Chapter 6

Solutions

EXERCISE 6.1

- Cash $600,000

- Cash equivalent $22,000

- Cash advance received from customer of $2,670 should be included as a debit to cash and a credit to a liability account

- Cash advance of $5,000 to company executive should be reported as a receivable

- Refundable deposit of $13,000 to developer should be reported as a receivable or a prepaid expense

- Cash restricted for future plant expansion of $545,000 should be reported as restricted cash in noncurrent assets

- The certificate of deposit of $575,000 matures in nine months so it should be re- ported as a temporary investment

- The utility deposit of $500 should be identified as a receivable or prepaid expense from the utility company

- The cash advance to subsidiary of $100,000 should be reported as a receivable

- The post-dated cheque of $30,000 should be reported as a payment of receivable when the post-date occurs; until the post-date, the $30,000 is classified as a receivable

- Details of the $115,000 cash restriction are to be separately disclosed in the balance sheet with further disclosures in the notes to the financial statements indicating the type of arrangement and amounts

- Cash $13,000

- Postage stamps on hand are reported as part of supplies or prepaid expenses

- Cash $520,000

- Cash held in a bond sinking fund is restricted; since the bonds are noncurrent, the restricted cash is also reported as noncurrent

- Cash $1,200

- Cash $13,000

- Cash equivalent $75,400

- The NSF cheque of $8,000 should be reported as a receivable

EXERCISE 6.2

- (Partial SFP):

Current assets

Cash and cash equivalent[1]

Cash Restricted cash balance

Non-current assets

Cash restricted for retirement of long-term debt

Current liabilities

Bank indebtedness[2]

$3,385,750

175,000

2,000,000

150,000

For Cash and cash equivalent:

Commercial savings account

– First Royal Bank ($575,000 − 175,000)Commercial chequing account

– First Royal BankMoney market fund

– Commercial Bank of British ColumbiaPetty cash

Cash floats (5 × $250)

60-day treasury bill

Currency and coin on hand

Cash reported on December 31, 2020

balance sheet as current asset$400,000

450,000

2,500,000

1,500

1,250

18,000

15,000

$3,385,750

- Other items classified as follows:

- The minimum balance at First Royal Bank of $175,000 is reported separately as a restricted cash balance as a current asset cash balance. In addition, a description of the details of the arrangement should be disclosed in the notes.

- The post-dated cheque for $25,000 is for a payment on accounts receivable and should not be recognized until the cheque is deposited on January 18. It will be held in a secure location until then.

- The post-dated cheque for $1,800 is for unearned revenue and will not be recorded as unearned revenue until the cheque can be deposited on January. It will be held in a secure location until then. Revenue will be recorded and unearned revenue offset when legal title to the goods passes to the customer on January 20.

- Travel advances for $15,000 are to be reported as prepaid travel.

- The $2,300 amount paid to the employee is to be reported as a receivable from the employee. It will be offset when collected from salary in January.

- The treasury bill for $50,000 should be classified as a temporary investment (current asset). It cannot be reported as a cash equivalent because the original maturity exceeds 90 days.

- Commercial paper should be reported as temporary investments (current as- set).

- Investments in shares should be classified with trading securities (current as- set) at their fair value of $4,060 ($4.06 × 1,000 shares).

EXERCISE 6.3

Partial classified balance sheet:

| Current assets Accounts receivable |

||

|---|---|---|

| Customer Accounts (of which accounts in the amount of $30,000 have been pledged as security for a bank loan) | $275,000 | |

