Chapter 11

Solutions

Exercise 11.1

The items below are identified as capitalized as an intangible asset or expensed, with the account each item would be recorded to.

- Expense as research and development expense

- Capitalize if the development phase criteria for capitalization are all met; else expense

- If reporting under IFRS, then capitalize the borrowing costs if the development phase criteria for capitalization are all met; else expense; if reporting under ASPE, then a policy choice exists for both borrowing costs and research and development costs

- Expense as salaries and wages expense

- Expense as marketing expenses

- Capitalize as part of the patent asset amount

- Expense as research expenses

- Expense to salaries, travel etc. as incurred

- Capitalize as part of the patent asset amount

- Capitalize as part of the software asset amount

- Expense as training expenses

- Capitalize as part of the software asset amount

- Organization expense

- Operating expense

- Capitalized to the franchise asset

- Under IFRS, will be capitalized only if the development costs meet all six development- phase criteria for capitalization; under ASPE, may be capitalized or expensed, depending on company’s policy when it meets the six criteria in the development stage

- Capitalized to the patent asset

- Capitalized to the patent asset

- Capitalized to the copyright

- Capitalized as development costs only if they meet all six development phase criteria for capitalization.

- Expensed to research and development expenses

- Expensed on the income statement

- Under IFRS, borrowing costs that are directly attributable to project that meet the six development phase criteria are capitalized; under ASPE, interest costs directly attributable to the project that meet the six development phase capitalization criteria can be either capitalized or expensed as set by the company’s policies

- Under IFRS, will be capitalized to the intangible asset only if the development costs meet all six development-phase criteria for capitalization

- Expensed to research and development expenses

- Expensed to interest expenses

- Expensed to research and development expenses

Exercise 11.2

- Intangible assets likely include:

- purchased trademark Aromatica Organica and its related internet domain name

- purchased patented soap recipes

- expenditures related to infrastructure and graphical design development of Harman’s unique website through which the retailers review the product offerings and place their orders.

- The majority of Harman’s assets are intangible. They include the Aromatica Organica trademark, the patented soap and oil recipes, and the company’s own product and ordering website. The intangible assets help to protect the revenues from competitor companies, so Harman can sell a unique product with a specific brand name that customers recognize for its fine quality and through a unique website developed by Harman.

- The intangible assets meet the definition of an asset because they involve past and present economic resources for which there are probable future economic benefits that are obtained and controlled by Harman. Recording intangible assets on the company’s SFP/BS provides users with relevant and faithfully representative information about the company’s expected future economic benefits, as well as financial statements that are complete and free from error or bias.

Exercise 11.3

Jan 1 Carrying value

Sept 1 Legal fees

Total amortization for 2020

288,000

42,000

330,000

÷ 14 years

÷ (4 months ÷ 160 months)*

Amortization

= 20,571

= 1,050

21,621

* September 1 was the date that the patent was legally upheld thus meeting the definition of an asset subject to amortization. There are 4 months remaining in 2020 starting September 1. If on January 1, 2020 there were 14 years remaining, then as at September 1, 2020, there would be 13 years + 4 months remaining. Converting this to months is 13 × 12 = 156 months + 4 months = 160 months. For 2020, there are 4 months to year- end to amortize the legal fees, so 4 ÷ 160 months would be the prorated amount of the legal fees capitalized for 2020.

Carrying amount as at Dec 31, 2020: 330,000 − 21,621 = $308,379

The accounting for the research expense of $140,000 is to be expensed when incurred because it can only be recognized from the development phase of an internal project when the six criteria for capitalization are met.

Exercise 11.4

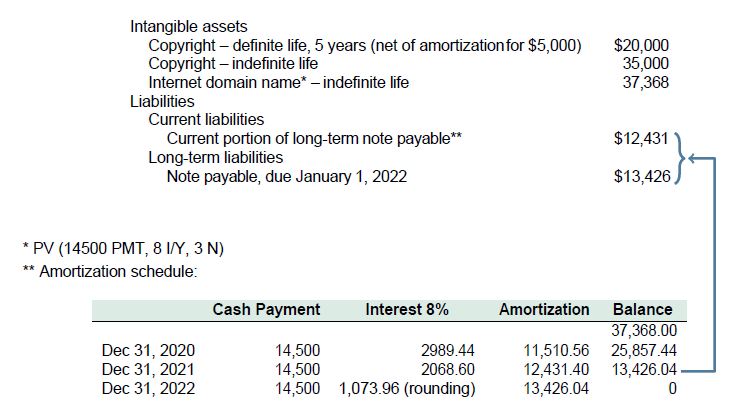

(Partial SFP/BS):

(Partial income statement):

(Partial income statement):

Amortization expense ($25,000 ÷ 5 years) $5,000

Note – item (b), purchased copyright and item (c), purchased Internet domain name have indefinite useful lives so they would not be amortized.

