11.2 Monetary Policy Targets

Recall from Chapter 10 that one of the most important functions of the Bank of Canada is to conduct monetary policy. To conduct the monetary policy, the Bank’s main operating tool is open market operations. One tool is the special purchase and resale agreement (SPRA).

The second tool used is called sale and repurchase agreement (SRA). Using these tools, the BoC can directly influence the overnight interest rate and money supply.

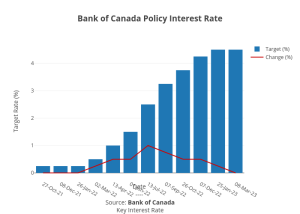

Overnight Interest Rate Target

The target for the overnight rate, also known as the key policy interest rate, is the interest rate that the Bank expects to be used in financial markets for one-day (or “overnight”) loans between financial institutions. This key rate serves as the benchmark that banks and other financial institutions use to set interest rates for consumer loans, mortgages, and other forms of lending.

|

|

Attribution

Principles of Macroeconomics by D. Curtis and I. Irvine is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.