| Other[3] ($2,500 + $6,000) | 8,500 | $283,500 |

| Non-current Assets Accounts Receivable |

||

|---|---|---|

| Advance to related company[4] | 30,000 | |

| Instalment accounts receivable due after December 31, 2021 | 50,000 |

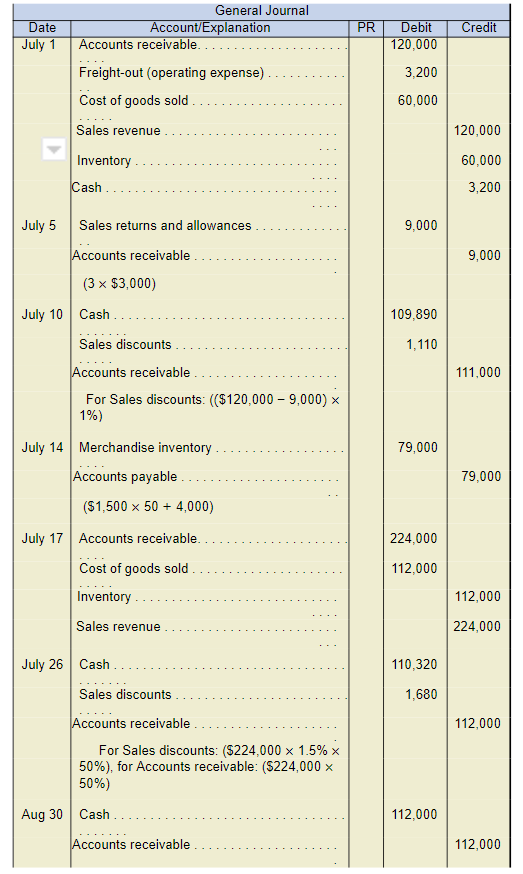

EXERCISE 6.4

a.

b. The implied interest rate on accounts receivable paid to Busy Beaver from Heintoch within the 15-day discount period = 1% ÷ [(30 − 15) ÷ 365] = 24.33%. This means that Heintoch would be using funds from the bank at a lower rate of 8% to save 24.33% interest on early payment of amounts owing to Busy Beaver. It is worthwhile to take advantage of the early payment discount terms in this case.

EXERCISE 6.5

a.

Calculation of cost of goods sold:

Opening inventory

Merchandise purchased

Less: Ending inventory

Cost of goods sold

Sales on account ($410,000 × 1.35)

Less collections deposited in bank

Uncollected balance

Balance per ledger

Unaccounted for shortage

$35,000

600,000

225,000

$410,000

553,500

420,000

133,500

85,000

$48,500

b. Accounts receivable balance per ledger of $85,000 is less than estimated accounts receivable of $133,500, suggesting that some accounts receivable collections may have been received but not actually deposited to the company’s bank account.

Controls to help prevent theft include proper segregation of duties among the person initially in receipt of the cheque, the person depositing it, and the person recording the collection. Customers should be encouraged to pay by cheque so an audit trail is maintained. A timely completion of the monthly bank reconciliation would help detect if any cash was recorded as collected, but not actually deposited to the company’s bank account.

EXERCISE 6.6

- An unadjusted debit balance in the AFDA at year-end is usually the result of write- offs during the year exceeding the total AFDA opening credit balance. The purpose of the AFDA is to ensure that the net accounts receivable is valued at net realizable value on the balance sheet.

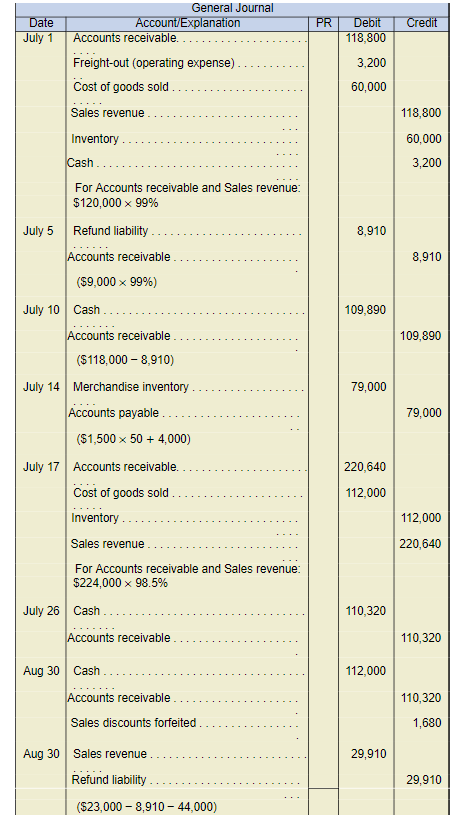

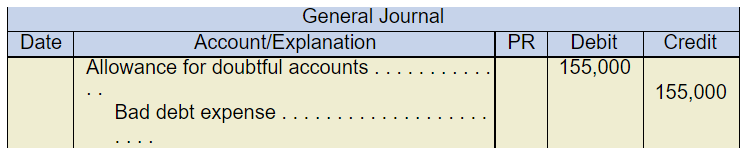

EXERCISE 6.7

-

Balance, January 1, 2020

Bad debt expense accrual (1% × ($16,000,000 × 0.75))

