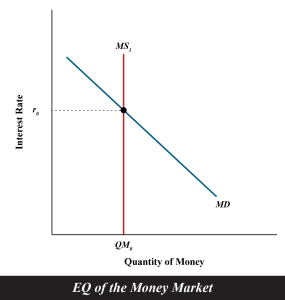

11.5 The Money Market and Equilibrium

The money market consists of money demand and money supply functions, and the equilibrium in the money market occurs where the money demand curve intersects the money supply curve. In other words, at that point, the quantity of money demand equals the quantity of money supply that determines the equilibrium interest rate and the equilibrium quantity of money. This equilibrium interest rate determined in the money market is the short-term interest rate.

Expansionary Monetary Policy

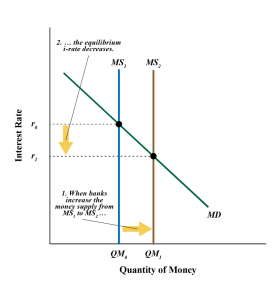

When the Bank of Canada wants to lower the overnight interest rate target, they conduct an open market operation of purchasing securities. This means the BoC injects money into the economy through banks and other financial institutions. This increase in money supply drives down the interest rate in the short term and keeps the rate close to the overnight target set by the BoC, as shown in Fig 11.6 below.

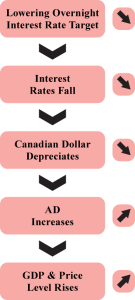

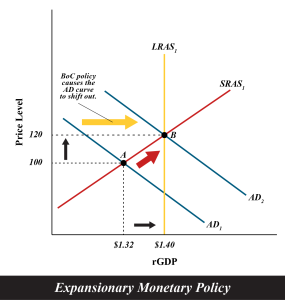

As retail banks obtain money from the Bank of Canada, they can lend out more funds to households and businesses. Recall from Chapter 7 that this increases the supply of loanable funds (SLF) and helps reduce long-term interest rates. As interest rates lower, consumption, investment, and net exports increase. Recall from Chapter 10 that lower interest rates result in households and businesses borrowing funds because loans become less costly. Also, a lower interest rate decreases the value of the Canadian dollar, so exports increase relative to imports. This stimulates Aggregate Demand (AD) and GDP growth. At the same time, lower interest rates lower bond yields and therefore, shares or stocks become more attractive relative to bonds, thereby increasing stock prices as demand for stocks increases. Firms tend to issue more shares at higher prices as they produce more financial capital, increasing AD through investment. Refer to Fig 11.8 below.

This monetary policy tool of lowering the overnight interest rate target and increasing the money supply through an open market operation of purchasing securities will be conducted when the Bank finds the economy is growing slowly. They adopt this policy to boost economic growth. Therefore, we call this Expansionary Monetary Policy.

The Bank of Canada cannot eliminate a recession but can keep periods of recession smaller and milder by conducting expansionary monetary policy tools.

Contractionary Monetary Policy

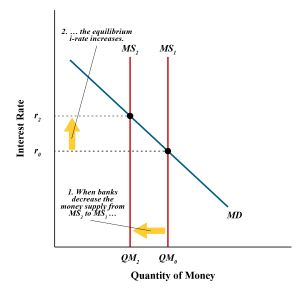

When the Bank of Canada wants to raise the overnight interest rate target, they conduct an open market operation selling government securities. This means the BoC gets money from banks and other financial institutions. So, banks are left with less reserves. This decrease in the money supply in the economy drives up the interest rate in the short term and keeps the rate close to the overnight target set by the BoC, as shown in Fig 11.9 below. [sometimes the BoC raises money this way and lends the money to the Federal government to finance its expenses in case the government faces a budget deficit]

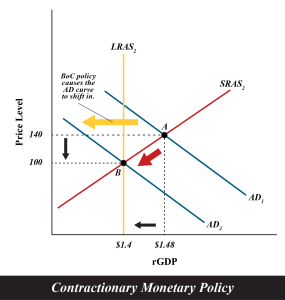

As retail banks lend money to the Bank of Canada, they can lend out less funds to households and businesses. Recall from Chapter 7 that this decreases the supply of loanable funds (SLF) and drives up long-term interest rates. As interest rates rise, consumption, investment, and net exports decrease. Recall from Chapter 10 that higher interest rates result in households and businesses borrowing less funds as loans become more costly. Also, a higher interest rate increases the value of the Canadian dollar, so exports decrease relative to imports. This decreases Aggregate Demand (AD) and GDP growth, as shown in Fig 11.11 below.

This monetary policy tool of raising the overnight interest rate target and decreasing money supply through an open market operation of selling securities will be conducted when the Bank finds the economy is experiencing inflation. They adopt this policy to lower the price level, which at the same time results in contracting economic growth. Therefore, we call this Contractionary Monetary Policy.

Inflation in Canada in 2022 and Bank of Canada’s Monetary Policy

Canada’s annual inflation rate reached 8.1% in June 2022 (Statistics Canada, 2022). This significant rise in the price level following the Covid outbreak in 2020-2021 was much beyond the Bank’s annual inflation target of 2%. Therefore, the Bank consistently kept raising the overnight interest rate throughout 2022. In March 2022, the Bank’s overnight rate target was 0.5%, which rose to 5.0% in October 2023. This has been the highest overnight interest rate target since Nov 2007, as reported by the Bank of Canada. The rise in interest rates also helped in cooling down the overheated Canadian housing market. Following this regular rise in the overnight interest rate targets during 2022, the CPI inflation rate started going down slowly, from 8.1% in June to 6.8% in October 2022 and 3.1% in October 2023 (Stats Canada).