Exercise 11.5

-

Under ASPE, Trembeld has the option either to expense all costs as incurred or to recognize the costs as an internally generated intangible asset when the six development phase criteria for capitalization are met. If Trembeld expenses all costs as incurred, they will be expensed as research and development expenses.

Research and development expense* 634,000

*$180,000 + 64,000 + 270,000 + 86,000 + 25,400 + 8,600

If Trembeld chooses, it can capitalize all costs incurred after April 1. The costs incurred prior to April 1 must be expensed as research and development expenses.

Intangible assets – development costs*

Research and development expense ($180,000 + $64,000)

390,000

244,000

*$270,000 + 86,000 + 25,400 + 8,600 = $390,000

Note: Under ASPE, once interest costs directly attributable to the acquisition, construction, or development of an intangible asset meet the six criteria to be capitalized, they may be capitalized or expensed depending on the company’s accounting policy for borrowing costs.

- If Trembeld followed IFRS, all costs associated with the development of internally generated intangible assets would be capitalized when the six development phase criteria for capitalization are met. The costs incurred prior to the date the required criteria were met would be expensed as research and development expense.

Intangible assets – development costs*

Research and development expense ($180,000 + $64,000)

390,000

244,000

*$270,000 + 86,000 + 25,400 + 8,600 = $390,000

Exercise 11.6

-

Under ASPE

Recoverability test:

The undiscounted future cash flows of $152,000 < the carrying amount $100,500; therefore the asset is impaired.

The impairment loss is calculated as the difference between the asset’s carrying amount $100,500 and fair value $55,000.

In this case, the undiscounted future cash flows ($152,000) > Carrying amount ($100,500), therefore the asset is not impaired.

-

Under IFRS

If carrying amount $100,500 > recoverable amount $115,000 (where recoverable amount is the higher of value in use $115,000 and fair value less costs to sell $50,000), the asset is impaired.

The impairment loss is calculated as the difference between carrying amount $100,500 and recoverable amount $115,000.

In this case, the carrying amount $100,500 is < the recoverable amount of $115,000 so there is no impairment loss.

-

Under ASPE, for indefinite-life intangible assets:

If the carrying amount $100,500 > the asset’s fair value $55,000, then the asset is impaired.

The impairment loss is calculated as $45,500 ($100,500 − $55,000).

Under IFRS, there is no impairment loss as the carrying amount of $100,500 < the recoverable amount of $115,000 (where recoverable amount is the higher of value in use and fair value less costs to sell).

Exercise 11.7

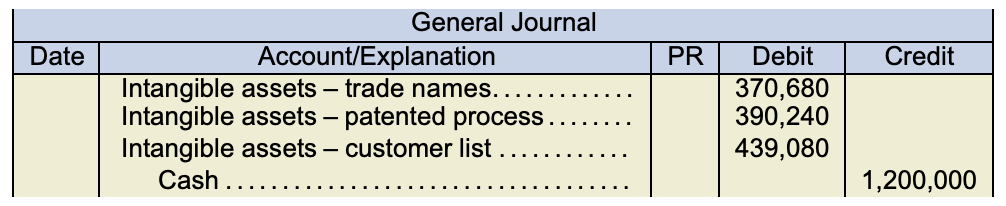

| Fair Value | % of Total | × Cost = | Recorded Amount (rounded) | |

|---|---|---|---|---|

| Trade name | $380,000 | 30.89% | $1.2 million | $370,680 |

| Patented process | 400,000 | 32.52% | $1.2 million | 390,240 |

| Customer list | 450,000 | 36.59% | $1.2 million | 439,080 |

| $1,230,000 | $1.2 million |

Note: The asset purchase is to be capitalized using the relative fair value method and assets separately reported so that the amortization expense can be separately determined for each based on their respective useful life.

Exercise 11.8

- At December 31, 2020, Bartek reports the patent:

Intangible assets

Patent

Accumulated amortization*

$800,000

425,000

$375,000

*Amortization 2017 to 2019: $800,000 ÷ 8 × 3 year = $300,000

Amortization for 2020:

(Remaining carrying value-revised residual value) ÷ (Remaining useful life)

(800,000-300,000-0 residual value) ÷ (7-3) = 125,000

Accumulated amortization 2017 to 2020: (300,000 + 125,000) = $425,000

-

The amount of amortization of the franchise for the year ended December 31, 2019, is $25,000: ($500,000 ÷ 20 years). Reason: Bartek should amortize the franchise over 20 years which is the period of the identifiable cash flows. Even though the franchise is considered as “perpetual,” the company believes it will generate future economic benefits for only the next 20 years.

