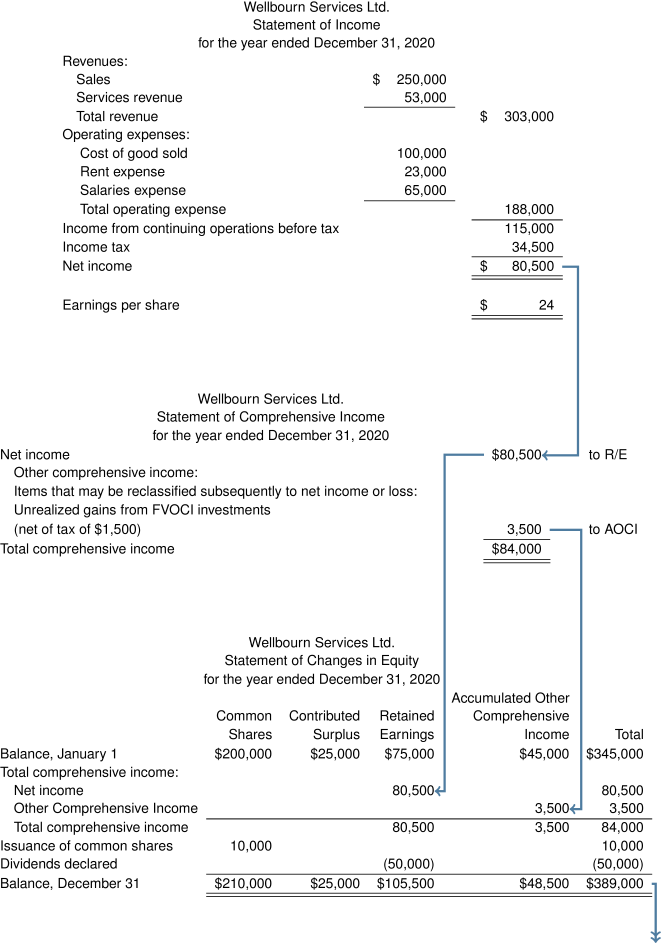

3.3 Financial Statements and Their Interrelationships

The core financial statements connect to complete an overall picture of the company’s operations and its current financial state. It is important to understand how these reports connect; therefore, a review of some simplified financial statements for Wellbourn Services Ltd., a large, privately-held company is presented below (assume Wellbourn applies IFRS; for simplicity, comparative year data and reporting disclosures are not shown).

As can be seen from the flow of the numbers above, the net income from the statement of income becomes the opening amount for the statement of comprehensive income (a statement required for all IFRS reporting companies).

Comprehensive income starts with net income/loss and includes certain gains or losses called other comprehensive income (OCI) that are not already reported in net income. The most notable examples for purposes of this course are:

- unrealized gains or losses for investments classified as fair value through OCI (FVOCI), resulting from changes in their fair value while the investment is being held (Chapter 8)

- gains/losses resulting from the application of the revaluation method for property, plant and equipment, and intangibles (Chapter 9)

In the next intermediate accounting course, another OCI item is the remeasurement gains and losses regarding defined benefit pension plans.

To summarize, IFRS companies must report:

- Other comprehensive income (OCI) = certain gains or losses not already included in net income, net of tax, with tax amount disclosed

- Total comprehensive income = net income/loss +/- other comprehensive income (OCI)

Returning to the Wellbourn financial statements, looking at the statement of comprehensive income, net income closes to retained earnings, while any other comprehensive income (OCI) gain or loss closes to accumulated other comprehensive income (AOCI) in the statement of changes in equity. The AOCI account is similar to a retained earnings account, except that AOCI only accumulates items from OCI.

To summarize:

- Retained earnings accumulate net income/loss over time. (ASPE and IFRS)

- AOCI accumulates other comprehensive income (OCI)/losses over time. (IFRS only)

It should also be noted that IFRS companies can choose to keep the statement of income separate from the statement of comprehensive income, or they can combine the two statements into one report called the statement of income and comprehensive income, which will be discussed in more detail in the next section.

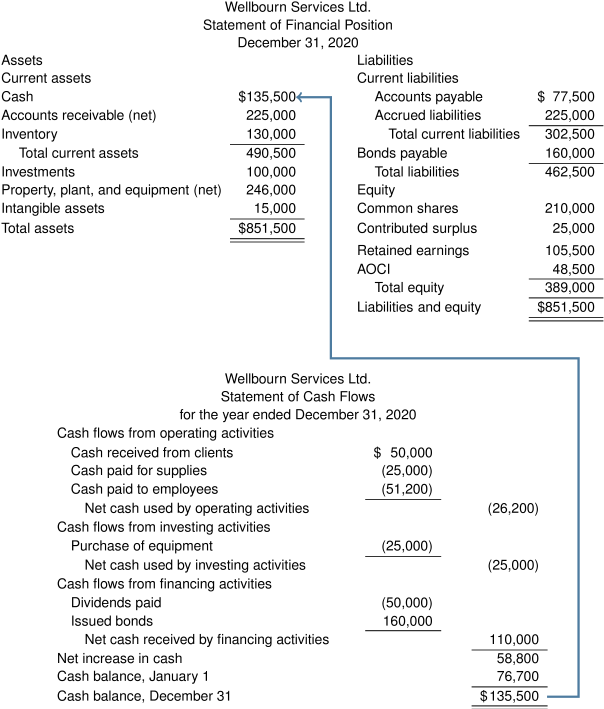

Looking at the Wellbourn statement of changes in equity, note that the total column balances to the equity section of the statement of financial position/balance sheet (SFP/BS). The final link between all the financial statements is regarding the statement of cash flows (SCF), where the ending cash balance must be equal to the cash balance reported in the SFP/BS. This completes the loop of interconnecting accounts and amounts.

3.3.1. Financial Statement Differences Between IFRS and ASPE

The core financial statements shown above illustrate the types of statements required for IFRS companies. They are the following:

- a statement of income

- a statement of comprehensive income

- a worksheet-style statement of changes in equity with all the

- equity accounts included

- a statement of financial position

- a statement of cash flows

- notes to the financial statements

IFRS requires the comparative previous year amounts be reported as well as disclosure of the earnings per share. ASPE does not require these disclosures. IFRS requires the statement of comprehensive income (or a combined statement of income and comprehensive income), whereas ASPE only requires a statement of income because comprehensive income does not exist. The statement of changes in equity required by IFRS shown in the Wellbourn example above now becomes a more simplified statement of retained earnings for ASPE, where only the details for retained earnings are reported (though any changes in shareholder equity accounts must be disclosed in the notes to the financial statements). The remaining equity accounts such as common shares and contributed surplus are reported as ending balances directly in the balance sheet for ASPE (called the statement of financial position for IFRS companies).