Uncollectible receivables written off

Balance, December 31, 2020, before adjustment

Allowance adjustment

Balance, December 31, 2020

$575,000

120,000

695,000

(40,000)

655,000

155,000

$500,000

- (Partial classified balance sheet as at December 31)

Current assets

Accounts receivable

Less allowance for doubtful accounts

Net accounts receivable

$50,950,000

500,000

50,450,000

The net accounts receivable balance is intended to measure the net realizable value of the accounts receivable at December 31.

- The direct write-off approach is not in compliance with GAAP unless the amount of the write-off is immaterial. Direct write-off does not match (bad debt) expense with revenues of the period, nor does it result in receivables being stated at estimated net realizable value on the balance sheet.

EXERCISE 6.8

![General Journal. Date May 1 2020: Notes receivable under debit 228,676 Services revenue under credit 228,676 PV = (0 PMT, 8 I/Y, 5 N, 336000 FV) Date Dec 31 2020 Notes receivable under debit 12,196 Interest income under credit 12,196 ($228,676 × 8% × 8 ÷ 12) Date Dec 31 2021 Notes receivable under debit 19,270 Interest income under credit 19,270 ([$228,676 + 12,196] × 8%) Date Dec 31 2022 Notes receivable under debit 20,811 Interest income under credit 20,811 ([$228,676 + 12,196 + 19,270] × 8%) Date Dec 31 2023 Notes receivable under debit 22,476 Interest income under credit 22,476 ([$228,676+12,196+19,270+20,811]×8%) Date Dec 31 2024 Notes receivable under debit 24,274 Interest income under credit 24,274 ([$228,676 + 12,196 + 19,270 + 20,811 + 22,476] × 8%) Date May 1 2025 Cash under debit 336,000 Notes receivable (can be netted together into one amount for $327,703 credit) under debit 8,297 Notes receivable (can be netted together into one amount for $327,703 credit) under credit 336,000 Interest income (rounded so that the carrying value was equal to $336,000 at maturity)under credit 8,297 Interest = ([$228,676 + 12,196 + 19,270 + 20,811 + 22,476 + 24,274] × 8%) × 4 ÷ 12 (rounded)](https://ecampusontario.pressbooks.pub/app/uploads/sites/1911/2021/11/16.png)

- Using a financial calculator input the following variables:

Interest = ± 228,676 PV, 0 PMT, 5 N, 336,000 FV

= 7.99 or 8% rounded

- (Partial balance sheet):

Non-current assets

Notes receivable, no-interest-bearing, due May 1, 2025

$260,142*

*$228,676 + 12,196 + 19,270

Unamortized discount as at December 31, 2021, is $336,000 − 260,142 = 75,858. As at December 31, 2024, the note would be classified as a current asset on the SFP because the maturity date of May 1, 2025, is within the next fiscal year.

- The fair value of the services provided can be used to value and record the transaction, instead of fair value of the note received.

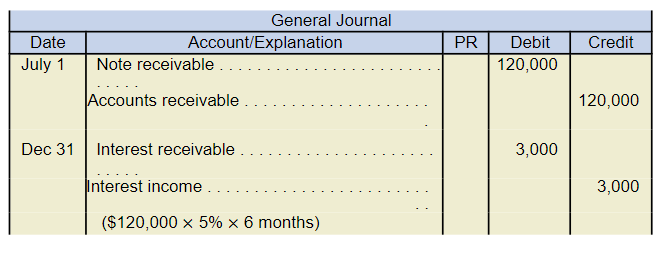

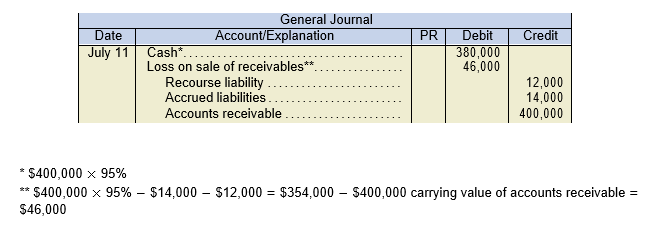

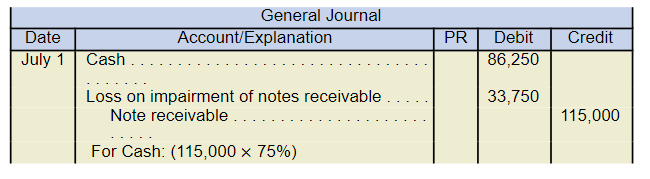

EXERCISE 6.9

a.

b.

