7.1 Financial Markets

Definitions

Financial Markets are marketplaces where money is invested and borrowed, or in other words, where securities are traded.

Securities are a synonym for financial assets or a certificate or other financial instrument that has monetary value and can be traded. These can be debt securities like bonds or equity securities like stocks.

Bond is a financial contract through which a borrower like a corporation, a city or state, or the federal government agrees to repay the amount that it borrowed and also a rate of interest over a period of time in the future; usually long-term (greater than 10 years) debt instruments.

We know individuals can either consume or save their income. We also noted that business investment in physical capital is primarily how they grow. Where do individuals put their savings, and where do businesses obtain the funding for investment expenditure? The answer to both of these questions is financial markets.

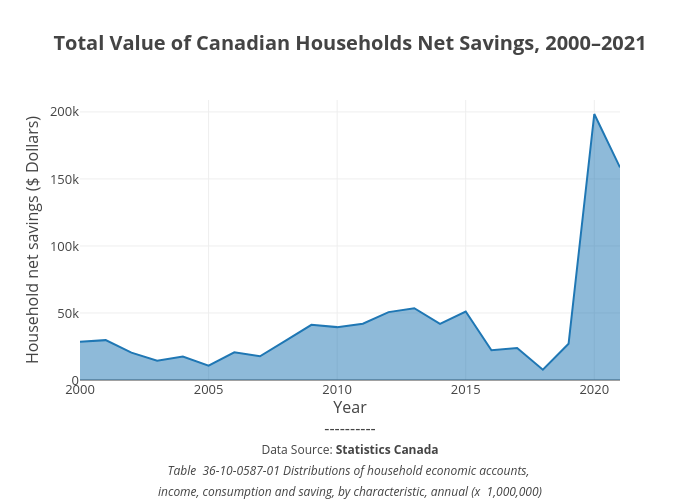

Graph Data Table

| Year | Household Savings (CAD) |

|---|---|

| 2000 | 28,603 |

| 2001 | 29,749 |

| 2002 | 20,423 |

| 2003 | 14,409 |

| 2004 | 17,511 |

| 2005 | 10,716 |

| 2006 | 20,714 |

| 2007 | 17,683 |

| 2008 | 29,296 |

| 2009 | 41,148 |

| 2010 | 39,451 |

| 2011 | 41,961 |

| 2012 | 50,651 |

| 2013 | 53,583 |

| 2014 | 41,838 |

| 2015 | 51,055 |

| 2016 | 22,235 |

| 2017 | 23,941 |

| 2018 | 7,733 |

| 2019 | 27,022 |

| 2020 | 198,463 |

| 2021 | 158,591 |

Canadian households saved almost $159 billion in 2021. Where did that savings go, and what was it used for? Some of the savings ended up in banks, which in turn loaned the money to individuals or businesses that wanted to borrow money. Some was invested in private companies or loaned to government agencies that wanted to borrow money to raise funds for purposes like building roads or mass transit. Some firms reinvested their savings in their own businesses.

Financial markets include the banking system, equity markets like the Toronto Stock Exchange, bond markets, and commodity markets. In the 21st Century, financial markets are global; Canadians put their savings into foreign and domestic bank accounts, foreign and domestic stocks, and foreign and domestic bonds. All financial assets are called securities. Equities (i.e. stocks) give savers ownership in a company in return for dividends (a regular payment from the company) and/or capital gains (e.g. when you sell the stock at a profit). Bonds are a type of debt in which a saver lends money to a borrower for an interest payment.

Loans, Bonds, and Stocks

A bank loan for a firm works much the same way as a loan for an individual buying a car or a house. The firm borrows an amount of money and then promises to repay it, including some rate of interest, over a predetermined period of time. If the firm fails to make its loan payments, the bank (or banks) can take the firm to court and require it to sell its buildings or equipment to pay its debt.

A bond is a financial contract like a loan. Typically, bond interest rates are lower than loan interest rates, and there are organized secondary markets for bonds, making them more liquid to bondholders than loans. Bonds are issued by major corporations and also by various levels of government. For example, cities borrow money by issuing municipal bonds, and the federal government borrows money when the Canadian Department of Finance issues Treasury bonds.

A corporation is a business that “incorporates”—that is owned by shareholders with limited liability for the company’s debt but shares in its profits (and losses). Corporations may be private or public and may or may not have publicly traded stock. They may raise funds to finance their operations or new investments by raising capital through selling stock or issuing bonds.

Attribution

“Financial Markets and Assets” from Macroeconomics by Lumen Learning is licensed under a Creative Commons Attribution 4.0 International License.