5.10 CPI and Core Inflation

Imagine driving a company truck across the country – you probably would care about things like the prices of available roadside food and motel rooms and the truck’s operating condition. However, the manager of the firm might have different priorities. He would care mainly about the truck’s on-time performance and much less about the food you were eating and the places you were staying. In other words, the company manager would pay attention to the firm’s production while ignoring transitory elements that impacted you but did not affect the company’s bottom line.

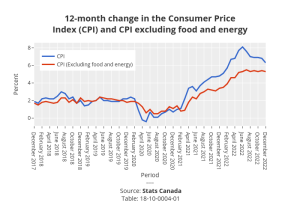

In a sense, a similar situation occurs with regard to measures of inflation. We’ve learned that CPI measures prices as they affect everyday household spending. Economists typically calculate a core inflation index by taking the CPI and excluding volatile economic variables, such as food and energy, whose prices show more swings. In this way, economists have a better sense of the underlying price trends that affect the cost of living.

|

|

Attribution

“22.2 How to measure changes in the cost of living” from Principles of Economics 2e by OpenStax is licensed under Creative Commons Attribution 4.0 International License.