Chapter 9

Solutions

Exercise 9.1

The following costs should be capitalized with respect to this equipment:

| Equipment | Costs |

|---|---|

| Cash price paid, net of $1,600 discount, excluding $3,900 of recoverable tax | $ 78,400 |

| Freight cost to ship equipment to factory | 3,300 |

| Direct employee wages to install equipment | 5,600 |

| External specialist technician needed to complete final installation | 5,600 |

| External specialist technician needed to complete final installation | 4,100 |

| Materials consumed in the testing process | 2,200 |

| Direct employee wages to test equipment | 1,300 |

| Legal fees to draft the equipment purchase contract | 2,400 |

| Government grant received on purchase of the equipment | (8,000) ______________ |

| Total cost capitalized | 89,300 ______________ |

The recoverable tax should be disclosed as an amount receivable on the balance sheet.

The repair costs, costs of training employees, overhead costs, and insurance cost would all be expensed as regular operating expenses on the income statement.

An alternative treatment for the government grant would be to defer it as an unearned revenue liability and then amortize it on the same basis as the equipment depreciation.

Exercise 9.2

The following costs would be capitalized with respect to the mine:

Direct material

Direct labour

Interest (3,000,000 × 8% × 9 ÷ 12)

Less interest on excess funds

Present value of restoration costs (FV=100,000, I=10, N=10)

Total cost capitalized

$2,200,000

1,600,000

180,000

(30,000)

38,554

3,988,554

Exercise 9.3

With a lump sum purchase, the cost of each asset should be determined based on the relative fair value of that component. The total fair value of the asset bundle is $250,000. Therefore, the allocation of the purchase price would be as follows:

| Specialized lathe | (30,000 ÷ 250,000) × 220,000 = | 26,400 |

|---|---|---|

| Robotic assembly machine | (90,000 ÷ 250,000) × 220,000 = | 79,200 |

| Laser guided cutting machine | (110,000 ÷ 250,000) × 220,000 = | 96,800 |

| Delivery truck | (20,000 ÷ 250,000) × 220,000 = | 17,600 _______________ |

| Total | 220,000 _______________ |

Exercise 9.4

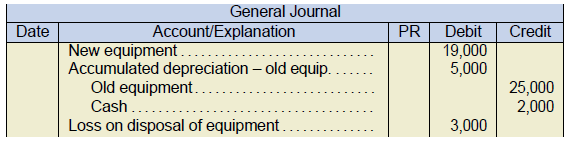

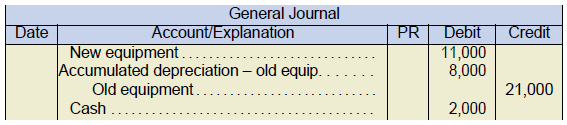

- Prabhu

Zhang

- Prabhu

Zhang

- Prabhu

NOTE: Loss must be recorded, as the asset acquired cannot be recorded at an amount greater than its fair value.

Zhang

Exercise 9.5

Transaction 1:

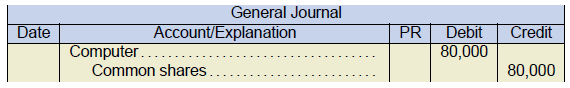

IFRS requires assets acquired in exchange for the company’s shares to be reported at the fair value of the asset acquired. The list price is not relevant, as the salesman has already indicated that this can be negotiated downward. If the $80,000 negotiated price is considered a reliable representation of the fair value of the asset, this amount should be used:

If the $80,000 price is not considered a reliable fair value, then the fair value of the shares given up ($78,750) should be used, as the shares are actively traded.

If the $80,000 price is not considered a reliable fair value, then the fair value of the shares given up ($78,750) should be used, as the shares are actively traded.

Transaction 2:

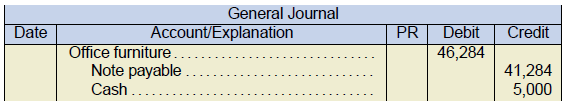

The asset acquired by issuing a non-interest bearing note needs to be reported at its fair value. As the interest rate of zero is not reasonable, based on market conditions, the payments for the asset need to be adjusted to their present value to properly reflect the current fair value of the asset.

