12.2 Fiscal Policy Tools

The Federal Government’s fiscal policy tools mainly aim to stimulate the economy out of a recession by increasing GDP or controlling rising inflation.

The government controls GDP and/or price levels through:

- Government purchases, [latex]G[/latex]

- Taxes, [latex]T[/latex]

- Transfer payments, [latex]TR[/latex]

Federal, provincial, and local governments could spend tax dollars to stimulate the economy at their discretion. Generally, these expenses are provided by the government sector and not by the private sector.

12.2.1 Automatic vs Discretionary Policies

Recall from Chapter 4, the “Phases of the Business Cycle.” It shows that economies go through periods of increasing and decreasing real GDP. Recall a sustained period in which real GDP is rising is an expansion; a sustained period in which real GDP is falling is a recession. Some types of government expenses and taxes change with respect to the business cycle. During the expansionary phase of the business cycle, unemployment falls, and therefore, the government’s revenue generation would likely increase. At the same time, EI claims decrease with more people having jobs, and transfer payments decrease as well, so government expenses are reduced. This may reduce budget deficits.

Conversely, during a recession, unemployment increases and therefore, the government’s tax collection (or revenues) tends to decrease. Claims for unemployment benefits go up, and thus, government expenditures increase simultaneously. This increases budget deficits. These are also known as “automatic stabilizers.” These changes in government expenses occur based on the state of the economy and does not require any action by the government.

When the government changes taxes or spending to address public policy goals, those policies are known as discretionary policies. These policy actions need to be passed by the Canadian Parliament. Governments use [latex]G[/latex], [latex]T[/latex], or [latex]TR[/latex] as their discretionary fiscal policy tools. Governments can either use each tool at a time or a combination of them.

12.2.2 Expansionary Fiscal Policy

If the economy is experiencing recession and the government wants to stimulate the economy by increasing Aggregate demand ([latex]AD[/latex]) and real GDP, it would,

- Increase [latex]G[/latex]

- Decrease [latex]T[/latex]

- Increase [latex]TR[/latex]

Recall from Chapters 4 & 9 GDP & [latex]AD[/latex] includes all four components of spending: consumption expenditure ([latex]C[/latex]), investment expenditure ([latex]I[/latex]), government expenditure or purchases ([latex]G[/latex]), and net export expenditure (exports, [latex]X[/latex], minus imports, [latex]M[/latex]). When the government increases [latex]G[/latex], it will increase [latex]AD[/latex] and real GDP because such public expenditure on goods and services directly gets added to the [latex]AD[/latex] and GDP equations.

Similarly, if the government decides to lower tax rates such as income taxes, disposable income increases, increasing household consumption spending. An increase in [latex]C[/latex] increases [latex]AD[/latex] and real GDP. At the same time, lowering corporate tax rates boost firms’ net profitability, which could stimulate investment spending by the private sector. [latex]AD[/latex] and real GDP could increase.

Finally, an increase in welfare payments or transfer payments supplements household income. Therefore, [latex]AD[/latex] and real GDP increase as consumption spending increases from additional income.

