1.2 Review – The Trial Balance

To help prove that the accounting equation is in balance, a trial balance is normally prepared instead of the T-account listing. A trial balance is an internal document that lists all the account balances at a point in time. The total debits must equal total credits on the trial balance. The form and content of a trial balance is illustrated below, using the account numbers, account names, and account balances of Big Dog Carworks Corp. at January 31, Y5. Assume that the account numbers are those assigned by the business.

| Big Dog Carworks Corp. Trial Balance At January 21, Y5 |

|||

|---|---|---|---|

| Acct. No. | Account | Debit | Credit |

| 101 | Cash | $3,700 | |

| 110 | Accounts receivable | 2,000 | |

| 161 | Prepaid insurance | 2,400 | |

| 183 | Equipment | 3,000 | |

| 184 | Truck | 8,000 | |

| 201 | Bank loan | $6,000 | |

| 210 | Accounts payable | 700 | |

| 247 | Unearned revenue | 400 | |

| 320 | Share capital | 10,000 | |

| 330 | Dividends | 200 | |

| 450 | Repair revenue | 10,000 | |

| 654 | Rent expense | 1,600 | |

| 656 | Salaries expense | 3,500 | |

| 668 | Supplies expense | 2,000 | |

| 670 | Truck opera on expense | 700 | |

| $27,100 | $27,100 | ||

Double-entry accounting requires that debits equal credits. The trial balance establishes that this equality exists for Big Dog but it does not ensure that each item has been recorded in the proper account. Neither does the trial balance ensure that all items that should have been entered have been entered. In addition, a transaction may be recorded twice. Any or all of these errors could occur and the trial balance would still balance. Nevertheless, a trial balance provides a useful mathematical check before preparing financial statements.

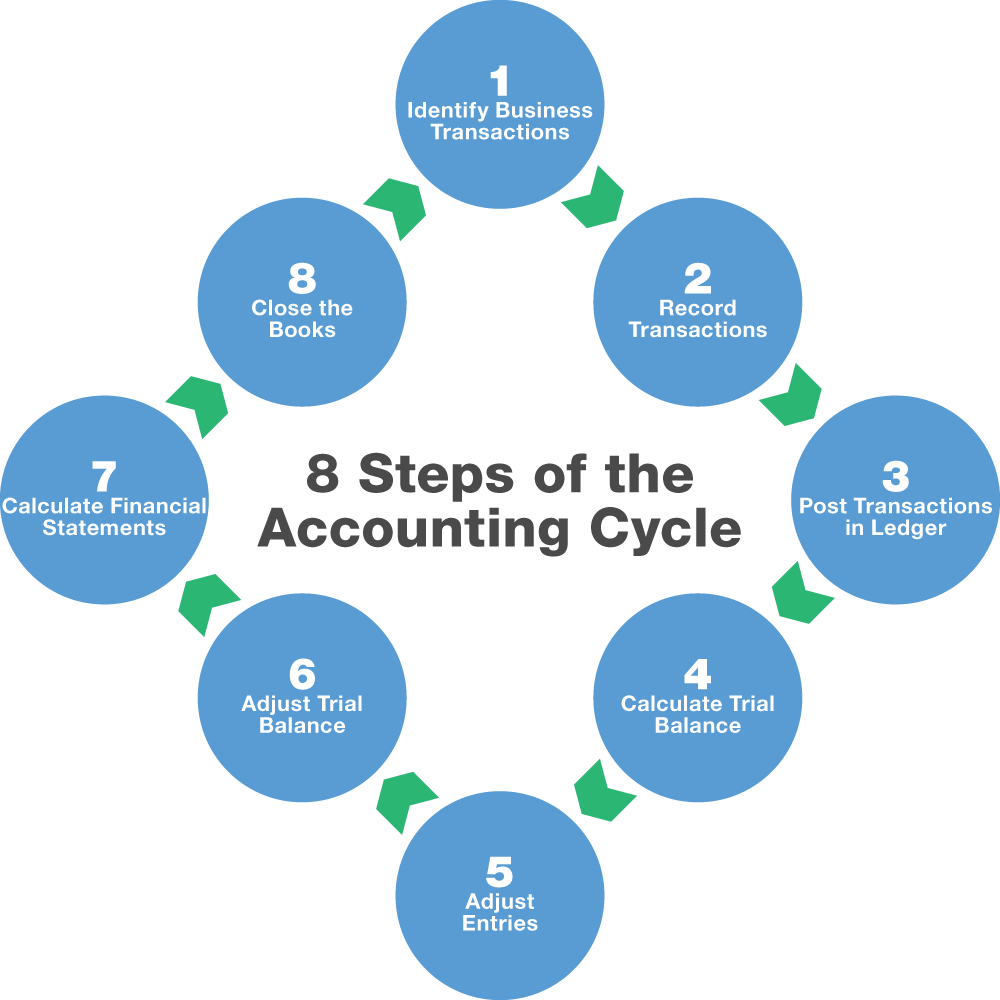

Before we continue to the adjusting entries, let’s consider the accounting cycle. In Intermediate Accounting, it is assumed that you recall and can easily record basic accounting transactions (events).

Before we consider the next section, we are at step 4 of the accounting cycle. The next section – Step 5 – Adjusting Entries is a very important part of the accounting cycle. Care should be taken to review the main types of adjusting journal entries.

Recall that under accrual basis accounting, revenues must be recorded in the period in which they are earned and expenses must be recognized in the period in which they are incurred, regardless of when payment occurs. They must match!