The note payable amount represents the present value of a $45,000 payment due in one year, discounted at 9%.

Exercise 9.6

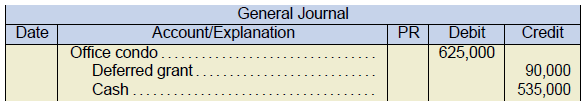

- Deferral Method

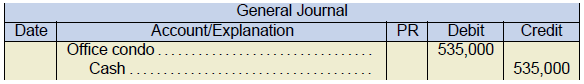

- Offset Method

- The deferral method will result in annual depreciation expense of $625,000 ÷ 30 years = $20,833, with an offsetting annual grant income amount recognized = $90,000 ÷ 30 years = $ 3,000 per year.The offset method will result in an annual depreciation expense of $535,000 ÷ 30 years = $17,833 with no grant income being recognized.The net difference in net income between the two methods is zero.

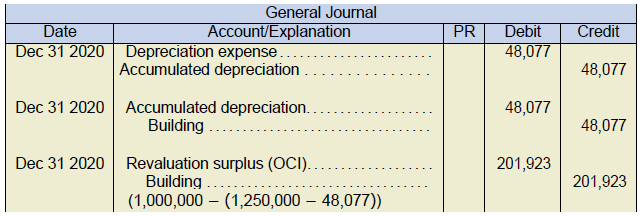

Exercise 9.7

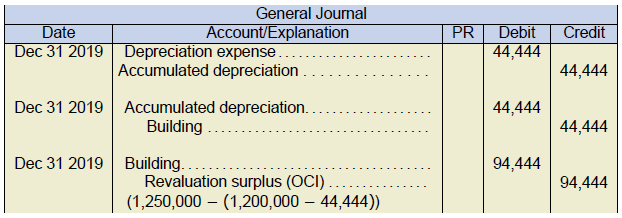

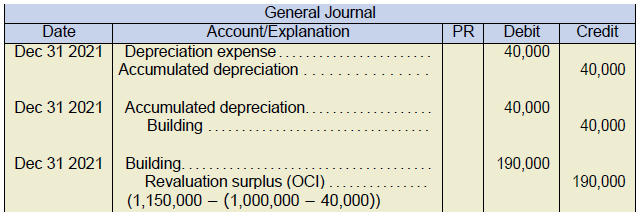

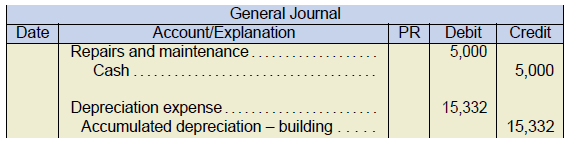

NOTE: Depreciation expense = $1,200,000 ÷ 27 years remaining = $44,444

NOTE: Depreciation expense = $1,200,000 ÷ 27 years remaining = $44,444

NOTE: Depreciation expense = $1,250,000 ÷ 26 years = $48,077

NOTE: Depreciation expense = $1,000,000 ÷ 25 years = $40,000

NOTE: Depreciation expense = $1,000,000 ÷ 25 years = $40,000

Exercise 9.8

Exercise 9.9

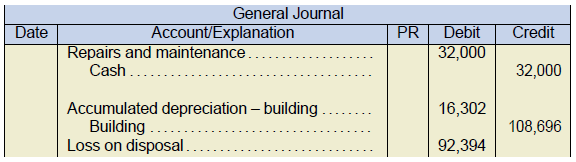

The replacement of the boiler should be treated as the disposal of a separate component. The original cost of the old boiler can be estimated as follows:

The replacement of the boiler should be treated as the disposal of a separate component. The original cost of the old boiler can be estimated as follows:

$125,000 ÷ (1 + 0.15) = 108,696

The old boiler would have been depreciated as part of the building as follows:

