Chapter 5

Solutions

Exercise 5.1

Scenario 1: Amount to be received = $80 × 36 months = $2,880

Allocate using relative fair values:

Phone: [500 ÷ (500 + (600 × 3))] × 2,880 = 626

Air-time: [(600 × 3) ÷ (500 + (600 × 3))] × 2,880 = 2,254

Therefore, $626 will be recognized immediately and $2,254 will be deferred and recognized over the 3-year term of the contract.

Scenario 2: Amount to be received = ($100 × 24 months) + $300 = $2,700

Allocate using relative fair values:

Phone: [500 ÷ (500 + (600 × 2))] × 2,700 = 794

Air-time: [(600 × 2) ÷ (500 + (600 × 2))] × 2,700 = 1,906

Therefore, $794 will be recognized immediately and $1,906 will be deferred and recognized over the 2-year term of the contract.

Exercise 5.2

Scenario 1: Allocate using residual values:

Phone: 2,880 − (600 × 3) = 1,080

Air-time: 600 × 3 = 1,800

Therefore, $1,080 will be recognized immediately and $1,800 will be deferred and recognized over the 3-year term of the contract.

Scenario 2: Allocate using residual values:

Phone: 2,700 − (600 × 2) = 1,500

Air-time: 600 × 2 = 1,200

Therefore, $1,500 will be recognized immediately and $1,200 will be deferred and recognized over the 2-year term of the contract.

Exercise 5.3

Art Attack Ltd. (consignor)

![General journal. To segregate consignment goods: Inventory on consignment 58,000 under debit; Finished goods inventory 58,000 under credit. To record freight: Inventory on consignment 2,200 under debit; cash 2,200 under credit. To record receipt of net sales: Cash 67,700 under debit; advertising expense 3,400 under debit; commission expense 7,900 under debit; consignment revenue 79,000 under credit. To record COGS [(58,000 + 2,200) x 80%]: cost of goods sold 48,160 under debit; inventory on consignment 481,60 under credit](https://ecampusontario.pressbooks.pub/app/uploads/sites/1911/2021/11/gj125.png)

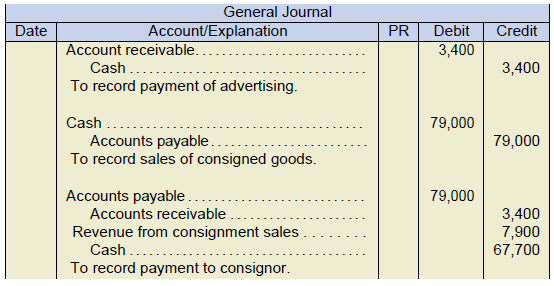

The Print Haus. (consignee)

Exercise 5.4

-

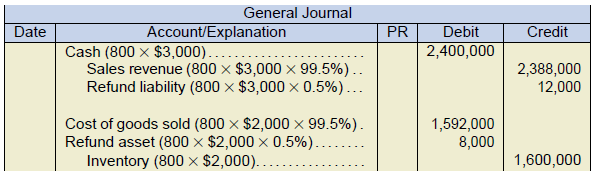

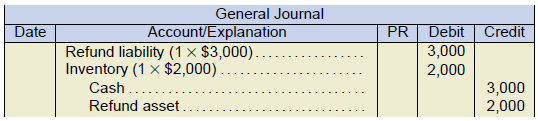

At the time of sale, it was estimated that 4 desks would be returned during the refund period (800 × 0.5% = 4). If a further 3 desks are returned before the refund period ends, journal entries similar to the one above would be made. If the refund period expires and the number of desks returned differs from the original estimate, the refund asset and refund liability account will need to be adjusted through net income. As a practical matter, the company will likely review the balances of the refund asset and liability accounts as part of the year-end adjustment process.

Exercise 5.5

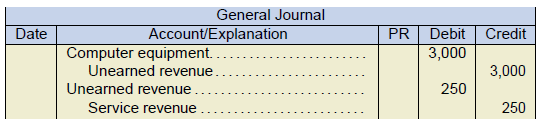

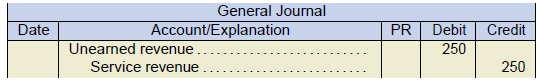

October journal entry:

November journal entry:

December journal entry:

Exercise 5.6

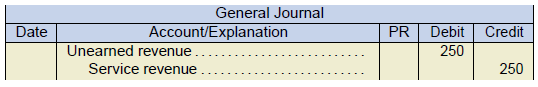

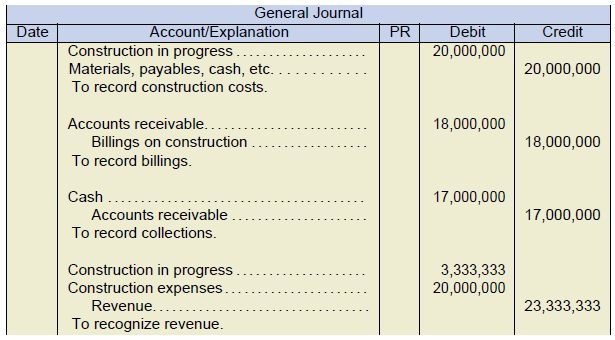

a. Construction Contract

| 2020 | 2021 | |

| Costs to date (A) | $20,000,000 | $31,000,000 |

| Estimated costs to complete project | 10,000,000 | 0 |

| Total estimated project costs (B) | 30,000,000 | 31,000,000 |

| Percent complete (C = A ÷ B) | 66.67% | 100.00% |

| Total contract price (D) | 35,000,000 | 35,000,000 |

| Revenue to date (C × D) | 23,333,333 | 35,000,000 |

| Less preciously recognized revenue | – | (23,333,333) |

| Revenue to recognize in the year | 23,333,333 | 11,666,667 |

| Costs incurred the year | 20,000,000 | 11,000,000 |

| Gross profit for the year | $3,333,333 | $666,667 |

b. 2020 Journal Entry: 2021 Journal Entry:

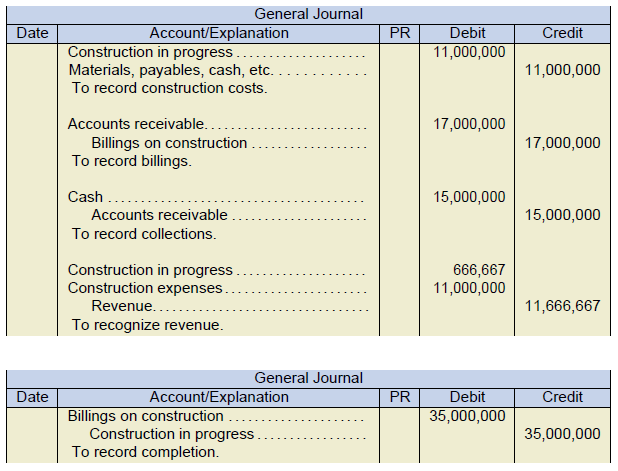

2021 Journal Entry:

Exercise 5.7

- Construction Contract

2021 2022 2023 Costs to date (A) $1,100,000 $3,400,000 $4,500,000 Estimated costs to complete project 3,200,000 1,000,000 – Total estimated project costs (B) 4,300,000 4,400,000 4,500,000 Percent complete (C = A ÷ B) 25.58% 77.27% 100.00% Total contract price (D) 5,200,000 5,200,000 5,200,000 Revenue to date (C × D) 1,330,160 4,018,040 5,200,000 Less previously recognized revenue – (1,330,160) (4,018,960) Revenue to recognize in the year 1,330,160 2,687,880 1,181,960 Costs incurred the year 1,100,000 2,300,000 1,100,000 Gross profit for the year $230,160 $387,880 $81,960 - Balance Sheet