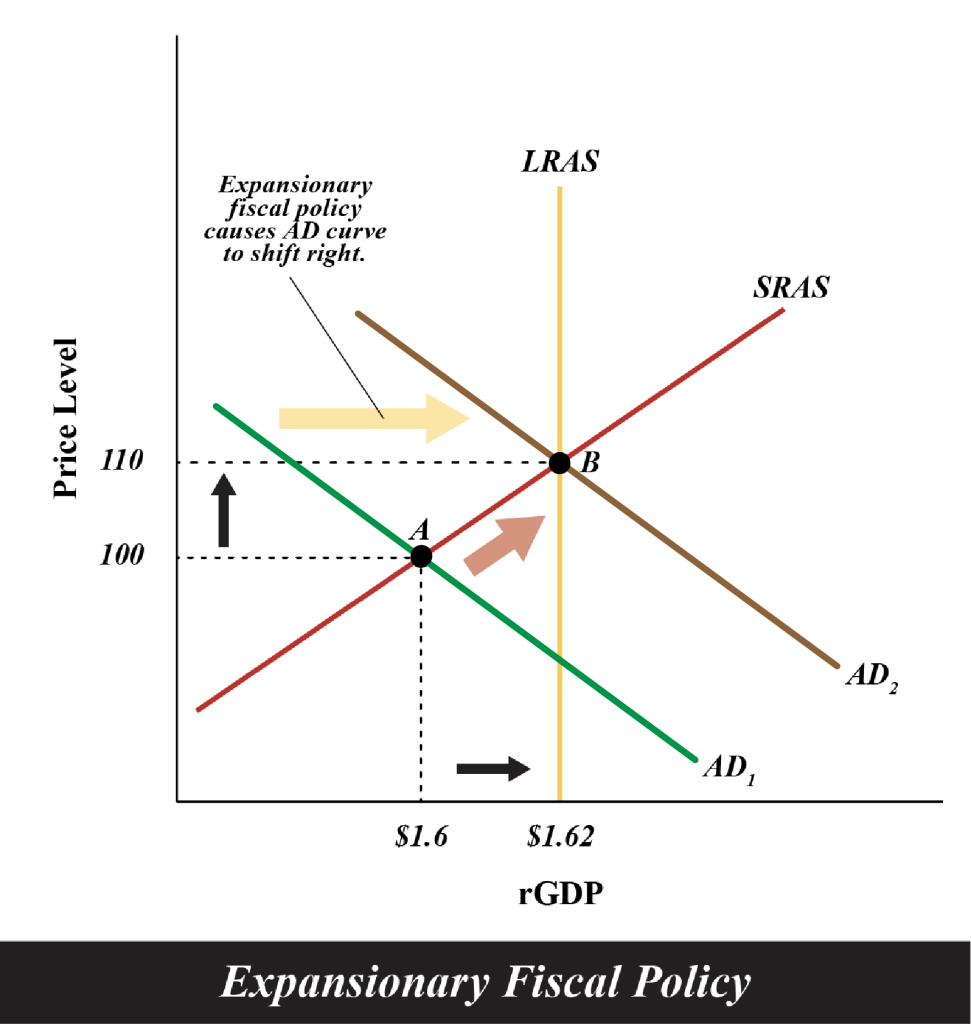

In each of the above scenarios, both aggregate demand and GDP expand, and therefore, these policy measures are called Expansionary Fiscal Policy tools as they help increase economic growth. At the same time, the price level rises due to an increase in [latex]AD[/latex], as seen in Fig 12.5 below. The economy faces a recessionary gap at point [latex]A[/latex]. An increase in [latex]AD[/latex] eliminates the gap and takes the economy to full employment at point [latex]B[/latex]. Expansionary policies help in eliminating recessionary gaps but might result in inflation. Also, an increase in government expenditure could widen a budget deficit or reduce a budget surplus.

12.2.3 Contractionary Fiscal Policy

If the economy is experiencing inflation and the government wants to bring down prices, it would,

- Decrease [latex]G[/latex]

- Increase [latex]T[/latex]

- Decrease [latex]TR[/latex]

When the government decreases [latex]G[/latex], it will decrease [latex]AD[/latex] and real GDP because the amount of public expenditure on goods and services decreases.

Then, if the government decides to increase tax rates, such as income taxes, disposable income decreases as net earnings go down, decreasing household consumption spending. A decrease in [latex]C[/latex] decreases [latex]AD[/latex] and real GDP. At the same time, raising corporate tax rates lowers firms’ net profitability, which could negatively affect private-sector investment spending. [latex]AD[/latex] and real GDP could decrease.