Calculate interest from January 1 to July 1

Calculate the loss form impairment:

EXERCISE 6.10

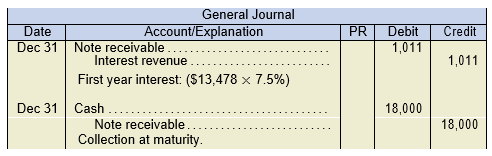

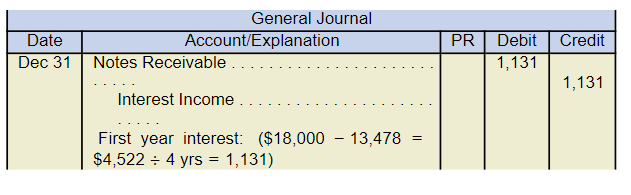

- Since Harrison uses ASPE, either straight-line or the effective interest method can be used for recognizing interest income. Below is the calculation using the straight- line method. Interest income for $1,131 for each of the next four consecutive years will be recorded.

EXERCISE 6.11

- To be recorded as a sale under IFRS, both of the following conditions must be met:

- The transferred assets risks and rewards of ownership have been transferred to the transferee. This is evidenced by transferring the rights to receive the cash flows from the receivables. Where the transferor continues to receive the cash flows, there must be a contractual obligation to pay these cash flows to the transferee without material delay.

- The transferee has obtained the right to pledge or to sell the transferred assets to an unrelated party (concept of control)

To be recorded as a sale under ASPE, the control over the receivables has been surrendered as evidenced by all of the following three conditions being met:

- The transferred assets have been isolated from the transferor.

- The transferee has obtained the right to pledge or to sell the transferred assets.

- The transferor does not maintain effective control of the transferred assets through a repurchase agreement.

- Management would likely prefer the receivables transfer transaction to be treated as a sale and derecognized from the accounts rather than a secured borrowing because the company would not have to record and report the additional debt in the SFP.

