1.0 Review – Transaction Analysis

Recall that financial accounting focuses on communicating information to external users. That information is communicated using financial statements. There are four financial statements: the income statement, statement of changes in equity, balance sheet, and statement of cash flows. Each of these is introduced in the following sections using an example based on a fictious corporate organization called Big Dog Carworks Corp.

The main focus of this course will be the asset side of the balance sheet (statement of financial position). However, we will review some of the basic and fundamental accounting transactions as a review before we begin an in-depth study of a company’s assets.

ASSETS = LIABILITIES + EQUITY

When financial transactions are recorded, combined effects on assets, liabilities, and equity are always exactly offsetting. This is the reason that the balance sheet always balances.

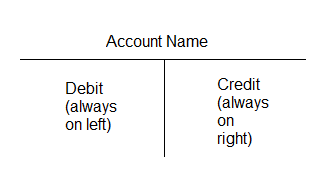

A simplified account, called a T-account, is often used as a teaching or learning tool to show increases and decreases in an account. It is called a T-account because it resembles the letter T. As shown in the T-account below, the left side records debit entries and the right side records credit entries.

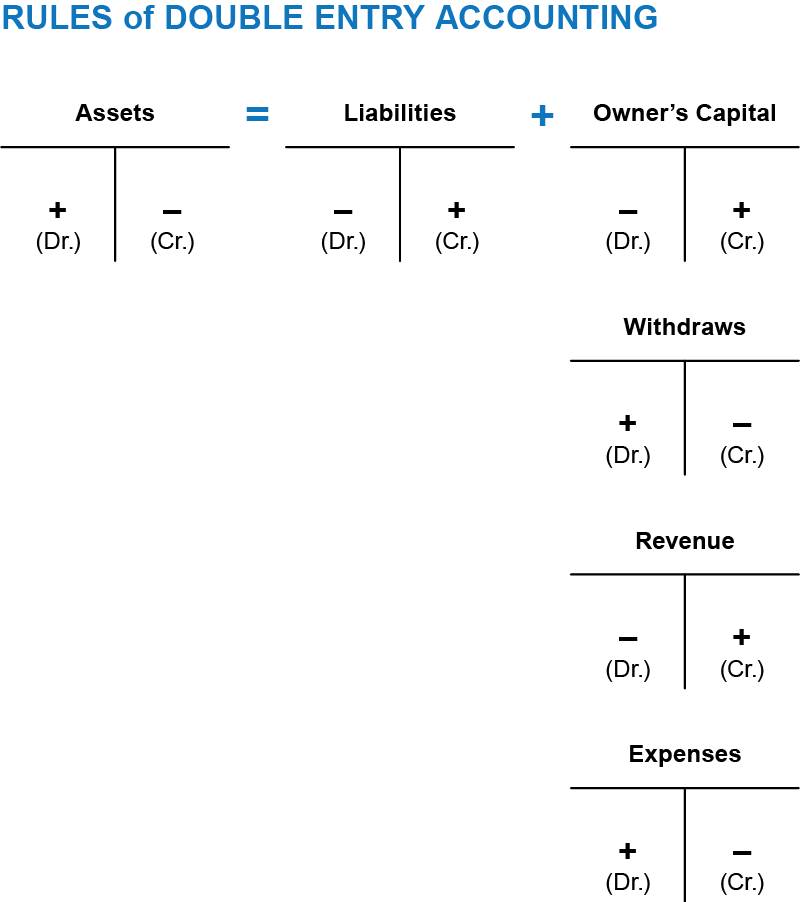

The type of account determines whether an increase or a decrease in a particular transaction is represented by a debit or credit. For financial transactions that affect assets, dividends, and expenses, increases are recorded by debits and decreases by credits. This guideline is shown in the following T-account.

The type of account determines whether an increase or a decrease in a particular transaction is represented by a debit or credit. For financial transactions that affect assets, dividends, and expenses, increases are recorded by debits and decreases by credits. This guideline is shown in the following T-account.

Let’s review some basic terminology:

- Transaction – an external event involving a transfer or exchange between two or more entities or parties.

- Account – an individual record of increases and decreases in specific assets, liabilities, shareholders’ equity or income statement item.

- Journal Entry – the means by which transactions are recorded in the general ledger.

- General Ledger – a chronological listing of transactions and other events expressed in terms of debits and credits to particular accounts.

As accountants, we MUST follow the rules of double-entry accounting. Below is a brief summary of how double-entry accounting works.

|

Increased Recorded By

|

Normal Balance

|

|||

|---|---|---|---|---|

| Account Category | Debit | Credit | Debit | Credit |

| Assets | X | X | ||

| Liabilities | X | X | ||

| Owner's Equity: | ||||

| Owner's Capital | X | X | ||

| Withdraws | X | X | ||

| Revenues | X | X | ||

| Expenses | X | X | ||

Remember:

Remember:

debits = credits

Transaction debits = transaction credits

Sum of all debits posted = sum of all credits posted

For every debit → there is a credit

Always remember the basic accounting equation:

Assets = Liabilities + Shareholder’s Equity

Each economic exchange is referred to as a financial transaction — for example, a transaction occurs when an organization exchanges cash for land and buildings. Incurring a liability in return for an asset is also a financial transaction. Instead of paying cash for land and buildings, an organization may borrow money from a financial institution. The company must repay this with cash payments in the future. The accounting equation provides a system for processing and summarizing these sorts of transactions.

