10.5 Bank of Canada

The Bank of Canada is Canada’s central bank.

The Governing Council leads the Bank of Canada, the Bank’s policy-making body. The Governing Council comprises the Governor, the Senior Deputy Governor and four Deputy Governors. The current governor is Tiff Macklen. Here are the primary functions of the Bank of Canada:

- Act as a Banker to the Federal Government

- Act as a Banker to the private banks

- Issue banknotes and coins

- Act as a Lender of Last Resort

- Conduct Monetary Policy

Currently, the Council’s main tool for conducting monetary policy is the target for the overnight rate (also known as the key policy rate). The Bank of Canada conducts open market operations to maintain the overnight policy rate.

10.5.1 Overnight Interest Rate

The Bank of Canada began to use the overnight interest rate setting as its monetary policy instrument, making changes in the interest rate, as necessary, to keep the Canadian inflation rate within a target range of 1 percent to 3 percent.

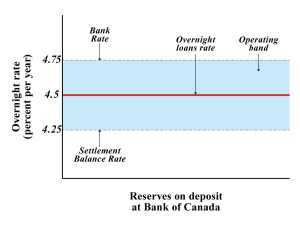

In Canada, the overnight rate is now the Bank of Canada’s key policy instrument. This is the interest rate that large financial institutions receive or pay on loans from one day until the next. The Bank implements monetary policy by setting a target for the overnight rate at the midpoint of an operating band, plus or minus one-quarter of one percentage point, or 25 basis points, from the target rate. As of March 2023, the overnight interest rate target set by the Bank of Canada is 4.5%. Refer to Fig 10.8 below.

The top range of the overnight interest rate is called the Bank rate. It is the rate at which retail banks can borrow money from the Bank of Canada. The bottom range is called the Settlement balance rate – the rate offered by the Bank of Canada to any retail bank on reserve deposits they keep with the Bank.

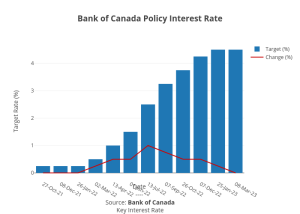

Fig 10.9 (a) shows the changes in the Bank of Canada’s overnight interest rate targets over a one-year, six-month period from October 2021 until March 2023. The table in Fig 10.9 (b) illustrates the changes in the target rates. Notice that from March 2022 until January 2023, the Bank consistently kept raising the interest rate (to fight inflation), using open market operations that we discuss in the next section below.

|

|

| Date | Target (%) | Change (%) | |

|---|---|---|---|

| 1 | 27-Oct-21 | 0.25 | 0 |

| 2 | 08-Dec-21 | 0.25 | 0 |

| 3 | 26-Jan-22 | 0.25 | 0 |

| 4 | 02-Mar-22 | 0.5 | 0.25 |

| 5 | 13-Apr-22 | 1 | 0.5 |

| 6 | 01-Jun-22 | 1.5 | 0.5 |

| 7 | 13-Jul-22 | 2.5 | 1 |

| 8 | 07-Sep-22 | 3.25 | 0.75 |

| 9 | 26-Oct-22 | 3.75 | 0.5 |

| 10 | 07-Dec-22 | 4.25 | 0.5 |

| 11 | 25-Jan-23 | 4.5 | 0.25 |

| 12 | 08-Mar-23 | 4.5 | 0 |

|

|

10.5.2 Open Market Operations

Open market operations are central bank purchases or sales of government securities in the open financial market. They are the main technique used by central banks to manage the size of the money supply. Open market operations alter the money supply.

To maintain the overnight interest rate within the target band, the Bank of Canada must intervene in the market to cover any shortages or remove any surpluses of funds that would push rates beyond its target. The Bank has two tools it uses for this purpose.

One tool is the special purchase and resale agreement (SPRA).

In an SPRA, the Bank offers to buy Government of Canada securities from major financial institutions, agreeing to sell them back the next business day. Banks are willing to enter into these agreements with the Bank of Canada because the Bank of Canada provides cash for the banks. This cash injection increases the money supply and puts downward pressure on the overnight interest rate which helps in keeping the rate at its lower target. The operating band consequently lowers.

Lowering the policy rate (overnight interest rate) target lowers the prime lending rate. The Prime rate is the interest rate that banks and lenders use to determine the interest rates for many types of loans and lines of credit. As the prime rate lowers, most interest rates prevailing in the markets fall. Therefore, an open market purchase of government securities lowers the interest rate by increasing the money supply in the economy.

In the opposite case, the second tool is used, which is called a sale and repurchase agreement (SRA). This is a sale of securities to major financial institutions for one day combined with a repurchase the following day. It makes a one-day reduction in the money supply, putting upward pressure on the overnight rate, which helps to take the overnight rate at its higher target. The operating band consequently rises.

Raising the policy rate (overnight interest rate) target raises the prime lending rate. As the prime rate rises, most interest rates prevailing in the markets rise. Therefore, an open market sale of government securities raises the interest rate by decreasing the money supply in the economy.

In the next chapter, we will look at the monetary policy tools explaining the open market operations in further detail.

Attribution

Principles of Macroeconomics by D. Curtis and I. Irvine is licensed under a Creative Commons Attribution Non-Commercial ShareAlike 4.0 International License.