12.5 Possible Obstacles to Fiscal Policy Measures

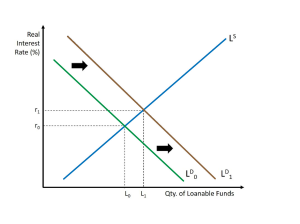

In the case of expansionary fiscal policy measures, the government increases [latex]G[/latex] and transfers payments to lower the effects of a recession. If the government faces a budget deficit, it must borrow money to finance such expenditure. Recall from Chapter 7: When the government needs more money for its operations than it has collected in revenues, it must run a budgetary deficit. As we saw earlier, when the deficit increases, the gap between [latex]G+T[/latex] and [latex]TR[/latex] increases. Therefore, the level of public dissavings increases. In this case, the demand for loanable funds increases as the government increases its borrowings. An increase in the demand for loanable funds raises the interest rate, as seen in Fig 12.9 below. Compared to the initial equilibrium, both the real interest rate and quantity of loanable funds increase from [latex]r_0[/latex] to [latex]r_1[/latex] and [latex]L_0[/latex] to [latex]L_1[/latex], respectively.

A rise in the interest rate tends to lower investments by the private sector as loans get more costly. This reduction in investment due to higher interest rates is known as the crowding-out effect. So, businesses may scale back investments or expansion plans because of the crowding-out effect, which might lower the outcome of the multiplier effect to a certain extent. On the one hand, while expansionary fiscal policy could result in an increase in [latex]AD[/latex] and GDP, on the other hand, a rise in the interest rate may partially offset that increase as businesses and consumers cut back some of their expenditure plans due to higher interest rates.

Our example under Section 12.3 above shows an increase in [latex]G[/latex] by [latex]\$100\;\text{billion}[/latex] (expansionary fiscal policy) increases real GDP by [latex]\$400\;\text{billion}[/latex], the multiplier is:

[latex]\begin{align*} \frac{\$400\;\text{billion}}{\$100\;\text{billion}}=4 \end{align*}[/latex]

which implies a dollar increase in [latex]G[/latex] increases real GDP by [latex]\$4[/latex]. However, due to the presence of the crowding out effect, we might see an increase in [latex]G[/latex] by [latex]\$100\;\text{billion}[/latex] increases real GDP by [latex]\$50\;\text{billion}[/latex], so the multiplier is:

[latex]\begin{align*}\frac{\$50\;\text{billion}}{\$100\;\text{billion}}=\frac{1}{2}\end{align*}[/latex]

This implies a dollar increase in [latex]G[/latex] increases real GDP by [latex]\$0.50[/latex]. Crowding out partially offsets the impact of the multiplier effect.

However, it is possible that the Bank of Canada could increase the money supply to offset the rise in the interest rates when the government and the Bank together fight to lower the effects of a recession.

Another obstacle to fiscal policy measures is the three lags in conducting fiscal policy tools: recognition lag, implementation lag, and impact lag. Recognition lag refers to identifying the correct economic circumstance to identify the appropriate policy tool for data collection, which might take between three to six months. Once the government makes a plan for implementing the policy tool, the Ministry of Finance formulates a budget presented to the Parliament. Implementation lag results from the approval of the tool through discussions and arguments by Members of the Parliament to decide on the appropriate course of action. This process takes a great deal of time as certain policy changes have political consequences. However, once the government implements the plan of action after consultations and approvals, it takes time to assess its impact on our economy, which is the impact lag. For example, after the fiscal policy legislation of lowering taxes is enacted, it takes a few months for people to see that effect on their paycheques. Similarly, if the legislation is about increasing [latex]G[/latex], for example, on public infrastructure such as transit and highways, that effect is much longer, as it takes time to develop plans, secure permissions, grant contracts, and begin work. Fiscal policy could take several months or years to have the desired effect on the economy.

Attribution

"8. The Market for Loanable Funds" in Introduction to Macroeconomics by J. Zachary Klingensmith is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License