-

Unamortized development costs would be reported as $50,000 ($250,000 net of $200,000 accumulated amortization) at December 31, 2020 on the SFP/BS.

Amortization for 2017 to 2020: $250,000 ÷ 5 years × 4 years = $200,000

Exercise 11.9

-

Cash purchase price

Fair value of assets

Less liabilities (carrying value = fair value)

Fair value of net assets

Value assigned to goodwill

$1,160,000

(460,000)

$863,000

700,000

$163,000

-

Under IFRS, the recoverable amount of the CGU of $1,850,000 (which is the greater of the fair value, less costs to sell $1,600,000, and the value in use $1,850,000) is compared with its carrying amount $1,925,000 to determine if there is any impairment.

The goodwill is impaired because carrying amount of the CGU $1,925,000 > recoverable amount of the CGU $1,850,000.The goodwill impairment loss is $75,000 ($1,925,000 − $1,850,000). A reversal of an impairment loss on goodwill is not permitted.

-

Under ASPE, goodwill is assigned to a reporting unit at the acquisition date. Goodwill is tested for impairment when events or changes in circumstances indicate impairment may exist. An impairment exists if the carrying amount of the reporting unit $1,925,000 exceeds the fair value of the reporting unit $1,860,000. In this case there is an impairment loss of $65,000 ($1,925,000 − $1,860,000). A reversal of an impairment loss on goodwill is not permitted.

Exercise 11.10

| Item | Classification |

|---|---|

| a. | Goodwill as a separate line item on the SFP/BS |

| b., c., d. | Research costs, organization cost, and the annual franchise fee would be classified as operating expenses |

| e., f., g., h. | Cash, accounts receivable, notes receivable due within one year from balance sheet date and prepaid expenses would be classified as current assets |

| i. | Intangible assets, if development criteria met at the acquisition date |

| j. | Non-current assets in the tangible property, plant, and equipment section. (Some accountants classify them as intangible assets on the basis that the improvements revert to the lessor at the end of the lease and therefore are more of a right than a tangible asset.) |

| k. | Intangible assets |

| l. | Intangible assets |

| m. | Investments section on the SFP/BS |

| n. | Intangible assets |

| o. | Discount on notes payable is shown as a deduction from the related notes payable on the SFP/BS as a liability |

| p., q. | Long-term assets in the tangible property, under plant, and equipment section |

| r. | Intangible asset |

| s. | Intangible asset |

| t. | Goodwill as a separate line item on the SFP/BS |

| u. | Expensed as part of research and development expense. (Development expenses are expensed unless all six criteria for capitalization are met.) |

Exercise 11.11

- The determination of useful life by management can have a material effect on the balance sheet as well as on the income statement. The following are the variables to consider when determining the appropriate useful life for a limited-life intangible.

- The legal life for a patent in Canada is twenty years but management can deem a shorter useful life based on

- the expected use of the patent

- economic factors such as demand and competition

- the period over which its benefits are expected to be provided.

- The estimated useful life of the patent should be based on neutral and unbiased consideration of the factors above, which requires a degree of professional judgment.

- The legal life for a patent in Canada is twenty years but management can deem a shorter useful life based on

-

December 31, 2019:

Amortization: $25,000 ÷ 20 = $1,250

Carrying amount: $25,000 − $1,250 = $23,750

December 31, 2020:

Amortization: $1,250 + ($35,000 ÷ 18.5 × (6 ÷ 12)) = $2,196 (rounded)

Carrying amount: $23,750 + $35,000 − $2,196 = $56,554

-

Dec 31, 2019 carrying amount from (b): $23,750

2020 amortization: ($23,750 ÷(15 − 1)) + ($35,000 ÷(15 − 1.5)) × (6 ÷ 12) = $2,993 (rounded)

Carrying amount: $23,750 + $35,000 − $2,993 = $55,757

-

If it has an indefinite life, then do not amortize. If classified as indefinite life, management must review useful life annually to ensure that conditions and circumstances continue to support the indefinite life assessment. Any change in useful life is to be accounted as a change in estimate, which is accounted for prospectively. Also, management would have to test annually for impairment or whenever indicators of such a possibility exist.