Current assets

Accounts receivable

Recognized contract revenues in excess of billings

Income Statement

Contract revenues

Contract costs

Gross profit

2,687,880

2,300,000

387,880

Exercise 5.8

- Construction Contract

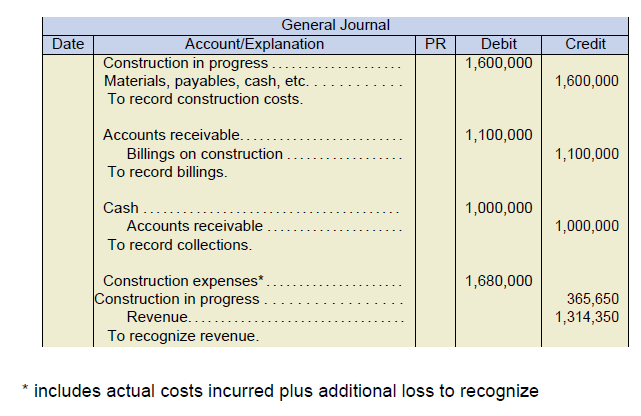

2020 2021 2022 Costs to date (A) $800,000 $2,400,000 $3,900,000 Estimated costs to complete project 2,100,000 1,600,000 – Total estimated project costs (B) 2,900,000 4,000,000 3,900,000 Percent complete (C = A ÷ B) 27.59% 60.00% 100.00% Total contract price (D) 3,500,000 3,800,000 3,800,000 Revenue to date (C × D) 965,650 1,314,350 1,520,00 Less previously recognized revenue – (965,650) (2,280,000) Revenue to recognize in the year 965,650 1,314,350 1,520,000 Costs incurred the year 800,000 1,600,000 1,500,000 Gross profit (loss) for the year $165,650 (285,650) 20,000 Additional loss to recognize (NOTE) (80,000) 80,000 Gross profit (loss) for the year $365,650 $100,000 NOTE: Additional loss represents the expected loss on work not yet completed (3,800,000 − 4,000,000) × 40% = 80,000

- Journal Entries

Exercise 5.9

- Zero Profit Method

2020 2021 2022 Revenues recognized 800,000 1,600,000 1,400,000 Expenses 800,000 1,800,000 1,300,000 Gross profit (200,000) 100,000 - Completed Contract Method

2020 2021 2022 Revenues recognized 0 0 3,800,000 Expenses 0 0 3,700,000 Gross profit 0 0 100,000 Loss on unprofitable contract (200,000)

Exercise 5.10

Chang Industries (Consignor) |

||||

| Mar 1, Y4 | Inventory on Consignment | 120,000 | ||

| Finished Goods Inventory | 120,000 | |||

| to record reclassing inventory | ||||

| the CONSIGNOR still maintains legal ownership (even though not in their possession) | ||||

|

|

||||

| Mar 1, Y4 | Inventory on Consignment | 5,000 | ||

| Cash | 5,000 | |||

| freight is NOT an expense - it's added to the value of our inventory | ||||

|

|

||||

| Sept 30, Y4 | Cash | 128,000 | ||

| Commission Expense | 24,000 | |||

| Advertising Expense | 8,000 | |||

| Cost of Goods Sold | 93,750 | |||

| Inventory on Consignment | 93,750 | |||

| Sales Revenue | 160,000 | |||

| sold 75% of inventory - cost of inventory | ||||

| actual cost | 120,000 | |||

| freight | 5,000 | |||

| TOTAL COST | 125,000 | |||

| % sold | 75% | |||

| VALUE OF ITEMS SOLD | 93,750 | |||

XYZ Inc (Consignee) |

|||

| sales | Cash | 160,000 | |

| Due to Consignor | 160,000 | ||

| note - these sales would be recorded each day/week | |||

|

|

|||

| Sept 30, Y4 | Due to Consignor | 160,000 | |

| Commission Revenue | 24,000 | ||

| Advertising Revenue (could offset expense) | 8,000 | ||

| Cash | 128,000 | ||

Exercise 5.11

Consignor (Iwanna Pass) |

||||

| Feb 16, Y6 | Inventory on Consignment | 250,000 | ||

| Merchandise Inventory | 250,000 | |||

| to reclass inventory sent on consignment | ||||

|

|

||||

| Feb 16, Y6 | Inventory on Consignment | 5,000 | ||

| Cash | 5,000 | |||

| to pay for freight costs to ship the merchandise | ||||

|

|

||||

| March 31, Y6 | Cash | 261,000 | ||

| Commission Expense | 30,000 | |||

| Advertising Expense | 9,000 | |||

| Sales | 300,000 | |||

| Cost of Goods Sold | 255,000 | |||

| Inventory on Consignment | 255,000 | |||

|

|

||||

| Sales | 300,000 | |||

| Commission | 10% | 30,000 | ||

| advertising | 3% | 9,000 | ||

| net cash to consignor | 261,000 | |||

Consignee (Bob's Tables n'Stuff) |

|||

| sales | Cash | 300,000 | |

| Payable to Consignor | 300,000 | ||

| remember, sales are happening daily - this is an accumulation of all the sales entries | |||