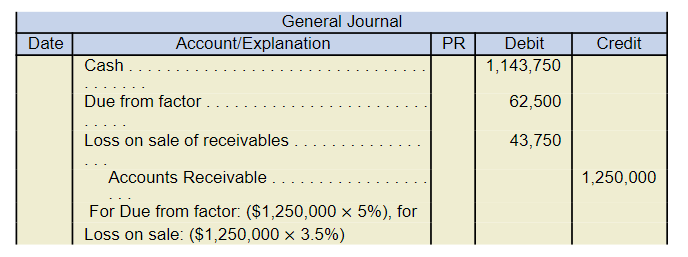

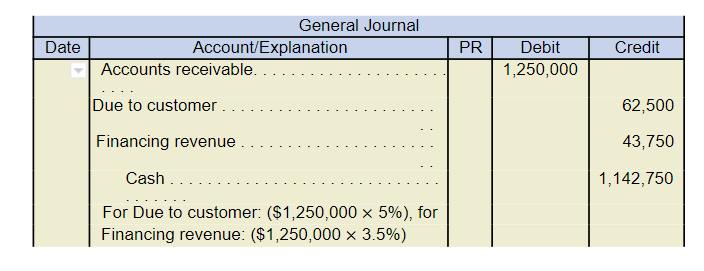

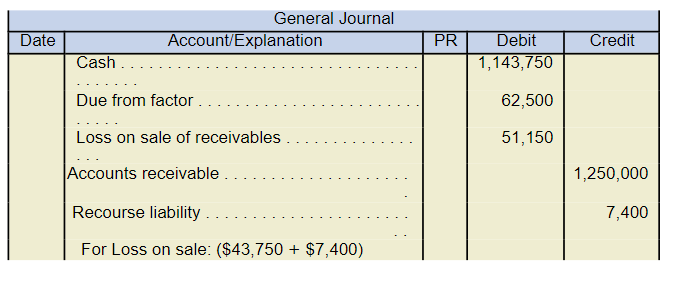

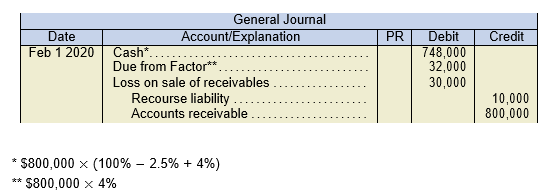

EXERCISE 6.12

EXERCISE 6.13

- Factoring the accounts receivable will improve the accounts receivable turnover ratio immediately after recording the entry on February 1 because the average accounts receivable amount in the denominator will decrease, making the ratio larger.For example, if sales were $3.2M and accounts receivable before the sale was $1.8M, the turnover ratio would be 1.78 (3.2M ÷ 1.8M) compared to 3.2 (3.2M ÷ 1M). If the calculation is made at the December 31 fiscal year-end, the balances of sales and average accounts receivable would no longer be affected by this transaction, and the accounts receivable turnover ratio would not be affected. This is because time has passed and many of the accounts would have been collected by year-end, had the company not sold them to a factor.

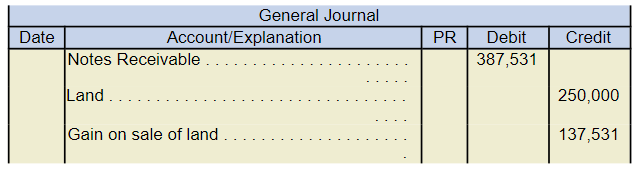

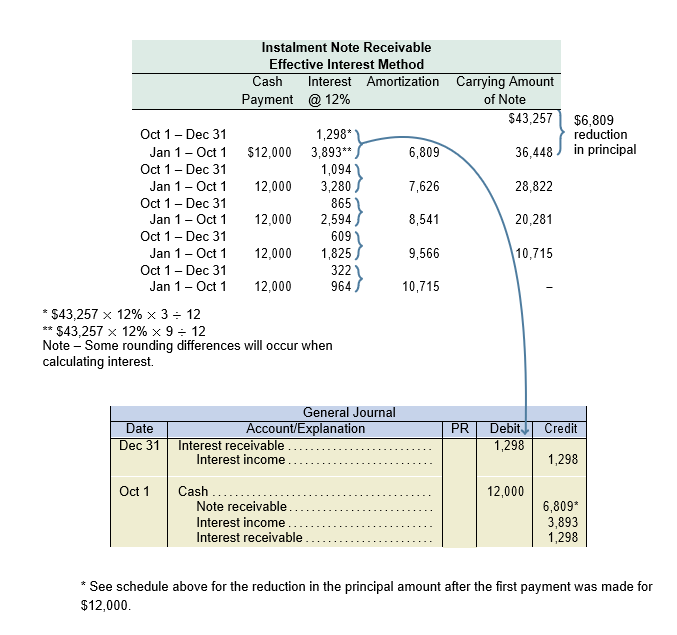

EXERCISE 6.14

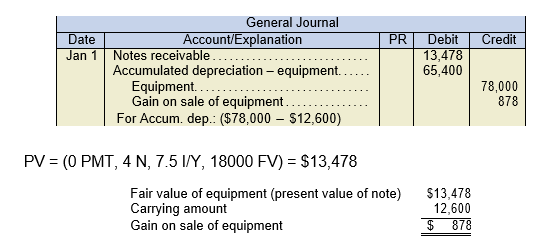

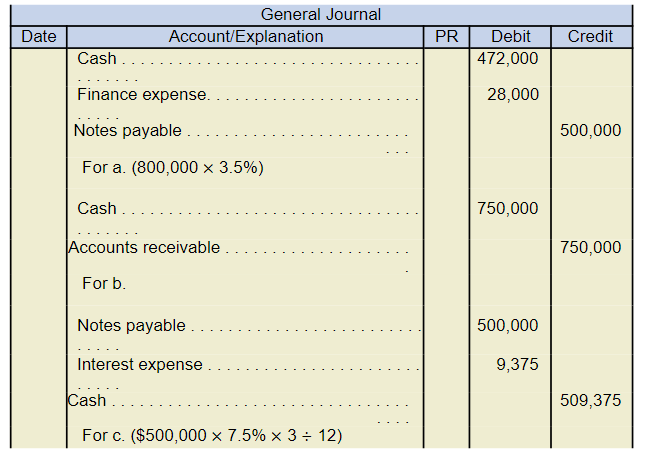

- i. Land in exchange for a note:

PV = (0 PMT, 3 N, 11 I/Y, 530,000 FV) = $387,531

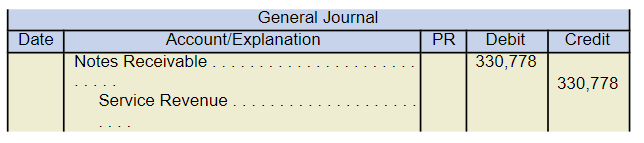

ii. Services in exchange for a note:

PV = (15,000 PMT, 6 N, 11 I/Y, 500,000 FV) = $330, 778

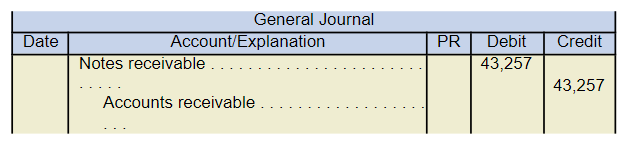

iii. Partial settlement of account in exchange for a note:

PV = (12,000 PMT, 5 N , 12 I/Y, 0 FV) = $43, 357

- From the perspective of Brew It Again, an instalment note reduces the risk of non- collection when compared to a non-interest-bearing note. In the case of the non- interest-bearing note, the full amount is due at the maturity of the note. The instalment note provides a regular reduction of the principal balance in every payment received annually. This is demonstrated in the effective interest table illustrated above for the instalment note.

EXERCISE 6.15

-

Accounts Receivable Turnover = Net Credit Sales ÷ Average Trade Receivables (net)

(Using credit sales) = $1,022,020 ÷ (($123,000 + $281,760) ÷ 2) = 5.05 times or about 72 days

Note that the write-off of $12,500 does not affect net accounts receivable. The average receivable is therefore about 72 days old (365 ÷ 5.05).

-

Credit sales are a better measure in the calculation of accounts receivable turnover ratio since cash sales do not affect accounts receivable balances. On this basis, Corvid Company’s accounts receivable turnover ratio has declined from the previous year. The average number of days to collect the accounts was 62 days (365 ÷ 5.85) compared to 72 days for 2020. This could be an unfavorable trend for future liquidity, if customers continue to pay slowly. Corvid may want to consider offering discounts for early payments of accounts or tighten their credit policy.

It should be noted that credit sales are not always available when performing analysis and calculating the accounts receivables turnover ratio. When not available, the figure of net sales should be used. As long as the calculation is done consistently between years, or between businesses, the comparison will remain relevant.