Exercise 11.12

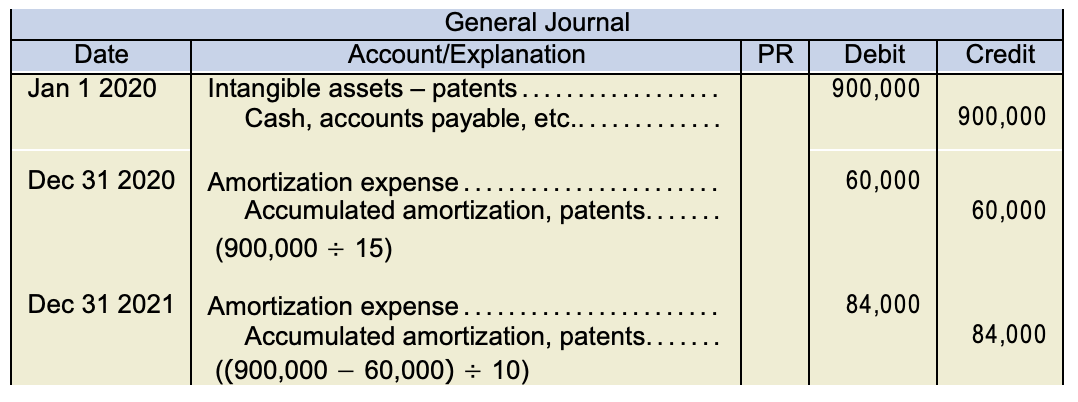

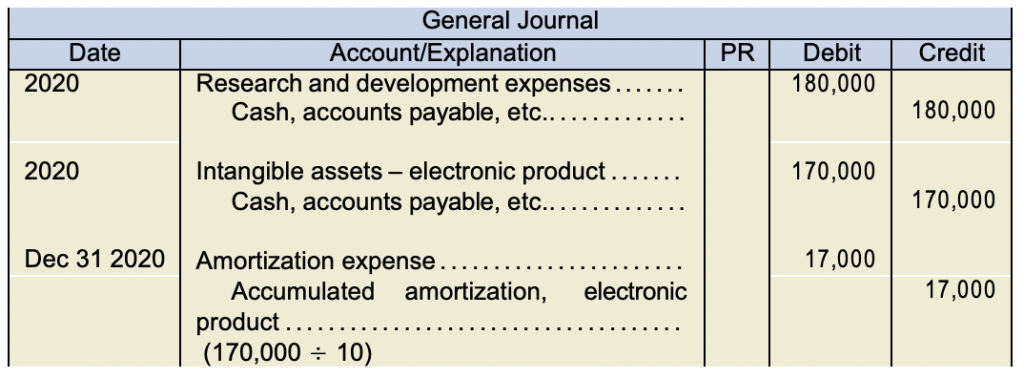

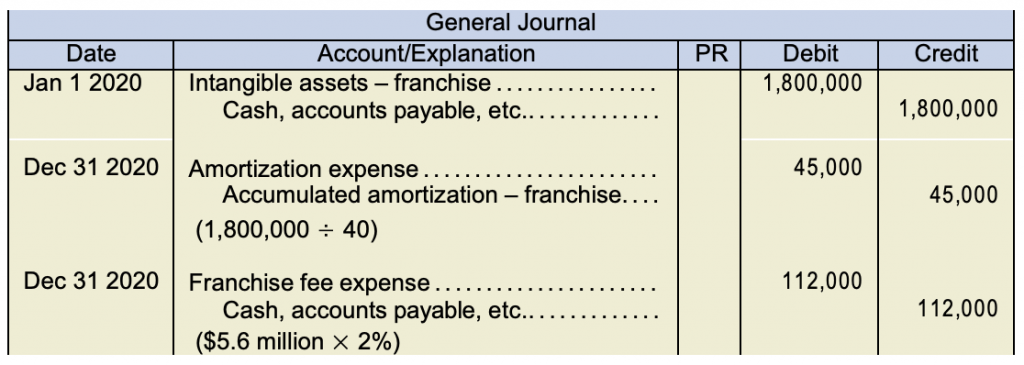

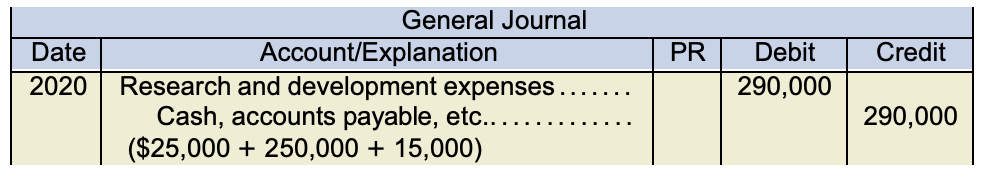

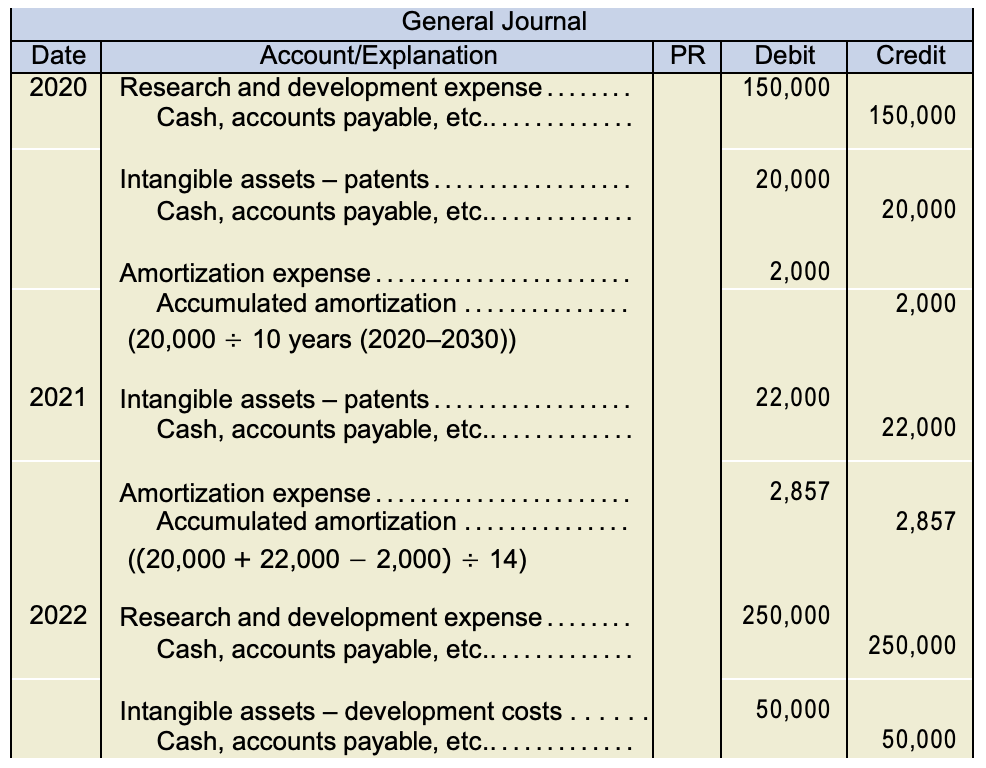

- Situation (i) Journal Entries:

Situation (ii) Journal Entries:

Situation (iii) Journal Entries:

Situation (iv) Journal Entries:

- Partial income statement:

Hilde Co.

Statement of Income (partial)

For the Year Ending December 31, 2020Revenue from franchise $5,600,000 Expenses Research and development expenses ($180,000 + 290,000) $470,000 Franchise fee expense 112,000 Amortization expense ($60,000 + 17,000 + 45,000) 122,000 704,000 Income from operations before taxes 4,896,000 Income tax expense 1,321,920 Net income $3,574,080 Partial balance sheet:

Hilde Co.

Balance Sheet (partial)

As at December 31, 2020Intangible assets: Intangible assets – patents $900,000 Accumulated amortization 60,000 $840,000 Intangible assets – electronic product 170,000 Accumulated amortization 17,000 153,000 Intangible assets – franchise 1,800,000 Accumulated amortization 45,000 1,755,000 Total intangible assets $2,748,000 Note: The balance sheet reporting requirement is to disclose the net amount for each intangible asset separately, its related accumulated amortization, any accumulated impairment losses, and a total for net intangible assets. With these requirements in mind, an alternative reporting format for the balance sheet would be to report the net amounts for each intangible asset as shown in the right-hand column with disclosure of the accumulated amortization, any accumulated impairment losses and the net amount for each intangible asset in an additional schedule in the notes to the financial statements.

- Under IFRS, if the costs meet the six development phase criteria for capitalization, then they are to be capitalized. Under ASPE, costs that meet the six development phase criteria for capitalization may either be capitalized or expensed, depending on the entity’s accounting policy. In this case, Hilde’s policy is to capitalize costs that meet the criteria; therefore, the accounting entries would be the same as the solution above.Under IFRS there is an option to use the revaluation model for subsequent measurement of intangible assets after acquisition if there is an active market for the intangible assets. Refer to the chapter on property, plant, and equipment for details about this model. In addition, under IFRS, an assessment of estimated useful life is required at each reporting date.

