5.11 Other Price Indexes

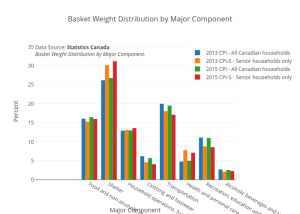

The basket of goods behind the Consumer Price Index represents an average hypothetical Canadian household’s consumption, which is to say that it does not exactly capture anyone’s personal experience. When the task is to calculate an average level of inflation, this approach works fine. What if you are concerned about inflation experienced by a certain group, like older people, low-income people, or single-parent families with children? In specific situations, a price index based on the buying power of the average consumer may not feel quite right.

This problem has a straightforward solution. If the Consumer Price Index does not serve the desired purpose, then invent another index based on a basket of goods appropriate for the group of interest. Statistics Canada publishes several experimental price indices: some for particular groups like older people or people experiencing poverty, some for different geographic areas, and some for certain broad categories of goods like food or housing.

|

|

Statistics Canada also calculates several price indices that are not based on baskets of consumer goods. For example, the Producer Price Index (PPI) is based on prices paid for supplies and inputs by producers of goods and services. We can break it down into price indices for different industries, commodities, and stages of processing (like finished goods, intermediate goods, or crude materials for further processing). There is an International Price Index based on the prices of exported or imported merchandise. An Employment Cost Index measures wage inflation in the labour market. The GDP deflator, which Statistics Canada measures, is a price index that includes all the GDP components (consumption plus investment plus government plus exports minus imports).

What’s the best measure of inflation?

If one is concerned with the most accurate measure of inflation, one should use the GDP deflator as it picks up the prices of goods and services produced. However, it is not a good measure of the cost of living as it includes prices of many products not purchased by households (for example, aircraft, fire engines, factory buildings, office complexes, and bulldozers). If one wants the most accurate measure of inflation as it impacts households, one should use the CPI, as it only picks up the prices of products purchased by households. That is why economists sometimes refer to the CPI as the cost-of-living index.

Attribution

“22.2 How to measure changes in the cost of living” from Principles of Economics 2e by OpenStax is licensed under Creative Commons Attribution 4.0 International License

“5.2 Price-Level Changes” from Principles of Macroeconomics by University of Minnesota is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License