108,696 ÷ 40 years = 2,717 per year

2,717 × 6 years (2014–2019) = 16,302

(NOTE: per company policy, no depreciation is taken in the year of disposal)

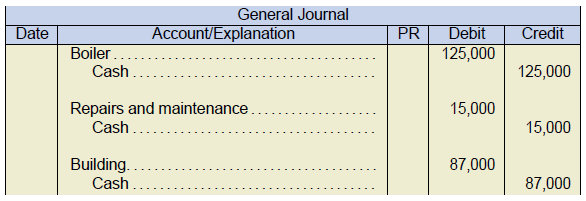

The purchase of the new boiler should be treated as a separate component:

This cannot be identified as a separate component, but it does extend the useful life of the asset, so capitalization is warranted.

This cannot be identified as a separate component, but it does extend the useful life of the asset, so capitalization is warranted.

Original depreciation: $800,000 ÷ 40 years = $20,000 per year

Original depreciation: $800,000 ÷ 40 years = $20,000 per year

Up to the end of 2019 = $120,000 (6 years)

Based on the journal entries above, revised depreciation is calculated as follows:

(800,000 − 120,000 −1 08,696 + 16,302 + 87,000) ÷ (40 − 6 + 10 = 44 years) = 15,332

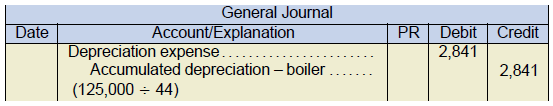

NOTE: the boiler has been depreciated over the same useful life as the building (44 years). As this is a separate component, a different useful life could be determined by management and used instead. Per company policy a full year of depreciation is taken in the year of acquisition.

NOTE: the boiler has been depreciated over the same useful life as the building (44 years). As this is a separate component, a different useful life could be determined by management and used instead. Per company policy a full year of depreciation is taken in the year of acquisition.

Exercise 9.10

| Vehicle (new) | 3,040 | ||

| Accumulated Depreciation | 20,100 | ||

| Vehicle (old) | 22,700 | ||

| Cash | 440 | ||

| Fair value | 3,450 | ||

| Carrying value (cost - accumulated depreciation) | 2,600 | ||

| Potential gain | 850 | ||

| However, since the transaction lacks commercial substance, no gain can be reported | |||

