10.3 Measuring Money: M1 and M2

+The money supply is the total quantity of money in the economy at any one time. Economists measure the money supply because it affects economic activity. What should be included in the money supply?

Cash in your pocket certainly serves as money. But what about cheques or credit cards? Are they money, too? Rather than trying to state a single way of measuring money, economists offer broader definitions of money based on the concept of liquidity. Liquidity refers to how quickly an asset can be used to buy a good or service. Liquidity is a relative concept. For example, cash is very liquid. Your $10 bill can be easily used to buy a hamburger at lunchtime. However, the $10 you have in your savings account is not easy to use. You must go to the bank or ATM and withdraw that cash to buy your lunch. Thus, $10 in your savings account is less liquid. Stocks and bonds are even less liquid since they must be sold to convert them to means of payment, and they might suffer a loss in value in the process.

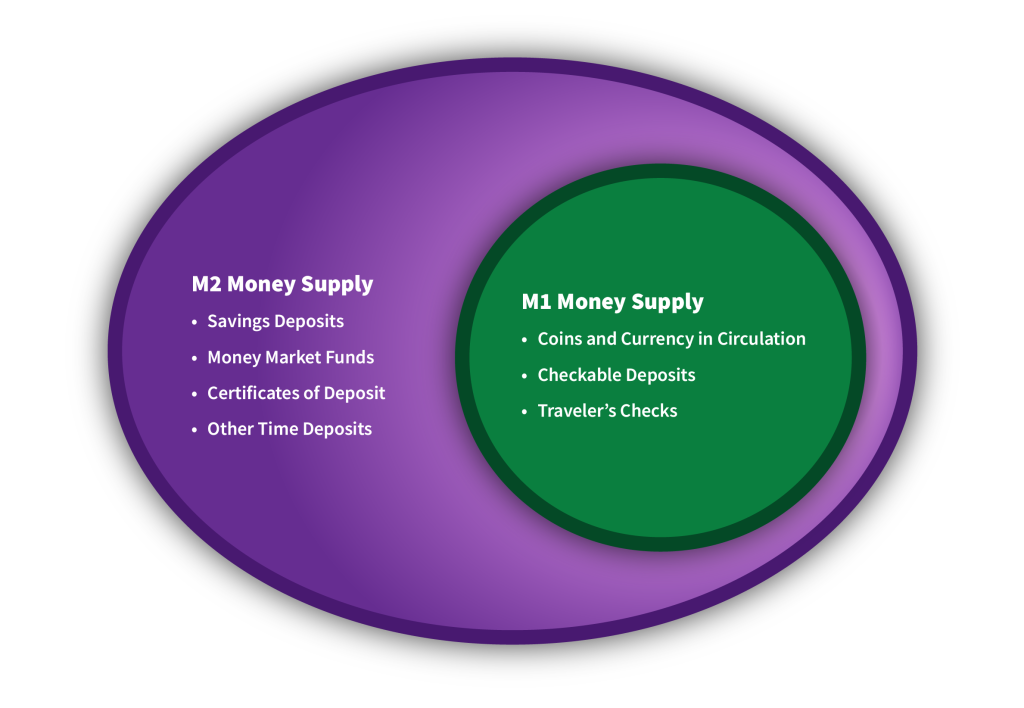

Economists generally use two definitions of the supply of money: M1 and M2.