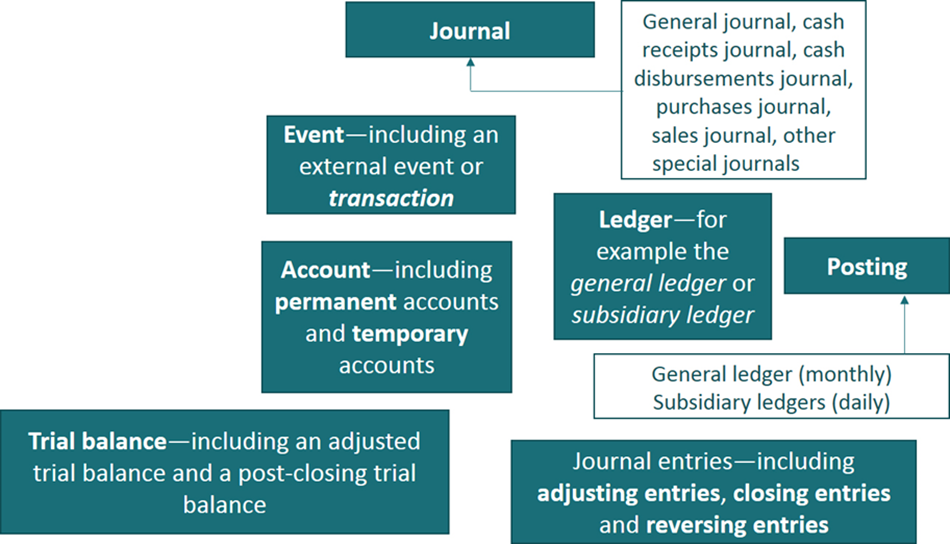

Various definitions of terms used in accounting were provided earlier in the chapter. As a reminder, the accounting process for recording transactions is very methodical and repetitious. The diagram below is a summary of how accounting transactions will flow.

As a continuation of the review of transactions. There are eight basic transactions, the transactions are summarized below:

| Transaction | Comments | Debit | Credit |

|---|---|---|---|

| Purchase an item on "credit" | If an asset is purchased or if the purchase is an "operating" expense | Machinery, equipment, etc., or expenses | Loans payable, notes payable, or accounts payable |

| Purchase an item for cash | If an asset is purchased or if the purchase is an "operating" expense | Machinery, equipment, etc., or expenses | CASH - always |

| Purchase something for cash and credit | If an asset is purchased or if the purchase is an "operating" expense | Machinery, equipment, etc., or expenses | CASH and some liability |

| Pay a liability | If the purchase was an "operating" expense | Accounts payable or loans payable, notes payable | CASH - always |

| Earn revenue for cash | Provided a good or service and received cash | CASH - always | Revenue |

| Earn revenue but charged on account | Provided a good or service - will be paid later | Accounts receivable | Revenue |

| Collect cash from a customer | Customer pays their invoice | CASH - always | Accounts receivable |

| Expenses paid in cash | Paid or an operating item | Expenses | CASH - always |

Another summary of the accounting transactions as they could impact various accounts:

| Account | Debit (Dr.) | Credit (Cr.) | |

|---|---|---|---|

| Assets | Cash | receive cash for some reason such as providing a service, selling an asset or payment of account. | Pay cash for service, or make a payment towards a liability. |

| Accounts Receivable | Sell goods or services on account. | Customer pays balance or makes a payment on account. | |

| Prepaid Items | Purchase an insurance policy or pay for a service in advance. | "Use up" a portion of the service. | |

| Inventory | Add to inventory - purchase of merchandise. | Deduct from inventory - inventory is sold. | |

| Investments | Add or purchase new investments. | Sell or cash in investments. | |

| Land, Building, Equipment | Add or purchase new long term assets. | Sell a piece of land, or sell equipment or building. | |

| Liabilities | Accounts Payable | Pay for goods or services purchased on account. | Purchase goods or services on account. |

| Wages Payable | Pay employees. | Account for wages due to employees. | |

| Unearned Revenue | Perform a service. | Receive cash for services not yet performed. | |

| Bank Loan | Make payments towards the loan. | Purchase a large item and obtain a loan. | |

| Revenue | Sales revenue | An item sold was returned. | Provide a good or service. |

| Expenses | Wages, Rent, Utilities etc. | Good or service was received. | An item purchased was returned. |

| Owner's Equity/ Capital | Withdraws | Owner's investment |

Accountants view financial transactions as economic events that change components within the accounting equation. These changes are usually triggered by information contained in source documents (such as sales invoices and bills from creditors) that can be verified for accuracy.