-

Impairment testing for limited-life assets under ASPE:

Limited-life intangible assets would be tested for possible impairment whenever events and circumstances indicate the carrying amount may not be recoverable. The carrying amount of the asset is compared to undiscounted future net cash flows of the asset, to determine if the asset is impaired. If impaired, the difference between the asset’s carrying amount and its fair value will be the impairment amount. Under ASPE, an impairment loss for intangible assets may not be reversed.

Impairment testing for limited-life intangibles under IFRS:

At the end of each reporting period, the asset is to be assessed for possible impairment. If impairment is suspected, and the carrying amount is higher than the recoverable amount (which is the higher of the value in use, and the fair value less costs to sell), the asset is impaired. The impairment loss is the difference between the asset’s carrying amount and its recoverable amount. Under IFRS, an impairment loss may be reversed in the future, although the reversal is limited to what the asset’s carrying amount would have been had there been no impairment.

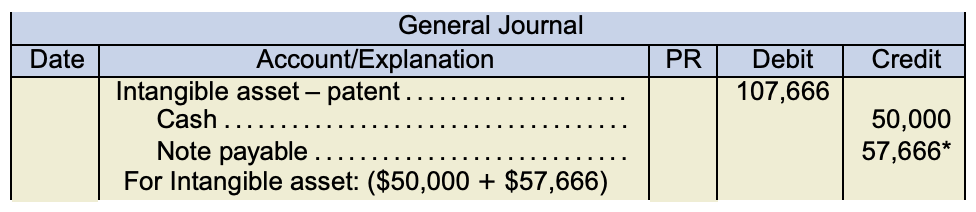

Exercise 11.13

Entry:

* Present value calculation:

* Present value calculation:

PV = (4,800** PMT, 9 I/Y***, 5 N, 60,000 FV)

PV = $57,666 (rounded)

** $60,000 × 8%

*** PV calculations use the market rate while the interest payment of $4,800 uses the stated rate.

Exercise 11.14

- Under IFRS, costs associated with the development of internally generated intangible assets are capitalized when the six specific criteria for capitalization are met in the development stage. The $250,000 must be expensed as it was incurred before the future benefits were reasonably certain. Costs incurred after the six specific criteria for capitalization are met, are capitalized. The $50,000 costs incurred indicates the company’s intention and ability to generate future economic benefits. As a result, the $50,000 would be capitalized as development costs. The $50,000 capitalized costs would be amortized over periods benefiting after manufacturing begins.

Exercise 11.15

-

Impairment for limited-life under IFRS:

Carrying value: 1,000,000

Recoverable amount: higher of value in use and fair value less costs to sell = higher of [$1,100,000 and ($1,000,000 − 45,000 = 955,000)] = 1,100,000

Carrying value is less than 1,100,000, therefore the franchise is not impaired.

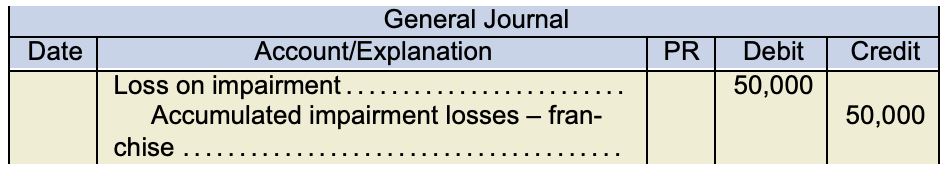

-

Carrying value: 1,000,000

Recoverable amount: 950,000

Carrying value is more than the recoverable amount therefore the franchise is impaired by $50,000.

-

Carrying value: 1,000,000

Recoverable amount: higher of value in use and fair value less costs to sell = higher of [$1,100,000 and ($1,350,000 − 45,000 = 1,305,000)] = 1,305,000

Carrying value is less than 1,305,000, therefore the franchise is not impaired.

-

Under IFRS, indefinite-life intangible assets are tested for impairment annually (even if there is no indication of impairment), which is the same as was done for limited-life intangible assets. So the answers in parts (a) to (c) will not change because the franchise has an unlimited life.

-

Under ASPE for limited-life intangibles, if there is reason to suspect impairment, then management can complete an assessment of the franchise. If the carrying value is greater than the undiscounted cash flows then it is impaired. The impairment amount is the difference between the carrying value and the fair value.

Part (a) Carrying value: 1,000,000

Undiscounted future cash flow = 1,200,000

Carrying value is less than 1,200,000, therefore the franchise is not impaired.

Part (b) Carrying value: 1,000,000

Recoverable amount (discounted future cash flows) = 950,000

Carrying value is more than the recoverable amount therefore the franchise is impaired by $50,000.

Part (c) Fair value changed to $1.35 million. Fair value is not relevant for ASPE to assess recoverability, so the answer does not change from part (b).