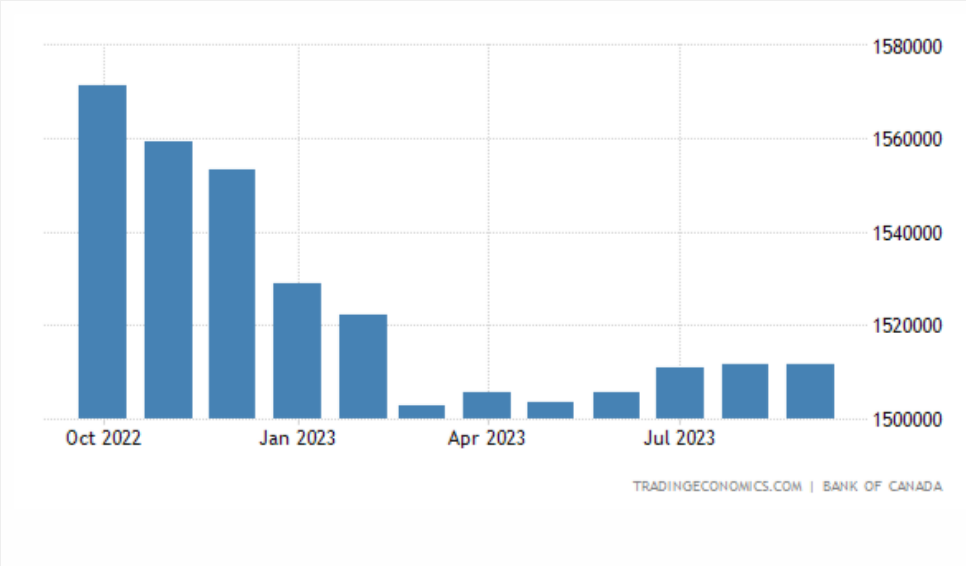

M1 includes those assets that are the most liquid, such as cash, chequable (demand) deposits, and traveller’s cheques. Chequable deposits are balances in chequing accounts. M1 is the narrowest definition of money supply. The bar graph in Fig 10.2 demonstrates the decline in M1 money in Canada over a certain period of time.

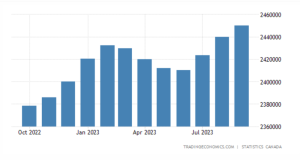

M2 includes M1 plus some less liquid (but still fairly liquid) assets, including savings and term deposits, certificates of deposit, and money market funds. Savings deposits in banks are bank accounts on which you cannot write a cheque directly. Certificates of deposit (CDs) or term deposits are accounts that the depositor has committed to leaving in the bank for a certain period of time, ranging from a few months to a few years. Many banks and other financial institutions also offer a chance to invest in money market funds, where the deposits of many individual investors are pooled together and invested safely, such as in short-term government bonds. Therefore, M2 is a broader definition of money supply than M1. If you look at the bar graph in Fig 10.3, it is now well understood why the M2 values are greater than the M1 values in Fig 10.2. The bar graph shows changes in M2 money in Canada over a certain period of time.

Look at the table below:

Consider the following statistics for the banking sector in Canada displayed in the table below (all numbers in billions of domestic currency).

| Coins and Currency in Circulation | [latex]1400[/latex] |

|---|---|

| Chequable Deposits | [latex]4[/latex] |

| Traveller’s Cheques | [latex]1200[/latex] |

| Savings Accounts | [latex]8000[/latex] |

| Money Market Mutual Funds | [latex]400[/latex] |

| Term Deposits | [latex]500[/latex] |

Using the data above:

[latex]\begin{align*}&\text{M1}=1400+4+1200=\$2,604\;\text{billion}\\&\text{M2}=\$2,604+8000+400+500=\$11,504\;\text{billion}\end{align*}[/latex].

|

|

|

|

Important Note:

Credit cards are not money. A credit card identifies you as someone with a special arrangement with the card issuer in which the issuer will lend you money and transfer the proceeds to another party whenever you want. Thus, if you present a MasterCard to a jeweller as payment for a $500 ring, the firm that issued you the card will lend you the $500 and send that money to the jeweller. You, of course, will be required to repay the loan later. But a card that says you have such a relationship is not money, just as your debit card is not money.

Attribution

“255 Reading: Defining Money by Its Functions” from Macroeconomics by Peter Turner is licensed under a Creative Commons Attribution 4.0 International License

“24.1 What Is Money?” from Principles of Macroeconomics by University of Minnesota is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.