|

|

|||

| March 31, Y6 | Payable to Consignor | 300,000 | |

| Commission Revenue | 30,000 | ||

| Advertising Revenue/Expense | 9,000 | ||

| Cash | 261,000 | ||

| to record settlement of account with the consignor | |||

Exercise 5.12

Requirement #1(a) Completed Contract

|

Y3 |

Y4 |

Y5 |

|||||

|---|---|---|---|---|---|---|---|

| Construction in Progress | 450,000 | 500,000 | 320,000 | ||||

| Cash / AP | 450,000 | 500,000 | 320,000 | ||||

| to record the construction costs incurred during the year | |||||||

| Accounts receivable | 500,000 | 400,000 | 600,000 | ||||

| Billings on Construction | 500,000 | 400,000 | 600,000 | ||||

| to record progress billings during the year | |||||||

| Cash | 485,000 | 365,000 | 650,000 | ||||

| Accounts receivable | 485,000 | 365,000 | 650,000 | ||||

| to record cash collections during the year | |||||||

| Billings on Construction | - | - | 1,500,000 | ||||

| Construction revenue | - | - | 1,500,000 | ||||

| Construction Expenses | - | - | 1,270,000 | ||||

| Construction in Progress | - | - | 1,270,000 | ||||

| to record the completion of the project and recognize revenue | |||||||

Requirement #1(b) Percentage of Completion

|

Y3 |

Y4 |

Y5 |

||||

|---|---|---|---|---|---|---|

| Construction in Progress | 450,000 | 500,000 | 320,000 | |||

| Cash / AP | 450,000 | 500,000 | 320,000 | |||

| to record the construction costs incurred during the year | ||||||

| Accounts receivable | 500,000 | 400,000 | 600,000 | |||

| Billings on Construction | 500,000 | 400,000 | 600,000 | |||

| to record progress billings during the year | ||||||

| Cash | 485,000 | 365,000 | 650,000 | |||

| Accounts receivable | 485,000 | 365,000 | 650,000 | |||

| to record cash collections during the year | ||||||

| Construction Expenses | 450,000 | 500,000 | 320,000 | |||

| Construction in Progress | 163,650 | 49,600 | 16,750 | |||

| Construction revenue (see below) | 613,650 | 549,600 | 336,750 | |||

| Billings on Construction | 1,500,000 | |||||

| Construction in Progress | 1,500,000 | |||||

| to record the completion of the project and recognize revenue | ||||||

| Construction Expenses (costs incurred) | 450,000 | 40.91% | 950,000 | 77.55% | 1,270,000 | 100.00% |

| Total estimated cost of the project | 1,100,000 | 1,225,000 | 1,270,000 | |||

| Revenue to recognize based on contract price | 613,650 | 1,163,250 | 1,500,000 | |||

| Less revenue recognized in prior period | - | 613,650 | 1,163,250 | |||

| Revenue to recognize in current year | 613,650 | 549,600 | 336,750 | |||

|

|

||||||

| Y3 = $1,500,000 × 40.91% = $613,650 | ||||||

| Y4 = $1,500,000 × 77.55% = $1,163,250 | ||||||

| Y5 = $1,500,000 × 100.00% = $1,500,000 note - if using excel, may be out due to rounding | ||||||

