7.4 The Loanable Funds Market

Definitions

Interest Rate is the “price” of borrowing in the financial market, a rate of return on an investment.

A consumer price index (CPI) is a price index, the price of a weighted average market basket of consumer goods and services purchased by households.

The GDP deflator (implicit price deflator) is a measure of the money price of all new, domestically produced, final goods and services in an economy in a year relative to the real value of them.

We aggregate the market for loans, bonds, and stocks as the market for loanable funds. The market has a demand side and a supply side, where the demand and supply interact to determine the rate of return on the loanable funds. In the market for loanable funds, the demand is measured by the willingness of firms to borrow to engage in large-scale construction projects. This could include constructing a new manufacturing facility, researching a new product line, or upgrading existing physical capital and technology.

On the other hand, the supply of loanable funds is determined by the willingness of households to save in addition to the savings, or dissavings, of the government.

Demand and Supply in the Loanable Funds Market

The simplest example of a rate of return is an interest rate. For example, when you put money into a savings account at a bank, you receive interest on your deposit. The interest payment expressed as a percent of your deposits is the interest rate. Similarly, if you demand a loan to buy a car or a computer, you will need to pay interest on the money you borrow.

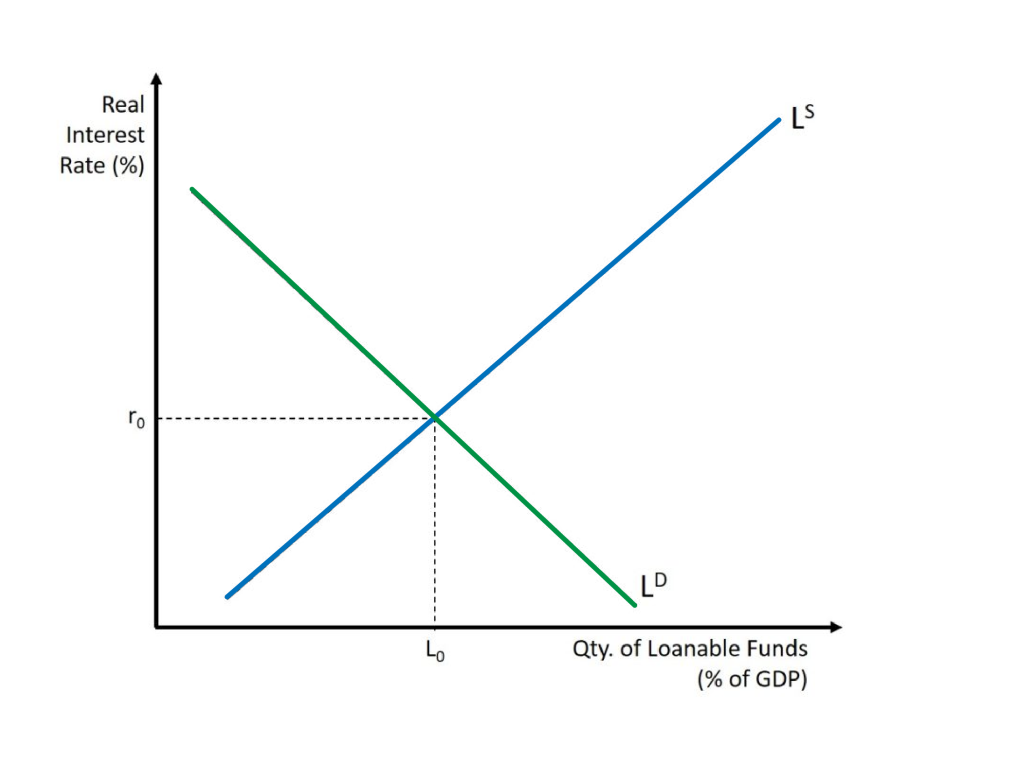

Figure 7.2 illustrates demand and supply in the financial market for loanable funds. The horizontal axis of the financial market shows the quantity of money that is loaned or borrowed in this market. The vertical axis measures the real rate of interest. Recall the “real interest rate” in an economy is often considered to be the rate of return minus an index of inflation, such as the rate of change of the CPI or GDP deflator.

The laws of demand and supply continue to apply in the financial markets. According to the law of demand, a higher price will decrease the quantity demanded (that is, people will buy less), and all else is constant. Similarly, in the financial markets, as the interest rate rises, consumers will reduce the quantity they borrow, and the quantity of loanable funds demanded will decrease (because loans get more costly). According to the law of supply, a higher price increases the quantity supplied, ceteris paribus. Consequently, as the interest rate paid on borrowing rises, more firms will be eager to issue loans. Conversely, if the interest rate on loans falls, the quantity of loanable funds supplied will decrease, and the quantity of loanable funds demanded will increase as loans get less costly.

In the financial market for loanable funds shown in Fig 7.2, the supply curve ([latex]L^S[/latex]) and the demand curve ([latex]L^D[/latex]) cross at the equilibrium point. The equilibrium occurs at a real interest rate where the quantity of loanable funds demanded and the quantity of loanable supplied are equal.

If the real interest rate (remember, this measures the “price” in the financial market) is above the equilibrium level, then an excess supply, or a surplus, of financial capital will arise in this market. As a result, some banks will lower the interest rates (or other fees) they charge to attract more business. This strategy will push the interest rate down toward the equilibrium level.

If the interest rate is below the equilibrium, then excess demand or a shortage of funds occurs in this market. At a low interest rate, the quantity of funds borrowed will increase, but the quantity of loanable funds supplied will decrease. In this situation, banks will perceive that they are overloaded with eager borrowers and conclude that they have an opportunity to raise interest rates.

Attribution

“Financial Markets, Supply and Demand, and Interest” from Macroeconomics by Lumen Learning is licensed under a Creative Commons Attribution 4.0 International License.