| Value of new vechicle = carrying value of assets given up: | |||

| Carrying value (cost - accumulated depreciation) | 2,600 | ||

| Cash | 440 | ||

| Value of new vehicle | 3,040 | ||

Exercise 9.11

| Equipment (new) | 6,910 | ||

| Accumulated Depreciation | 2,120 | ||

| Loss on trade of machinery | 3,670 | ||

| Equipment (old) | 9,000 | ||

| Cash | 3,700 | ||

| Fair value of equipment traded | 3,210 | ||

| Carrying value (cost - accumulated depreciation) | 6,880 | ||

| Loss (since FV < CV) | 3,670 | ||

| Value of new equipment = fair value of assets given up: | |||

| Fair value of equipment | 3,210 | ||

| Cash | 3,700 | ||

| Value of new vehicle | 6,910 | ||

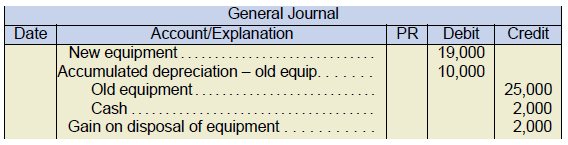

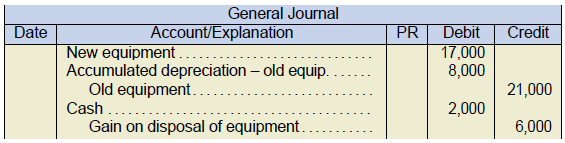

Exercise 9.12

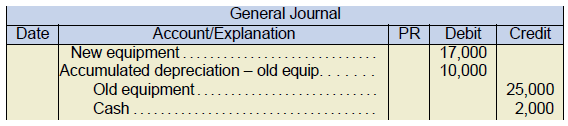

1. Has commercial substance

Kitchener

| Equipment (new) | 28,000 | |||||

| Accumulated Depreciation | 31,250 | |||||

| Equipment (old) | 50,100 | |||||

| Cash | 3,000 | |||||

| Gain on trade of equipment | 6,150 | |||||

| FV of assets given up: | Gain or loss: | |||||

| Equipment | 25,000 | FV of equipment given up | 25,000 | |||

| Cash | 3,000 | CV of equipment given up | 18,850 | |||

| value of new equipment | 28,000 | GAIN (FV > CV) | 6,150 | |||

Waterloo

| Cash | 3,000 | |||||

| Equipment (new) | 25,000 | |||||

| Accumulated Depreciation | 21,990 | |||||

| Loss on trade of equipment | 5,060 | |||||

| Equipment (old) | 55,050 | |||||

| FV of assets given up: | Gain or loss: | |||||

| Equipment | 28,000 | FV of equipment given up | 28,000 | |||

| Cash | -3,000 | CV of equipment given up | 33,060 | |||

| value of new equipment | 25,000 | LOSS (FV < CV) | 5,060 | |||

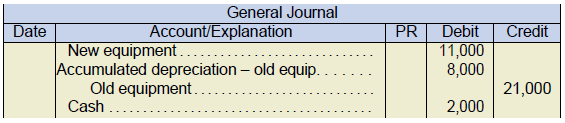

2. Does not have commercial substance

Kitchener

| Equipment (new) | 21,850 | |||||

| Accumulated Depreciation | 31,250 | |||||

| Equipment (old) | 50,100 | |||||

| Cash | 3,000 | |||||

| CV of assets given up: | Gain or loss: | |||||

| Equipment | 18,850 | FV of equipment given up | 25,000 | |||

| Cash | 3,000 | CV of equipment given up | 18,850 | |||

| value of new equipment | 21,850 | GAIN (FV > CV) | 6,150 | |||

| Cannot record a gain - no commercial substance | ||||||

Waterloo

| Cash | 3,000 | |||||

| Equipment (new) | 25,000 | |||||

| Accumulated Depreciation | 21,990 | |||||

| Loss on trade of equipment | 5,060 | |||||

| Equipment (old) | 55,050 | |||||

| CV of assets given up: | Gain or loss: | |||||

| Equipment | 33,060 | FV of equipment given up | 28,000 | |||

| Cash | -3,000 | CV of equipment given up | 33,060 | |||

| value of new equipment | 30,060 | LOSS (FV < CV) | 5,060 | |||

| **NOTE - the FV cannot exceed the FV of the asset ($25,000) | ||||||

Exercise 9.13

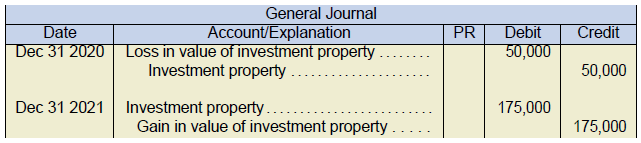

| December 31, Y3 | Investment Property | 360,000 | ||

| Gain in Value of Investment Property | 360,000 | |||

| ($7,060,000 - $6,700,000) | ||||

| December 31, Y4 | Loss in Value of Investment Property | 110,000 | ||

| Investment Property | 110,000 | |||

| ($6,950,000 - 7,060,000) | ||||

| December 31, Y5 | Investment Property | 306,000 | ||

| Gain in Value of Investment Property | 306,000 | |||

| ($7,256,000 - $6,950,000) | ||||

| remember, no depreciation is recorded when the fair value model is used. | ||||