If one item within the accounting equation is changed, then another item must also be changed to balance it. In this way, the equality of the equation is maintained. For example, if there is an increase in an asset account, then there must be a decrease in another asset or a corresponding increase in a liability or equity account. This equality is the essence of double-entry accounting. The equation itself always remains in balance after each transaction. The operation of double-entry accounting is illustrated in the following section, which shows 10 transactions of Big Dog Carworks Corp. for January Y5.

Transactions summary:

- Issued share capital for $10,000 cash.

- Received a bank loan for $3,000.

- Purchased equipment for $3,000 cash.

- Purchased a truck for $8,000; paid $3,000 cash and incurred a bank loan for the balance.

- Paid $2,400 for a comprehensive one-year insurance policy effective January 1.

- Paid $2,000 cash to reduce the bank loan.

- Received $400 as an advance payment for repair services to be provided over the next two months as follows: $300 for February, $100 for March.

- Performed repairs for $8,000 cash and $2,000 on credit.

- Paid a total of $7,100 for operating expenses incurred during the month; also incurred an expense on account for $700.

- Dividends of $200 were paid in cash to the only shareholder, Bob Baldwin.

The transactions above are summarized below.

| Big Dog Carworks Transactions | |||||

| Effect on the Account Equation | |||||

|---|---|---|---|---|---|

| Transaction Number | Date | Description of Transaction | Assets | Liabilities | Equity |

| 1 | Jan. 1 | Big Dog Carworks Corp. issued 1,000 shares to Bob Baldwin, the owner or shareholder, for $10,000 cash.

The asset Cash is increased while the equity item Share Capital is also increased. The impact on the equation is: CASH SHARE CAPITAL |

+10,000 |

+10,000 | |

| 2 | Jan. 2 | Big Dog Carworks Corp. borrowed $3,000 from the bank and deposited the cash into the business’s bank account.

The asset Cash is increased and the liability Bank Loan is also increased. The impact on the equation is: CASH BANK LOAN |

+3,000 |

+3,000 | |

| 3 | Jan. 2 | The corporation purchased $3,000 of equipment for cash.

The is an increase of the asset Equipment and a decrease to another asset, Cash. The impact on the equation is: EQUIPMENT CASH |

+3,000 -3,000 |

||

| 4 | Jan. 2 | The corporation purchased a tow truck for $8,000, paying $3,000 cash and incurring and additional bank loan for the balance.

The asset Cash is decreased which the asset Truck is increased and the liability Bank Loan is also increased. The impact on the equation is: CASH TRUCK BANK LOAN |

-3,000 +8,000 |

+5,000 | |

| 5 | Jan. 5 | Big Dog Carworks Corp. paid $2,400 for a one-year insurance policy, effective January 1.

Here the asset Prepaid Insurance is increased and the asset Cash is decreased. The impact on the equation is: PREPAID INSURANCE CASH Since the one-year period will not be fully used at January 31 when financial statements are prepared, the insurance cost is considered to be an asset at the payment date. The transaction does not affect liabilities or equity. |

+2,400 -2,400 |

||

| 6 | Jan. 10 | The corporation paid $2,000 cash to the bank to reduce the loan outstanding.

The asset Cash is decreased and there is a decrease in the liability Bank Loan. The impact on the equation is: BANK LOAN CASH |

-2,000 |

-2,000 |

|

| 7 | Jan. 15 | The corporation received $400 as an advance payment from a customer for services to be performed in the future.

The asset Cash is increased by $400 and liability, Unearned Revenue, is also increased since the revenue has not been earned as of January 15. It will be earned when the work is performed in the future. At January 31, these amounts are repayable to customers if the work is not done (and thus a liability). The impact on the equation is: CASH UNEARNED REVENUE |

+400 |

+400 | |

| 8 | Jan. 20 | Automobile repairs of $10,000 were made for a customer; $8,000 of repairs were paid in cash and $2,000 of repairs will be paid in the future.

Cash and Accounts Receivable assets of the corporation increase. The repairs are a revenue; revenue causes an increase in net income and an increase in net income causes an increase in equity. The impact on the equation is: CASH ACCOUNTS RECEIVABLE REPAIR REVENUE This activity increases assets and net income. |

+8,000 +2,000 |

+10,000 |

|

| 9 | Jan. 31 | The corporation paid operating expenses for the month as follows: $1,600 for rent; $3,500 for salaries; and $2,000 for supplies expense. The $700 for truck operating expenses (e.g., oil, gas) was on credit.

There is a decrease in the asset Cash. Expenses cause net income to decrease and a decrease in net income causes equity to decrease. There is an increase in the liability Accounts Payable. The impact on the equation is: RENT EXPENSE SALARIES EXPENSE SUPPLIES EXPENSE TRUCK OPERATING EXPENSE CASH ACCOUNTS PAYABLE |

-7,100 |

+700 |

-1,600 -3,500 -2,000 -700 |

| 10 | Jan. 31 | Dividends of $200 were paid in cash to the only shareholder, Bob Baldwin.

Dividends cause retained earnings to decrease. A decrease in retained earnings will decrease equity. The impact on the equation is: DIVIDENDS CASH |

-200 |

-200 |

|