-

Part (a) Under ASPE, indefinite-life intangible assets are tested for impairment when circumstances indicate that the asset may be impaired same as with limited-life intangibles. However, the test differs from the test for limited-life assets. Here, a fair value test is used, and an impairment loss is recorded when the carrying amount exceeds the fair value of the intangible asset.

Carrying value: 1,000,000

Fair value: 1,000,000

Carrying value is equal to the fair value for 1,000,000; therefore, the franchise is not impaired.

Part (b) Under ASPE, the recoverable amount refers to undiscounted future cash flows, which does not affect the impairment test for indefinite-life intangible assets, which compares the carrying value to the fair value of the asset. The fair value remains at 1,000,000; therefore the asset is not impaired.

Part (c) Carrying value: 1,000,000

Fair value: 1,350,000

Carrying value is less than the fair value for 1,350,000; therefore the franchise is not impaired under ASPE for an indefinite-life asset.

Exercise 11.16

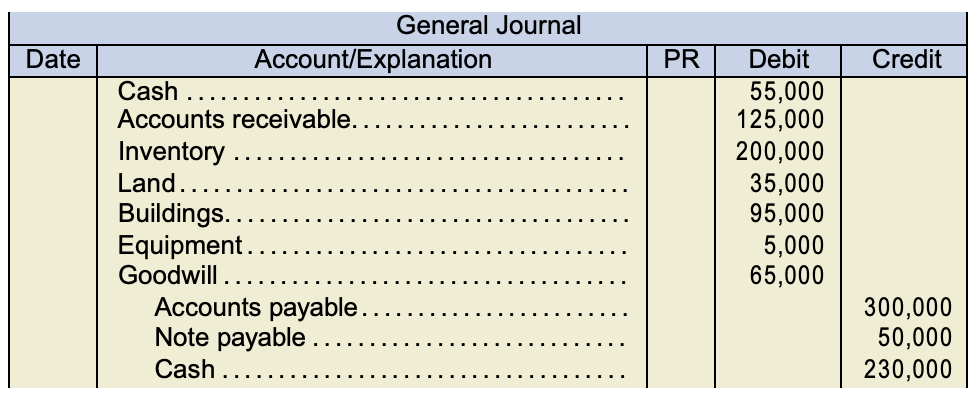

- Payment of total consideration of $280,000 for Candelabra resulted in payment for goodwill of $65,000. Goodwill is defined as an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified or separately recognized. In paying for goodwill of $65,000, Boxlight may have considered the value of Candelabra’s established customers for repeat business, the company’s reputation, the competence and ability of its management team to strategize effectively, its credit rating with its suppliers, and whether the company has highly qualified and motivated employees. Together, these could make the value of the business greater than the sum of the fair value of its net identifiable assets.

-

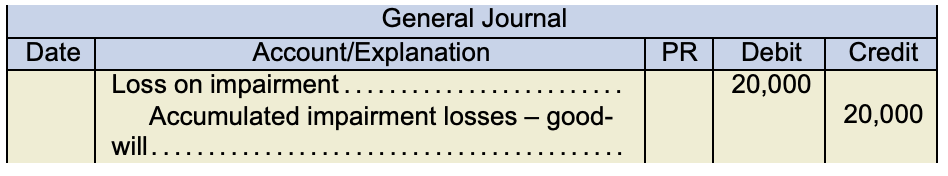

Carrying value

Fair value

Impairment amount

$200,000

180,000

20,000

-

Carrying value: 180,000

Recoverable amount: higher of value in use and fair value less costs to sell = higher of [$170,000 and ($160,000 − 10,000 = 150,000)] = 170,000

Carrying value is greater than 170,000; therefore, the franchise is impaired by $10,000 (180,000 − 170,000).

Note: Had the impairment amount exceeded the $65,000 goodwill carrying value, the amount of the difference would be allocated to the remaining net identifiable assets on a prorated basis.

-

For part (c), reversal of goodwill if impairment losses exist is not permitted under ASPE. For part (d), reversal of goodwill impairment losses is not permitted under IFRS.