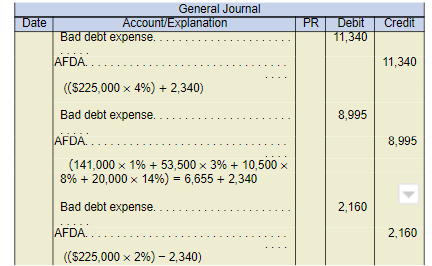

EXERCISE 6.16

EXERCISE 6.17

Exercise 6.18

1. Percent of credit sales

|

Account Name |

Debit |

Credit |

|

|---|---|---|---|

| Bad Debt Expense | 31,270 | ||

| Allowance for Doubtful Accounts | 31,270 | ||

|

|

|||

| ($2,659,000 × 98%) × 1.20% | |||

2. Percent of accounts receivable

|

Account Name |

Debit |

Credit |

||

|---|---|---|---|---|

| Bad Debt Expense | 26,211 | |||

| Allowance for Doubtful Accounts | 26,211 | |||

|

|

||||

| ($745,600 × 5.20%) = $38,771 required balance in afda | ||||

| Required balance | 38,771 | |||

| Current balance (credit) | 12,560 | assume credit if not stated | ||

| Entry needed | 26,211 | |||

Exercise 6.19

|

London Corp |

|||||

| Balance per books | $9,370 | May deposit | 5,000 | ||

| April deposits | 1,540 | ||||

| Add: collection of note | 1,000 | TRUE May deposit | 3,460 | ||

| per books | 5,810 | ||||

| Deduct: | |||||

| NSF Cheque | 335 | May cheques | 4,000 | ||

| May Service Charge | 25 | 360 | April o/s cheques | 2,000 | |

| Reconciled Balance | $10,010 | TRUE May cheques | 2,000 | ||

| per books | 3,100 | ||||

| Balance per bank | $8,760 | ||||

| Add: Deposits in Transit | 2,350 | difference | |||

| Deduct: Outstanding cheques | 1,100 | ||||

| Reconciled Balance | $10,010 | ||||

Exercise 6.20

Present value of the note receivable

| PV | $27,945.15 |

| Rate | 5% |

| Nper | 3 |

| Pymt | 0 |

| FV | -$32,350 |

| Type | 0 |

Journal entries

| 1/1/Y3 |

Account Name |

Debit |

Credit |

|

| Notes Receivable | 27,945 | |||

| Sales | 27,945 | |||

|

|

||||

| 12/31/Y3 |

Account Name |

Debit |

Credit |

|

| Notes Receivable | 1,397 | |||

| Interest Revenue | 1,397 | |||

| $27,945 × 5% | ||||

|

|

||||

| 12/31/Y4 |

Account Name |

Debit |

Credit |

|

| Notes Receivable | 1,467 | |||

| Interest Revenue | 1,467 | |||

| ($27,945 + $1,397) × 5% | ||||

|

|

||||

| 12/31/Y5 |

Account Name |

Debit |

Credit |

|

| Notes Receivable | 1,540 | |||

| Interest Revenue | 1,540 | |||

| ($27,945 + $1,397 + $1,467) × 5% | ||||

|

|

||||

| 12/31/Y5 |

Account Name |

Debit |

Credit |

|

| Cash | 32,350 | |||

| Notes Receivable | 32,350 | |||

Exercise 6.21

1. Journal entries

| 1/22/Y4 | Allowance for Doubtful Accounts | 23,650 | ||

| Accounts Receivable | 23,650 | |||

| write off Slide Corp. | ||||

|

|

||||

| 2/15/Y4 | Accounts Receivable | 12,000 | ||

| Allowance for Doubtful Accounts | 12,000 | |||

| reinstate the amount to be received from Slide Corp. ($60,000 x 0.20) | ||||

| when cash is received, another entry will be required - to record receipt of cash. | ||||

2. Net Realizable Value

|

Before |

After |

|

|---|---|---|

| Accounts Receivable | $3,004,150 | $2,992,500 |

| Allowance for Doubtful Accounts | 98,560 | 86,910 |

| Net realizable value | $2,905,590 | $2,905,590 |

Exercise 6.22

1. Without recourse (Oxford)

| Cash | 1,130,304 | |

| Due from factor (1) | 134,560 | |

| Loss on disposal of accounts receivable (2) | 80,736 | |

| Accounts Receivable | 1,345,600 | |

|

|

||

| (1) $1,345,600 × 10% | ||

| (2) $1,345,600 × 6% | ||

2. With recourse (Oxford)

| Cash | 1,130,304 | |

| Due from factor (1) | 134,560 | |

| Loss on disposal of accounts receivable (2) | 93,036 | |

| Recourse Liability | 12,300 | |

| Accounts Receivable | 1,345,600 | |

|

|

||

| (1) $1,345,600 × 10% | ||

| (2) ($1,345,600 × 6%) +$12,300 | ||

- The treasury bill for $18,000 is to be classified as a cash equivalent because the original maturity is less than 90 days. ↵

- The bank overdraft at the Lemon Bank for $150,000 is to be reported separately as a current liability because there are no other accounts at Lemon Bank available for offset. ↵

- These items could be separately classified, if considered material. ↵

- This classification assumes that these receivables are not collectible in the near term based on the fact that they were advanced in 2015 and remain outstanding. ↵