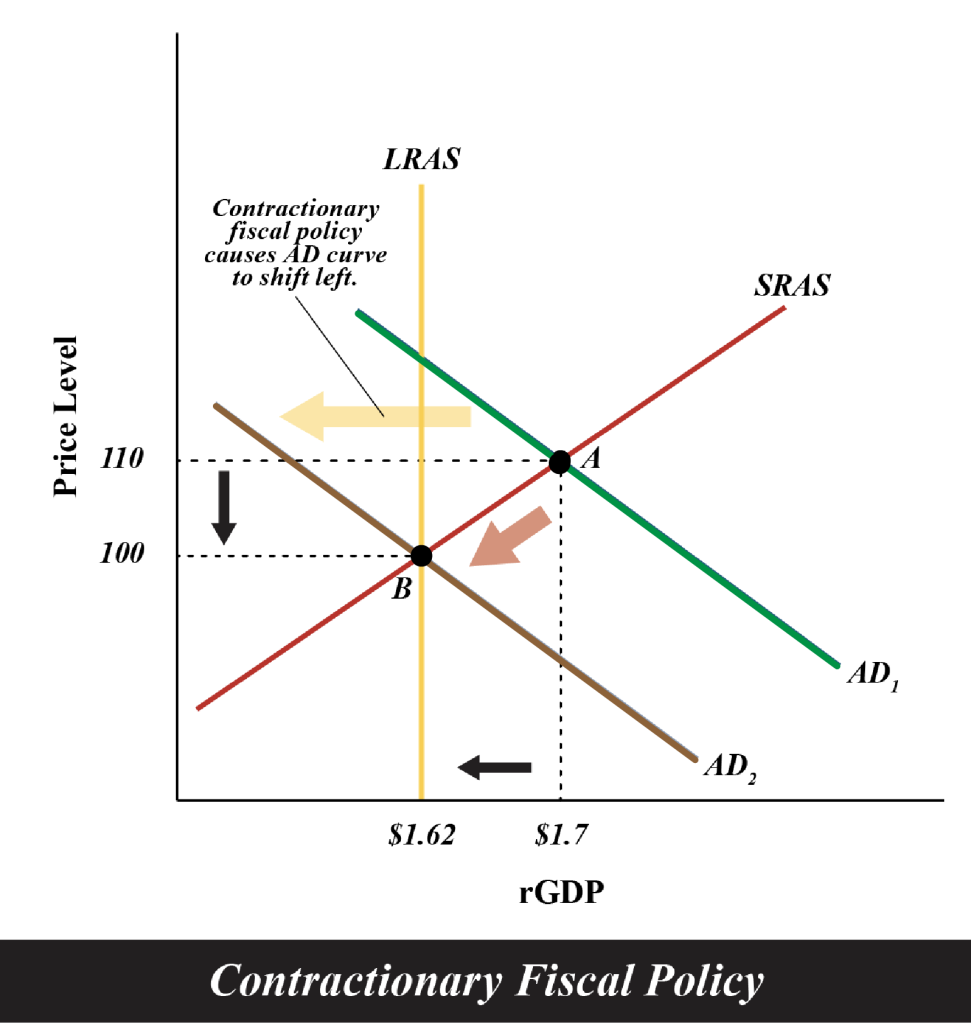

Finally, a cut in welfare payments or transfer payments reduces household income. Therefore, [latex]AD[/latex] and real GDP also decrease as consumption spending decreases due to less income. Decrease in [latex]AD[/latex] helps to lower the price level, as shown in Fig 12.6 below. The economy faces an inflationary gap at point [latex]A[/latex]. A decrease in [latex]AD[/latex] eliminates the gap and brings the economy back to full employment at point [latex]B[/latex].

In each of the above scenarios, aggregate demand and real GDP contract. Therefore, these policy measures are called Contractionary Fiscal Policy tools as they tend to decrease economic growth to lower inflation. However, decreasing government expenditure could also help reduce a budget deficit. Sometimes, if the government is facing huge public debt, they might take contractionary policies called “austerity” measures to reduce budget gaps, as we saw with the Greek economy in 2010.