Exercise 11.17

1. Dufferin follows IFRS

| In order to determine if there is impairment, compare carrying value to the recoverable amount: | ||||||

| Carrying value | 435,600 | |||||

| Recoverable amount (higher of): | ||||||

| Value in use | 410,200 | |||||

| Fair value | 378,500 | |||||

| Therefore, recoverable amount | 410,200 | |||||

| Impairment | 25,400 | |||||

| Dec 31, Y8 | Loss on impairment | 25,400 | ||||

| Accumulated impairment loss - patent | 25,400 | |||||

2. Dufferin follows APSE

| In order to determine impairment, compare the carrying value and undiscounted cash flows. | |

| Carrying value | 435,600 |

| Undiscounted cash flow (UDCF) | 445,700 |

| Since UDCF > Carrying value, there is NO impairment. | |

| no entry required | |

Exercise 11.18

1. Centralia follows IFRS

a. In order to determine impairment, we must compare the carrying value with the recoverable amount:

| Carrying value | $2,265,000 | |||||

| Recoverable amount (higher of): | ||||||

| Fair Value | 1,759,600 | |||||

| Value in use | 1,549,700 | |||||

| Therefore, the recoverable amount is | 1,759,600 | |||||

| Impairment | 505,400 | |||||

| Dec 31, Y5 | Loss on impairment | 505,400 | ||||

| Accumulated impairment loss - trademark | 505,400 | |||||

b. Amortization expense (using straight-line)

| Revised carrying value (at Dec 31, Y5) | 1,759,600 | ||||

| Remaining useful life | 10 | ||||

| Amortization | 175,960 | ||||

| Dec 31, Y6 | Amortization expense | 175,960 | |||

| Accumulated amortization | 175,960 | ||||

c. Recovery of impairment

| Recovery of impairment | |||||

| Fair value (at Dec 31, Y6) | 2,190,000 | ||||

| Carrying value (at Dec 31, Y6) | 1,583,640 | ($1,759,600 - $175,960) | |||

| Potential recovery (have to check) | 606,360 | ||||

| To check the maximum amount, we must look at what the trademark would be without impairment | |||||

| Original carrying value | $2,265,000 | ||||

| Remaining useful life | 10 | ||||

| Amortization | 226,500 | ||||

| Carrying value (max recovery) | 2,038,500 | ||||

| We cannot recover to the fair value of $2,190,000 - max amount to recover to is $2,038,500: | |||||

| Carrying value (max recovery) | 2,038,500 | ||||

| Carrying value (at Dec 31, Y6) | 1,583,640 | ||||

| Recovery | 454,860 | ||||

| Dec 31, Y6 | Accumulated impairment loss - trademark | 454,860 | |||

| Recovery of loss from impairment | 454,860 | ||||

2. Centralia follows ASPE

a. In order to determine if there is impairment, we must compare undiscounted cash flow to carrying value.

| Carrying value | $2,265,000 | ||||

| Undiscounted cash flows (UDCF) | $1,965,300 | ||||

| Since UDCF < Carrying value, there is impairment | |||||

| To determine the amount of impairment, compare the carrying value to the fair value: | |||||

| Carrying value | $2,265,000 | ||||

| Fair value | $1,759,600 | ||||

| Impairment is $505,400 ($2,265,000 - $1,759,600) | |||||

| Dec 31, Y5 | Loss on impairment | 505,400 | |||

| Accumulated impairment loss - trademark | 505,400 | ||||

b. Amortization expense (using straight-line)

| Revised carrying value (at Dec 31, Y5) | 1,759,600 | ||||

| Remaining useful life | 10 | ||||

| Amortization | 175,960 | ||||

| Dec 31, Y6 | Amortization expense | 175,960 | |||

| Accumulated amortization | 175,960 | ||||

c. ASPE does not allow reversal of impairment

No entry

Exercise 11.19

1. Goodwill calculation

| Price paid for net assets | 546,000 |

| Fair value of net assets purchased | 356,900 |

| Goodwill | 189,100 |

| Remember, goodwill is not amortized, it is only tested for impairment. | |

2. Assume MVR follows IFRS:

a. Journal entry

| Carrying value of goodwill | 189,100 | |||||

| Recoverable amount (higher of): | ||||||

| Fair value | 164,230 | |||||

| Value in use | 168,960 | |||||

| Therefore, recoverable amount is | 168,960 | |||||

| Impairment | 20,140 | |||||

| Dec 31, Y4 | Loss on impairment | 20,140 | ||||

| Accumulated impairment loss - goodwill | 20,140 | |||||

b. Reversal of goodwill impairment loss is NOT permitted under IFRS.

3. Assume MVR follows ASPE:

a. Journal entry

| Compare carrying value to undiscounted cash flow: | |||||

| Carrying value | 189,100 | ||||

| Undiscounted cash flow (UDCF) | 175,400 | ||||

| Since UDCF < Carrying value, the is impairment | |||||

| Carrying value | 189,100 | ||||

| Fair value | 164,230 | ||||

| 24,870 | |||||

| Dec 31, Y4 | Loss on impairment | 24,870 | |||

| Accumulated impairment loss - goodwill | 24,870 | ||||

b. Reversal of impairment losses are NOT permitted under IFRS.