Requirement #2(a) Completed Contract

|

Y3 |

Y4 |

Y5 |

|

|---|---|---|---|

| Balance Sheet | |||

| Accounts Receivable | 15,000 | 50,000 | - |

| Construction in Progress | 450,000 | 950,000 | - |

| Billings on Construction | 500,000 | 900,000 | - |

| Income Statement | |||

| Construction Revenue | - | - | 1,500,000 |

| Less: Construction Expenses | - | - | -1,270,000 |

| Net income | - | - | 230,000 |

Requirement #2(b) Percentage of Completion

|

Y3 |

Y4 |

Y5 |

|

|---|---|---|---|

| Balance Sheet | |||

| Accounts Receivable | 15,000 | 50,000 | - |

| Construction in Progress | 613,650 | 1,163,250 | - |

| Billings on Construction | 500,000 | 900,000 | - |

| Income Statement | |||

| Construction Revenue | 613,650 | 549,600 | 336,750 |

| Less: Construction Expenses | -450,000 | -500,000 | -320,000 |

| Net income | 163,650 | 49,600 | 16,750 |

Exercise 5.13

Part 1

1. Percent completion method

| Construction in Progress | 13,750,000 | |

| Cash / A/P | 13,750,000 | |

| Accounts Receivable | 12,500,000 | |

| Billings on Construction | 12,500,000 | |

| Cash | 12,000,000 | |

| Accounts Receivable | 12,000,000 | |

| Construction Expense | 13,750,000 | |

| Construction in Progress | 2,187,500 | |

| Construction Revenue | 15,937,500 |

| Costs incurred to date | 13,750,000 | 62.50% |

| Total Estimated Costs | 22,000,000 | |

| Revenue to recognize | 15,937,500 | ($25,500,000 × 62.50%) |

| Revenue recognized in prior year | - | |

| Revenue to recognize in current year | 15,937,500 |

2. Completed contract method

| Construction in Progress | 13,750,000 | |

| Cash / A/P | 13,750,000 | |

| Accounts Receivable | 12,500,000 | |

| Billings on Construction | 12,500,000 | |

| Cash | 12,000,000 | |

| Accounts Receivable | 12,000,000 |

Part 2

1. Percent of completion method

| Construction in Progress | 8,250,000 | |

| Cash / A/P | 8,250,000 | |

| Accounts Receivable | 13,000,000 | |

| Billings on Construction | 13,000,000 | |

| Cash | 12,000,000 | |

| Accounts Receivable | 12,000,000 | |

| Construction Expense | 8,250,000 | |

| Construction in Progress | 1,312,500 | |

| Revenue | 9,562,500 | |

| Billings on Construction | 25,500,000 | |

| Construction in Progress | 25,500,000 |

| Costs incurred to date | 22,000,000 | 100.00% |

| Total Estimated Costs | 22,000,000 | |

| Revenue to recognize | 25,500,000 | ($25,500,000 × 100.00%) |

| Revenue recognized in prior year | 15,937,500 | |

| Revenue to recognize in current year | 9,562,500 |

2. Completed contract method

| Construction in Progress | 8,250,000 | |

| Cash / A/P | 8,250,000 | |

| Accounts Receivable | 13,000,000 | |

| Billings on Construction | 13,000,000 | |

| Cash | 12,000,000 | |

| Accounts Receivable | 12,000,000 | |

| Construction Expense | 22,000,000 | |

| Billings on Construction | 25,500,000 | |

| Revenue | 25,500,000 | |

| Construction in Progress | 22,000,000 |

Exercise 5.14

Requirement 1 – Completed Contract

|

Y2 |

Y3 |

Y4 |

||||

|---|---|---|---|---|---|---|

| Construction in Progress | 175,000 | 678,000 | 316,000 | |||

| Cash/ A/P | 175,000 | 678,000 | 316,000 | |||

| Accounts Receivable | 150,000 | 700,000 | 650,000 | |||

| Billings on Construction | 150,000 | 700,000 | 650,000 | |||

| Cash | 125,000 | 710,000 | 665,000 | |||

| Accounts Receivable | 125,000 | 710,000 | 665,000 | |||

| Construction Expense | 1,169,000 | |||||

| Billings on Construction | 1,500,000 | |||||

| Construction Revenue | 1,500,000 | |||||

| Construction in Progress | 1,169,000 | |||||

Requirement 2 – Percent of Completion

|

Y2 |

Y3 |

Y4 |

||||||

|---|---|---|---|---|---|---|---|---|

| Construction in Progress | 175,000 | 678,000 | 316,000 | |||||

| Cash/ A/P | 175,000 | 678,000 | 316,000 | |||||

| Accounts Receivable | 150,000 | 700,000 | 650,000 | |||||

| Billings on Construction | 150,000 | 700,000 | 650,000 | |||||

| Cash | 125,000 | 710,000 | 665,000 | |||||

| Accounts Receivable | 125,000 | 710,000 | 665,000 | |||||

| Construction Expense | 175,000 | 678,000 | 316,000 | |||||

| Construction in Progress | 87,500 | 150,293 | 93,207 | |||||

| Construction Revenue | 262,500 | 828,293 | 409,207 | |||||

| Billings on Construction | 1,500,000 | |||||||

