Both of these statements are critical tools used to assess a company’s financial position and its current cash resources, as explained in the opening story about Amazon. Cash is one of the most critical assets to success as will be discussed in a subsequent chapter on cash and receivables. How an investor knows when to invest in a company and how a creditor knows when to extend credit to a company is the topic of this chapter.

NOTE: IFRS refers to the balance sheet as the statement of financial position (SFP) and ASPE continues to use the term balance sheet (BS). To simplify the terminology, this chapter will refer to this statement as the SFP/BS, unless specific reference to either one is necessary.