5.12 Real vs Nominal Interest Rates

Inflation influences our interest rates for car loans or personal lines of credit. For instance, imagine you borrowed $100 from your bank one year ago at 8% interest on your loan. When you repay the loan, you must repay the $100 you borrowed plus $8 in interest—a total of $108. This 8% interest rate is the stated interest rate on the loan you must pay back, called the nominal interest rate.

But the nominal interest rate doesn’t take inflation into account. In other words, it is unadjusted for inflation. To continue our scenario, suppose on your way to the bank, a newspaper headline caught your eye stating: “Inflation at 5% This Year!” Inflation is a rise in the general price level, as you know. A 5% inflation rate means that an average basket of goods you purchased this year is 5% more expensive when compared to last year. This leads to the concept of the real, or inflation-adjusted, interest rate. The real interest rate measures the percentage increase in purchasing power the lender receives when the borrower repays the loan with interest. In our earlier example, the lender earned 8% or $8 on the $100 loan. However, because inflation was 5% over the same period, the lender earned only 3% in real purchasing power or $3 on the $100 loan. The real interest rate is the “true” cost of borrowing.

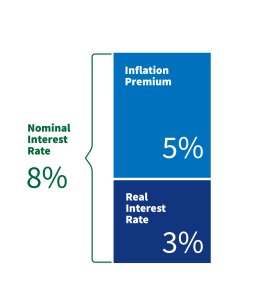

The diagram below illustrates the relationship between nominal interest rates, real interest rates, and the inflation rate. As shown, the nominal interest rate equals the real interest rate plus the inflation rate.

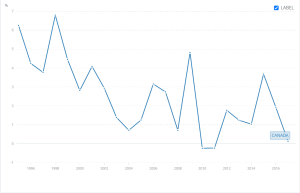

A comparison of the nominal and real interest rates for Canada is shown in the figure below:

|

|

Advertised interest rates that you may see at banks or other financial service providers are typically nominal interest rates. This means it’s up to you to estimate how much of the interest rate a bank may pay you on a savings deposit is an increase in your purchasing power and how much is simply making up for yearly inflation.

Attribution

“What it the difference between the real interest rate and the nominal interest rate?” by Federal Reserve Bank of San Francisco, © 2023 Federal Reserve Bank of San Francisco, used in accordance with the FRBSF Site Policy.