| Construction in Progress | 1,500,000 | |||||||

|

Y2 |

Y3 |

Y4 |

|

|---|---|---|---|

| Contract Revenue | 1,500,000 | 1,500,000 | 1,500,000 |

| Costs incurred to date | 175,000 | 853,000 | 1,169,000 |

| Total cost of project | 1,000,000 | 1,173,000 | 1,169,000 |

| Percent | 17.50% | 72.72% | 100.00% |

| % of Revenue | 262,500 | 1,090,793 | 1,500,000 |

| Prior Recognized | - | 262,500 | 1,090,793 |

| Revenue to Recognize | 262,500 | 828,293 | 409,207 |

Exercise 5.15

Requirement #1(a) Completed Contract

|

Y5 |

Y6 |

Y7 |

|||||

|---|---|---|---|---|---|---|---|

| Construction in Progress | 1,875,000 | 5,875,000 | 6,962,500 | ||||

| Cash / AP | 1,875,000 | 5,875,000 | 6,962,500 | ||||

| to record the construction costs incurred during the year | |||||||

| Accounts receivable | 1,750,000 | 5,800,000 | 7,950,000 | ||||

| Billings on Construction | 1,750,000 | 5,800,000 | 7,950,000 | ||||

| to record progress billings during the year | |||||||

| Cash | 1,600,000 | 5,750,000 | 8,150,000 | ||||

| Accounts receivable | 1,600,000 | 5,750,000 | 8,150,000 | ||||

| to record cash collections during the year | |||||||

| Billings on Construction | - | - | 15,500,000 | ||||

| Construction revenue | - | - | 15,500,000 | ||||

| Construction Expenses | - | - | 14,712,500 | ||||

| Construction in Progress | - | - | 14,712,500 | ||||

| to record the completion of the project and recognize revenue | |||||||

Requirement #1(b) Percent of Completion

|

Y5 |

Y6 |

Y7 |

||||||

|---|---|---|---|---|---|---|---|---|

| Construction in Progress | 1,875,000 | 5,875,000 | 6,962,500 | |||||

| Cash / AP | 1,875,000 | 5,875,000 | 6,962,500 | |||||

| to record the construction costs incurred during the year | ||||||||

| Accounts receivable | 1,750,000 | 5,800,000 | 7,950,000 | |||||

| Billings on Construction | 1,750,000 | 5,800,000 | 7,950,000 | |||||

| to record progress billings during the year | ||||||||

| Cash | 1,600,000 | 5,750,000 | 8,150,000 | |||||

| Accounts receivable | 1,600,000 | 5,750,000 | 8,150,000 | |||||

| to record cash collections during the year | ||||||||

| Percentage of project completed | 13.07% | 53.45% | 100.00% | |||||

| Revenue to recognize | 2,025,261 | 6,259,221 | 7,215,517 | |||||

| Construction Expenses | 1,875,000 | 5,875,000 | 6,962,500 | |||||

| Construction in Progress | 150,850 | 383,900 | 252,750 | |||||

| Construction revenue | 2,025,850 | 6,258,900 | 7,215,250 | |||||

| Billings on Construction | 15,500,000 | |||||||

| Construction in Progress | 15,500,000 | |||||||

| to record the completion of the project and recognize revenue | ||||||||

| Construction Expenses (costs incurred) | 1,875,000 | 13.07% | 7,750,000 | 53.45% | 14,712,500 | 100.00% | ||

| Total estimated cost of the project | 14,350,000 | 14,500,000 | 14,712,500 | |||||

| Revenue to recognize based on contract price | 2,025,850 | 8,284,750 | 15,500,000 | |||||

| Less revenue recognized in prior period | - | 2,025,850 | 8,284,750 | |||||

| Revenue to recognize in current year | 2,025,850 | 6,258,900 | 7,215,250 | |||||

| Y5 = $15,500,000 × 13.07% = $2,025,850 | ||||||||

| Y6 = $15,500,000 × 53.45% = $8,284,750 | ||||||||

| Y7 = $15,500,000 × 100.00% = $15,500,000 note - if using excel, may be out due to rounding | ||||||||

Requirement #2(a) Completed Contract

|

Y5 |

Y6 |

Y7 |

|

|---|---|---|---|

| Balance Sheet | |||

| Accounts Receivable | 150,000 | 200,000 | - |

| Construction in Progress | 1,875,000 | 7,750,000 | - |

| Billings on Construction | 1,750,000 | 7,550,000 | - |

| Income Statement | |||

| Construction Revenue | - | - | 15,500,000 |

| Less: Construction Expenses | - | - | -14,712,500 |

| Net income | - | - | 787,500 |

Requirement #2(b) Percent of Completion

|

Y5 |

Y6 |

Y7 |

|

|---|---|---|---|

| Balance Sheet | |||

| Accounts Receivable | 150,000 | 200,000 | - |

| Construction in Progress | 2,025,850 | 8,284,750 | - |

| Billings on Construction | 1,750,000 | 7,550,000 | - |

| Income Statement | |||

| Construction Revenue | 2,025,850 | 6,258,900 | 7,215,250 |

| Less: Construction Expenses | -1,875,000 | -5,875,000 | -6,962,500 |

| Net income | 150,850 | 383,900 | 252,750 |