12.4 The Tax-Cut Multiplier

The government can also induce economic spending through tax cuts, such as income tax cuts increasing net earnings. So, the government expects people to have more disposable income, which could increase consumption spending. The initial benefits of the tax cuts could generate more spending for the overall economy. Therefore, tax cuts also generate a multiplier effect.

The tax-cut multiplier is calculated using the following formula:

[latex]\begin{align*}\frac{\text{Change in real GDP}}{\text{Change in Taxes}}\end{align*}[/latex]

A [latex]\$15\;\text{billion}[/latex] tax cut results in an increase in real GDP by [latex]\$20\;\text{billion}[/latex], therefore

[latex]\begin{align*}\text{Tax Multiplier}&=\frac{\$20\;\text{billion}}{-\$15\;\text{billion}}\\[2ex]&=-1.3\end{align*}[/latex]

so a dollar cut in taxes will increase real GDP by [latex]\$1.3[/latex].

Note the tax multiplier is negative because a cut in taxes causes an increase in GDP.

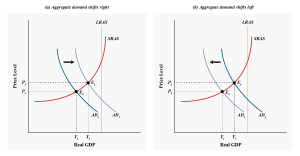

The two graphs below show the effect of an expansionary policy in lowering the recessionary gap (Fig 12.8a) and the effect of a contractionary policy in widening the recessionary gap (Fig 12.8b).

Government Expense Multiplier Vs Tax-cut Multiplier

The government expense multiplier is more effective in generating economic growth than the tax cut multiplier because any increase in public investment spending is expected to generate more induced consumption spending through job creation as the government spends money on infrastructure such as roads, schools, or healthcare. On the other hand, the tax cut multiplier does help generate economic growth, but tax cuts may not directly help add jobs to the economy. So, from a policy perspective, an expansionary fiscal policy using [latex]G[/latex] is more effective for the economy in the long run than lowering taxes.

Note: the multiplier applies when [latex]G[/latex] decreases or taxes increase, as well as when [latex]G[/latex] increases or taxes decrease. Consumer confidence decreases when [latex]G[/latex] decreases, or people face rising taxes. These changes will reduce aggregate expenditure and have an even larger effect on real GDP than the initial changes because of the multiplier effect.

Attribution

“Business Cycles and Growth in the AD–AS Model” from Macroeconomics by Lumen Learning is licensed under a Creative Commons Attribution 4.0 International License.