Exercise 9.14

1. Revaluation

| Dec 31, Y4 | Accumulated Depreciation - Buildings | 89,600 | ||

| Buildings | 89,600 | |||

| reverse/close accumulated depreciation to the asset account. | ||||

| Dec 31, Y4 | Revaluation Loss | 47,300 | ||

| Buildings | 47,300 | |||

| revalue to the appraised value ($300,000 CV to $275,000 revaluation value) | ||||

| Dec 31, Y4 | Accumulated Depreciation - Equipment | 54,900 | ||

| Equipment | 54,900 | |||

| reverse/close accumulated depreciation to the asset account. | ||||

| Dec 31, Y4 | Equipment | 9,500 | ||

| Revaluation Surplus - OCI | 9,500 | |||

| revalue to the appraised value ($80,000 to $90,000 revaluation value) | ||||

| Remember, can only have a credit in revaluation surplus, revaluation gain is NOT recorded | ||||

2. Depreciation Expense

| Dec 31, Y5 | Depreciation Expense - Building | 12,800 | ||

| Accumulated Depreciation - Buildings | 12,800 | |||

| 25 years remain (at beginning of Y5 = $320,000 / 25 years) | ||||

| Dec 31, Y5 | Depreciation Expense - Equipment | 8,000 | ||

| Accumulated Depreciation - Equipment | 8,000 | |||

| 10 years remain (at the beginning of Y5 = $80,000 / 10 years) | ||||

Exercise 9.15

| Jan 1, Y3 | Equipment | 200,000 | |||

| Cash | 200,000 | ||||

| record purchase of equipment | |||||

| Dec 31, Y3 | Depreciation Expense - Equipment | 10,000 | |||

| Accumulated Depreciation - Equipment | 10,000 | ||||

| annual straight-line depreciation = $200,000 / 20 years | |||||

| Dec 31, Y4 | Depreciation Expense - Equipment | 10,000 | |||

| Accumulated Depreciation - Equipment | 10,000 | ||||

| annual straight-line depreciation = $200,000 / 20 years | |||||

| Dec 31, Y5 | Depreciation Expense - Equipment | 10,000 | |||

| Accumulated Depreciation - Equipment | 10,000 | ||||

| annual straight-line depreciation = $200,000 / 20 years | |||||

| Dec 31, Y5 | Accumulated Depreciation - Equipment | 30,000 | |||

| Equipment | 30,000 | ||||

| reverse/close accumulated depreciation to the asset | |||||

| Dec 31, Y5 | Equipment | 16,000 | |||

| Revaluation Surplus - OCI | 16,000 | ||||

| revalue as needed ($186,000 - 170,000 carrying value) | |||||

| Carrying value = | 200,000 | Original cost | |||

| 30,000 | Accumulated Depreciation | ||||

| 170,000 | |||||

| Dec 31, Y6 | Depreciation Expense - Equipment | 10,941 | |||

| Accumulated Depreciation - Equipment | 10,941 | ||||

| annual straight-line depreciation = $186,000 / 17 years | |||||

| 17 years = 20 years originally - 3 years of depreciation recorded = 17 years remaining | |||||

| Dec 31, Y7 | Depreciation Expense - Equipment | 10,941 | |||

| Accumulated Depreciation - Equipment | 10,941 | ||||

| annual straight-line depreciation = $186,000 / 17 years | |||||

| 17 years = 20 years originally - 3 years of depreciation recorded = 17 years remaining | |||||

| Dec 31, Y8 | Depreciation Expense - Equipment | 10,941 | |||

| Accumulated Depreciation - Equipment | 10,941 | ||||

| annual straight-line depreciation = $186,000 / 17 years | |||||

| 17 years = 20 years originally - 3 years of depreciation recorded = 17 years remaining | |||||

| Dec 31, Y8 | Accumulated Depreciation - Equipment | 32,824 | |||

| Equipment | 32,824 | ||||

| reverse/close accumulated depreciation to the asset | |||||

| Dec 31, Y8 | Revaluation Surplus - OCI | 16,000 | |||

| Revaluation Loss | 5,676 | ||||

| Equipment | 21,676 | ||||

| revalue as needed ($131,500 - 153,176 carrying value) | |||||

| Carrying value = | 186,000 | Revised cost | |||

| 32,824 | Accumulated Depreciation | ||||

| 153,176 | |||||